Technology peripherals

Technology peripherals

It Industry

It Industry

2024 Q1 China's display market TOP10 released: AOC, HKC, Xiaomi top three sales

2024 Q1 China's display market TOP10 released: AOC, HKC, Xiaomi top three sales

2024 Q1 China's display market TOP10 released: AOC, HKC, Xiaomi top three sales

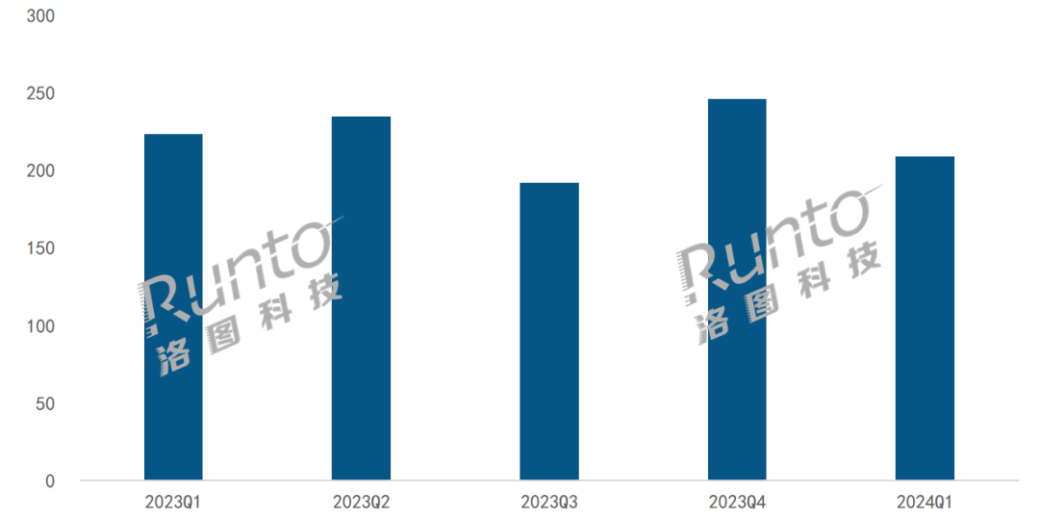

According to news from this site on April 19, according to the latest "Monthly Tracking Monitor Online Retail Market in Mainland China" report released by RUNTO, In the first quarter of 2024, the online public retail sales of monitors in Mainland China will be The sales volume in the market (excluding content e-commerce companies such as Doukuai) was 2.09 million units, a year-on-year decrease of 6%; the sales volume was 2.2 billion yuan, a year-on-year decrease of 12%.

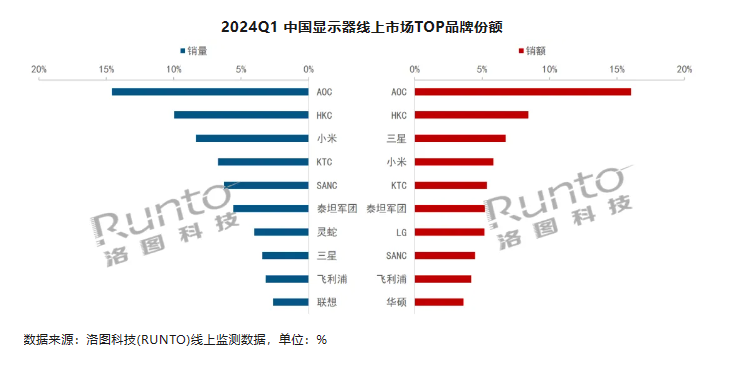

This site learned from the report that AOC ranks first in both sales and sales in the online market, with a share of approximately It was 15%, a slight increase. HKC and Xiaomi ranked second and third respectively in terms of sales in the online market.

KTC, SANC and Titan Legion focus on the layout of the e-sports field, and the penetration rate of their internal brand e-sports products exceeds 85%. Samsung ranks eighth in sales and third in sales. In the mid-to-high-end product line, Samsung’s OLED and Mini LED products lead the market share.

- The overall market demand is weak. It is difficult to achieve effective breakthroughs in the application scenarios and technological changes of displays in the short term. Against the background of weak socio-economic recovery,

terminal demand is slightly weak;

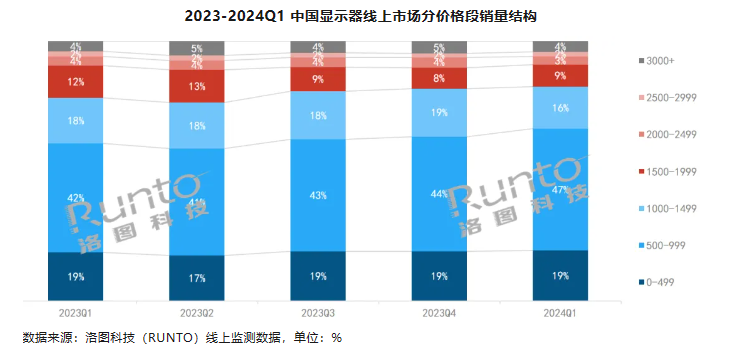

- Start adjusting the low price strategy. As the prices of upstream panels and other components increased in the

first quarter of this year, costs increased , and some companies began to adjust their low-price strategies in order to obtain better profit margins;

