Ethereum saw an outflow of $3.6 billion in the first quarter, where did the money go?

Written by: Michael Nadeau

Compiled by: Luffy, Foresight News

People They say you should follow the smart money in investing, and the beauty of public blockchains is that we can easily do this using on-chain data.

As the infrastructure connecting blockchains improves, network effects and economic moats within any single network may become increasingly difficult to achieve. Therefore, we have been studying the net fund flows of the top 15 L1s and L2s to reveal exactly where value flows in public blockchain networks, and now it is time to share our findings with you.

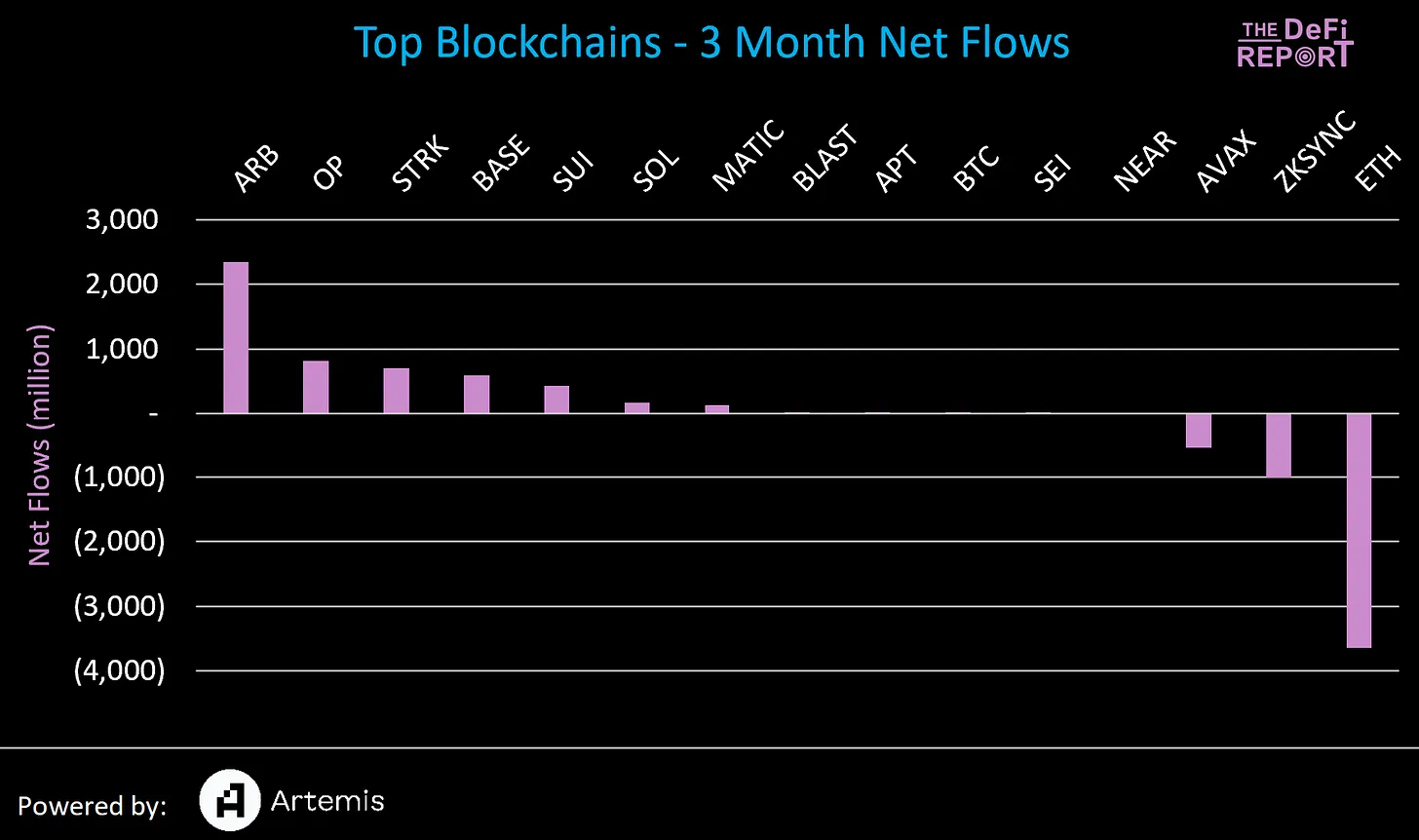

Which blockchains have the largest net inflow of funds?

