web3.0

web3.0

Guide to Maximizing AirPuff Points Revenue: How to Use Leverage to Increase Expected Returns

Guide to Maximizing AirPuff Points Revenue: How to Use Leverage to Increase Expected Returns

Guide to Maximizing AirPuff Points Revenue: How to Use Leverage to Increase Expected Returns

Original title: "Leveraged Points Farming With Airpuff.io"

Author: THOR AND HYPHIN

Compiled by Shenchao TechFlow

Introduction

In the current DeFi activities , the strategy of airdropping points through leveraged exposure is likely to be the best strategy. Participants in Ethena’s Season 1 event received returns ranging from 100-500% depending on their leveraged exposure to Ethena’s “shards.” Many expect Eigenlayer and its LRT ecosystem to be comparable in terms of returns, with EIGEN points currently valued at $0.20 to $0.40. One way to get these points activities is through Airpuff.

Airpuff is a multi-chain currency market that provides leveraged exposure to points projects such as Eigenlayer, Renzo, Etherfi, Kelp, Ethena and more. Users can leverage points up to 12.75x, or trade by lending assets, which can earn annualized interest rates in excess of 50%. Airpuff is preparing for their $APUFF TGE, the Foundry LBP that will last until April 11th at 12:00 PM UTC. Today’s report will break down the Airpuff protocol, the $APUFF token, and finally give specific strategies and expected returns.

Use Airpuff for Leverage Points Airdrop Campaign

At its core, AirPuff is made up of two key components that work together to facilitate Leverage Points campaigns .

1. Lending

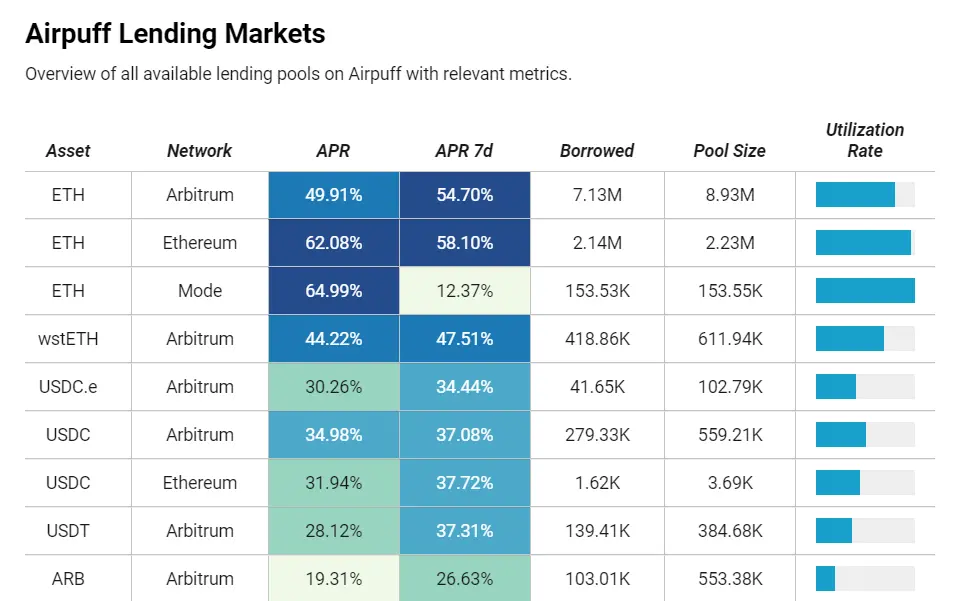

All necessary lending operations are performed through the lending pool, which allows depositors to provide liquidity to the platform Sex is highly profitable on multiple networks.

There are no fees for deposits, but there is a flat 0.2% fee for withdrawing assets from the lending pool.

Interest received from provisioned assets is determined by the utilization of the collateral pool, meaning it will continually fluctuate based on demand. Accumulated interest is snapshotted every hour and distributed to the value of the tokens being lent, effectively compounding interest.

