How much liquidity can liquidity re-hypothecation bring?

Original title: "How Liquid Are Liquid Restaking Tokens?"

Original author: Kairos Research

Original compilation: Ladyfinger, Blockbeats

Editor’s note:

EigenLabs’ newly launched data availability AVS, EigenDA, represents the beginning of the re-staking era on the mainnet. This article aims to provide a comprehensive analysis of Liquidity Recollateralized Tokens (LRT), exploring their integration in the DeFi ecosystem and comparison with traditional staking tokens. We paid particular attention to the current state of market liquidity and potential opportunities and challenges in the lending market going forward. Through this report, readers can gain a clear understanding of this emerging market and understand how LRT affects staking and re-staking strategies on a global scale.

EigenLayer’s first AVS lands on the mainnet

Recently, EigenLabs released its data availability AVS, and EigenDA is officially on the mainnet, which represents the beginning of the re-staking era. Although the EigenLayer market still has a long way to go, one trend is already very clear, and that is that Liquidity Re-staking Tokens (LRT) will become the main way for re-stakers. Over 73% of all EigenLayer staking is via LRT, but how liquid are these assets? This report delves into the issue and discusses the overall details of EigenLayer.

Introduction to EigenLayer and LRT

EigenLayer enables the reuse of ETH on the consensus layer of Ethereum through a new original concept of cryptoeconomics-"re-pledge". ETH can be re-staking on EigenLayer in two main ways: through native ETH or using Liquid Staking Tokens (LST). Re-staking ETH is used to support an additional application called the Active Validation Service (AVS), which in turn allows re-stakers to earn additional staking rewards.

The main concern users have about staking and re-staking is the opportunity cost of staking ETH. For native ETH staking, this problem has been solved with Liquidity Staking Tokens (LST), which can be thought of as liquidity receipt tokens that represent the amount of ETH someone has staked. The LST market on Ethereum is currently approximately $48.65 billion, making it the largest DeFi field currently. Today, LST accounts for approximately 44% of all staked ether, and as restaking continues to grow in popularity, we expect the Liquidity Restaking Token (LRT) industry to follow a similar growth pattern, perhaps even more aggressively.

Although LRT and LST share some similar characteristics, they have very different missions. The end goal of every LST is essentially the same, which is to stake users’ ETH and provide a liquidity receipt token. However, for LRT, the ultimate goal is to delegate user shares to one or more operators that will support some AVS. How each operator allocates its delegated shares to these different AVS is up to the individual operator. Therefore, the operators whose shares the LRT entrusts have a large impact on the overall activity, operational performance, and security of the re-staking ETH. Finally, they must also ensure that appropriate risk assessments are conducted for the unique AVS supported by each operator, as the risk of curtailment may vary depending on the service provided. It’s important to note that most Active Validation Services (AVS) launch with little to no risk reduction, but as time goes on and the staking market becomes more open and permissionless, we will gradually see these protections removed.

However, despite the different structural risks, LRT reduces the opportunity cost of re-pledged capital by providing liquid receipt tokens that can be used as productive collateral in DeFi, or used to ease withdrawal periods. This last point is especially important as the main benefit of LRT is to bypass the traditional withdrawal period, which for EigenLayer is 7 days. Given this core principle of LRTs, we expect that they will naturally face net sales pressure because the barrier to entry to rehypothecation is low but the barrier to exit is high, so the liquidity of these LRTs will be their lifeline.

