web3.0

web3.0

The scale of Merlin's airdrop reached US$730 million, and the ratio of points to tokens is about 68:1. It is estimated that most assets may not outperform the market in terms of staking income.

The scale of Merlin's airdrop reached US$730 million, and the ratio of points to tokens is about 68:1. It is estimated that most assets may not outperform the market in terms of staking income.

The scale of Merlin's airdrop reached US$730 million, and the ratio of points to tokens is about 68:1. It is estimated that most assets may not outperform the market in terms of staking income.

On April 17, Merlin Chain announced that it has opened the airdrop query page corresponding to Merlin's Seal points. It is reported that 20% of MERL will be distributed to users who pledge Merlin's Seal. Based on the total amount of MERL of 2.1 billion, the number of tokens in this airdrop is approximately 420 million. Although the MERL token has not yet been officially issued, multiple over-the-counter MERL platforms have launched this trading pair. The price of MERL on April 18 was approximately 1.74, based on this price. The size of this round of airdrops is approximately US$730 million.

Taken together, the income from staking airdrops on Merlin The results are not optimistic. PANews counted the results of the main pledged assets. If they all pledged assets worth 1 BTC at the beginning. In the end, only BTC, ETH, USDT, and ORDI had a positive comprehensive rate of return, while the pledge results of the other assets were all negative. Among them, except for BTC, the combined return rate reached 82.25%, outperforming the highest spot return during this period. Other assets are inferior to holding spot and selling at a high point.

Single bet on Bitcoin may earn more money than the market

According to current user feedback, the points-to-token exchange ratio is approximately 68:1, and the total amount of this airdrop is 4.2 tokens , PANews calculated that the total number of points is approximately 28.5 billion points.

Based on this amount of points, if calculated based on the off-site token price of $1.74, the price of each point is approximately $0.025.

So how much income can you get from staking on Merlin Chain?

According to the above calculation method, the number of MERL tokens that can be exchanged for 1 Bitcoin per day is approximately 146, and the income amount is approximately US$255 per day. If a user starts staking on February 8th, it will last until April 14th. The 66-day staking income is approximately $16,876.

If you had not participated in Merlin’s staking activity, would you have earned more?

On February 8, Bitcoin’s closing price was US$45,288, rising to a maximum of US$73,777 on April 14. If User A is a master trader and chooses to just hold Bitcoin during this period and sell it at the highest point, then User A’s maximum return on spot is $28,488, with a maximum return of 62.9%.

Assuming that user B is a loyal user on the Merlin chain, he pledged 1 Bitcoin from the first day of staking, and did not choose to withdraw until April 14th (theoretical calculation, in fact, it will have to wait for 1 Bitcoin Withdrawal is only possible after the currency is halved). Then the user’s income is the income from Bitcoin holdings and the Merlin airdrop income. The combined income of the two is approximately US$37,249, with a maximum yield of 82.25%.

In comparison, if the price of MERL tokens can maintain the current trading price after going online, then users staking on MERL may be able to avoid certain risks of bull market corrections, but the overall difference is not big. . If MERL's official opening price falls below $0.83, combining MERL's airdrop income and currency holding income will not be as good as selling BTC at a high point.

Pledged hair was cut off by the market?

Since Merlin’s points are calculated in terms of equivalent assets denominated in BTC (each BTC is 10,000 points per day), with the recent violent fluctuations in the market, many pledged non-BTC assets have been affected by the exchange rate of BTC , resulting in the double damage of falling spot prices and reducing the number of points.

For those users who pledge RATS assets, staking on Merlin may miss the best opportunity to sell. During the Merlin staking period, RATS's simple holding rate of return is up to 169%, and if Merlin is chosen to pledge to obtain airdrops, the overall rate of return is -10.67%.

For example, during the initial pledge, user A chooses to pledge BTC, and user B pledges RATS. They are also assets worth 1 BTC. Assume that the initial capital is US$45,288.

For user A, the number of points he gets every day is the same, which is 10,000 points.

As for user B, the exchange rate of RATS to BTC has been changing, and the overall trend is downward. From February 8 to April 14, the exchange rate of RATS to BTC dropped by 56.79%, which means that B The user's daily points will be less than 10,000 points. If we estimate this decline process based on linear changes, overall user B who pledges RATS will receive 220,000 fewer points than user A who pledged BTC, which translates to approximately 2754 MERL less.