Winner:

- We can see that Arbitrum is the biggest winner. Arbitrum has received over $2.3 billion in net traffic from other blockchains in the past 3 months.

- Optimism came in second, with nearly $800 million in net inflows during the same period.

- StarkWare ranked third with over $700 million in net inflows.

- Base ranks fourth, with nearly $600 million in net inflows over the past three months.

- Finally, Sui rounds out the top five with $423 million in inflows and is the only non-EVM chain to see significant inflows over the past 90 days.

Losers:

- Over the past 90 days, Ethereum has seen net outflows of over $3.6 billion. Over the same period, more than $4.4 billion entered the Ethereum ecosystem through L2. L2 pays settlement fees to ETH L1, so the funds don’t actually leave Ethereum.

- In the past 3 months, zkSync has seen over $1 billion in outflows.

- Avalanche has over $500 million exiting the ecosystem.

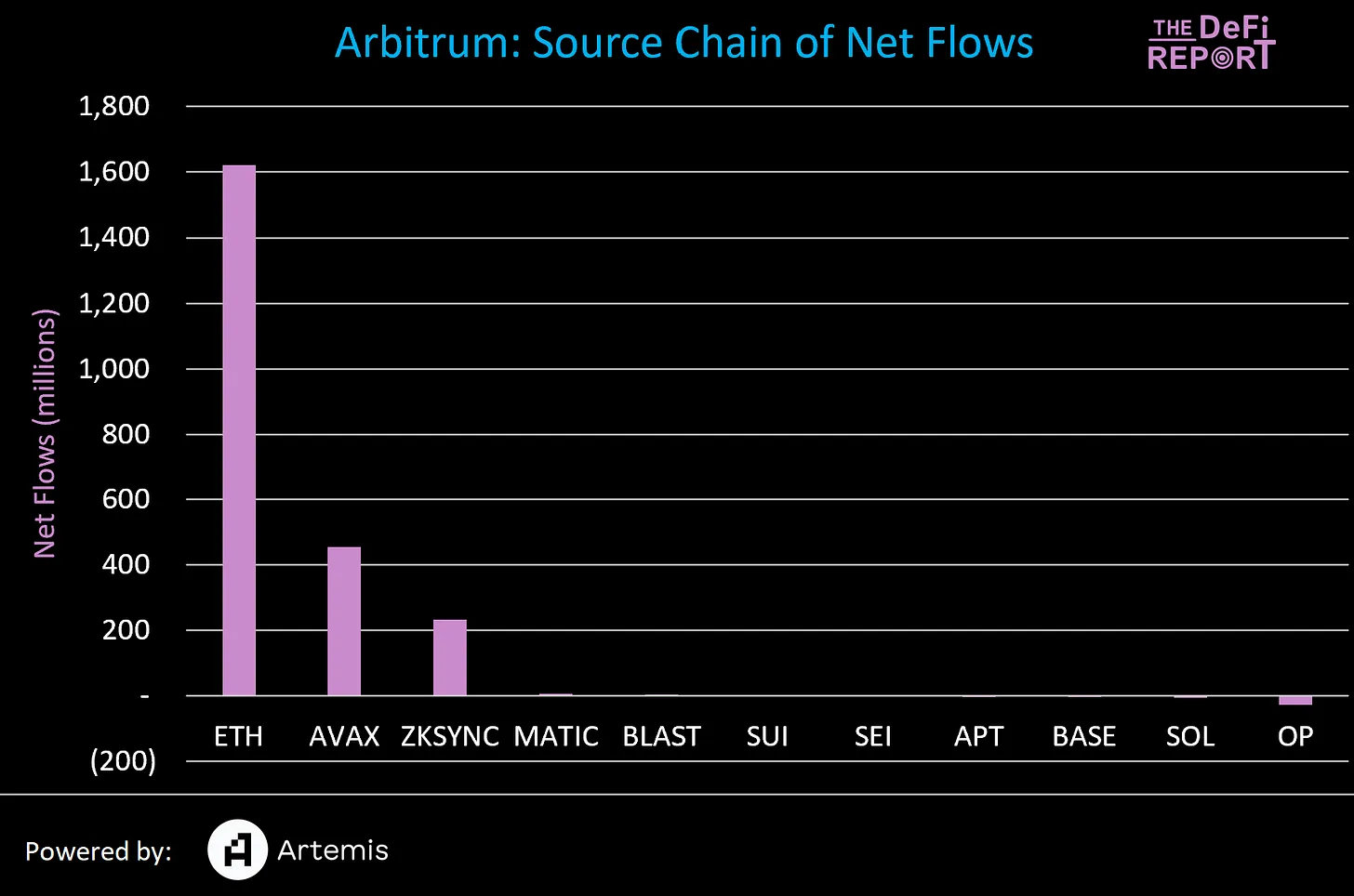

Where do Arbitrum’s net inflows come from?

We can see that the vast majority of Arbitrum’s inflows (70%) come from Ethereum L1. About 25% of the inflows are stablecoins, with other tokens accounting for 75%. We expect funds to continue to leave Ethereum L1 and flow into the most popular L2 instead.

But unexpectedly, nearly $500 million in funds left the Avalanche ecosystem and flowed to Arbitrum. If we revisit the first chart, Avalanche was one of the biggest losers of the group, with $543 million leaving the ecosystem last quarter, 84% of which went to Arbitrum.