- Product homogeneity and structural upgrade go hand in hand. The current display lacks innovative reforms and new scenario expansion, but at the same time

product performance indicators are generally experiencing upward upgrades. The product ranges of 60Hz and 75Hz are iterating to 100Hz, and 144Hz and 165Hz are rising to 180Hz;

- OLED/Mini LED are actively being introduced in the high-end market. With the joint efforts of upstream panel manufacturers and terminal brands,

the number of complete machine brands and product models equipped with OLED and Mini LED has increased significantly;

- Traditional e-commerce encounters Due to scale bottleneck, other channels have failed to emerge. In the past few years, e-commerce channels have become the main battlefield for market competition. However, after the carnival, the changes in the scale of traditional e-commerce channels are leveling off, and the development of emerging e-commerce channels will still take time.

The above is the detailed content of 2024 Q1 China's display market TOP10 released: AOC, HKC, Xiaomi top three sales. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

AI Hentai Generator

Generate AI Hentai for free.

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

1377

1377

52

52

SANC launches 23.8-inch G52 Plus monitor: 2K native 180Hz FastIPS, 799 yuan

Jul 29, 2024 pm 09:57 PM

SANC launches 23.8-inch G52 Plus monitor: 2K native 180Hz FastIPS, 799 yuan

Jul 29, 2024 pm 09:57 PM

According to news from this site on July 29, SANC launched a G52 monitor in December last year, with a 23.8-inch 2K180Hz, with a starting price of 798 yuan. Now it has launched a G52Plus monitor, with a starting price of 799 yuan. Compared with the G52, the color gamut and brightness are slightly smaller. promote. This monitor still uses a 23.8-inch Fast panel with 2560*1440 resolution, 180Hz refresh rate, brightness increased to 350 nits, 10bit color depth, 1msGTG response time, 100% sRGB/97%DCI-P3 color gamut, G-Sync compatible. This website noticed that this monitor has also been upgraded with a lifting and rotating bracket, and the design is more low-key. It is also equipped with an under-screen night light and supports Owl

Discover ways to solve ghosting problems on HP monitors (How to eliminate ghosting on HP monitors)

Aug 08, 2024 am 01:11 AM

Discover ways to solve ghosting problems on HP monitors (How to eliminate ghosting on HP monitors)

Aug 08, 2024 am 01:11 AM

As a common computer peripheral, HP monitors will inevitably have some problems. One of them is the ghosting problem. When we use HP monitors, blur, ghosting or lag appears on the screen, which will not only affect our visual experience, but also reduce our work efficiency. How should we solve this problem? Understand the phenomenon of ghosting - Ghosting is when a copy of an object or text appears on the monitor screen, causing the image to be blurred or overlapping. -Ghosting issues can be caused by a variety of factors, such as monitor aging, signal transmission issues, etc. Check the connecting cables - Check that the cables connecting the computer and monitor are intact. - Make sure the connection cable is appropriately tight and not loose or broken. Adjust resolution and refresh rate - in operating system settings

KTC '25GR950' 24.5-inch monitor is now available: 1080P 180Hz Fast IPS, 579 yuan

Aug 19, 2024 pm 10:45 PM

KTC '25GR950' 24.5-inch monitor is now available: 1080P 180Hz Fast IPS, 579 yuan

Aug 19, 2024 pm 10:45 PM

According to news from this website on August 19, KTC launched a 24.5-inch monitor with model number "25GR950" on JD.com today. This monitor features "1080P180Hz" and the initial price is 579 yuan. As of the time of publication of this website, the machine has not yet been displayed. Specific sales time. According to reports, this monitor uses a 1920x1080 resolution 180Hz panel, a response speed of 1ms, a static contrast ratio of 1000:1, a brightness of 350 nits, supports 8-Bit color, and covers 99% sRGB and 95% DCI-P3 color gamut. This monitor stand supports tilting, and the monitor body supports VESA100x100mm wall mounting. It provides 1 DP1.4 interface, 2 HDMI2.0 interfaces, and 1 3.