Combined with the RATS price falling by approximately 37.4% from February 8 to April 14, even including the 26.6% return obtained through staking, the comprehensive return during this period is -10.6%.

However, the above calculation only counts Merlin’s pledge airdrop reward income, and does not include rewards from other projects in the Merlin ecosystem. If combined with airdrop rewards from other projects in the ecology, the income situation will be better.

50% of the airdrop tokens will be released in the first month and will be fully unlocked in 6 months

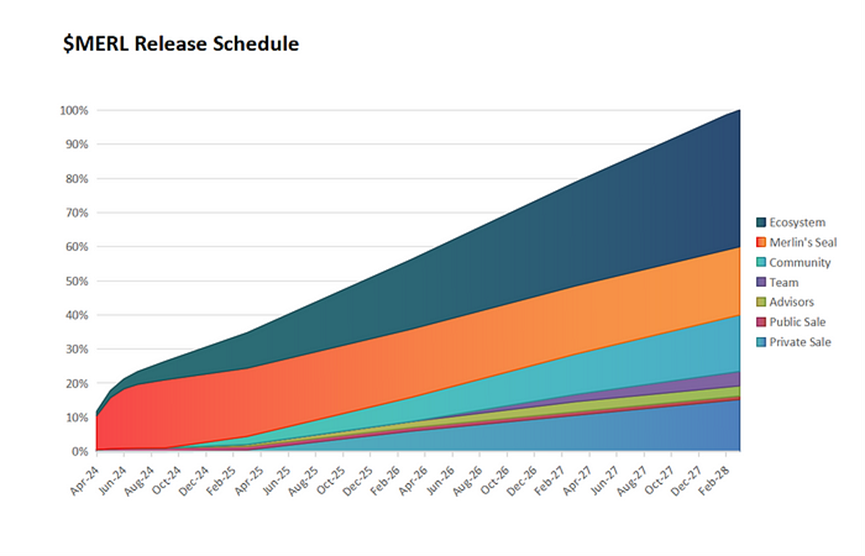

The total supply of MERL is 210 million and will be released linearly within 4 years. 20% of the tokens in this round of airdrop will be released in the first month and 50% will be gradually unlocked in 6 months thereafter. Based on the current OTC price of US$1.74, the fully diluted market value is approximately US$3.654 billion.

According to the official announcement, MERL tokens will be released at 10:00 UTC on April 19 Start trading on OKX, Hashkey Global, Bitget and many other CEXs.

Officially released data shows that during this round of airdrop activities. 91% comes from the Bitcoin native community (of which $1.75 billion in BTC and $980 million in BRC-20 assets). From this point of view, most users still choose to use BTC for pledge, which is currently the best choice for airdrops on the Merlin chain.

Generally speaking, for those users who hope to gain profits through airdrops, the last big airdrop, StarkNet, continued to decline, falling 85% from its high point. When pledging real gold and silver in exchange for airdrops, you may also want to consider hedging against changes in market conditions and learning more clever operating techniques. Airdrops are no longer a mindless way to make money.

The above is the detailed content of The scale of Merlin's airdrop reached US$730 million, and the ratio of points to tokens is about 68:1. It is estimated that most assets may not outperform the market in terms of staking income.. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

AI Hentai Generator

Generate AI Hentai for free.

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

1377

1377

52

52

What is Ouyi for? What is Ouyi

Apr 01, 2025 pm 03:18 PM

What is Ouyi for? What is Ouyi

Apr 01, 2025 pm 03:18 PM

OKX is a global digital asset trading platform. Its main functions include: 1. Buying and selling digital assets (spot trading), 2. Trading between digital assets, 3. Providing market conditions and data, 4. Providing diversified trading products (such as derivatives), 5. Providing asset value-added services, 6. Convenient asset management.

How to roll positions in digital currency? What are the digital currency rolling platforms?

Mar 31, 2025 pm 07:36 PM

How to roll positions in digital currency? What are the digital currency rolling platforms?

