web3.0

web3.0

VanEck: Institutions are not yet on board! 90% of Bitcoin spot ETF funds come from retail investors

VanEck: Institutions are not yet on board! 90% of Bitcoin spot ETF funds come from retail investors

VanEck: Institutions are not yet on board! 90% of Bitcoin spot ETF funds come from retail investors

It has been exactly three months since the U.S. Securities and Exchange Commission (SEC) approved the listing of multiple Bitcoin spot ETFs. Currently, market investors are very enthusiastic about purchasing this product and continue to do so. Bringing incremental funds also promoted the rise of BTC.

VanEck CEO: 90% of the funds come from retail investors

Originally, the market thought that the Bitcoin spot ETF would attract a large number of institutional funds to enter the market and increase their holdings of Bitcoin. However, the Bitcoin spot ETF Janvan Eck, CEO of issuer VanEck, said in a recent interview that the current flow of funds into Bitcoin ETFs does not mainly come from traditional financial institutions, but from retail investors: the initial success of these ETFs since their launch has exceeded expectations. There have even been billions of dollars in inflows on some trading days, but I think traditional funds have not yet entered the market on a large scale. I still think 90% of the funds come from retail investors. Although some Bitcoin whales and other institutions have invested some assets, they have already been exposed to Bitcoin before.

What is worth thinking about here is whether, compared to institutional investors, retail investors, due to their small capital size, speculative nature and other factors, will amplify FUD sentiment during the decline in Bitcoin prices, thus Triggered a series of accelerated declines and liquidations of BTC?

But on the other hand, does this mean that when institutions enter the market (real big funds), it will further promote the rise of BTC prices? However, there is also a possibility that these institutions do not want to cause market fluctuations because of their large funds, so they choose to conduct OTC privately. It deserves our continued attention and verification in the future.

Traditional funds may enter the market in May

Janvan Eck added that so far no U.S. bank has officially approved or allowed its financial advisors to recommend Bitcoin. But next month, we may see some investment from banks and traditional financial companies. Bitcoin ETF is still in its infancy: there is still a lot to be perfected, a lot of technology is being developed on the chain, and we have a long way to go. Way to go.

BlackRock IBIT is expected to become the largest Bitcoin ETF

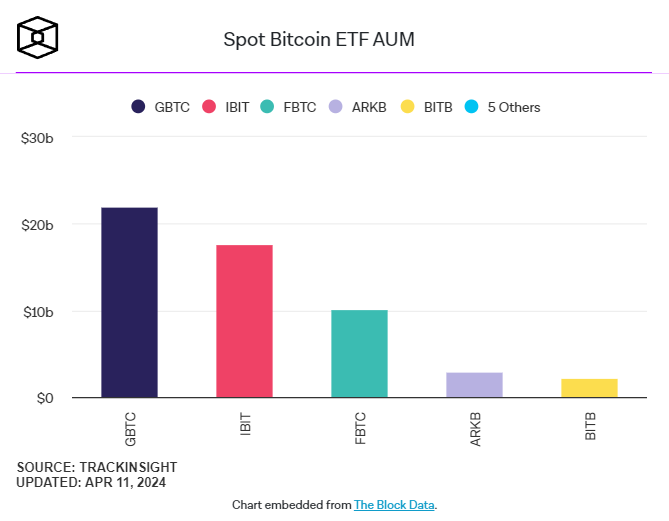

In addition, according to statistics from The Block, among all the Bitcoin spot ETFs currently on the market, the asset management giant BlackRock ’s IBIT holdings have soared from US$4.4 billion two months ago to US$18.2 billion, approaching Grayscale’s US$23.2 billion.

At the same time, due to the high management fees of Grayscale’s Bitcoin ETF, there may be further outflows of funds. Therefore, the market judges that IBIT may surpass Grayscale GBTC and become the largest Bitcoin ETF on the market.

The above is the detailed content of VanEck: Institutions are not yet on board! 90% of Bitcoin spot ETF funds come from retail investors. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

1387

1387

52

52

Gate.io Sesame Open Exchange Tips for Buying and Selling Coins (Guide to Novice)

Apr 21, 2025 am 11:51 AM

Gate.io Sesame Open Exchange Tips for Buying and Selling Coins (Guide to Novice)

Apr 21, 2025 am 11:51 AM

Tips for buying and selling coins on Gate.io include: 1. Make research plans before buying coins to understand the market and risks; 2. Choose trading pairs with high liquidity such as BTC/USDT; 3. Use limit orders to control the buying cost; 4. Pay attention to market trends and analyze price trends; 5. Set stop-profit and stop-loss when selling coins, and manage risks; 6. Use batch selling strategies to balance returns and risks; 7. Combine market sentiment and judge the selling timing; 8. Pay attention to macroeconomic and policy changes, and adjust strategies in a timely manner.

