web3.0

web3.0

A weekly review of the crypto market: BTC ushered in the fourth halving, and the rune ecology attracted attention

A weekly review of the crypto market: BTC ushered in the fourth halving, and the rune ecology attracted attention

A weekly review of the crypto market: BTC ushered in the fourth halving, and the rune ecology attracted attention

A. Market view

1. Macro liquidity

Monetary liquidity improves. U.S. retail sales data for March exceeded expectations, and Powell's hawkish speech further dampened expectations for an interest rate cut. The dot plot shows the Fed is expected to make three 25-basis-point rate cuts this year, but investors now expect only one or two cuts. In January this year, they expected to cut interest rates six times. Risks in the situation in the Middle East have eased. The U.S. dollar index reached a six-month high, and U.S. stocks fell sharply. Crypto markets follow U.S. stocks’ correction.

2. Full market conditions

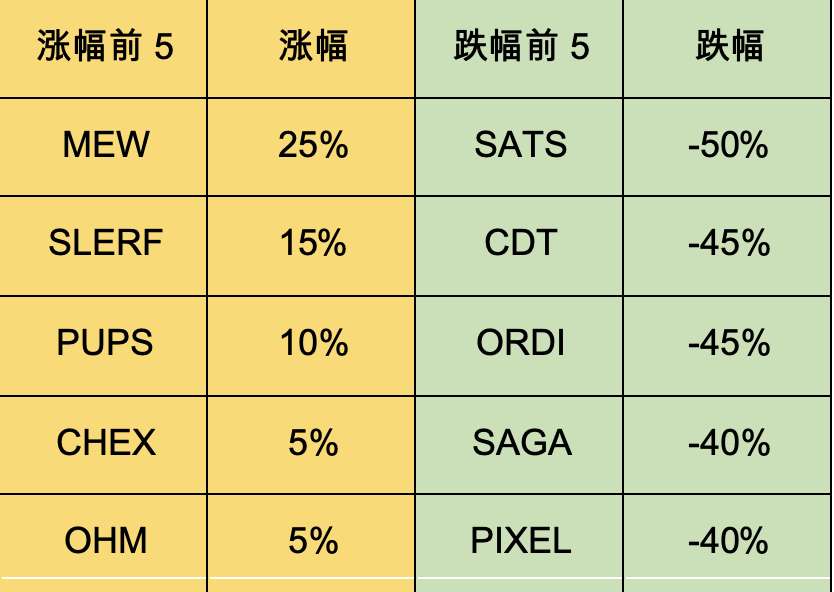

Top 100 gainers by market value:

This week BTC fell weakly, and the BTC dominance rate rose to a new high in 4 years. The exchange rate of altcoins started not to match that of BTC. Market hot spots revolve around the BTC rune ecology and football fan coins. The Rune Protocol will be launched at the halving block on the weekend. It is recommended to prepare your wallet in advance and prepare to play runes. The biggest difference between runes and inscriptions is that they attract more American funds.

1. TAO: TAO listed on Binance Exchange. TAO is POW's AI machine learning training. Its architecture is similar to Polkadot and its economic model is similar to BTC.

2.OMNI: OMNI is listed on Binance Exchange. OMNI focuses on cross-chain information transfer between ETH L2 and uses modularity to solve the problem of L2 fragmentation. ZETA on the same track has a market capitalization of US$2.5 billion.

3.MERLIN: MERLIN is listed on OK Exchange. The public chain MERLIN is the EVM L2 of BTC, and 20% of the airdrop will be unlocked in the next six months. STX on the same track has a market capitalization of US$4 billion, and CKB has a market capitalization of US$1 billion.

