web3.0

web3.0

Monad raised US$225 million to kick off the 'parallel EVM' hype again. What other projects are worth paying attention to?

Monad raised US$225 million to kick off the 'parallel EVM' hype again. What other projects are worth paying attention to?

Monad raised US$225 million to kick off the 'parallel EVM' hype again. What other projects are worth paying attention to?

Author: Xiyou, ChainCatcher

Editor: Marco, ChainCatcher

April 9, Layer1 network Monad developer Monad Labs It completed US$225 million in financing at a valuation of US$3 billion. This round of financing was led by Paradigm, with participation from well-known institutions such as Electric CapitalAmber Group, Animoca Ventures, Bankless Ventures, Coinbase Ventures, and Wintermute Ventures.

The recent financing raised by Monad is the largest cryptocurrency financing so far in 2024. More than 50 institutions and investors participated in the investment, making it another king worth paying attention to in the crypto community. The project has also set off a boom in "parallel EVM" hype.

Monad is a high-performance Layer1 network that focuses on the concept of "Parallel EVM". It hopes to improve and enhance the execution efficiency of EVM in the Layer1 network by introducing "parallel processing" in the execution layer.

However, Monad’s mainnet will not be deployed until the end of this year, and the testnet is not open to the public. Currently, users can only participate by joining its Discord community. But its main concept of "parallel EVM" has become popular again with Monad's large financing.

"Parallel EVM": optimize EVM execution efficiency, "horizontal expansion" blockchain performance

"Parallel EVM" can be regarded as "parallel EVM compatible" II The technology integration of the two is an optimization of the existing EVM network execution layer. It is essentially a special optimization of the performance of each component of EVM to increase the number of transactions (TPS) or computing tasks processed by the network per unit time. Solve the current EVM inefficiency problem caused by transaction sequence execution.

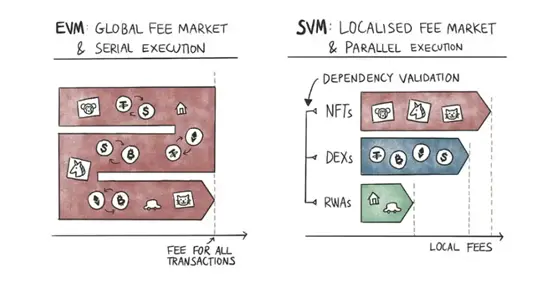

In traditional EVM environments, such as Ethereum, each transaction on the chain is executed in sequence, that is, when a user submits multiple transactions. When a transaction is submitted, it needs to be queued and processed in the order of submission time. Only after the transaction submitted first is confirmed, the transaction submitted later will start to be processed. Most high-performance Layer 1 such as Solana, Aptos, Sui, etc. , in fact, they are essentially designing their own optimization solutions based on the inability to process transactions in parallel on the Ethereum chain. However, everyone pays more attention to the innovation of the consensus algorithm and ignores the technical innovation of the execution layer. But they want to get one. For a high-performance public chain, the consensus algorithm and execution layer need to cooperate with each other. The consensus algorithm can ensure node collaboration and maintain network security. The execution layer needs to improve the efficiency of processing transactions and executing smart contracts. Parallel EVM. It is hoped that by partitioning or grouping all the transactions to be executed, and then relying on the scheduling algorithm to effectively manage the synchronization processing of each zone or each group of transactions, the ultimate goal is to allow multiple independent transactions to be executed in parallel at the same time, thereby improving Layer1 Transaction execution efficiency of the overall network. For example, Ethereum’s EVM is like a one-way street. Cars, electric vehicles, bicycles, people, etc. all gather on the same street, in order of queuing. Driving one after another is very congested and chaotic; but parallel EVM technology can divide this one-way road into multiple lanes such as motor lanes, non-motorized lanes, cycling lanes, and sidewalks to move forward simultaneously, which improves efficiency and alleviates congestion. Parallel execution in the blockchain is to process unrelated transactions at the same time, such as partitioning or grouping transactions on the chain such as DEX, NFT, GameFi, etc., so that they can execute transactions independently in parallel. This It also means that different transactions can be executed on different processing units at the same time, instead of being queued in chronological order, which greatly improves efficiency. Solana's SVM and Aptos' STM, which are famous for their high performance, are all used. ## Regarding the improvement of blockchain performance by "parallel EVM", community user Liu said:

## Regarding the improvement of blockchain performance by "parallel EVM", community user Liu said:

In fact, the "Parallel EVM" narrative is not a new concept. As early as 2022, Polygon PoS announced that it had completed a parallel EVM upgrade and doubled its network speed. BSC also It has already cooperated with NodeReal to develop parallel EVM technology.

It’s just that at that time, everyone didn’t pay much attention to the “parallel EVM” technology. They paid more attention to the consensus algorithm of the blockchain network and the Rollup expansion method.

