web3.0

web3.0

Canaccord Genuity: More companies may follow MicroStrategy's lead in investing in Bitcoin

Canaccord Genuity: More companies may follow MicroStrategy's lead in investing in Bitcoin

Canaccord Genuity: More companies may follow MicroStrategy's lead in investing in Bitcoin

At the 2024 Digital Assets Seminar held by Canadian investment bank Canaccord Genuity last week, a team of analysts headed by Joseph Vafi stated that since the Bitcoin spot ETF obtained approval from the U.S. SEC in January this year Approval of listing has also boosted market investment demand for spot BTC: It is now increasingly clear that ETFs are driving additional demand for spot BTC, thereby producing a huge exponential effect. Spot BTC is more attractive than ETFs because as Bitcoin matures as an asset class, there may be more ways to hedge risk and generate HODL returns.

More companies may imitate micro-strategies to reserve Bitcoin

Canaccord Genuity continued to point out that in the next few months, the scope of influence of Bitcoin spot ETFs will continue to expand, Some institutions, including certain sovereign funds, may have invested in Bitcoin, and official reports from such investors may be made public soon.

In addition, according to the new FASB accounting standards, coupled with high inflation, it may also prompt more companies to follow MicroStrategy and use Bitcoin as an asset reserve, adding onto its company's balance sheet.

Samir Kerbage, chief investment officer of Hashdex, also believes that the influence of Bitcoin spot ETFs will continue to grow: many banks, endowments and pension funds around the world have just begun the due diligence process and are considering investing in BTC through newly launched ETFs. As these large financial institutions make decisions in the coming months, inflows are likely to increase again, potentially setting a new milestone for one of the most successful ETF launches in U.S. history.

MicroStrategy’s stock price has soared more than 7 times in five years

MicroStrategy, the dominant Bitcoin holding among US listed companies, was founded in 1989. It was originally a company that provided data analysis, software development and cloud computing. technology company, but its revenue capabilities have not been particularly outstanding in recent years. It was not until August 2020 that MicroStrategy announced that it would continue to invest in Bitcoin, thus starting its mighty path of skyrocketing stock prices.

According to Google Finance, MicroStrategy’s share price has soared from US$140 to the current US$1,270 in the past five years, an increase of nearly 750%. And two of the periods of high growth also correspond to Bitcoin’s bull market, one in 2021 and the other this year.

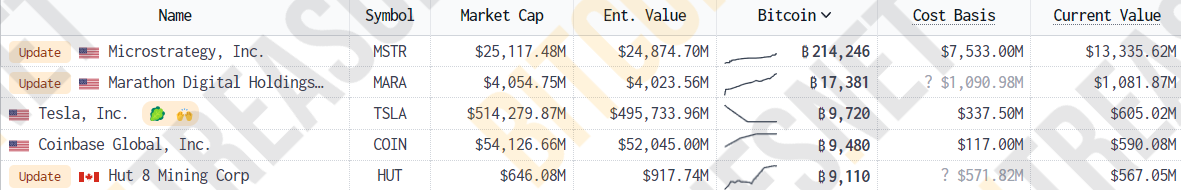

Micro-strategy Bitcoin holdings have a floating profit of 5.806 billion

According to current data from bitcointreasuries, Micro-Strategy has spent US$7.533 billion to purchase 214,246 Bitcoins so far. On Bitcoin When it exceeded US$70,000 again this week, the highest floating profit in the account had reached US$7.647 billion.

Although the current price of Bitcoin has corrected, it still has unrealized profits of US$5.806 billion.

If there is a wave of corporate Bitcoin purchases, how much incremental funds will it bring?

There are successful cases of micro-strategy. The Japanese company Metaplanet also announced this month that it will invest 1 billion yen to buy Bitcoin. Let us just imagine, if companies start a wave of Bitcoin purchases, there will be How much money is being poured into the crypto market?

Based on the current market capitalization of the U.S. stock market of US$51 trillion, if each company uses 1% of its market capitalization to purchase Bitcoin, that is equivalent to US$510 billion in incremental funds. You need to know, The current total market value of Bitcoin is only US$1.22 trillion, which is enough to push the price of Bitcoin to another level.

The above is the detailed content of Canaccord Genuity: More companies may follow MicroStrategy's lead in investing in Bitcoin. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

AI Hentai Generator

Generate AI Hentai for free.