In most cases, ETH is in high demand and has the most attractive yields. This is mainly because borrowing non-ETH assets will Collateral is automatically converted to ETH when a position is opened, effectively going long, thereby introducing additional price risk to the borrower.

Another benefit of participating in the loan market is that users receive a share of all points earned using collateral.

WhalesMarket data shows that liquidity providers have cumulatively earned approximately $77,000 in points across all lending pools

Borrowers are also eligible based on the provided Specific assets (ETH and stETH receive higher rewards), time and amount provided to receive AirPuff point rewards.

2. Airdrop

You can use the protocol’s native airdrop strategy Buffs to obtain amplified airdrop rewards.

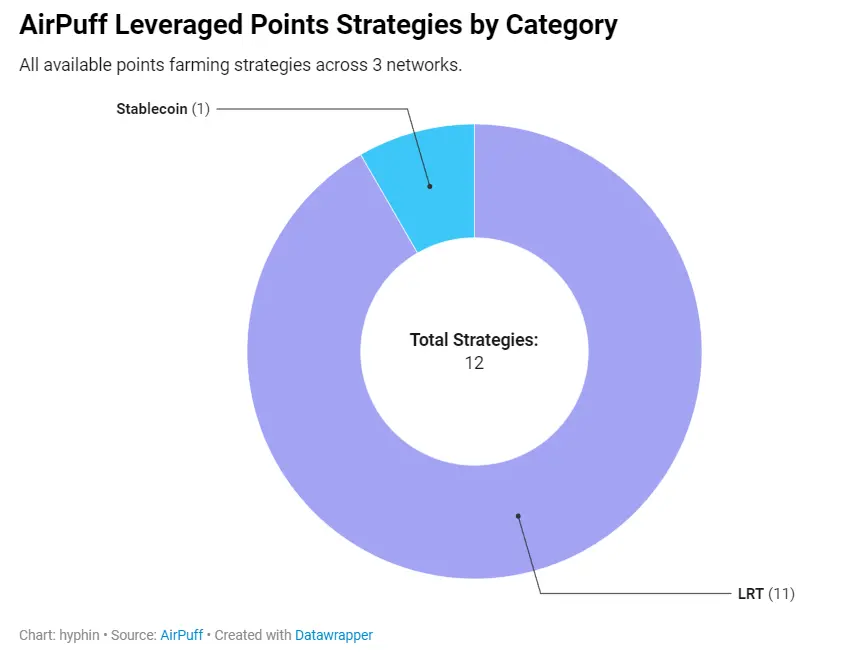

Currently, there are 12 different buffs available on 3 different networks, with most strategies related to LRTs that provide EigenLayer points, while also providing Native protocol incentives. However, there are also options that include additional unique ecosystem rewards (for example, Mode Points for strategy on Mode).

Depending on the strategy, users can leverage multiple collateral options to maximize potential rewards from events, including AirPuff, with up to 15x leverage. When borrowing or lending on any asset, be sure to be aware of higher-than-normal interest rates and take into account the complexities of using non-ETH collateral.

10% of all points earned from leveraged positions will be distributed to lenders and an additional 5% will be distributed to veAPUFF participants. There is also a fixed fee of 0.2% for closing a position.

For speculators with a smaller risk appetite, you can also choose the non-leveraged airdrop option while taking advantage of the rewards and incentives provided by the platform.