Until the end of 2023, Paradigm CTO Georgios Konstantopoulos, Dragonfly Capital partner Haseeb Qureshi, Polygon former founder Jaynti Kanani (JD) and others all said when looking forward to industry trends in 2024: "2024 will be The Year of Parallel EVM".

Among them, JD, the former founder of Polygon, said that in 2024, every L2 will be labeled as "Parallel EVM" and rebranded.

The public support of leading VCs has sparked a wave of EVM-compatible Layer 1s that use parallel execution technology, such as Sei, Monad, Polygon, etc., and has also made the concept of "parallel EVM" a new hot spot pursued by the encryption community.

In March this year, the news that "Solana EVM solution Eclipse received US$30 million in financing" caused dissatisfaction from Sei founder Jay, questioning its excessive hype and difficulty in implementing ecological development. It also triggered a heated public debate on the topic of "EVM parallel expansion" among Eclipse founder Neel Somani, Fantom founder AC, etc., making the "parallel EVM" narrative once again become the focus of the community.

What are the representative projects of parallel EVM network?

Data from the encrypted data platform Rootdata shows that there are 7 "parallel EVM" concept projects that have been included, including Monad, Sei, Canto, Artela, Neon, Eclipse, Cipherem, etc.

Developer Pignard said: "A major premise of 'parallel EVM' is that EVM is compatible with the network. Although networks such as Solana, Aptos, Fuel, and Sui use parallel execution, due to It is a non-EVM network, so it is not included in the 'Parallel EVM' project category. "

Currently, existing parallel EVM networks can be divided into three categories:

First: Originally, EVM that did not use parallel execution technology was compatible with Layer 1. Later, parallel EVM upgrades were completed through technical iterations, and all EVM networks can essentially undergo parallel EVM upgrades. For example, Polygon has completed the parallel EVM upgrade in 2022; Fantom's Fantom Sonic upgrade network, which will be launched in April, also introduces parallel execution technology;

The second is: EVM using parallel execution technology Compatible with Layer1, such as Monand, Sei V2 and Artela;

The third is: Layer2 network using non-EVM Layer1 parallel execution technology, such as expanded layer2 EVM compatible chain represented by Solana Neon, Eclipse, Lumio, etc. They abstract EVM into a pluggable execution module, and can select the best "VM execution layer" according to needs, thereby realizing parallel capabilities. For example, the Lumio settlement layer is in Ethereum, and the execution layer can choose to use Solana VM, Move VM, EVM etc.

Parallel EVM track representative project

1、Parallel EVM leader Monad

Monad is A Layer 1 network area dedicated to solving the scalability problem of traditional EVM, aiming to improve network transaction processing speed by optimizing EVM such as introducing parallel execution and pipeline architecture, so that its TPS can reach 10,000.

On April 9, Monad completed a US$225 million financing led by Paradigm at a valuation of US$3 billion. In February last year, it also raised US$19 million in the seed round, bringing the total financing to US$244 million. It is currently the parallel EVM project with the highest financing and valuation.

Monad’s team background also attracts attention. The founding team members come from the market-making giant Jump Trading. One of the founders, Keone Hon, was the head of research at Jump Trading and has worked in the company for 8 years. Another co-founder, James Hunsaker, is a senior software engineer at Jump Trading and a core maintainer of Pyth Network.

In September last year, Monad revealed the network token MON in the project technical document released, but then the introduction to MON in the document was deleted.

Monad has launched an internal test network in March. It is reported that the test network will be open to the public in a few months.

2, Sei will launch the parallel EVM network Sei V2 in the first half of the year

Sei was originally a Layer1 network dedicated to transactions. Provide advanced infrastructure for various trading applications such as DeFi, DEX, games, etc.

In November last year, Sei announced that it would comprehensively upgrade its network and launch Sei V2, becoming the first high-performance parallel EVM, increasing its TPS to 12,500.

The Sei v2 parallel EVM test network was launched in February this year. Applications that support EVM deployment can be migrated to the network with one click. It is reported that its parallel EVM network can handle thousands of transactions per second. The main network It is expected to be launched in the first half of this year.

In March, Sei announced the launch of the Parallel Stack open source framework, which supports the use of parallel processing technology in Layer2 and Rollup networks.

3, Artela launches EVM dual virtual machines to improve execution layer performance

Artela hopes to expand the EVM to unlock the scalability of the Layer 1 network and support EVM parallelism implement. It aims to unlock the performance of the EVM blockchain and improve network execution efficiency by building EVM, that is, EVM WASM. The core members of the team come from Ant Chain.

The public test network is now online. It is reported that the Artela ecological incentive plan Renaissance Plan will be launched in April.

4, Canto plans to introduce parallel EVM technology

Canto is an EVM-compatible Layer1 network built based on the Cosmos SDK, specially designed for DeFi applications.