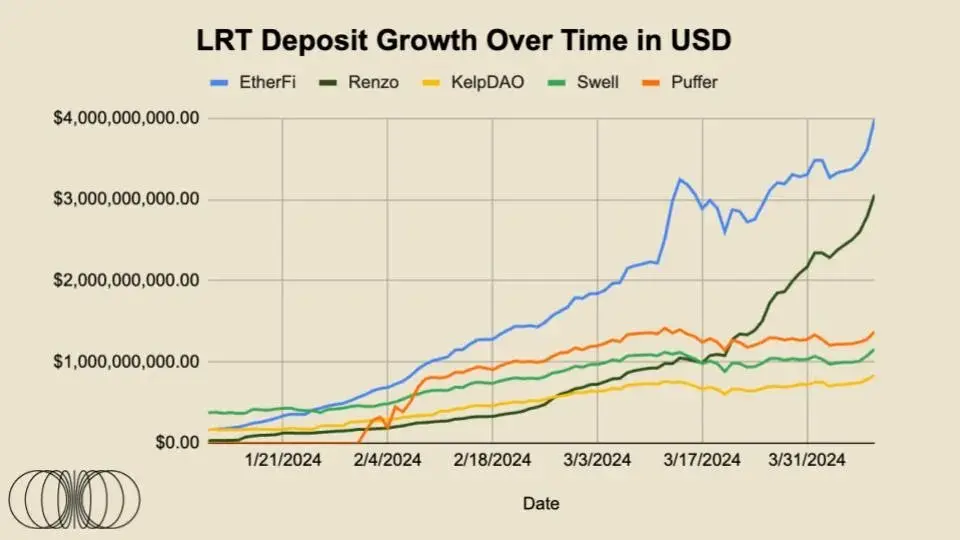

So, as EigenLayer’s TVL continues to climb, it’s important to understand what’s driving the protocol’s growth and how these forces will impact inflows/outflows in the coming months. As of this writing, 73% of all EigenLayer deposits are made via Liquidity Recollateralized Tokens (LRT). To provide a context, on December 1, 2023, LRT had approximately $71.74 million in deposits. Today, April 9, 2024, they have grown to approximately $10 billion, an increase of more than 13,800% in less than four months. However, as LRT continues to dominate EigenLayer’s rehypothecation deposit growth, there are some important factors to consider.

Not all LRTs are composed of the same underlying assets. LRT's share mandate for AVS will look different in the long term, but not much in the short term. Most importantly, the mobility characteristics of different LRTs vary widely.

Given that liquidity is the most critical advantage of LRT, most of this report will focus on the last point.

Currently, the bullish case for EigenLayer deposits is primarily motivated by the speculative nature of Eigen Points, which we can assume will translate into some form of airdrop distribution of potential EIGEN tokens. There are currently no AVS rewards live, meaning there are currently no additional incremental benefits on these LRTs. In order to drive and sustain over $13.35 billion in TVL, the AVS market must naturally find a balance between the incremental returns required by re-hypothecaters and the price AVS are willing to pay for security.

For LRT depositors, we have seen EtherFi start off with huge success with its ETHFI governance token airdrop, which as of now has a fully diluted valuation of approximately $6 billion. Combining all the above factors, it becomes increasingly possible that some funds may gradually flow out for re-staking after the release of EIGEN and other expected LRT airdrops.

However, in terms of reasonable returns, users will be hard-pressed to find higher returns in the Ethereum ecosystem that do not involve EigenLayer. There are several interesting revenue opportunities within the Ethereum ecosystem. For example, Ethena is a synthetic stablecoin backed by collateralized ETH and hedged with ETH futures. The protocol currently offers around 30% annualized yields on its sUSDe product. Additionally, as users become more comfortable with interoperability and bridging to new chains, revenue-seeking users may look elsewhere, potentially driving a massive outflow of capital away from Ethereum.

Nonetheless, we think it’s reasonable to assume there won’t be any incremental staking yield events larger than a potential EIGEN token airdrop to re-stakeholders and a high nine-figure valuation in the private market Large, blue-chip AVS may also issue their tokens to re-stakeholders. Therefore, it is reasonable to assume that a certain percentage of ETH will flow out of the EigenLayer deposit contract via withdrawals after these events.