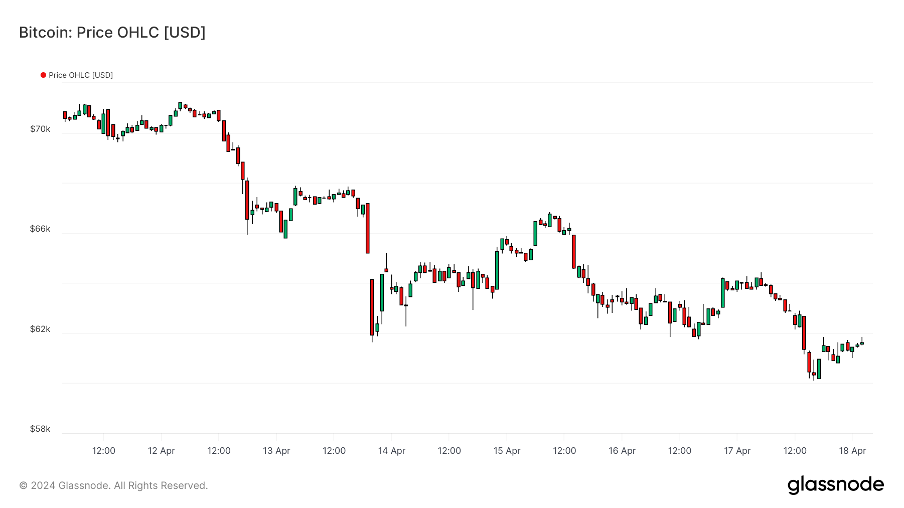

3. BTC market

1) On-chain data

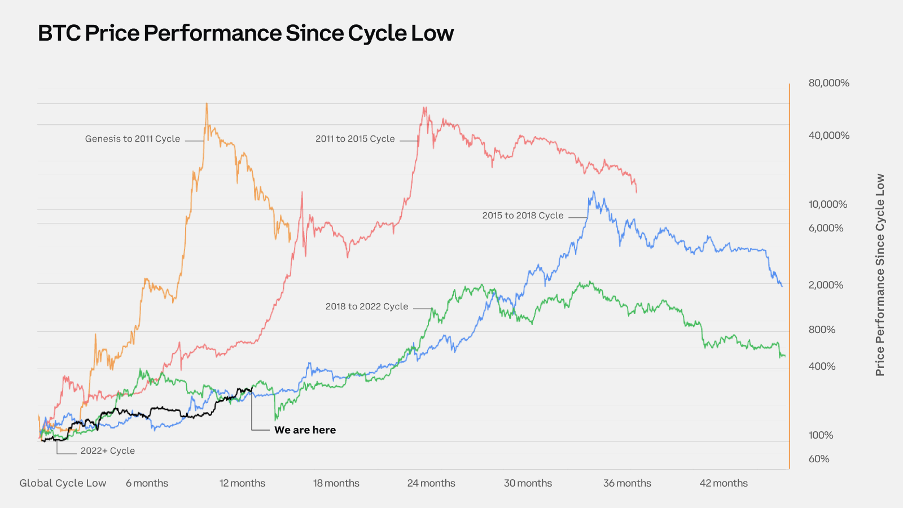

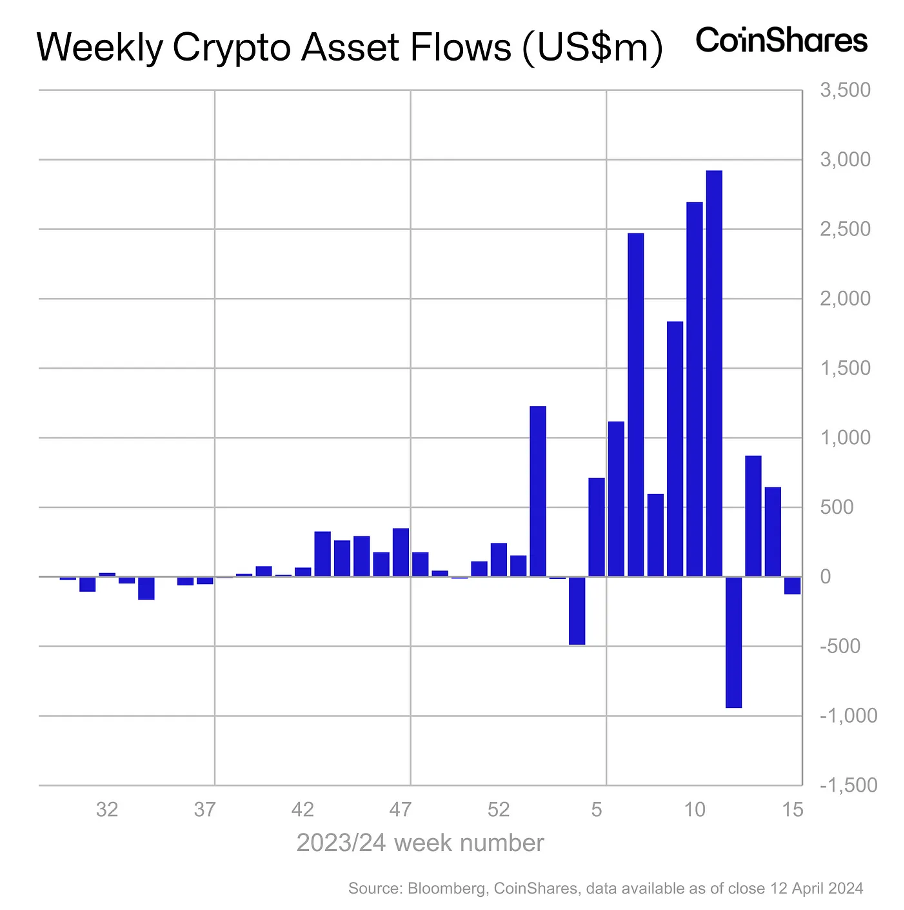

Can the cyclical pattern of BTC continue? The first two bull markets lasted 3.5 years; the current one is 1.5 years old. Prices rose 113x and 19x in past cycles, while so far this cycle, prices have only risen 4x. Spot ETF inflows brought in $12 billion in new capital. ETF holdings of BTC are estimated to be worth $60 billion and have become one of the most important drivers of the market.

#The market value of stablecoins increased by 2%, and long-term funding fundamentals are still good.

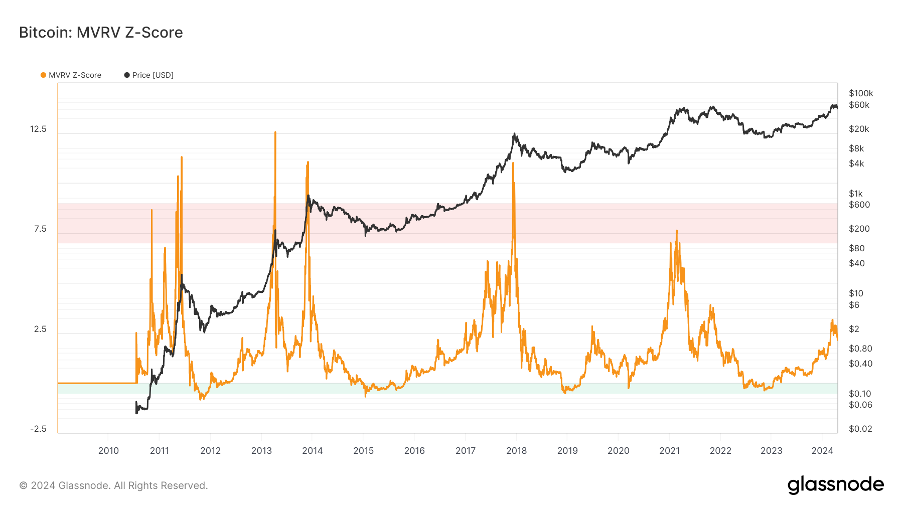

The long-term trend indicator MVRV-ZScore is based on the total market cost and reflects the overall profitability of the market. When the indicator is greater than 6, it is the top range; when the indicator is less than 2, it is the bottom range. MVRV fell below the key level 1 and holders were in the red overall. The current indicator is 2.1, entering the intermediate stage.