AOC launches 'U24P10R' 23.8-inch monitor: 4K 60Hz + 90W PD USB-C, 1699 yuan

Aug 16, 2024 am 07:34 AM

AOC launches 'U24P10R' 23.8-inch monitor: 4K 60Hz + 90W PD USB-C, 1699 yuan

Aug 16, 2024 am 07:34 AM

According to news from this site on August 15, AOC launched a 23.8-inch monitor model "U24P10R" on JD.com today. This monitor features "4K60Hz + 90WPD USB-C" and is currently on sale, with an initial price of 1,699 yuan. According to reports, this monitor is equipped with a 3840x2160 resolution 60Hz IPS panel, a brightness of 400 nits, a response speed of 4ms, a static contrast ratio of 1300:1, supports 10-Bit color, and covers 100% sRGB and 95% DCI-P3 color gamut. In addition, this monitor stand supports tilt/lift/rotate/tilt, the monitor body supports 100x100mm VESA wall mounting, and provides 2 HDMI2.0 interfaces and 1 DP1

AOC 'Q24B35' 23.8-inch monitor is now available: 2K 120Hz, 749 yuan

Aug 17, 2024 pm 07:44 PM

AOC 'Q24B35' 23.8-inch monitor is now available: 2K 120Hz, 749 yuan

Aug 17, 2024 pm 07:44 PM

According to news from this site on August 17, AOC launched a 23.8-inch monitor with the model number "Q24B35" in its JD flagship store today. This monitor features "2K120Hz", but it is currently out of stock. The product page shows that the price of the monitor is 749 yuan. According to reports, this monitor uses a 2560x1440 resolution 120Hz IPS panel, a brightness of 250 nits, a static contrast ratio of 1300:1, a response speed of 4ms, and supports 8-Bit color. In addition, the monitor stand supports tilt/lift/rotate/tilt, the main body supports VESA100x100mm wall mounting, and provides 1 HDMI2.0 interface and 1 DP1.4 interface. This site organizes the currently known monitor parameter information as follows:

180Hz WQHD Rapid VA panel, MSI launches MAG 275CQPF curved monitor

Aug 07, 2024 pm 08:18 PM

180Hz WQHD Rapid VA panel, MSI launches MAG 275CQPF curved monitor

Aug 07, 2024 pm 08:18 PM

According to news from this site on August 7, based on reports from foreign media GdM and DisplaySpecifications, MSI launched the MAG275CQPF curved screen monitor on the 5th of this month. MAG275CQPF is equipped with a 27-inch 1500R curvature RapidVA panel with a resolution of 2560×1440 (aspect ratio 16:9), a refresh rate of 180Hz, a GtG response time as low as 0.5ms, and supports Adaptive-Sync adaptive synchronization and HDR. The display has a typical brightness of 300 nits, a static contrast ratio of 5000:1, and a dynamic contrast ratio of 100000000:1. It supports 8 dithers and 10 color depths, and the color gamut covers 136% sRGB, 94

Thor Darth Vader 27-inch gaming monitor DQ27F300L is on sale: 2K+300Hz, starting price is 1,799 yuan

Aug 09, 2024 pm 10:42 PM

Thor Darth Vader 27-inch gaming monitor DQ27F300L is on sale: 2K+300Hz, starting price is 1,799 yuan

Aug 09, 2024 pm 10:42 PM

According to news from this website on August 9, Thor’s new 27-inch monitor, Black Knight, goes on sale today, supporting 2K300Hz screen display. The daily price is 1,899 yuan, and the initial price is 1,799 yuan. According to reports, the Thor Black Knight display DQ27F300L is 27 inches in size, natively supports 300Hz high refresh rate, has built-in dark screen brightness adjustment, and supports HDR400. The display has a resolution of 2560×1440, covers 95% DCI-P3/99% sRGB color gamut, has a brightness of 450nit, supports AdaptiveSync variable refresh anti-tearing, hardware low blue light and DC flicker-free screen. Thor Black Knight 27-inch gaming monitor DQ27F300L interface information is as follows: HDMI2.1×2DP1.4×

MSI showcases MAG 321CUPDF: the world's first curved dual-mode monitor, supporting 4K 160Hz / 1080P 320Hz

Aug 23, 2024 am 11:17 AM

MSI showcases MAG 321CUPDF: the world's first curved dual-mode monitor, supporting 4K 160Hz / 1080P 320Hz

Aug 23, 2024 am 11:17 AM

According to news from this website on August 23, MSI attended the Cologne Games Show in Germany and showed off the new MAG321CUPDF monitor, claiming to be the world's first curved dual-mode monitor. MSI initially showed the details of the monitor at the 2024 Taipei International Computer Show held in June this year, but the model at the time was MPG321CUPF, but now the official model and series have been adjusted, and it is now called MAG321CUPDF. The MAG321CUPDF display is 31.5 inches in size and supports a 160Hz refresh rate at 4K (3840x2160) resolution and a 320Hz refresh rate at 1080P resolution. Users can switch to high resolution or high refresh rate according to needs. MAG321CUPD