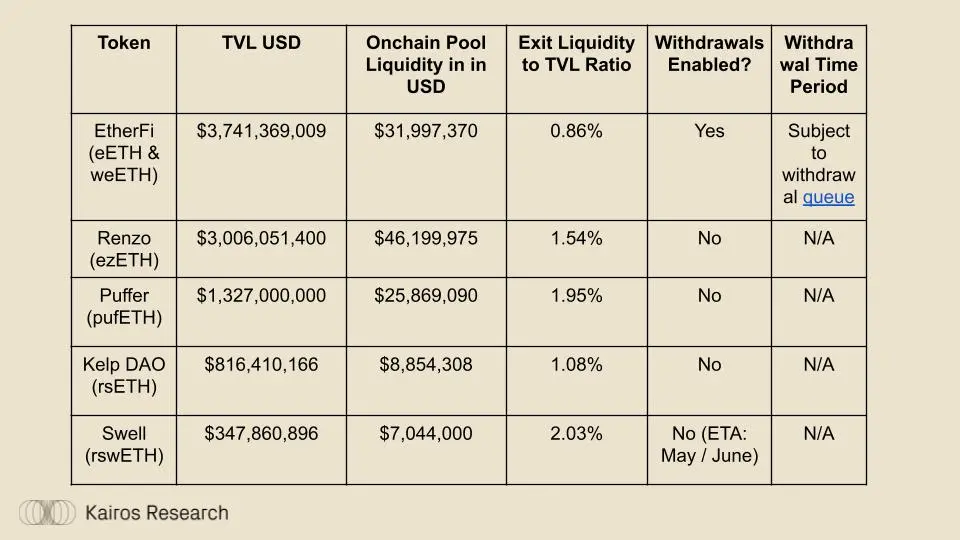

Given that there is a seven-day cooling off period for EigenLayer withdrawals, and the vast majority of capital is re-hyped via LRT, the fastest exit route will be to swap your LRT for ETH. However, the liquidity characteristics of these different LRTs vary widely, and many LRTs are unable to conduct large-scale exits at market prices. Additionally, as of writing, EtherFi is the only LRT provider to enable withdrawals.

LRT trading for less than its underlying asset could lead to painful arbitrage cycles in the restaking protocol, imagine an LRT trading at 90% of its underlying ETH value, a market maker arbitrageur could step in to buy This LRT and advances the redemption process, hoping to make a profit of approximately 11.1% while hedging the ETH price. From a supply and demand perspective, LRT is more likely to face net sales pressure as sellers may avoid the seven-day withdrawal queue. On the other hand, users wishing to re-stake may deposit their ETH immediately, and purchasing LRT from the open market will provide little benefit to already-owned staked ETH.

Data Tracking

The data portion of this month’s report, starting below, will track LRT’s growth, adoption, and liquidity conditions, as well as any notable news we feel should be covered.

Top 5 LRT Overview and Growth:

LRT Liquidity & Total Volume

Comparison of staking via LST and LRT Traditional staking has several key advantages, but these advantages are almost completely undermined if LRT itself is illiquid. Liquidity refers to "the efficiency or ease with which an asset can be quickly converted into cash without affecting its market price." It is critical to ensure that LRT issuers provide sufficient on-chain liquidity for large holders to enable them to redeem receipt tokens at a near 1:1 value.

Each existing LRT has very unique liquidity characteristics. We expect these conditions to persist for several reasons:

1. Some protocols may be lucky in the early stages to get investors and users to provide liquidity for their LRT;

2. There are many ways to incentivize liquidity through grants, token issuance, on-chain bribery systems, or through the anticipation of events such as “points”;

3. Some protocols will have more complex and centralized liquidity providers that will keep their LRT pegged closer to the underlying asset, while having less overall USD liquidity. It should be noted that concentrated liquidity only works within a tight price range, and any price movement outside the selected range will result in significant price impact.