Projected Returns

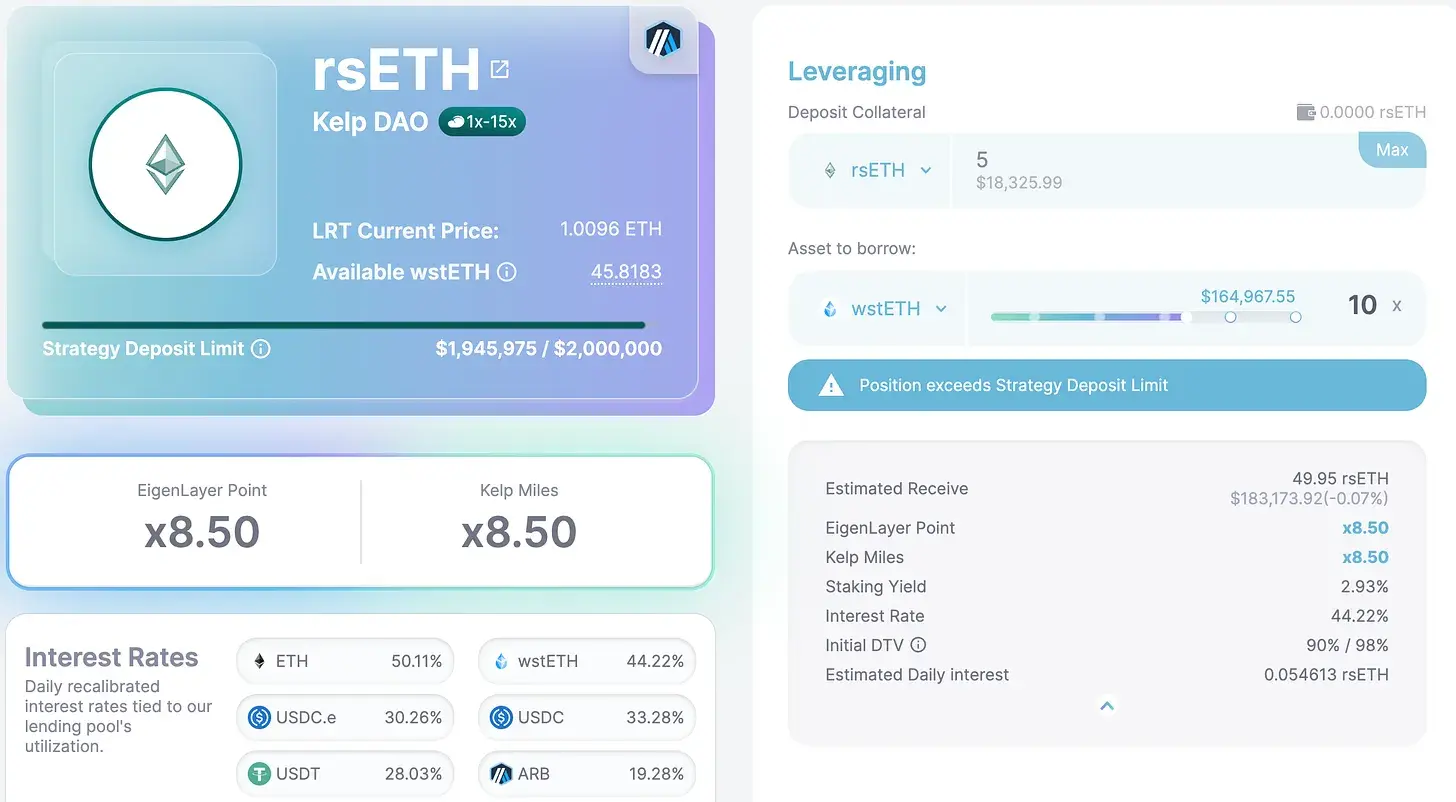

To illustrate the potential returns of the strategy, let’s look at the rsETH Liquid Re-Staking Token from Kelp . The image below shows the vault on Airpuff. While it's nearly full now, capacity is likely to increase in the future.