How to avoid losses after ETH upgrade

Apr 21, 2025 am 10:03 AM

How to avoid losses after ETH upgrade

Apr 21, 2025 am 10:03 AM

After ETH upgrade, novices should adopt the following strategies to avoid losses: 1. Do their homework and understand the basic knowledge and upgrade content of ETH; 2. Control positions, test the waters in small amounts and diversify investment; 3. Make a trading plan, clarify goals and set stop loss points; 4. Profil rationally and avoid emotional decision-making; 5. Choose a formal and reliable trading platform; 6. Consider long-term holding to avoid the impact of short-term fluctuations.

What are the top ten platforms in the currency exchange circle?

Apr 21, 2025 pm 12:21 PM

What are the top ten platforms in the currency exchange circle?

Apr 21, 2025 pm 12:21 PM

The top exchanges include: 1. Binance, the world's largest trading volume, supports 600 currencies, and the spot handling fee is 0.1%; 2. OKX, a balanced platform, supports 708 trading pairs, and the perpetual contract handling fee is 0.05%; 3. Gate.io, covers 2700 small currencies, and the spot handling fee is 0.1%-0.3%; 4. Coinbase, the US compliance benchmark, the spot handling fee is 0.5%; 5. Kraken, the top security, and regular reserve audit.

Ranking of legal platform apps for virtual currency trading

Apr 21, 2025 am 09:27 AM

Ranking of legal platform apps for virtual currency trading

Apr 21, 2025 am 09:27 AM

This article lists the ranking of APPs for legal platforms for virtual currency transactions, emphasizing that compliance is an important consideration for choosing a platform. The article recommends platforms such as Coinbase, Gemini, and Kraken, and reminds investors to study regulatory information and pay attention to security records when making choices. At the same time, the article emphasizes that virtual currency transactions are high-risk and investments should be cautious.

Keep up with the pace of Coinjie.com: What is the investment prospect of crypto finance and AaaS business

Apr 21, 2025 am 10:42 AM

Keep up with the pace of Coinjie.com: What is the investment prospect of crypto finance and AaaS business

Apr 21, 2025 am 10:42 AM

The investment prospects of crypto finance and AaaS businesses are analyzed as follows: 1. Opportunities of crypto finance include market size growth, gradual clear regulation and expansion of application scenarios, but face market volatility and technical security challenges. 2. The opportunities of AaaS business lie in the promotion of technological innovation, data value mining and rich application scenarios, but the challenges include technical complexity and market acceptance.

How to distinguish between altcoins and mainstream coins? Which one is more worth investing in? Learn about the coin circle in one article

Apr 21, 2025 am 11:18 AM

How to distinguish between altcoins and mainstream coins? Which one is more worth investing in? Learn about the coin circle in one article

Apr 21, 2025 am 11:18 AM

The difference between altcoins and mainstream coins is mainly reflected in: 1. Market value and liquidity: The mainstream currency has a large market value and strong liquidity; the altcoins have a small market value and poor liquidity. 2. Technology and innovation: The mainstream currency technology is mature and has extensive innovation; innovation or replication based on altcoin technology. 3. Application scenarios and communities: mainstream coins are widely used and active in the community; altcoins are narrow and small in the community. Investment choices require risk tolerance and goals.

Top 11 list of Bitcoin Exchange Rate Conversion Global (Updated in 2025)

Apr 21, 2025 am 11:27 AM

Top 11 list of Bitcoin Exchange Rate Conversion Global (Updated in 2025)

Apr 21, 2025 am 11:27 AM

The exchange rate of Bitcoin to currencies of various countries is as follows: 1. USD: at 7:20 on April 9, the exchange rate is 10,152.53. 2. Domestic: at 2:2 on April 9, 1 Bitcoin = 149,688.2954 yuan. 3. Swedish Krona: At 12:30 on April 9, the exchange rate was 758,541.05.

How to choose the Bitcoin trading platform that suits you

Apr 21, 2025 am 11:42 AM

How to choose the Bitcoin trading platform that suits you

Apr 21, 2025 am 11:42 AM

When choosing a Bitcoin trading platform that suits you, you need to consider the following factors: 1. Security: Choose a platform that uses advanced security technologies such as multi-signature and cold storage, such as Coinbase. 2. Transaction fees: Research the charging standards of the platform, such as Binance's low handling fees. 3. Regulatory compliance: Choose a platform that complies in your region to protect your legitimate rights and interests. 4. Trading functions and services: Choose a platform that provides rich trading functions and good customer service, such as Huobi.com. 5. Ease of use: For beginners, choose a platform with a friendly interface and simple operation, such as Coinbase. 6. Liquidity: Choose a platform with high liquidity, such as Binance, to ensure timely transactions.