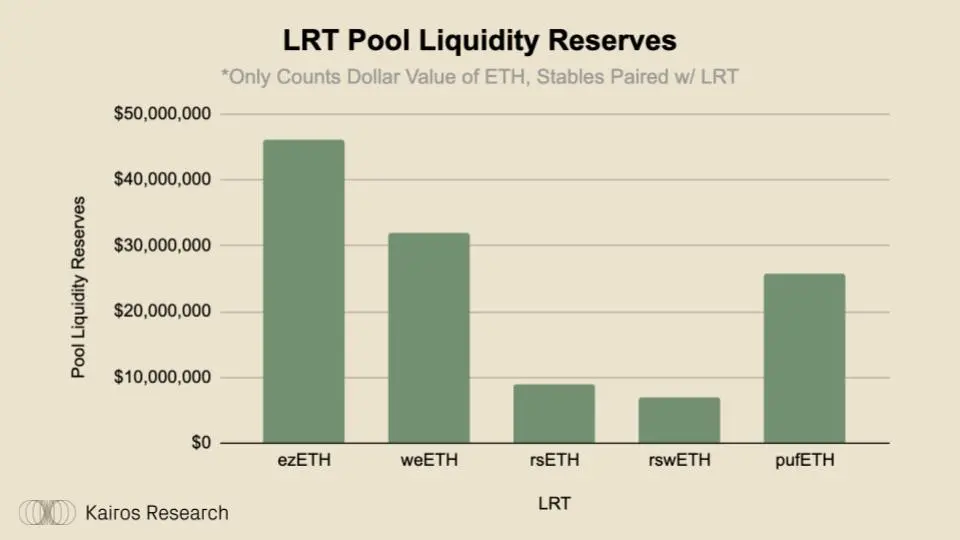

Here is a very simple breakdown of on-chain pool liquidity for the top five LRTs on Ethereum mainnet (plus Arbitrum). Exit liquidity refers to the USD value of the cash-like side of the LRT liquidity pool.

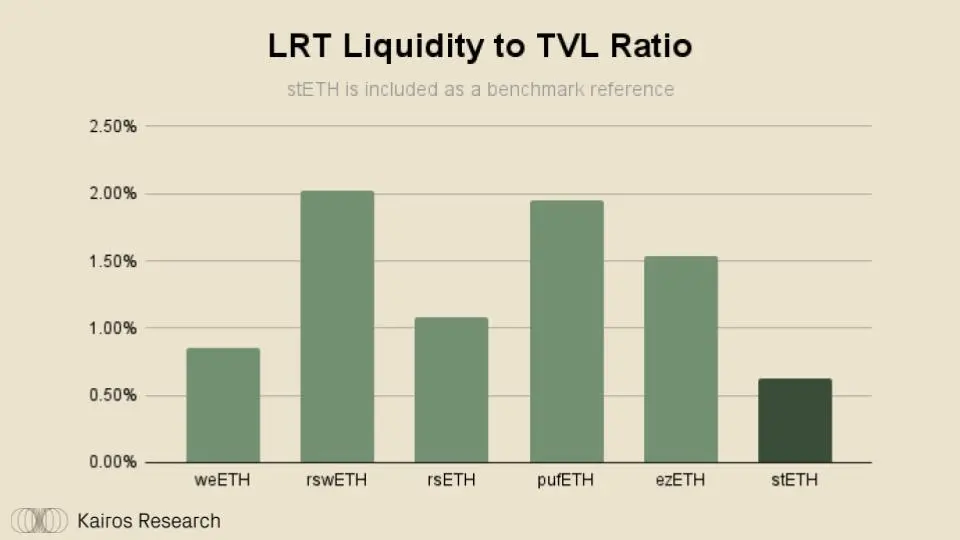

On the platforms Curve, Balancer and Uniswap, the five largest LRT groups have over 1.36 ready pool liquidity billion, which is impressive considering the emerging nature of the rehypothecation industry. However, to more clearly demonstrate the liquidity of each LRT, we will apply a Liquidity/Market Cap ratio to each asset.

