web3.0

web3.0

BlackRock CEO: The Fed will only cut interest rates twice in 2024! No return to 2% inflation target

BlackRock CEO: The Fed will only cut interest rates twice in 2024! No return to 2% inflation target

BlackRock CEO: The Fed will only cut interest rates twice in 2024! No return to 2% inflation target

This site (120bTC.coM): The recently released CPI and non-farm employment data in the United States exceeded market expectations, showing that the labor market is still strong and inflation is still stubborn. The market is pessimistic that the Fed There is little hope that interest rates will be cut in June. Goldman Sachs once again lowered the number of interest rate cuts this month. It is expected that there will be only two rate cuts this year, one in July and one in November. This is lower than what most Fed officials predicted at the March meeting. Three interest rate cuts.

Like Goldman Sachs, Larry Fink, CEO of global asset management leader BlackRock, who also predicts that the United States will only cut interest rates twice this year, said in an interview with CNBC yesterday (12th): Earlier this year, some When prominent economists say there will be six rate cuts this year, I say probably two. I still say "maybe twice."

He predicts that the Federal Reserve will still take some interest rate cuts this year, but it will not be able to achieve its goal of suppressing the inflation rate to 2% this year. Many Fed officials have previously stressed that it would not be appropriate to cut interest rates prematurely before seeing more data showing that inflation is falling to the 2% target.

Larry Fink: The Federal Reserve will not be able to achieve the 2% inflation target this year

The CEO of BlackRock, who has an asset management scale of US$10.5 trillion and launched his own Bitcoin spot ETF at the beginning of the year with great success pointed out that the U.S. central bank is unlikely to achieve its 2% inflation target anytime soon. He thinks the central bank's targets may be set too high.

"Inflation has slowed, and we have been saying it will slow. But will it slow to the 2% ultimate goal that the Fed is seeking? I doubt it. I think we can get it to The inflation rate is stable in the range of 2.8% to 3%, which means that the victory over inflation is complete.”

The market is pessimistic about starting interest rate cuts in June

This week, there is a vote this year. Right, Atlanta Fed Chairman Raphael Bostic, who has always been dovish, reiterated his expectation that interest rates will be cut only once in 2024. Barclays Bank also adjusted its interest rate cut expectations on the 10th, believing that the Federal Reserve will only cut interest rates once this year. The amplitude is 1 yard. But some officials still predict there will be three interest rate cuts this year.

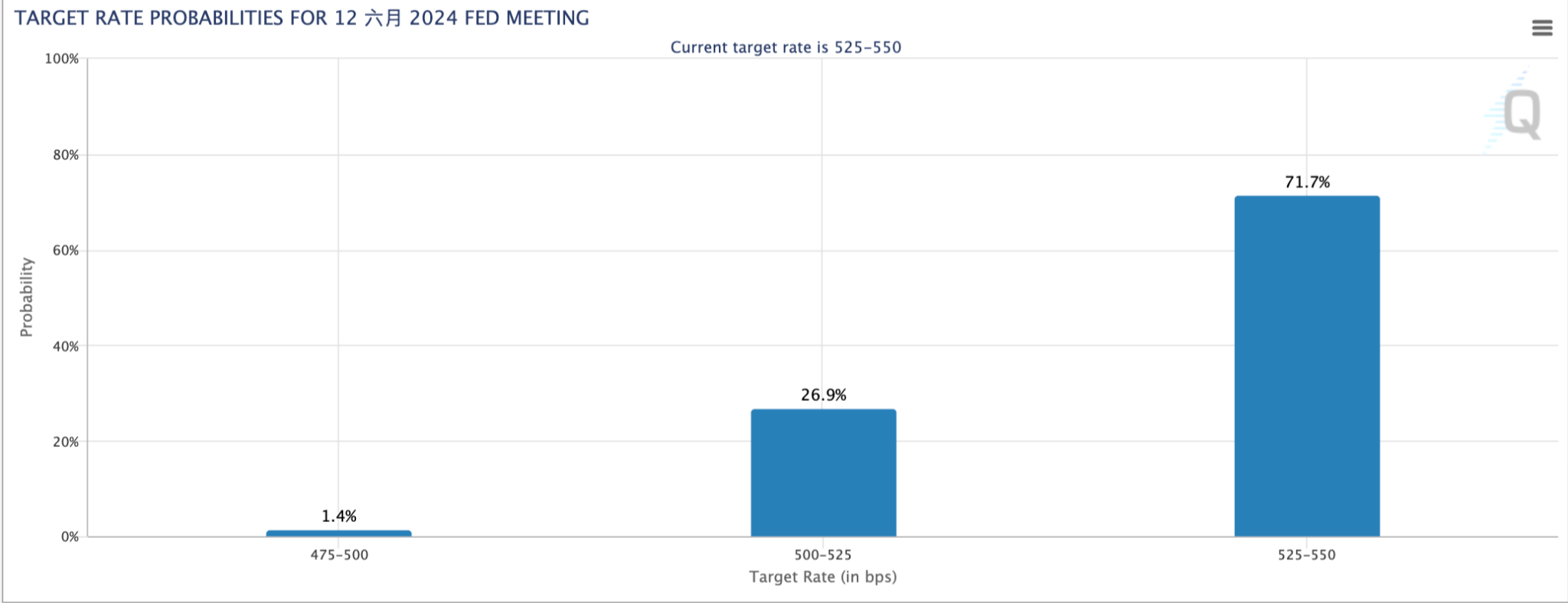

CME Group FedWatch data shows that the probability of keeping interest rates unchanged at 5.25%~5.50% in June is as high as 71.7%, and the probability of starting to cut interest rates by 1 percentage point in July is about 44.5%, and the probability of reducing interest rates by 2 percentage points. Then there are 11.4%.