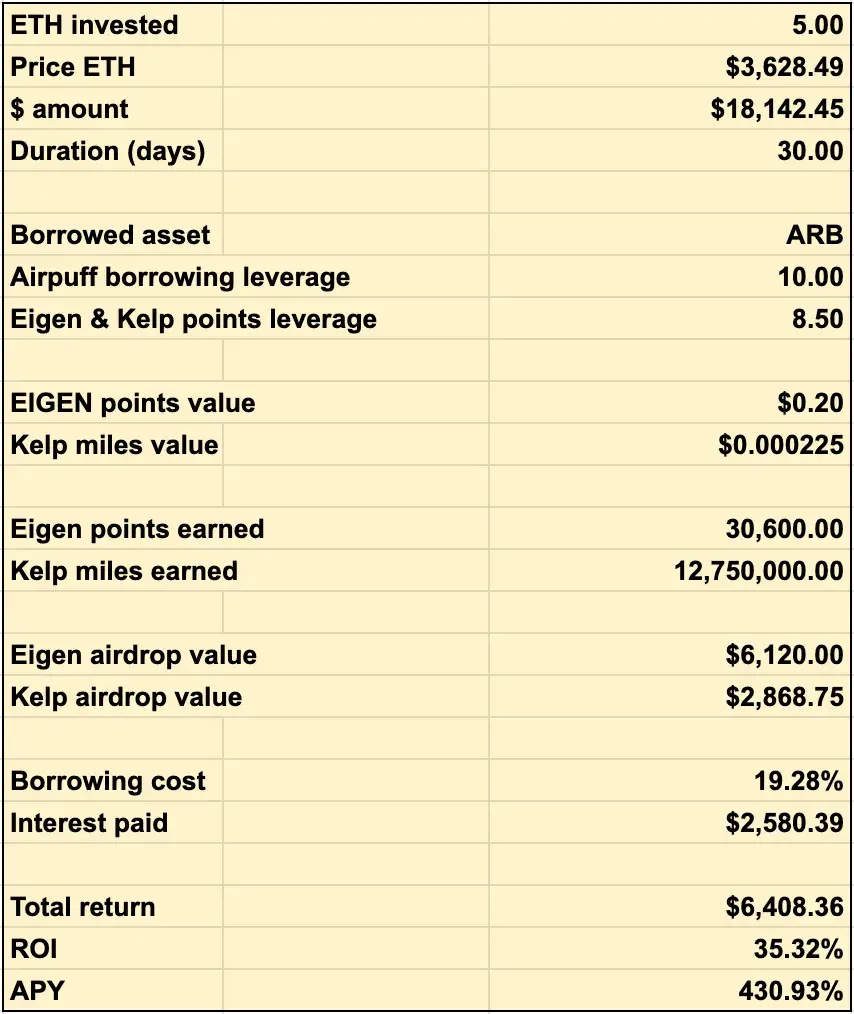

In this example, wstETH is lent against it with 10x leverage using 5 ETH as collateral. Each cycle then converts wstETH to rsETH. Since Airpuff draws points and distributes them to veAPUFF holders and lenders, the effective points leverage is 8.5x. In the lower left corner you can see the interest rates for various assets.