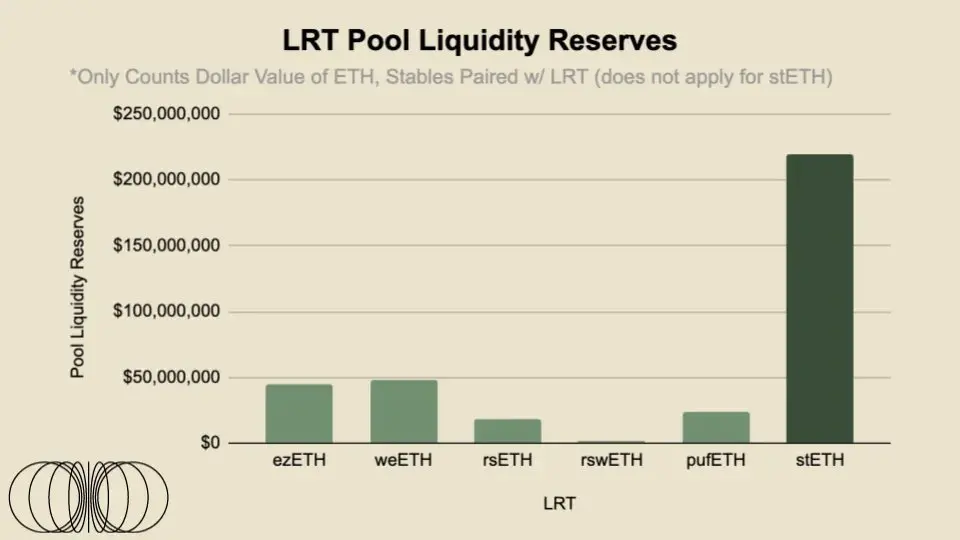

Compared to stETH, the top liquid staking token, LRT’s liquidity ratio is not overly worrisome. However, given the additional layer of risk that comes with re-staking, and the fact that Eigenlayer’s plus seven-day withdrawal cycle exceeds Ethereum’s unstaking queue, LRT’s liquidity may be more important than LST’s liquidity. Additionally, stETH trades on several large centralized exchanges, with order books managed by professional high-frequency trading firms. This means that stETH has far more liquidity than what is seen on-chain. For example, on OKX and Bybit, ±2% of order book liquidity exceeds $2 million.

Therefore, LRT can also work with centralized exchanges to strengthen integration and educate market makers about the risks and rewards of being a liquidity provider in these centralized venues.

LRT’s data

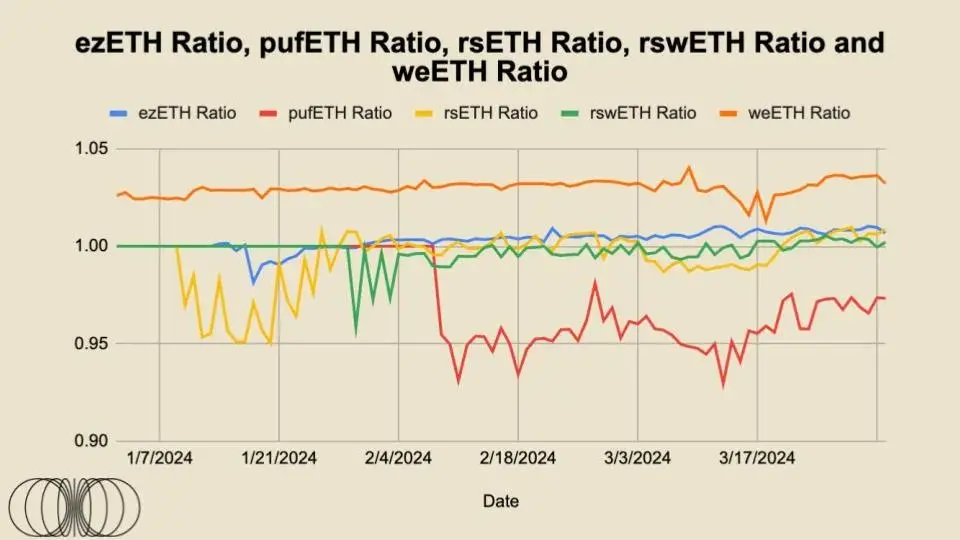

As shown in the figure above, rsETH, rswETH and ezETH all trade relatively closely with ETH on a 1:1 basis, with A slight premium. Due to their nature, they should all trade at a "premium" in the future. Since these are non-basing tokens, unlike stETH, they automatically compound staking rewards and this is then reflected in the token price. This is why 1 wstETH is currently trading at around 1.16 ETH. In theory, the "fair value" of these tokens should continue to grow over time due to the time*staking reward factor and be reflected in the increased fair value of these tokens.