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

1378

1378

52

52

What is Ouyi for? What is Ouyi

Apr 01, 2025 pm 03:18 PM

What is Ouyi for? What is Ouyi

Apr 01, 2025 pm 03:18 PM

OKX is a global digital asset trading platform. Its main functions include: 1. Buying and selling digital assets (spot trading), 2. Trading between digital assets, 3. Providing market conditions and data, 4. Providing diversified trading products (such as derivatives), 5. Providing asset value-added services, 6. Convenient asset management.

Will Dogecoin etf be approved?

Mar 28, 2025 pm 03:51 PM

Will Dogecoin etf be approved?

Mar 28, 2025 pm 03:51 PM

As of March 2025, the Dogecoin ETF has not yet had a clear approval schedule. 1. There is no formal application yet and the SEC has not received any relevant application. 2. Market demand and controversy are high, and regulators are conservative. 3. The potential timeline is a 1-2-year review period, which may be observed from 2025 to 2026, but there is high uncertainty.

How many times will the Dogecoin ETF price rise?

Mar 28, 2025 pm 03:42 PM

How many times will the Dogecoin ETF price rise?

Mar 28, 2025 pm 03:42 PM

The possible price increase of Dogecoin ETF after approval is 2 to 5 times, and the current price of $0.18 may rise to $0.6 to $1.2. 1) In the optimistic scenario, the increase can reach 3 times to 10 times, due to the bull market and the boost of Musk; 2) In the neutral scenario, the increase is 1.5 times to 3 times, due to moderate capital inflows; 3) In the pessimistic scenario, the increase is 0.5 times to 1.5 times, due to bear market and low liquidity.

How to calculate the transaction fee of gate.io trading platform?

Mar 31, 2025 pm 09:15 PM

How to calculate the transaction fee of gate.io trading platform?

Mar 31, 2025 pm 09:15 PM

The handling fees of the Gate.io trading platform vary according to factors such as transaction type, transaction pair, and user VIP level. The default fee rate for spot trading is 0.15% (VIP0 level, Maker and Taker), but the VIP level will be adjusted based on the user's 30-day trading volume and GT position. The higher the level, the lower the fee rate will be. It supports GT platform coin deduction, and you can enjoy a minimum discount of 55% off. The default rate for contract transactions is Maker 0.02%, Taker 0.05% (VIP0 level), which is also affected by VIP level, and different contract types and leverages

What are the Ethereum trading platforms?

Mar 26, 2025 pm 04:48 PM

What are the Ethereum trading platforms?

Mar 26, 2025 pm 04:48 PM

Want to play Ethereum? Choose the right trading platform first! There are centralized exchanges (CEXs) such as Binance, Ouyi, Coinbase, Kraken, and Gate.io. The advantages are fast speed and good liquidity, while the disadvantages are centralized risks. There are also decentralized exchanges (DEXs) such as Uniswap, SushiSwap, Balancer, and Curve. The advantages are security and transparency, while the disadvantages are slow speed and poor experience.

The latest summary of Ethereum formal trading platform 2025

Mar 26, 2025 pm 04:45 PM

The latest summary of Ethereum formal trading platform 2025

Mar 26, 2025 pm 04:45 PM

In 2025, choosing a "formal" Ethereum trading platform means security, compliance and transparency. Licensed operations, financial security, transparent operations, AML/KYC, data protection and fair trading are key. Compliant exchanges such as Coinbase, Kraken, and Gemini are worth paying attention to. Binance and Ouyi have the opportunity to become formal platforms by strengthening compliance. DeFi is an option, but there are risks. Be sure to pay attention to security, compliance, expenses, spread risks, back up private keys, and conduct your own research.

How to download kraken exchange

Mar 27, 2025 pm 04:21 PM

How to download kraken exchange

Mar 27, 2025 pm 04:21 PM

Want to experience a safe and reliable Kraken exchange? This tutorial details how to download the Kraken App (iOS & Android) and access the web version, and reminds everyone to pay attention to safety. Be sure to download it from the official channel, enable two-factor authentication, and protect account security.

Currency Trading Network Official Website Collection 2025

Mar 31, 2025 pm 03:57 PM

Currency Trading Network Official Website Collection 2025

Mar 31, 2025 pm 03:57 PM

It ranks among the top in the world, supports all categories of transactions such as spot, contracts, and Web3 wallets. It has high security and low handling fees. A comprehensive trading platform with a long history, known for its compliance and high liquidity, supports multilingual services. The industry leader covers currency trading, leverage, options, etc., with strong liquidity and supports BNB deduction fees.