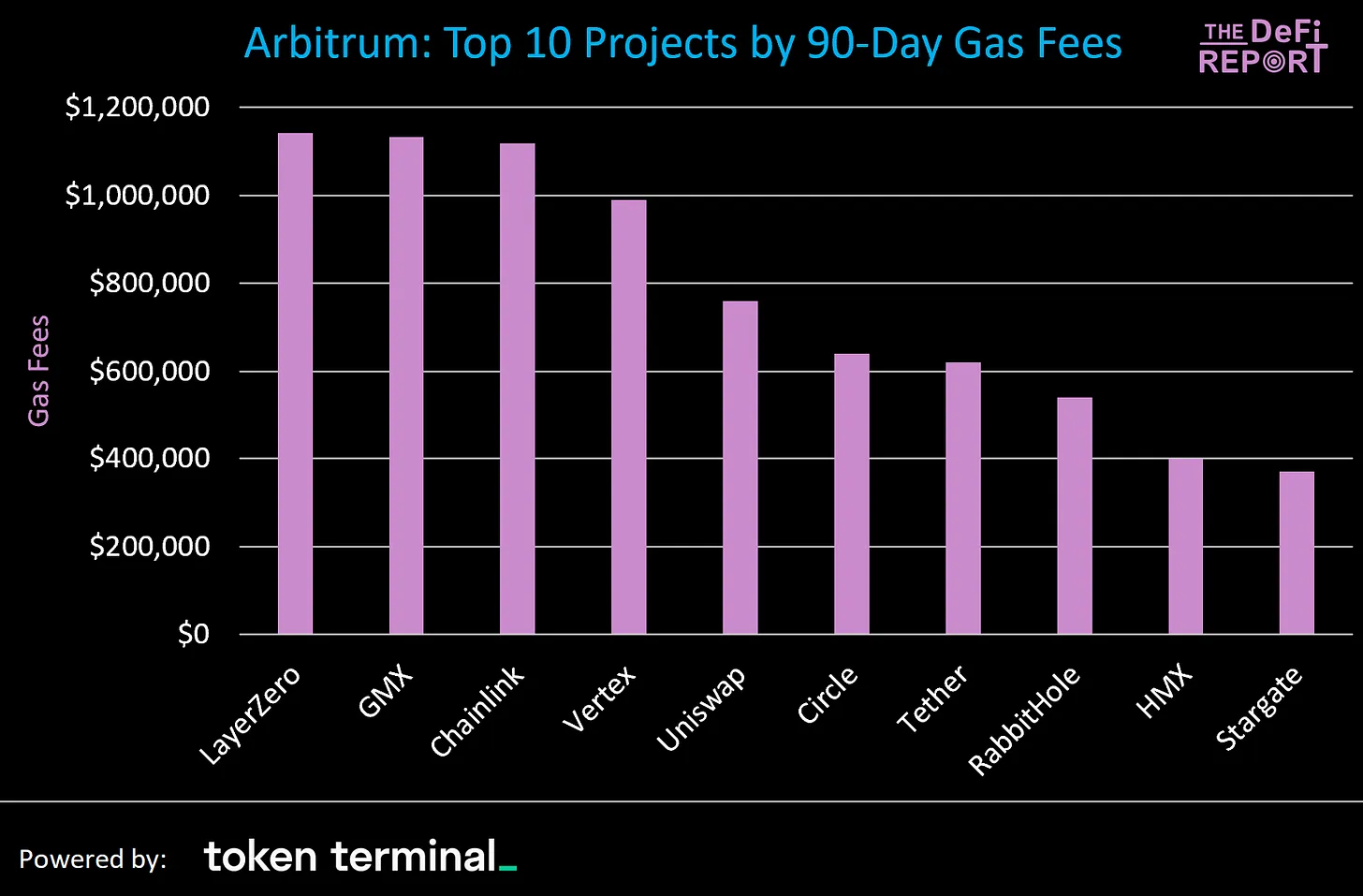

Which projects on Arbitrum are receiving these inflows?

We can’t say with certainty which projects on Arbitrum are capturing these inflows, but the projects mentioned above accounted for the most gas consumption on Arbitrum over the past quarter.

When we look at 90-day trends, RabbitHole (one game) stands out as its gas consumption rose 1,147% over the past quarter.

Another interesting observation about Arbitrum is that Pyth Network (the leading data oracle within Solana) has experienced a 600% increase in gas consumption in the past quarter after supporting Arbitrum.