The anchoring of these LRTs is very important because they essentially represent the degree of trust that market participants have in the entire project, which is directly affected by the stake that participants put in or the willingness of arbitrageurs to trade these premiums and discounts to keep the tokens The impact of willingness to trade at “fair value”.

It can be seen from the trading conditions of the two most liquid LRTs, ezETH and weETH, that their trading prices are relatively stable over time, and are mostly consistent with their fair values. . EtherFi's slight deviation from fair value in weETH can largely be attributed to the launch of its governance token, as opportunistic farmers swapped out their tokens and, naturally, other market participants stepped in to trade this discount arbitrage. We can expect to see similar events occur once Renzo launches its governance token.

KelpDAO’s rsETH traded at a discount to fair value at launch, but has since slowly but steadily returned to parity.

For rswETH, it has been trading slightly below its fair value most of the time, but has recently appeared to have reached parity with its fair value. Of all these LRTs, pufETH is the major outlier as they only trade at a discount to fair value. However, this trend appears to be coming to an end, as it is increasingly trading at a value closer to the fair value of its underlying assets.

With the exception of EtherFi, none of these LRT providers have withdrawals enabled. We believe that ample liquidity coupled with the ability for users to withdraw funds at will will increase market participants’ confidence in trading these discounts or premiums.

LRT in the DeFi Ecosystem

Once LRT is further integrated within the broader DeFi ecosystem, especially the lending market, its importance will increase significantly. For example, when we look at the current currency markets, specifically LST like wstETH/stETH is the largest collateralized asset on Aave and Spark, providing approximately $4.8 billion and $2.1 billion respectively. As LRT develops more and more in the DeFi ecosystem, we expect them to surpass LST in terms of final amount, especially as the market understands the risk and product structure better, they will become more valuable based on time. Lindy Features. Additionally, there are governance proposals on both Compound and Aave to introduce Renzo’s ezETH.

However, as mentioned before, liquidity will continue to be the lifeblood of these products to ensure the breadth and depth of their DeFi integration and overall durability.

Conclusion

Although stETH gained an early lead and occupied a dominant position due to the first-mover advantage, the series of LRT mentioned in this report roughly Launched at the same time and had market momentum on their side. We expect this to be a market structure where winners dominate the market, as most liquid assets operate under the power law; simply put, liquidity begets liquidity. This is why Binance, despite all the negative news and turmoil, continues to dominate the centralized exchange market share.

In general, the liquidity of liquid re-staking tokens is not very strong. Liquidity is decent, but each individual LRT has greater nuances that will only increase as delegation strategies start to differ over the long term. For first-time users, it may be easier to understand LRT as a collateralized ETF. Many will compete for the same market share, but allocation strategies and fee structures may be the deciding factors in who the winners and losers are in the long run. Additionally, as products become more differentiated, liquidity will become even more important, given how long withdrawal cycles are.

In the cryptocurrency world, seven days can sometimes feel like a month in normal time, as global markets operate 24/7. Finally, as these LRTs begin to integrate into the lending market, pool liquidity will become even more important, as liquidators will only want to take on acceptable risk, depending on the different liquidity characteristics of the underlying collateral in question.

The above is the detailed content of How much liquidity can liquidity re-hypothecation bring?. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

AI Hentai Generator

Generate AI Hentai for free.

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

1386

1386

52

52

What is Ouyi for? What is Ouyi

Apr 01, 2025 pm 03:18 PM

What is Ouyi for? What is Ouyi

Apr 01, 2025 pm 03:18 PM

OKX is a global digital asset trading platform. Its main functions include: 1. Buying and selling digital assets (spot trading), 2. Trading between digital assets, 3. Providing market conditions and data, 4. Providing diversified trading products (such as derivatives), 5. Providing asset value-added services, 6. Convenient asset management.