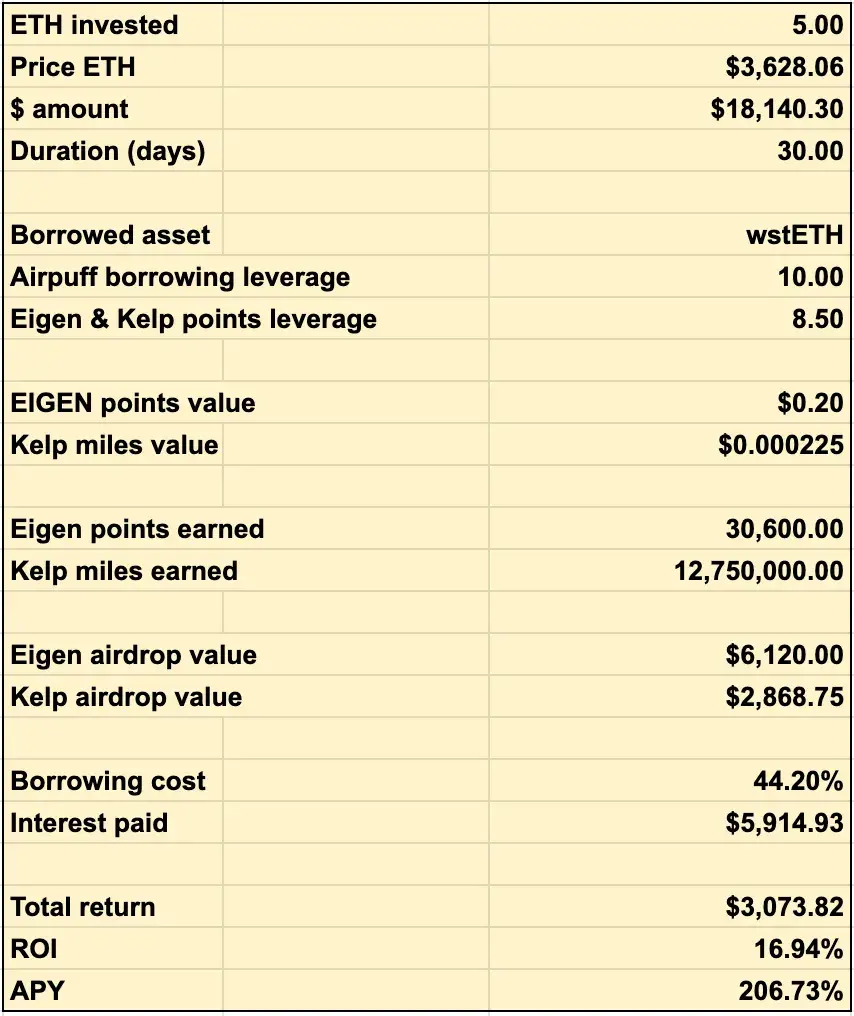

The following is the return calculation for this strategy. Eigen Points and Kelp Miles values are based on TVL and airdrop percentage predictions from another post and should be taken with a grain of salt (though these prices are more conservative). As can be seen, by depositing 5 ETH, with 10x leverage and a duration of 30 days, and lending out wstETH, the strategy returns an ROI of 16.94%, equivalent to an annualized return of approximately 206%. Keep in mind that there are a lot of assumptions here, so actual returns may differ from estimates.

With utilization rates above 80% in various markets, borrowing rates are currently very high, which has a negative impact on returns (nearly $6,000 in interest paid). More information on these below:

0-80% Utilization: Rates will increase linearly from 5% to 15%.

80-100% Utilization: Rate will increase linearly from 15% to 45%.

# Why not borrow in USDC or ARB since the borrowing rate is much lower? Because you have to bear more liquidation risk. If the value of rsETH against USDC or ARB drops, you could be liquidated and lose your entire deposit. As leverage increases, so does the risk of liquidation. The risk is much lower when lending wstETH as they all track ETH, but you could also be liquidated if rsETH decoupled. Compared to lending wstETH, the returns for lending ARB are as follows:

As you can see, the returns are higher. However, it is important to note that liquidation risk is also higher.

TGE & $APUFF

Early depositors of Airpuff can not only obtain basic points through Eigenlayer and LRT, but also obtain "Airpuff Points", which will Converted to a $APUFF airdrop in May. A total of 7% of the $APUFF supply will be airdropped to protocol users over two seasons. 4% of these will be airdropped in the first season, and another 3% will be airdropped in the following season. For more information on how to qualify, please see this page.

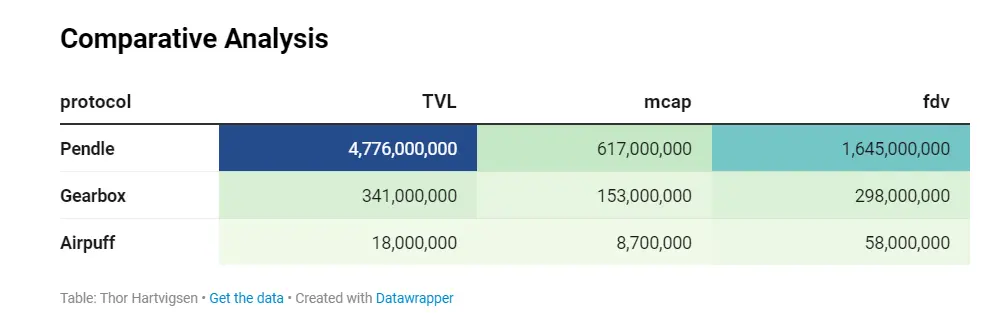

Additionally, the $APUFF Liquidity Boot Pool (LBP) is currently live on Fjord Foundry from 12am UTC on April 8th to 12am UTC on April 11th. As of this writing, Airpuff has raised $2.5 million in $APUFF in LBP, which will bring the token’s market cap to $8.7 million and FDV to $58 million. Click here to enter the LBP’s website:

$APUFF tokens will be listed once the LBP ends. The initial circulating supply is 16% (15% from LBP and 1% from private placement). Here are some comparison metrics between Airpuff, Pendle, and Gearbox.