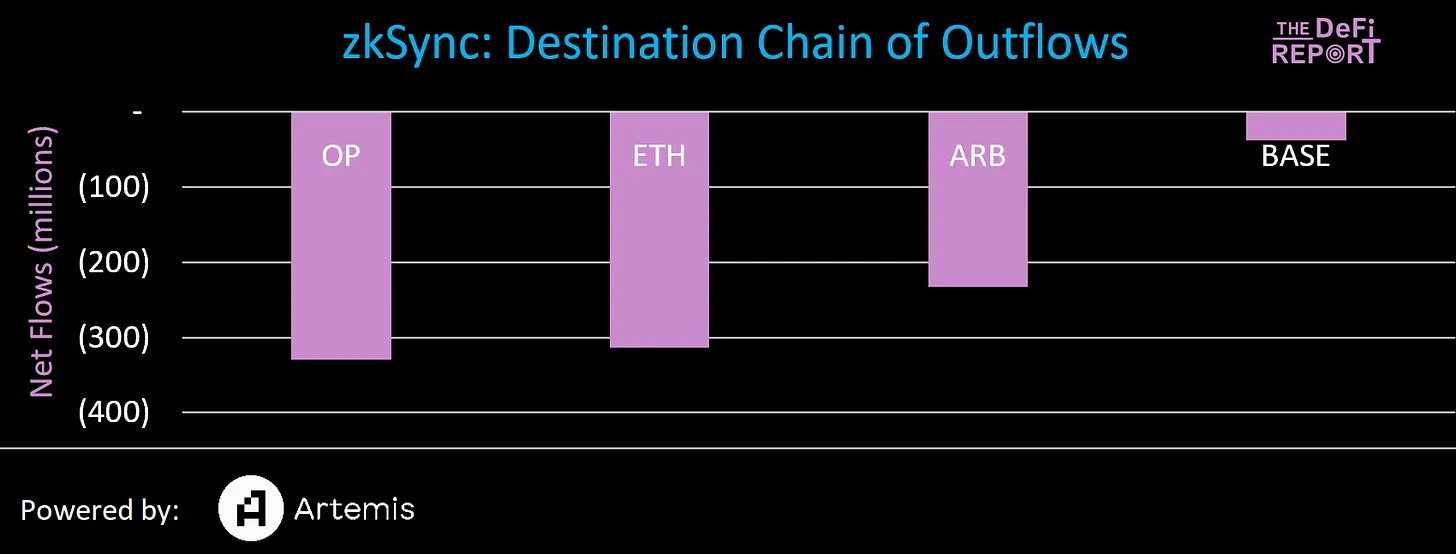

Blockchains with the Most Money Outflows

We talked about Avalanche, but beyond that, zkSync (Ethereum L2) has lost over $1 billion in funds in the past 90 days. Where did the money go?

- $328 million flows into Optimism

- $313 million flows into Ethereum

- $232 million flows into Arbitrum

- $37M flows into Base

