web3.0

web3.0

CryptoQuant: The impact of Bitcoin halving weakens! The growth of investors has become the main driving force for the rise of BTC

CryptoQuant: The impact of Bitcoin halving weakens! The growth of investors has become the main driving force for the rise of BTC

CryptoQuant: The impact of Bitcoin halving weakens! The growth of investors has become the main driving force for the rise of BTC

This site (120bTC.coM): With the Bitcoin halving coming next Saturday (20th), the market is all looking forward to the rapid growth of Bitcoin prices under the halving market. However, the encryption analysis agency CryptoQuant recently A research report points out that the impact of the supply reduction caused by the halving on the price of Bitcoin may not be as significant as most investors expect.

There was already a supply shortage before the halving

CryptoQuant’s analysis pointed out that the impact of the halving on the Bitcoin market is gradually weakening. They pointed out that between 2021 and 2023, the market has already seen several situations where demand from long-term holders exceeds supply, but the current gap between supply and demand is wider than ever, meaning that the market is already in supply before the halving. shortage status. Therefore, even if the supply is further reduced after the halving, the upward pressure on the price of Bitcoin may not be as significant as in the past.

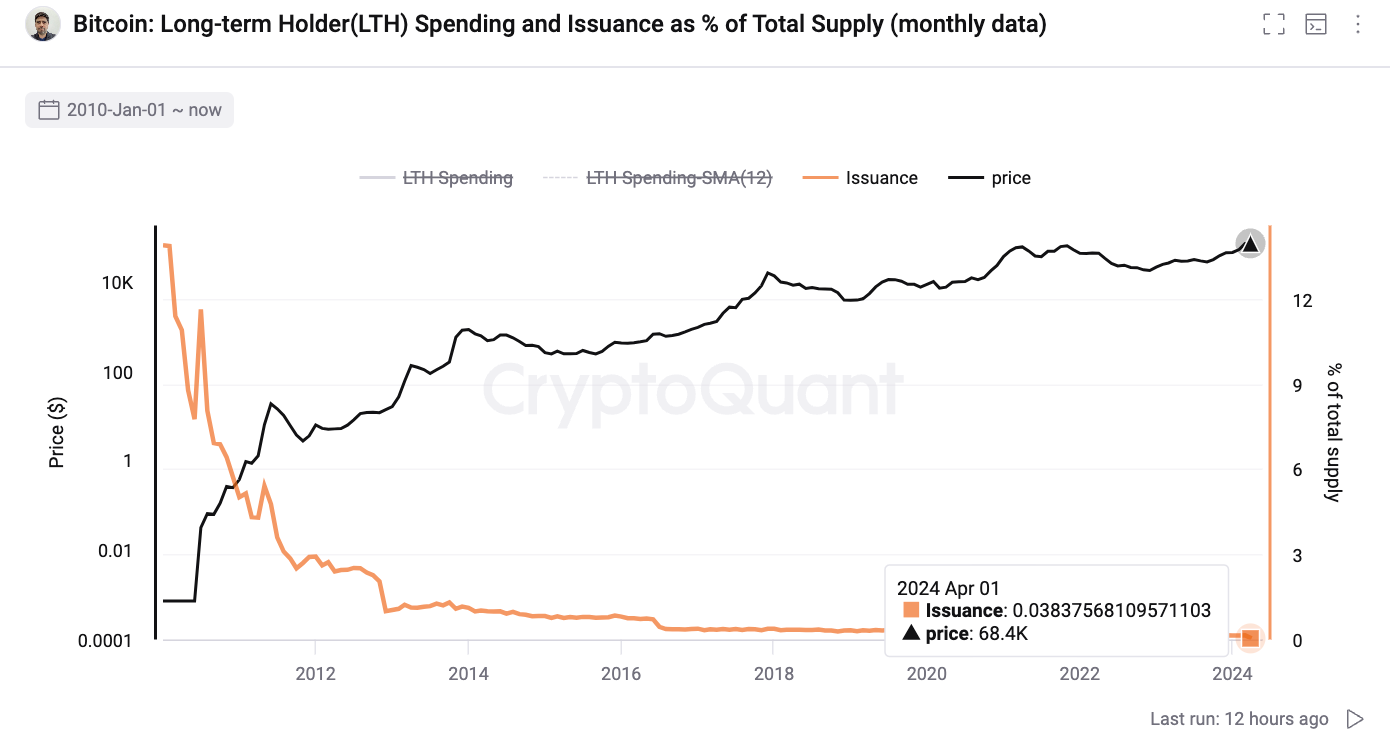

In addition, it can be observed from the chart below that the proportion of new monthly Bitcoin issuance continues to decline, currently falling below 4% of the total available supply, compared with the previous Bitcoin halving , the proportion is obviously smaller. Before the first, second and third halvings, issuance accounted for 69%, 27% and 10% of the total available supply respectively. This is further evidence of the strong market demand for Bitcoin, with investors continuing to buy or holders generally unwilling to sell their Bitcoins.