In March this year, Canto announced a Cyclone Stack development plan, aiming to introduce parallel execution EVM technology to improve its network performance.

5, Neon: Solana EVM compatible solution

Neon EVM is a parallel EVM built based on the Solana network, and is also the first Solana EVM compatible solution , allowing Solidity and Vyper EVM developers to deploy their DApps to the Solana network with one click and enjoy Solana’s high throughput and low gas fees.

The specific process is that Neon EVM can package transactions similar to the EVM network into Solana transactions for operation, and then send them to the Solana network, and then process and execute transaction data in a parallel manner in the network , to improve transaction speed, the network TPS is now as high as 2000.

Simply put, Neon EVM has built a software environment for Solana. Through this network, EVM developers can migrate applications to Solana with one click, and transactions are executed in parallel with Solana.

6, Eclipse aims to introduce SVM to Ethereum

Eclipse is a Rollup Layer2 modular universal solution supported by Solana virtual machine SVM , that is, the transaction data of the Eclipse network is settled in Ethereum, and ETH is used as gas fee on the chain, but the execution layer runs in the SVM environment.

Facing the problem of insufficient performance caused by the sequential execution of EVM, contrary to Neon’s idea of introducing EVM into Solana, Eclipse’s strategy is to introduce SVM into Ethereum.

In short, the logic of Eclipse product operation is: transaction execution is in Solana's SVM, and transaction settlement is still on Ethereum.

On March 11, Eclipse announced the completion of a $50 million Series A financing led by Hack VC and others. Currently, Eclipse is in the testnet stage. On April 9, an official document stated that the mainnet will be open to developers soon.

7, Lumio: Modular VM Layer2

Lumio is a modular VM Layer2 network built based on OP Stack, because it is an Optimism super chain One of them, called SuperLumio, aims to introduce high-performance VMs such as Aptos VM, Move VM, and Solana VM into the existing major Ethereum and Bitcoin Layer 2.

The product design logic is similar to the Eclipse product. Simply put, Lumio supports the use of Ethereum or Bitcoin as its settlement layer, and the execution layer can use virtual machines such as Aptos VM and Solana VM for parallel execution.

Lumio is the mainnet that was launched in February this year

The above is the detailed content of Monad raised US$225 million to kick off the 'parallel EVM' hype again. What other projects are worth paying attention to?. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

1389

1389

52

52

Rexas Finance (RXS) can surpass Solana (Sol), Cardano (ADA), XRP and Dogecoin (Doge) in 2025

Apr 21, 2025 pm 02:30 PM

Rexas Finance (RXS) can surpass Solana (Sol), Cardano (ADA), XRP and Dogecoin (Doge) in 2025

Apr 21, 2025 pm 02:30 PM

In the volatile cryptocurrency market, investors are looking for alternatives that go beyond popular currencies. Although well-known cryptocurrencies such as Solana (SOL), Cardano (ADA), XRP and Dogecoin (DOGE) also face challenges such as market sentiment, regulatory uncertainty and scalability. However, a new emerging project, RexasFinance (RXS), is emerging. It does not rely on celebrity effects or hype, but focuses on combining real-world assets (RWA) with blockchain technology to provide investors with an innovative way to invest. This strategy makes it hoped to be one of the most successful projects of 2025. RexasFi

Asset Manager Canary Capital is seeking SEC approval to launch SUI Exchange Trade's fund with points

Apr 21, 2025 pm 02:36 PM

Asset Manager Canary Capital is seeking SEC approval to launch SUI Exchange Trade's fund with points

Apr 21, 2025 pm 02:36 PM

Share this article! CanaryCapital Asset Management plans to launch its first spot cryptocurrency exchange-traded fund (ETF) that tracks the price of SUI (Sui). The company has filed an application with the U.S. Securities and Exchange Commission (SEC) seeking approval to issue its SUIETF. This will be the first ETF to track the performance of a well-known Layer-1 network. The ETF plans to leverage some of its positions through trusted staking providers. “The issuer may utilize or motivate all or part of the SUI of the Trust Fund to participate in Staking through one or more trusted Staking providers. Considering any of the Trusts’ possible participation in any

PI Network (PI) April 8 price forecast: Will PI reach $3 again?

Apr 21, 2025 pm 02:27 PM

PI Network (PI) April 8 price forecast: Will PI reach $3 again?