# Institutional funds began to outflow netly, and spot ETFs had net outflows for 3 consecutive days. Investor sentiment is hesitant.

2) Futures market

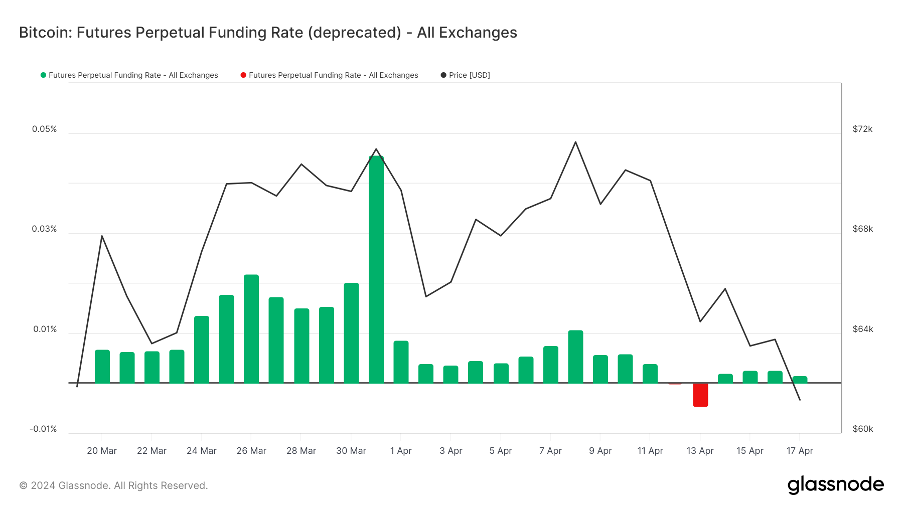

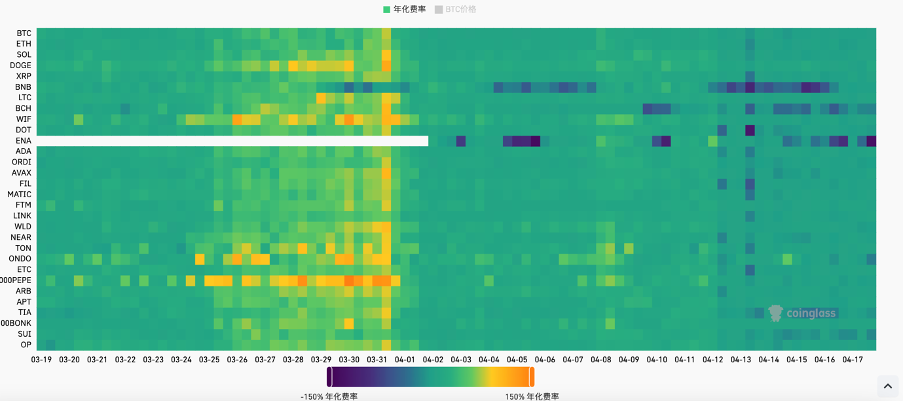

Futures funding rate: This week the rate is close to 0. The fee rate is 0.05-0.1%, and the long leverage is high, which is the short-term top of the market; the fee rate is -0.1-0%, the short leverage is high, and it is the short-term bottom of the market.

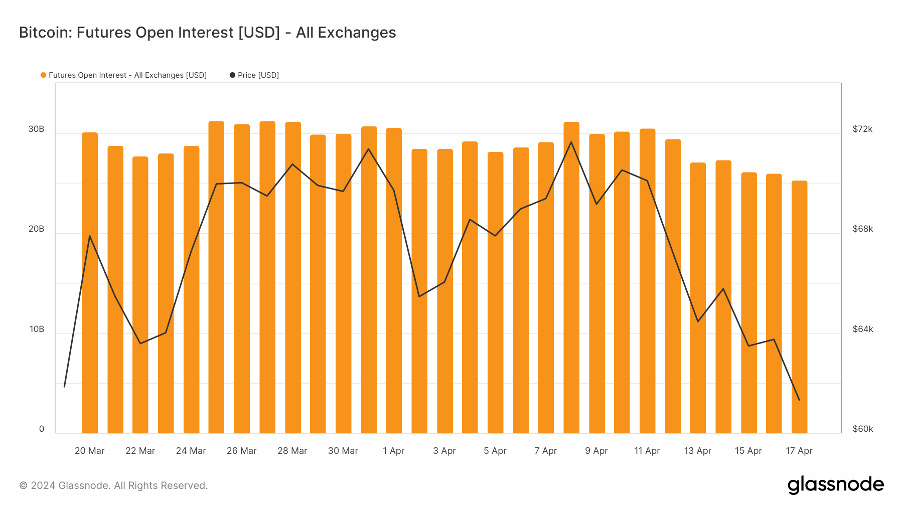

Futures positions: BTC positions dropped sharply this week, and the main players in the market left the market.

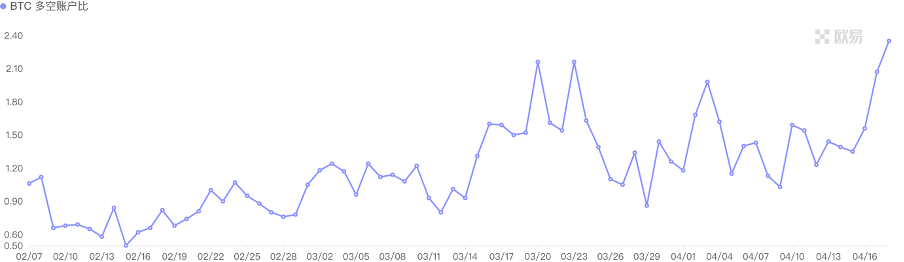

Futures long-short ratio: 2.4, market sentiment is still greedy. Retail investor sentiment is mostly a reverse indicator, with a reading below 0.7 indicating panic and a reading above 2.0 indicating greed. The long-short ratio data fluctuates greatly, and the reference significance is weakened.