Bitcoin’s monthly issuance falls below 4% of total available supply

CryptoQuant: Demand growth is the main driver of price increases after halving Li

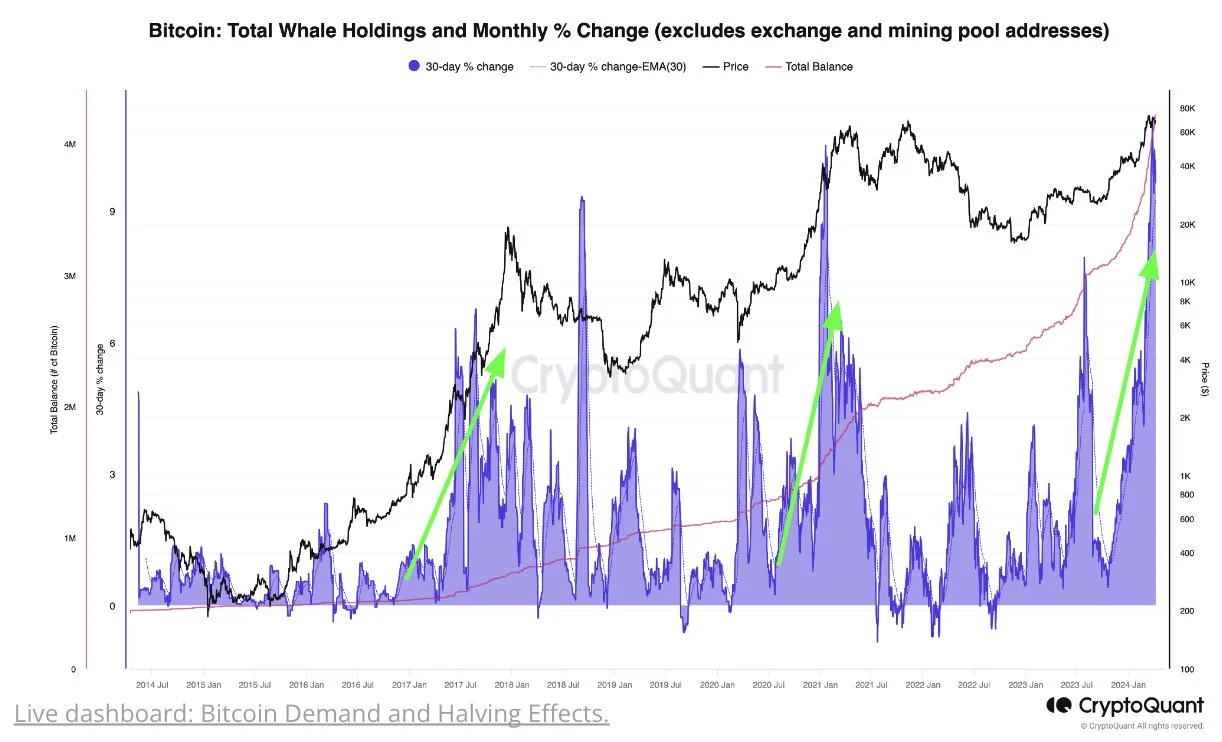

CryptoQuant further reveals from the analysis of the chart below that the demand for giant whales holding 1,000 to 10,000 Bitcoins has reached an all-time high, with their holdings increasing by 11% from last month, and long-term holdings Investors are adding as many as 200,000 Bitcoins to their balances every month, which is about seven times the monthly new issuance of Bitcoin (28,000 Bitcoins).

In past cycles, the surge in positions from giant whales (purple area in the figure below) was an important factor driving the rise in Bitcoin prices. Therefore, CryptoQuant believes that the growth in demand seems to be the main driver of the price increase after the halving.

This emphasizes a key point, since price is determined by supply and demand. Although the halving directly brings about the halving of the supply, compared to its potential boost to the price of Bitcoin, CryptoQuant pays more attention to demand growth as the key driver of the rise in Bitcoin prices.