Mar 31, 2025 pm 07:36 PM

Digital currency rolling positions is an investment strategy that uses lending to amplify trading leverage to increase returns. This article explains the digital currency rolling process in detail, including key steps such as selecting trading platforms that support rolling (such as Binance, OKEx, gate.io, Huobi, Bybit, etc.), opening a leverage account, setting a leverage multiple, borrowing funds for trading, and real-time monitoring of the market and adjusting positions or adding margin to avoid liquidation. However, rolling position trading is extremely risky, and investors need to operate with caution and formulate complete risk management strategies. To learn more about digital currency rolling tips, please continue reading.

How to calculate the transaction fee of gate.io trading platform?

Mar 31, 2025 pm 09:15 PM

How to calculate the transaction fee of gate.io trading platform?

Mar 31, 2025 pm 09:15 PM

The handling fees of the Gate.io trading platform vary according to factors such as transaction type, transaction pair, and user VIP level. The default fee rate for spot trading is 0.15% (VIP0 level, Maker and Taker), but the VIP level will be adjusted based on the user's 30-day trading volume and GT position. The higher the level, the lower the fee rate will be. It supports GT platform coin deduction, and you can enjoy a minimum discount of 55% off. The default rate for contract transactions is Maker 0.02%, Taker 0.05% (VIP0 level), which is also affected by VIP level, and different contract types and leverages

Tutorial on how to register, use and cancel Ouyi okex account

Mar 31, 2025 pm 04:21 PM

Tutorial on how to register, use and cancel Ouyi okex account

Mar 31, 2025 pm 04:21 PM

This article introduces in detail the registration, use and cancellation procedures of Ouyi OKEx account. To register, you need to download the APP, enter your mobile phone number or email address to register, and complete real-name authentication. The usage covers the operation steps such as login, recharge and withdrawal, transaction and security settings. To cancel an account, you need to contact Ouyi OKEx customer service, provide necessary information and wait for processing, and finally obtain the account cancellation confirmation. Through this article, users can easily master the complete life cycle management of Ouyi OKEx account and conduct digital asset transactions safely and conveniently.

Currency Trading Network Official Website Collection 2025

Mar 31, 2025 pm 03:57 PM

Currency Trading Network Official Website Collection 2025

Mar 31, 2025 pm 03:57 PM

It ranks among the top in the world, supports all categories of transactions such as spot, contracts, and Web3 wallets. It has high security and low handling fees. A comprehensive trading platform with a long history, known for its compliance and high liquidity, supports multilingual services. The industry leader covers currency trading, leverage, options, etc., with strong liquidity and supports BNB deduction fees.

Top 10 of the formal Web3 trading platform APP rankings (authoritatively released in 2025)

Mar 31, 2025 pm 08:09 PM

Top 10 of the formal Web3 trading platform APP rankings (authoritatively released in 2025)

Mar 31, 2025 pm 08:09 PM

Based on market data and common evaluation criteria, this article lists the top ten formal Web3 trading platform APPs in 2025. The list covers well-known platforms such as Binance, OKX, Gate.io, Huobi (now known as HTX), Crypto.com, Coinbase, Kraken, Gemini, BitMEX and Bybit. These platforms have their own advantages in user scale, transaction volume, security, compliance, product innovation, etc. For example, Binance is known for its huge user base and rich product services, while Coinbase focuses on security and compliance. Choosing a suitable platform requires comprehensive consideration based on your own needs and risk tolerance.

gate official website login address gateio web version login portal address

Mar 31, 2025 pm 01:15 PM

gate official website login address gateio web version login portal address

Mar 31, 2025 pm 01:15 PM

Gate.io not only provides basic buying, selling and trading functions, but also launches a variety of innovative trading models and services to meet the needs of different users. The platform also provides a wealth of trading tools and analysis functions to help users make smarter investment decisions. Users can pledge their holdings to the platform, participate in mining activities, and obtain additional benefits.

Sesame Open Door Gate Official Website PC Login Entrance

Mar 31, 2025 pm 06:15 PM

Sesame Open Door Gate Official Website PC Login Entrance

Mar 31, 2025 pm 06:15 PM

The PC login portal of Sesame Open Door Gate official website is convenient and efficient. Users can log in in only three steps: First, open the browser and search for "Sesame Open Door Gate official website" and enter the official website; second, click the "Login" button on the homepage of the official website, enter the user name and password to log in; finally, after successfully logging in, you can enter the personal account management interface. To ensure account security, it is recommended to log in under a secure network environment to avoid operating under public WiFi. If you have any questions, please contact the platform customer service for help.