The market is bearish and interest rates will be cut in June

The above is the detailed content of BlackRock CEO: The Fed will only cut interest rates twice in 2024! No return to 2% inflation target. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

1386

1386

52

52

What is Ouyi for? What is Ouyi

Apr 01, 2025 pm 03:18 PM

What is Ouyi for? What is Ouyi

Apr 01, 2025 pm 03:18 PM

OKX is a global digital asset trading platform. Its main functions include: 1. Buying and selling digital assets (spot trading), 2. Trading between digital assets, 3. Providing market conditions and data, 4. Providing diversified trading products (such as derivatives), 5. Providing asset value-added services, 6. Convenient asset management.

How many times will the Dogecoin ETF price rise?

Mar 28, 2025 pm 03:42 PM

How many times will the Dogecoin ETF price rise?

Mar 28, 2025 pm 03:42 PM

The possible price increase of Dogecoin ETF after approval is 2 to 5 times, and the current price of $0.18 may rise to $0.6 to $1.2. 1) In the optimistic scenario, the increase can reach 3 times to 10 times, due to the bull market and the boost of Musk; 2) In the neutral scenario, the increase is 1.5 times to 3 times, due to moderate capital inflows; 3) In the pessimistic scenario, the increase is 0.5 times to 1.5 times, due to bear market and low liquidity.

Will Dogecoin etf be approved?

Mar 28, 2025 pm 03:51 PM

Will Dogecoin etf be approved?

Mar 28, 2025 pm 03:51 PM

As of March 2025, the Dogecoin ETF has not yet had a clear approval schedule. 1. There is no formal application yet and the SEC has not received any relevant application. 2. Market demand and controversy are high, and regulators are conservative. 3. The potential timeline is a 1-2-year review period, which may be observed from 2025 to 2026, but there is high uncertainty.

How to calculate the transaction fee of gate.io trading platform?

Mar 31, 2025 pm 09:15 PM

How to calculate the transaction fee of gate.io trading platform?

Mar 31, 2025 pm 09:15 PM

The handling fees of the Gate.io trading platform vary according to factors such as transaction type, transaction pair, and user VIP level. The default fee rate for spot trading is 0.15% (VIP0 level, Maker and Taker), but the VIP level will be adjusted based on the user's 30-day trading volume and GT position. The higher the level, the lower the fee rate will be. It supports GT platform coin deduction, and you can enjoy a minimum discount of 55% off. The default rate for contract transactions is Maker 0.02%, Taker 0.05% (VIP0 level), which is also affected by VIP level, and different contract types and leverages

How to download kraken exchange

Mar 27, 2025 pm 04:21 PM

How to download kraken exchange

Mar 27, 2025 pm 04:21 PM

Want to experience a safe and reliable Kraken exchange? This tutorial details how to download the Kraken App (iOS & Android) and access the web version, and reminds everyone to pay attention to safety. Be sure to download it from the official channel, enable two-factor authentication, and protect account security.

Currency Trading Network Official Website Collection 2025

Mar 31, 2025 pm 03:57 PM

Currency Trading Network Official Website Collection 2025

Mar 31, 2025 pm 03:57 PM

It ranks among the top in the world, supports all categories of transactions such as spot, contracts, and Web3 wallets. It has high security and low handling fees. A comprehensive trading platform with a long history, known for its compliance and high liquidity, supports multilingual services. The industry leader covers currency trading, leverage, options, etc., with strong liquidity and supports BNB deduction fees.

The latest recommendations for regular virtual currency platforms

Mar 27, 2025 pm 04:33 PM

The latest recommendations for regular virtual currency platforms

Mar 27, 2025 pm 04:33 PM

Want to invest in virtual currency, but are afraid of choosing the wrong platform? This article recommends industry-recognized and relatively formal platforms such as Coinbase and Kraken, and emphasizes the compliance, security and other factors that should be focused on when choosing a platform.

Top 10 of the formal Web3 trading platform APP rankings (authoritatively released in 2025)

Mar 31, 2025 pm 08:09 PM

Top 10 of the formal Web3 trading platform APP rankings (authoritatively released in 2025)

Mar 31, 2025 pm 08:09 PM

Based on market data and common evaluation criteria, this article lists the top ten formal Web3 trading platform APPs in 2025. The list covers well-known platforms such as Binance, OKX, Gate.io, Huobi (now known as HTX), Crypto.com, Coinbase, Kraken, Gemini, BitMEX and Bybit. These platforms have their own advantages in user scale, transaction volume, security, compliance, product innovation, etc. For example, Binance is known for its huge user base and rich product services, while Coinbase focuses on security and compliance. Choosing a suitable platform requires comprehensive consideration based on your own needs and risk tolerance.