APUFF Token Economics

Airpuff uses the dual-token model of $APUFF. Users can choose to lock $APUFF to earn veAPUFF (similar to vePENDLE), which will give them the right to vote on token incentive allocations in various markets and earn rewards through bribery. These bribes come from the proceeds paid by protocols to Airpuff to develop library strategies and direct issuances as a means to promote the growth of their protocols and increase adoption.

To further strengthen the token holder base, and in order to be eligible for $APUFF issuance, users must lock at least 5% of the value of their holdings in veAPUFF. Finally, Airpuff takes a 5% fee from the points earned by all lenders and borrowers (Eigen points, LRT points, etc.) and distributes it to veAPUFF holders to further increase the utility of the token.

Conclusion

2024 is the year of points trading, and Airpuff achieves this in a unique way with its currency market and built-in leverage. In the coming months, Airpuff will integrate new vaults, launch more on-chain projects, and issue $APUFF tokens to give users greater exposure to various points projects.

The above is the detailed content of Guide to Maximizing AirPuff Points Revenue: How to Use Leverage to Increase Expected Returns. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

AI Hentai Generator

Generate AI Hentai for free.

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

Pi Node Teaching: What is a Pi Node? How to install and set up Pi Node?

Mar 05, 2025 pm 05:57 PM

Pi Node Teaching: What is a Pi Node? How to install and set up Pi Node?

Mar 05, 2025 pm 05:57 PM

Detailed explanation and installation guide for PiNetwork nodes This article will introduce the PiNetwork ecosystem in detail - Pi nodes, a key role in the PiNetwork ecosystem, and provide complete steps for installation and configuration. After the launch of the PiNetwork blockchain test network, Pi nodes have become an important part of many pioneers actively participating in the testing, preparing for the upcoming main network release. If you don’t know PiNetwork yet, please refer to what is Picoin? What is the price for listing? Pi usage, mining and security analysis. What is PiNetwork? The PiNetwork project started in 2019 and owns its exclusive cryptocurrency Pi Coin. The project aims to create a one that everyone can participate

Top 10 virtual digital currency app platforms in the world, the top ten virtual currency trading platforms in 2025

Mar 05, 2025 pm 08:00 PM

Top 10 virtual digital currency app platforms in the world, the top ten virtual currency trading platforms in 2025

Mar 05, 2025 pm 08:00 PM

With the booming development of the virtual currency industry, virtual digital currency trading platforms around the world are becoming increasingly stronger. This article focuses on the top ten virtual digital currency app platforms in the world in 2025, including Binance, OKX, Gate.io, Kraken, Gemini, FTX, Bybit, KuCoin, Huobi and Coinbase. These platforms are known for their advanced features, a wide range of transaction pairs, low fees and stable performance, providing users with a wide range of virtual currency trading options.

Various ETF issuers compete to apply for Solana ETF! But why is BlackRock still absent?

Mar 03, 2025 pm 06:33 PM

Various ETF issuers compete to apply for Solana ETF! But why is BlackRock still absent?