Key points: All funds flowing out of zkSync remain within the Ethereum ecosystem.

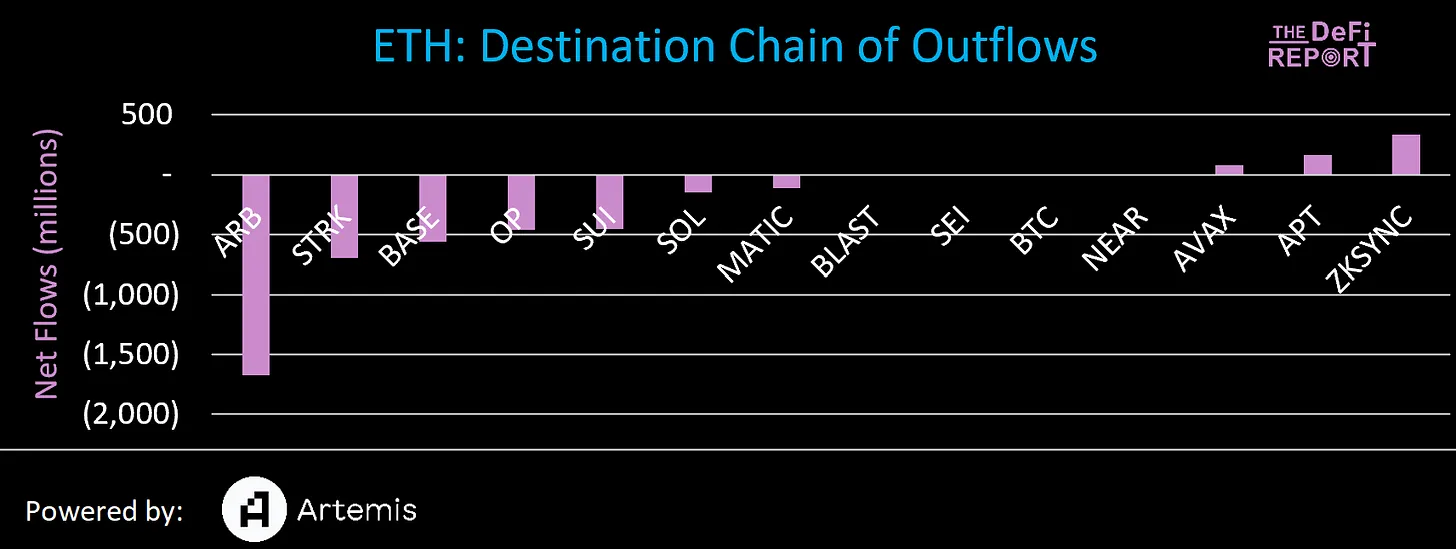

What about Ethereum? We know Arbitrum received $1.6 billion from Ethereum, but where did the rest of the money go?

The vast majority of Ethereum’s net outflows also remain within the Ethereum ecosystem, flowing to Starknet, Base and Optimism.