3) Spot market

BTC continues to fall, and the halving is good news. The lowest shutdown price for miners is now $49,000. BTC is currently down 15% from the top, while many major altcoins are down close to 50% from the top. This is because ETFs bring permanent buying pressure and altcoin unlocks bring permanent selling pressure. There is a high probability that we will have to wait until the end of the year when the Federal Reserve officially cuts interest rates and market liquidity fully improves before we can truly see a general rise in the market. Patience will be rewarded eventually.

B. Market data

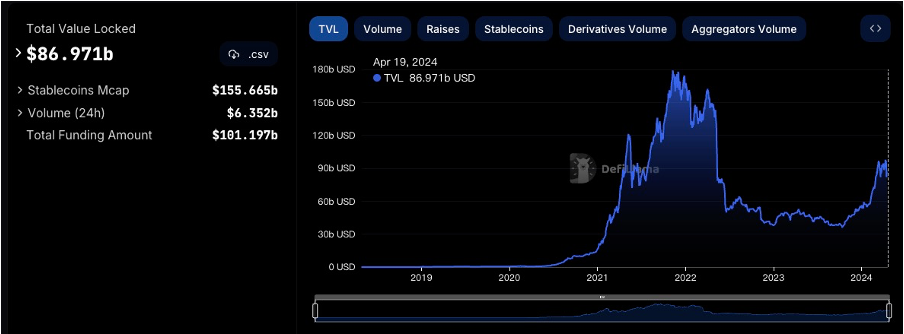

1. Total lock-up volume of public chains

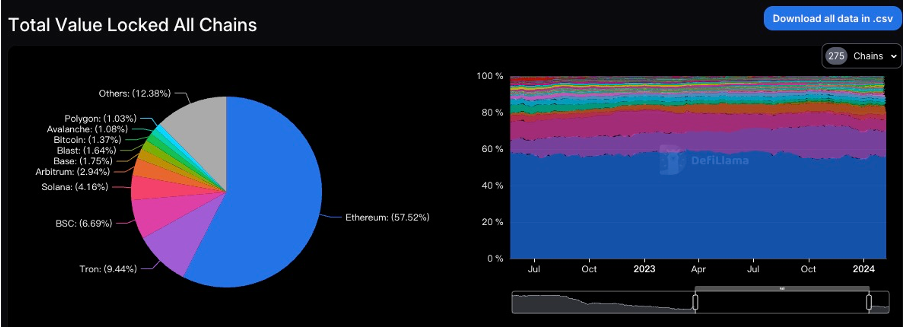

2. Each public chain Chain TVL proportion

The total TVL this week was around US$87 billion, an overall decrease of US$8.8 billion, a decrease of 9.2%. Almost all mainstream public chain TVL prices plummeted this week. The ETH chain fell by 11%, the TRON chain fell by 16%, the SOLANA chain fell by 17%, the ARB chain fell by 15%, the BLAST chain fell by 19%, the BTC and POLYGON chains both fell by 13%, and the OP chain fell by 15% this week, TVL has Less than 850 million US dollars, and dropped to 12th place. Under this market situation, the outstanding MERLIN chain soared 103% this week, and has risen 2864% cumulatively in the past month.