okx Ouyi Exchange web version enter link click to enter

Mar 31, 2025 pm 06:21 PM

okx Ouyi Exchange web version enter link click to enter

Mar 31, 2025 pm 06:21 PM

1. Enter the web version of okx Euyi Exchange ☜☜☜☜☜☜ Click to save 2. Click the link of okx Euyi Exchange app ☜☜☜☜ Click to save 3. After entering the official website, the clear interface provides a login and registration portal. Users can choose to log in to an existing account or register a new account according to their own situation. Whether it is viewing real-time market conditions, conducting transactions, or managing assets, the OKX web version provides a simple and smooth operating experience, suitable for beginners and veterans. Visit OKX official website now for easy experience

gate.io registration tutorial

Mar 31, 2025 pm 11:09 PM

gate.io registration tutorial

Mar 31, 2025 pm 11:09 PM

This article provides a detailed Gate.io registration tutorial, covering every step from accessing the official website to completing registration, including filling in registration information, verifying, reading user agreements, etc. The article also emphasizes security measures after successful registration, such as setting up secondary verification and completing real-name authentication, and gives tips from beginners to help users safely start their digital asset trading journey.

gate.io latest registration tutorial for beginners

Mar 31, 2025 pm 11:12 PM

gate.io latest registration tutorial for beginners

Mar 31, 2025 pm 11:12 PM

This article provides newbies with detailed Gate.io registration tutorials, guiding them to gradually complete the registration process, including accessing the official website, filling in information, identity verification, etc., and emphasizes the security settings after registration. In addition, the article also mentioned other exchanges such as Binance, Ouyi and Sesame Open Door. It is recommended that novices choose the right platform according to their own needs, and remind readers that digital asset investment is risky and should invest rationally.

The latest registration tutorial for gate.io web version

Mar 31, 2025 pm 11:15 PM

The latest registration tutorial for gate.io web version

Mar 31, 2025 pm 11:15 PM

This article provides a detailed Gate.io web version latest registration tutorial to help users easily get started with digital asset trading. The tutorial covers every step from accessing the official website to completing registration, and emphasizes security settings after registration. The article also briefly introduces other trading platforms such as Binance, Ouyi and Sesame Open Door. It is recommended that users choose the right platform according to their own needs and pay attention to investment risks.

ok official portal web version ok exchange official web version login portal

Mar 31, 2025 pm 06:24 PM

ok official portal web version ok exchange official web version login portal

Mar 31, 2025 pm 06:24 PM

This article details how to use the official web version of OK exchange to log in. Users only need to search for "OK Exchange Official Web Version" in their browser, click the login button in the upper right corner after entering the official website, and enter the user name and password to log in. Registered users can easily manage assets, conduct transactions, deposit and withdraw funds, etc. The official website interface is simple and easy to use, and provides complete customer service support to ensure that users have a smooth digital asset trading experience. What are you waiting for? Visit the official website of OK Exchange now to start your digital asset journey!

What are the recommended websites for virtual currency app software?

Mar 31, 2025 pm 09:06 PM

What are the recommended websites for virtual currency app software?

Mar 31, 2025 pm 09:06 PM

This article recommends ten well-known virtual currency-related APP recommendation websites, including Binance Academy, OKX Learn, CoinGecko, CryptoSlate, CoinDesk, Investopedia, CoinMarketCap, Huobi University, Coinbase Learn and CryptoCompare. These websites not only provide information such as virtual currency market data, price trend analysis, etc., but also provide rich learning resources, including basic blockchain knowledge, trading strategies, and tutorials and reviews of various trading platform APPs, helping users better understand and make use of them

XBIT Decentralized Exchange APP download recommendation

Mar 31, 2025 pm 08:21 PM

XBIT Decentralized Exchange APP download recommendation

Mar 31, 2025 pm 08:21 PM

This article introduces in detail the download and installation steps of the XBIT Exchange mobile APP, including four steps: accessing the official website (https://www.xbit.com/), downloading the installation package of the corresponding operating system (iOS or Android), installing software (including the installation methods of iOS and Android systems), and finally opening the app and registering/logging in. Please be careful to visit the official website to avoid malware and phishing websites, and select the installation package according to your own system version. If you have any questions, please contact XBIT Exchange online customer service.