Sui was the largest non-EVM beneficiary of Ethereum outflows, receiving $452 million. Additionally, Solana received $152 million in inflows from Ethereum.

Key Points Summary

As public blockchain networks mature, we expect the amount of funding in the technology stack to rise.

We also expect that there will eventually be 3-5 major L1s (and possibly a series of less important L1 blockchains).

But as cross-chain infrastructure and account abstraction mature, we expect value to flow freely across various networks and ecosystems, making impenetrable network effects and economic moats more difficult to achieve.

Having said that, we have drawn some key conclusions from analyzing the flows in the main L1 and L2.

Ethereum

The largest L1 has lost a lot of money, but it has recovered at the L2 level. In my opinion, this is good for Ethereum. It would be a red flag if we saw funds leaving L1 instead of going to L2, but leaving the Ethereum ecosystem entirely. To be clear, we are not seeing this today.

Additionally, Ethereum’s TVL is up 60% in the past 3 months despite over $3 billion in outflows. This highlights the shortcomings of TVL as a KPI (the underlying asset price is highly volatile and easily manipulated).

Solana

Over the past 3 months, Solana’s net inflows across the 15 largest L1s and L2s were only $169 million. During the same period, Solana's TVL grew from $1.4 billion to $4.5 billion (a 221% increase).

So how did this happen?

- Over the past 3 months, the price of SOL has increased from $100 to $171 (a 77% increase).

- More and more SOL is being added to liquidity staking solutions (Marinade, Jito, BlazeStake)

- There are several projects in the Solana ecosystem that have issued tokens, such as Jito, Pyth , Jupiter and Tensor. These projects created billions of dollars in additional wealth, some of which remains in Solana DeFi.

- Memecoin on Solana has been in a frenzy for months, with increasing transaction volume and “value locked”.

Solana’s growth in TVL is largely organic within the ecosystem.

Sui

Sui is the biggest winner in the new era of "high throughput" blockchain. It received $423 million in net inflows, the vast majority of which came from Ethereum. This appears to have been the main catalyst that drove Sui TVL from $220 million to $660 million today.

Cross-chain bridge

As mentioned above, as cross-chain infrastructure matures, the flow of value across various networks is likely to accelerate, driving value out of any given L1, and Possibly to the cross-chain bridge itself. To be clear, we are not currently seeing this happening but are still monitoring it.

Wormhole is one of the largest cross-chain bridges today. It provides interoperability between Solana, Ethereum, Arbitrum, BNB, Avalanche, Optimism, Near and Polygon. The team recently launched its token, with FDV briefly exceeding $10 billion. This number is close to that of Ethereum L2, which is a market signal that cross-chain infrastructure is strong and worth paying attention to.

The above is the detailed content of Ethereum saw an outflow of $3.6 billion in the first quarter, where did the money go?. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

1387

1387

52

52

How to distinguish between altcoins and mainstream coins? Which one is more worth investing in? Learn about the coin circle in one article

Apr 21, 2025 am 11:18 AM

How to distinguish between altcoins and mainstream coins? Which one is more worth investing in? Learn about the coin circle in one article

Apr 21, 2025 am 11:18 AM

The difference between altcoins and mainstream coins is mainly reflected in: 1. Market value and liquidity: The mainstream currency has a large market value and strong liquidity; the altcoins have a small market value and poor liquidity. 2. Technology and innovation: The mainstream currency technology is mature and has extensive innovation; innovation or replication based on altcoin technology. 3. Application scenarios and communities: mainstream coins are widely used and active in the community; altcoins are narrow and small in the community. Investment choices require risk tolerance and goals.

How to avoid losses after ETH upgrade

Apr 21, 2025 am 10:03 AM

How to avoid losses after ETH upgrade

Apr 21, 2025 am 10:03 AM

After ETH upgrade, novices should adopt the following strategies to avoid losses: 1. Do their homework and understand the basic knowledge and upgrade content of ETH; 2. Control positions, test the waters in small amounts and diversify investment; 3. Make a trading plan, clarify goals and set stop loss points; 4. Profil rationally and avoid emotional decision-making; 5. Choose a formal and reliable trading platform; 6. Consider long-term holding to avoid the impact of short-term fluctuations.