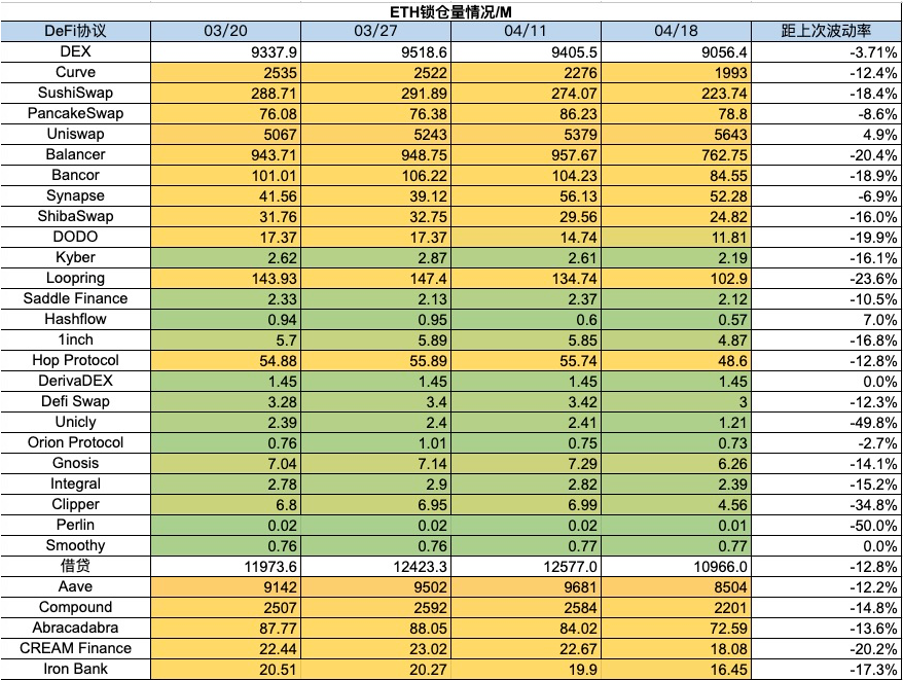

3. The lock-up amount of each chain protocol

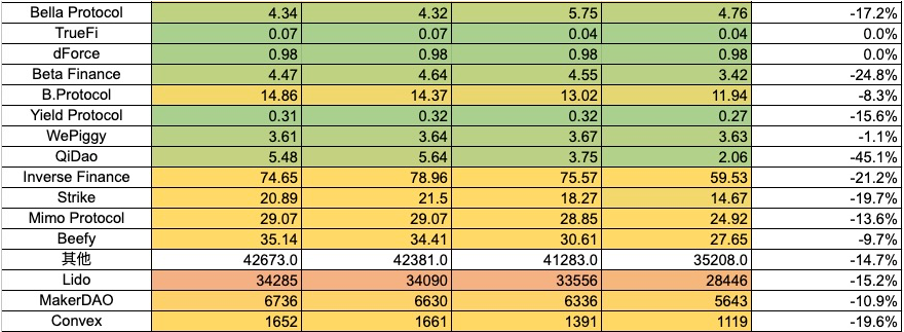

1) The lock-up amount of ETH

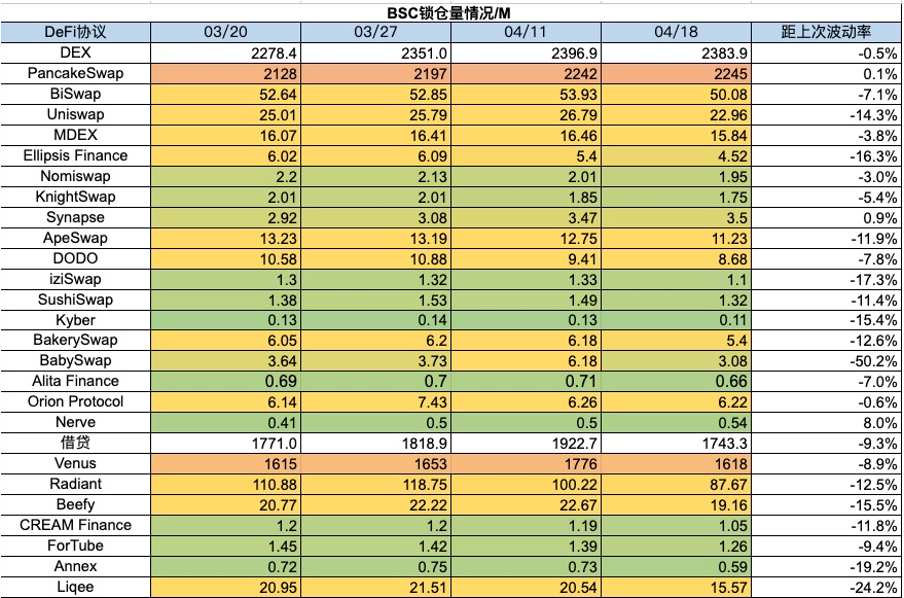

2) BSC Lock Amount

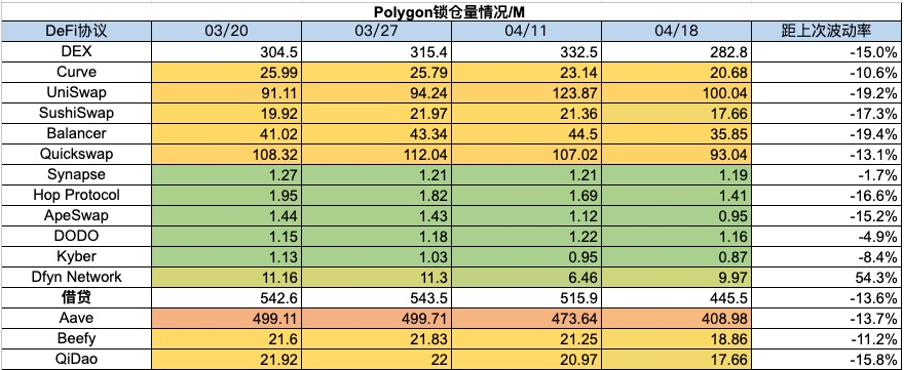

3) Polygon Lock Amount

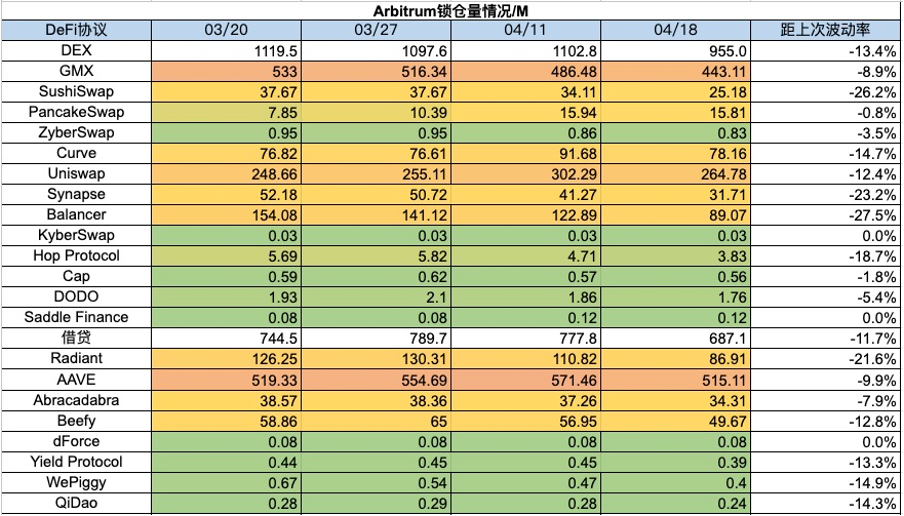

4)Arbitrum Lock Position volume situation

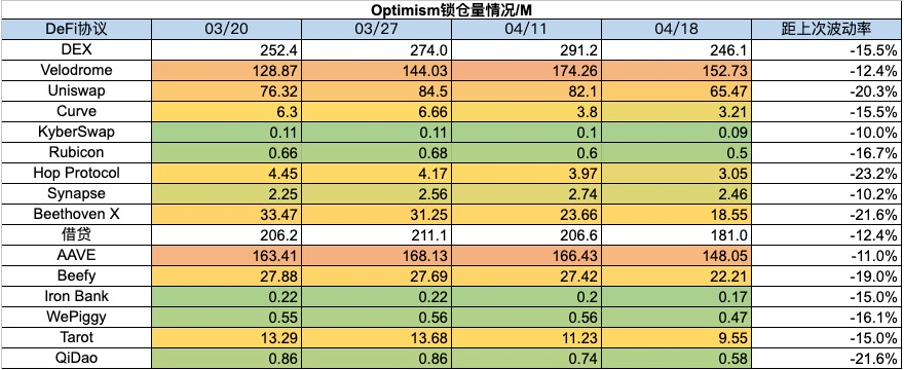

5) Optimism lock-up volume situation

6) Base lock-up volume situation

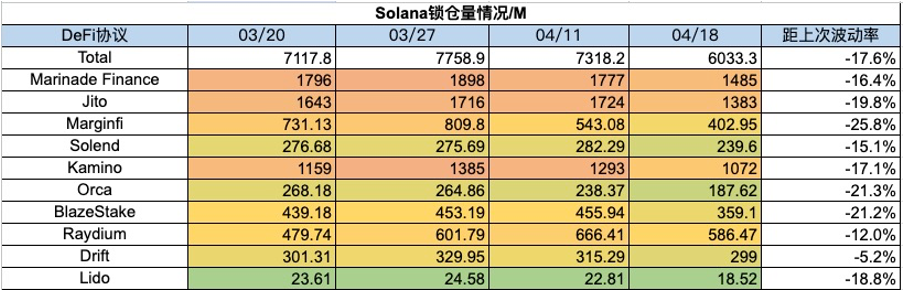

7) Solana lock-up volume

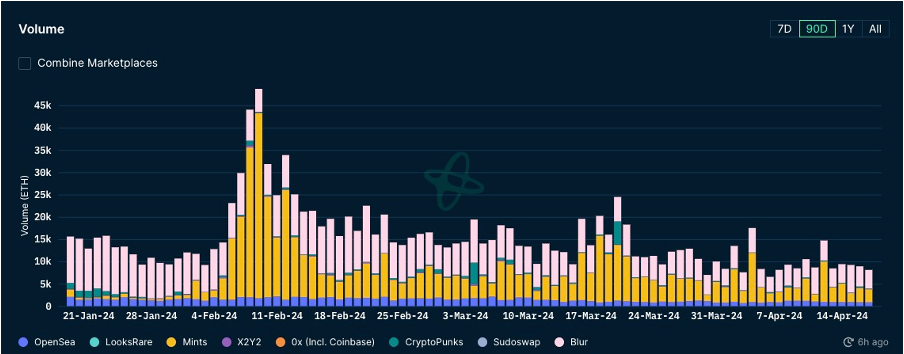

4. Changes in NFT market data 1) NFT-500 index

4. Changes in NFT market data 1) NFT-500 index

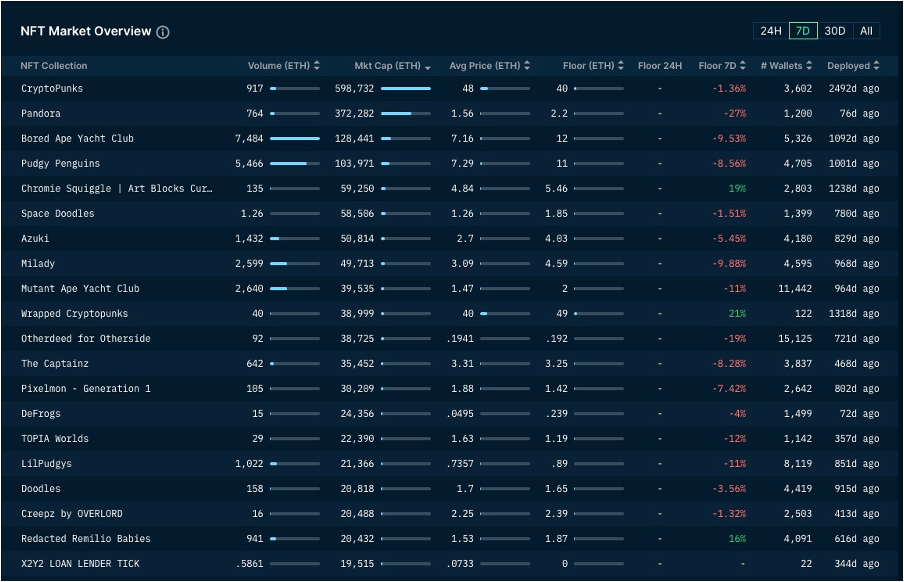

2) NFT market situation

3) NFT trading market share

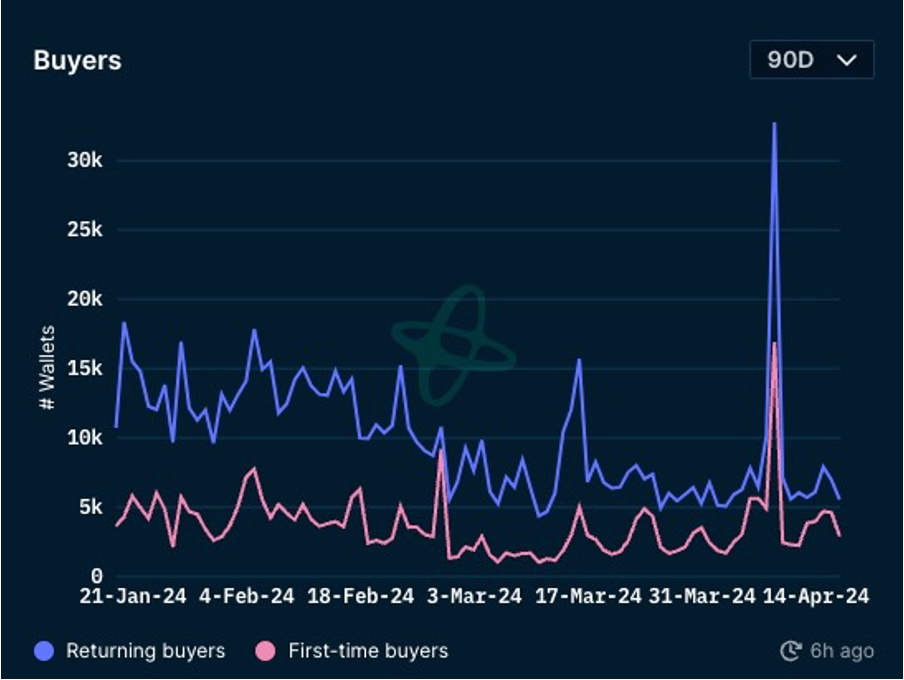

4) NFT buyer analysis