When the Bitcoin holdings in the whale’s purple area surge, the Bitcoin price can be seen to rise significantly

The above is the detailed content of CryptoQuant: The impact of Bitcoin halving weakens! The growth of investors has become the main driving force for the rise of BTC. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

AI Hentai Generator

Generate AI Hentai for free.

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

How many times will the Dogecoin ETF price rise?

Mar 28, 2025 pm 03:42 PM

How many times will the Dogecoin ETF price rise?

Mar 28, 2025 pm 03:42 PM

The possible price increase of Dogecoin ETF after approval is 2 to 5 times, and the current price of $0.18 may rise to $0.6 to $1.2. 1) In the optimistic scenario, the increase can reach 3 times to 10 times, due to the bull market and the boost of Musk; 2) In the neutral scenario, the increase is 1.5 times to 3 times, due to moderate capital inflows; 3) In the pessimistic scenario, the increase is 0.5 times to 1.5 times, due to bear market and low liquidity.

What is Ouyi for? What is Ouyi

Apr 01, 2025 pm 03:18 PM

What is Ouyi for? What is Ouyi

Apr 01, 2025 pm 03:18 PM

OKX is a global digital asset trading platform. Its main functions include: 1. Buying and selling digital assets (spot trading), 2. Trading between digital assets, 3. Providing market conditions and data, 4. Providing diversified trading products (such as derivatives), 5. Providing asset value-added services, 6. Convenient asset management.

Will Dogecoin etf be approved?

Mar 28, 2025 pm 03:51 PM

Will Dogecoin etf be approved?

Mar 28, 2025 pm 03:51 PM

As of March 2025, the Dogecoin ETF has not yet had a clear approval schedule. 1. There is no formal application yet and the SEC has not received any relevant application. 2. Market demand and controversy are high, and regulators are conservative. 3. The potential timeline is a 1-2-year review period, which may be observed from 2025 to 2026, but there is high uncertainty.

The latest summary of Ethereum formal trading platform 2025

Mar 26, 2025 pm 04:45 PM

The latest summary of Ethereum formal trading platform 2025

Mar 26, 2025 pm 04:45 PM

In 2025, choosing a "formal" Ethereum trading platform means security, compliance and transparency. Licensed operations, financial security, transparent operations, AML/KYC, data protection and fair trading are key. Compliant exchanges such as Coinbase, Kraken, and Gemini are worth paying attention to. Binance and Ouyi have the opportunity to become formal platforms by strengthening compliance. DeFi is an option, but there are risks. Be sure to pay attention to security, compliance, expenses, spread risks, back up private keys, and conduct your own research.

What are the Ethereum trading platforms?

Mar 26, 2025 pm 04:48 PM

What are the Ethereum trading platforms?

Mar 26, 2025 pm 04:48 PM

Want to play Ethereum? Choose the right trading platform first! There are centralized exchanges (CEXs) such as Binance, Ouyi, Coinbase, Kraken, and Gate.io. The advantages are fast speed and good liquidity, while the disadvantages are centralized risks. There are also decentralized exchanges (DEXs) such as Uniswap, SushiSwap, Balancer, and Curve. The advantages are security and transparency, while the disadvantages are slow speed and poor experience.

The latest recommendations for regular virtual currency platforms

Mar 27, 2025 pm 04:33 PM

The latest recommendations for regular virtual currency platforms

Mar 27, 2025 pm 04:33 PM

Want to invest in virtual currency, but are afraid of choosing the wrong platform? This article recommends industry-recognized and relatively formal platforms such as Coinbase and Kraken, and emphasizes the compliance, security and other factors that should be focused on when choosing a platform.

Top 10 of the formal Web3 trading platform APP rankings (authoritatively released in 2025)

Mar 31, 2025 pm 08:09 PM

Top 10 of the formal Web3 trading platform APP rankings (authoritatively released in 2025)

Mar 31, 2025 pm 08:09 PM

Based on market data and common evaluation criteria, this article lists the top ten formal Web3 trading platform APPs in 2025. The list covers well-known platforms such as Binance, OKX, Gate.io, Huobi (now known as HTX), Crypto.com, Coinbase, Kraken, Gemini, BitMEX and Bybit. These platforms have their own advantages in user scale, transaction volume, security, compliance, product innovation, etc. For example, Binance is known for its huge user base and rich product services, while Coinbase focuses on security and compliance. Choosing a suitable platform requires comprehensive consideration based on your own needs and risk tolerance.