When is Bitcoin's first high? A list of Bitcoin historical prices

Apr 21, 2025 am 11:24 AM

When is Bitcoin's first high? A list of Bitcoin historical prices

Apr 21, 2025 am 11:24 AM

Since its birth in 2009, Bitcoin has staged a thrilling epic of value growth. This crypto asset, which was originally worth only US$0.008, broke through the $100,000 mark on December 5, 2024, completing an astonishing increase of more than 12.5 million times.

Top 11 list of Bitcoin Exchange Rate Conversion Global (Updated in 2025)

Apr 21, 2025 am 11:27 AM

Top 11 list of Bitcoin Exchange Rate Conversion Global (Updated in 2025)

Apr 21, 2025 am 11:27 AM

The exchange rate of Bitcoin to currencies of various countries is as follows: 1. USD: at 7:20 on April 9, the exchange rate is 10,152.53. 2. Domestic: at 2:2 on April 9, 1 Bitcoin = 149,688.2954 yuan. 3. Swedish Krona: At 12:30 on April 9, the exchange rate was 758,541.05.

How to manage the risks of lending positions on the whale chain?

Apr 21, 2025 am 07:15 AM

How to manage the risks of lending positions on the whale chain?

Apr 21, 2025 am 07:15 AM

Managing the risk of lending positions on the whale chain requires seven aspects: 1. Reasonably control positions and leverage to avoid excessive leverage; 2. Closely monitor the value of collateral and position health, and take timely measures; 3. Pay attention to market conditions and macro trends, and prepare for risks in advance; 4. Conduct risk hedging, use derivative tools or different assets to hedge; 5. Formulate emergency and stop loss strategies, set stop loss positions and emergency plans; 6. Ensure sufficient liquidity and retain high-liquidity assets; 7. Distribute lending platforms and assets to reduce concentrated risks.

Analysis of the layout of Crypto Finance and AaaS on Crypto Finance and AaaS means to investors?

Apr 21, 2025 am 10:36 AM

Analysis of the layout of Crypto Finance and AaaS on Crypto Finance and AaaS means to investors?

Apr 21, 2025 am 10:36 AM

Bijie.com has laid out crypto finance and AaaS, which has brought many impacts to investors. It can provide more investment opportunities, involving a variety of crypto assets and innovative projects; provide professional investment services to help investors make decisions; but it is also accompanied by high risks, the crypto market fluctuates greatly, and AaaS technology has variables. At the same time, it lowers investment thresholds, such as BOSS storage and one-stop AaaS platforms. It also allows investors to obtain comprehensive information, understand industry trends, and assist investment decisions.

Keep up with the pace of Coinjie.com: What is the investment prospect of crypto finance and AaaS business

Apr 21, 2025 am 10:42 AM

Keep up with the pace of Coinjie.com: What is the investment prospect of crypto finance and AaaS business

Apr 21, 2025 am 10:42 AM

The investment prospects of crypto finance and AaaS businesses are analyzed as follows: 1. Opportunities of crypto finance include market size growth, gradual clear regulation and expansion of application scenarios, but face market volatility and technical security challenges. 2. The opportunities of AaaS business lie in the promotion of technological innovation, data value mining and rich application scenarios, but the challenges include technical complexity and market acceptance.

Web3 trading platform ranking_Web3 global exchanges top ten summary

Apr 21, 2025 am 10:45 AM

Web3 trading platform ranking_Web3 global exchanges top ten summary

Apr 21, 2025 am 10:45 AM

Binance is the overlord of the global digital asset trading ecosystem, and its characteristics include: 1. The average daily trading volume exceeds $150 billion, supports 500 trading pairs, covering 98% of mainstream currencies; 2. The innovation matrix covers the derivatives market, Web3 layout and education system; 3. The technical advantages are millisecond matching engines, with peak processing volumes of 1.4 million transactions per second; 4. Compliance progress holds 15-country licenses and establishes compliant entities in Europe and the United States.