Almost all floor prices of blue-chip projects in the NFT market fell this week, and the market maintained a stable downward trend. This week BAYC fell 10%, MAYC fell 11%, Pudgy Penguins fell 9%, Lilpudgys fell 11%, Milady fell 10%, Azuki fell 5%, and Pandora fell 27%. The transaction volume of the NFT market is still declining. Compared with the 30% decline in transaction volume last month, BAYC still maintains the top position with a seven-day transaction volume of 7,484 eth. The number of first-time and repeat buyers continues to trend downward. Generally speaking, the NFT market has been in a cold winter for longer than expected, and there are no signs of recovery yet.

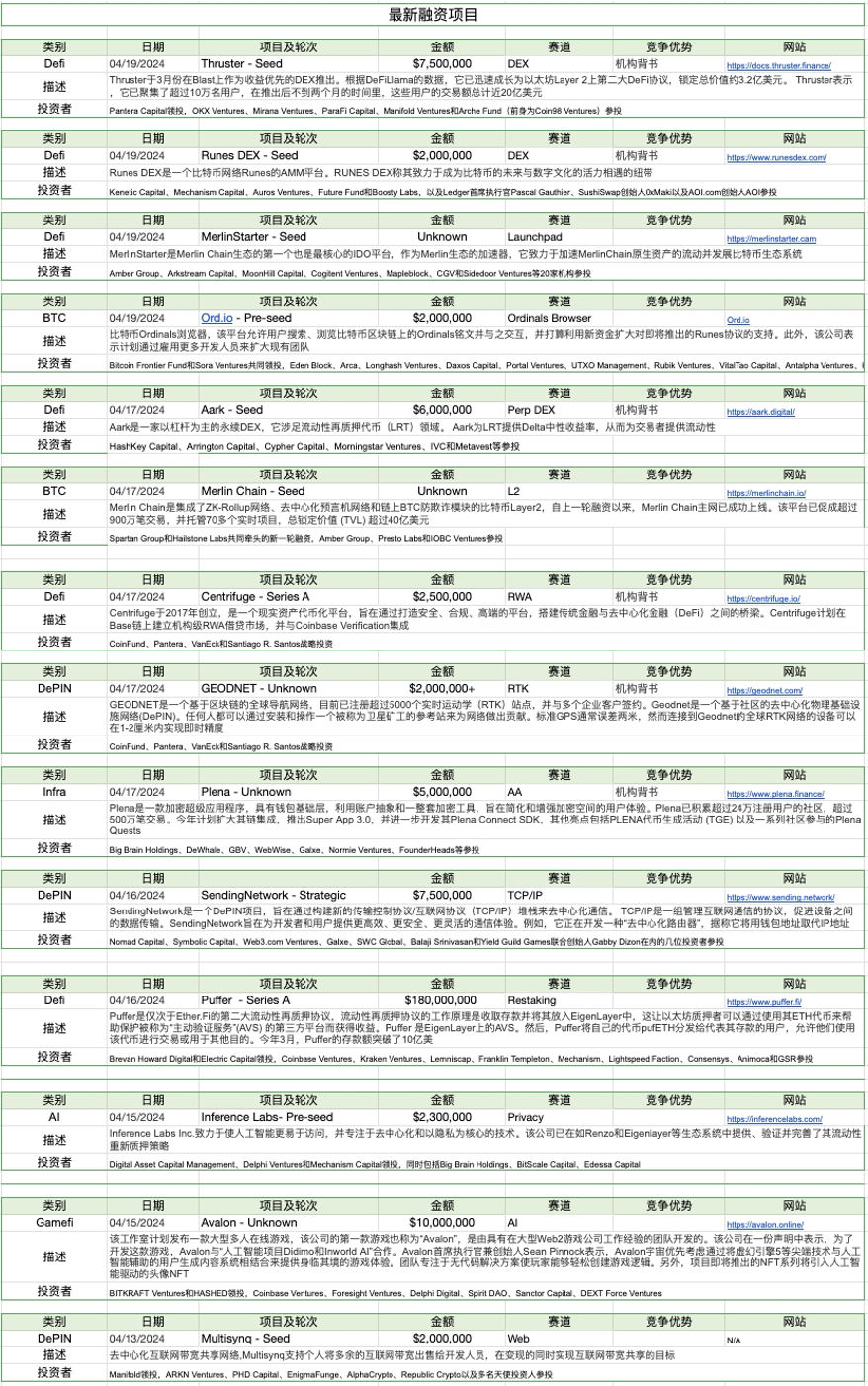

5. The latest financing situation of the project

6. Post-investment dynamics

1) Avalon — GameFi crypto game studio Avalon completed 1,000 Ten thousand US dollars in financing, co-led by Bitkraft Ventures and Hashed, with participation from Coinbase Ventures, Foresight Ventures, Spartan Capital, LiquidX and Momentum6.

The studio plans to release Avalon, a massively multiplayer online game, with a closed early access version set to launch later this year. The Avalon metaverse will be combined with an AI-assisted user-generated content system through technology such as Unreal Engine 5. Additionally, Avalon’s upcoming NFT series will introduce AI-powered avatar NFTs.

2) Merlin Chain — BTC L2

OKX will launch Merlin Chain (MERL) spot trading at 18:00 on April 19th, and the deposit will be on April 17th Open at 18:00 on Sunday. Merlin Chain tweeted that its airdrop tokens will be unlocked in batches and the application channel is currently open. MERL tokens will unlock 50% at TGE and 25%/12.5%/6.25%/3.125%/3.125% each month for the next 5 months. During the first 6 months, only the user’s tokens will be circulating in the market. Team shares will be fully locked for 24 months with a 24-month linear release, and investor shares will also be locked for 24 to 48 months.