Apr 21, 2025 pm 02:27 PM

The price of PI coins has rebounded. Can it return to $3? Latest PI coin news analysis The PI coin news on April 8 continues to be optimistic, and the PI coin price is recovering from the market downturn. Bullish forecasts show that PI coin prices are expected to hit new highs. The sentiment of community members also rose, and many people asked: "Can PI coin reach $3 again?" Let's analyze today's PI coin news in depth and explore the possibility of it returning to $3. PI coins rebounded strongly today? Today, the price of PI coins rose 6.54% to $0.5817. Despite this, the recent decline cannot be ignored, with a weekly decline of about 19.26%. The highest price of PI coins is US$3.84, 51.72% higher than the current price. But today's price fluctuations showed signs of bullishness, with the highest reaching

Recently, cryptocurrency markets have been facing turmoil, and Cardano (ADA) has dropped below key support levels amid economic uncertainty.

Apr 21, 2025 pm 02:33 PM

Recently, cryptocurrency markets have been facing turmoil, and Cardano (ADA) has dropped below key support levels amid economic uncertainty.

Apr 21, 2025 pm 02:33 PM

Cryptocurrency market turmoil has intensified, and Cardano (ADA) has fallen below key support levels, raising concerns among investors. This article will analyze the recent performance of ADA and compare the strong growth momentum of another cryptocurrency, Coldware (COLD). ADA prices have continued to decline in the past five months, falling below the $0.61 support level on April 7, 2025, triggering volatility in the overall cryptocurrency market. At the same time, Coldware (COLD)'s pre-sale performed well, with financing of US$2.4 million in the second phase. So, what are the advantages of Coldware compared to Cardano? Coldware rises against the trend. In the same market environment where ADA prices fall, Coldware(C

XRP could soar to $12.5, surpassing Ethereum

Apr 21, 2025 pm 02:39 PM

XRP could soar to $12.5, surpassing Ethereum

Apr 21, 2025 pm 02:39 PM

The latest report predicts that XRP price may soar to $12.5 and surpass Ethereum to become the second largest cryptocurrency in market capitalization, even achieving this before the end of the next U.S. presidency. Core View: Standard Chartered's Jeffrey Kendrick predicts XRP will reach $12.5 and will become the second largest crypto asset in market capitalization before the end of the next presidency. Kendrick's report "The Seven Deadly Sins of (Digital) Integration" points out that by 2028, XRP's market value may exceed Ethereum. Multiple positive factors drive XRP prices to rise, including regulatory progress and increased institutional investment. The resolution of Ripple's SEC lawsuit is a key factor in XRP's bullishness. Kendrick predicts if SEC draft is obtained in the third quarter of 2025

The top ten recommendations for 2025 are authoritatively released by the currency trading platform app

Apr 21, 2025 pm 04:36 PM

The top ten recommendations for 2025 are authoritatively released by the currency trading platform app

Apr 21, 2025 pm 04:36 PM

The top ten Apps of the 2024 currency trading platform are: 1. Binance, the world's largest trading volume, suitable for professional traders; 2. Gate.io, supports a wide range of digital assets and provides pledge services; 3. OKX, has many innovative functions, supports multi-chain trading; 4. Coinbase, has a friendly interface, suitable for beginners; 5. FTX, focuses on derivative trading, and provides low-cost tools; 6. Huobi, high liquidity, and global layout; 7. Crypto.com, comprehensive services, rich reward plans; 8. Bybit, derivative trading platform, suitable for high-frequency trading; 9. KuCoin, a new token initial platform, low fees; 10. Phem

On April 7, Calamos Investments expands its suite of protected Bitcoin ETFs by launching three new funds

Apr 21, 2025 pm 02:24 PM

On April 7, Calamos Investments expands its suite of protected Bitcoin ETFs by launching three new funds

Apr 21, 2025 pm 02:24 PM

Each protected Bitcoin ETF provides different levels of Bitcoin returns and downside security. Calamos Investments expands its suite of protected Bitcoin ETFs by launching three new funds: Squid Bitcoin Structured AltProtectionETF-April (NYSE: CBOA), Calamos Bitcoin90SeriesstructedAltProtectionETF-April (NYSE: CBXA) and CALAMOSBITCOINBITCOIN80SELCORINEDALTPRECTINDALTP

WorldCoin (WLD) price forecast 2025-2031: Will WLD reach USD 4 by 2031?

Apr 21, 2025 pm 02:42 PM

WorldCoin (WLD) price forecast 2025-2031: Will WLD reach USD 4 by 2031?

Apr 21, 2025 pm 02:42 PM

WorldCoin (WLD) stands out in the cryptocurrency market with its unique biometric verification and privacy protection mechanisms, attracting the attention of many investors. WLD has performed outstandingly among altcoins with its innovative technologies, especially in combination with OpenAI artificial intelligence technology. But how will the digital assets behave in the next few years? Let's predict the future price of WLD together. The 2025 WLD price forecast is expected to achieve significant growth in WLD in 2025. Market analysis shows that the average WLD price may reach $1.31, with a maximum of $1.36. However, in a bear market, the price may fall to around $0.55. This growth expectation is mainly due to WorldCoin2.