Mar 03, 2025 pm 06:33 PM

Many ETF issuers are scrambling to apply for SolanaETF, but BlackRock is still holding back? This article will interpret this phenomenon. SolanaETF application boom The Securities and Exchange Commission (SEC) has accepted SolanaETF applications submitted by several institutions, including Bitwise, 21Shares, VanEck, CanaryCapital and Grayscale. Bloomberg predicts that the probability of Solana spot ETF being approved by the end of the year is as high as 70%, which is closely related to the Trump administration's friendly attitude towards cryptocurrencies. The establishment of Franklin's "Franklin SolanaTrust" also implies its potential application for SolanaETF. However, Sol

![Bitcoin [BTC] was on a downtrend after losing the $92,000-support level in the final week of February](https://img.php.cn/upload/article/001/246/273/174209101774967.jpg?x-oss-process=image/resize,m_fill,h_207,w_330) Bitcoin [BTC] was on a downtrend after losing the $92,000-support level in the final week of February

Mar 16, 2025 am 10:10 AM

Bitcoin [BTC] was on a downtrend after losing the $92,000-support level in the final week of February

Mar 16, 2025 am 10:10 AM

Technical indicators such as the OBV showed that selling pressure has been dominant, meaning more losses may be likely ahead.

Understand the current situation and future of MEV on a single article

Mar 04, 2025 pm 05:06 PM

Understand the current situation and future of MEV on a single article

Mar 04, 2025 pm 05:06 PM

Sui Blockchain's MEV (Maximum Extractable Value) strategy and future outlook MEV have become the core issues in the blockchain field, which are related to transaction sorting and arbitrage opportunities. Sui is committed to guiding the development of MEV through Sui Improvement Proposal (SIP) and other mechanisms, ensuring transparency, transaction security, network health, and participant rewards. In addition to existing mechanisms, more mechanisms are planned to be introduced to ensure that its core principles can effectively guide the evolution of MEVs on Sui. Design principles and considerations Sui's every transaction contains potential profit opportunities. Sui's MEV ecosystem consists of the following mechanisms: MEV transaction submission mechanism MEV opportunity release mechanism MEV

PI price forecast: How high can PI coins rise?

Mar 03, 2025 pm 07:27 PM

PI price forecast: How high can PI coins rise?

Mar 03, 2025 pm 07:27 PM

Since the launch of PiNetwork (PI)'s independent network, it has continued to attract the attention of the cryptocurrency community. In contrast to the recent sluggish performance of mainstream cryptocurrencies such as Bitcoin (BTC), Ethereum (ETH) and Solana (SOL), the price of PI has risen against the trend. PI cryptocurrency: Binance listing may become a catalyst for price surge PINetwork (PI) price upward momentum Strong PI is currently priced at $1.6750, far higher than the previous low of $0.6020. Trading activity and investor interest continue to grow, and PI's future price trend has become the focus of market attention. PI market performance: Strong rebound and key resistance levels PI mainnet started at the beginning

Top 10 Free Virtual Currency Exchanges Rankings The latest top ten virtual currency APP trading platforms

Mar 11, 2025 am 10:18 AM

Top 10 Free Virtual Currency Exchanges Rankings The latest top ten virtual currency APP trading platforms

Mar 11, 2025 am 10:18 AM

The top ten free virtual currency exchanges are ranked: 1. OKX; 2. Binance; 3. Gate.io; 4. Huobi Global; 5. Kraken; 6. Coinbase; 7. KuCoin; 8. Crypto.com; 9. MEXC Global; 10. Bitfinex. These platforms each have their own advantages.

Does Bitcoin have stocks? Does Bitcoin have equity?

Mar 03, 2025 pm 06:42 PM

Does Bitcoin have stocks? Does Bitcoin have equity?

Mar 03, 2025 pm 06:42 PM

The cryptocurrency market is booming, and Bitcoin, as a leader, has attracted the attention of many investors. Many people are curious: Do Bitcoin have stocks? The answer is no. Bitcoin itself is not a stock, but investors can indirectly invest in Bitcoin-related assets through various channels, which will be explained in detail in this article. Alternatives to Bitcoin Investment: Instead of investing directly in Bitcoin, investors can participate in the Bitcoin market by: Bitcoin ETF: This is a fund traded on the stock trading market, whose asset portfolio contains Bitcoin or Bitcoin futures contracts. This is a relatively convenient option for investors who are accustomed to stock investments, without having to hold Bitcoin directly. Bitcoin Mining Company Stocks: These companies' business is Bitcoin mining and holding Bitcoin