After users apply for MERL tokens, the team will conduct a token airdrop on April 19, 14:00-16:00 Beijing time. Additionally, 15.23% of the total supply of MERL will be allocated to private placement investors, with two issuance schedules.

Among them, in the Series A private placement (accounting for 1.33% of the total supply), there is a 6-month cliff (fully locked) and then released in 18 months; in the Series B private placement (accounting for 13.90% of the total supply) ), 12 months cliff, and then released in 18 months. The linear release rules for Merlin's Seal's tokens (20% of the total supply) are consistent with airdrop tokens. The advisor's tokens (accounting for 3% of the total supply) have a 6-month cliff and will be released linearly in 30 months; the community's tokens (accounting for 16.57% of the total supply) will be released linearly in 48 months; the ecosystem's tokens will be released linearly in 48 months. Coins (40% of the total supply) will be released linearly over 48 months.

3) dappOS — Intent Execution Network

Perpetual contract trading platform KiloEx has integrated dappOS V2 to provide an intent-centric trading experience and will Issue joint airdrop rewards.

dappOS stated that this integration allows users to seamlessly interact with KiloEx and obtain KiloEx points without manual complicated on-chain operations, with the interaction time reduced by 85% and the handling fee reduced by 70%. dappOS is an intent execution network that converts intentions of specific value into on-chain results by creating a two-sided market. On the supply side, it enables service providers to stake and choose to run one or more execution services; on the demand side, it enables developers to find solutions that meet user intentions.

Foresight News previously reported that dappOS completed a 15.3 million Series A round of financing led by Polychain at a valuation of US$300 million in March 2024. Recently, dappOS and GMX jointly airdropped 100,000 ARB to trading users.

The above is the detailed content of A weekly review of the crypto market: BTC ushered in the fourth halving, and the rune ecology attracted attention. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

1387

1387

52

52

Binance's big move: The margin collateral ratio of multi-currency combinations will be adjusted in April

Apr 21, 2025 am 11:36 AM

Binance's big move: The margin collateral ratio of multi-currency combinations will be adjusted in April

Apr 21, 2025 am 11:36 AM

Binance made several adjustments to the margin collateral ratio of multi-currency combinations in April 2025. 1. Adjustment on April 4: In the multi-asset margin mode, FLOW and COMP have dropped from 80% to 70%, 1INCH has dropped from 70% to 65%, HOT and RVN have dropped from 70% to 60%, IOTX has dropped from 70% to 55%; in the unified account mode, CRV and UNI have dropped from 85% to 80%, ALGO has dropped from 85% to 75%, KSM has dropped from 80% to 70%, XTZ has dropped from 75% to 60%, and XEC has dropped from 70% to 55%. 2. Adjustment on April 11: In the combination margin mode, ICP dropped from 80% to 70%, SNX dropped from 80% to 65%, and MANA dropped from 75% to 6

Binance officially announced: On April 11, the collateral rate of multiple cryptocurrencies will be adjusted again

Apr 21, 2025 am 11:21 AM

Binance officially announced: On April 11, the collateral rate of multiple cryptocurrencies will be adjusted again

Apr 21, 2025 am 11:21 AM

Binance has adjusted the collateral ratio of several assets, involving FLOW, COMP, etc., which has generally declined. 1. FLOW and COMP have been reduced from 80% to 70%. 2. 1INCH dropped from 70% to 65%. The move is designed to manage risks and ensure market stability, and investors need to adjust their positions to cope with increased margin requirements and potential forced closing risks.

The top ten virtual currency trading app addresses

Apr 21, 2025 am 09:24 AM

The top ten virtual currency trading app addresses

Apr 21, 2025 am 09:24 AM

This article summarizes the information of the top ten virtual currency trading apps including Binance, Ouyi and Sesame Open Door, but for security reasons, the URL is not provided directly. Instead, it emphasizes the importance of safe access to the official platform through trusted channels and provides verification methods. At the same time, the article reminds investors to consider factors such as security, transaction fees, currency selection when choosing an APP, and pay attention to the risks of virtual currency trading.

Ranking of legal platform apps for virtual currency trading

Apr 21, 2025 am 09:27 AM

Ranking of legal platform apps for virtual currency trading

Apr 21, 2025 am 09:27 AM

This article lists the ranking of APPs for legal platforms for virtual currency transactions, emphasizing that compliance is an important consideration for choosing a platform. The article recommends platforms such as Coinbase, Gemini, and Kraken, and reminds investors to study regulatory information and pay attention to security records when making choices. At the same time, the article emphasizes that virtual currency transactions are high-risk and investments should be cautious.

How to avoid losses after ETH upgrade

Apr 21, 2025 am 10:03 AM

How to avoid losses after ETH upgrade

Apr 21, 2025 am 10:03 AM

After ETH upgrade, novices should adopt the following strategies to avoid losses: 1. Do their homework and understand the basic knowledge and upgrade content of ETH; 2. Control positions, test the waters in small amounts and diversify investment; 3. Make a trading plan, clarify goals and set stop loss points; 4. Profil rationally and avoid emotional decision-making; 5. Choose a formal and reliable trading platform; 6. Consider long-term holding to avoid the impact of short-term fluctuations.

A list of top 10 global leading virtual currency trading apps in 2025

Apr 21, 2025 pm 12:06 PM

A list of top 10 global leading virtual currency trading apps in 2025

Apr 21, 2025 pm 12:06 PM

The top ten leading virtual currency trading apps in the world in 2025 are: 1. Binance, 2. Gate.io, 3. OKX, 4. Huobi Global, 5. Bybit, 6. Kraken, 7. FTX, 8. KuCoin, 9. Coinbase, 10. Crypto.com.

Recommended top ten digital currency APPs in the world (authoritative release in 2025)

Apr 21, 2025 pm 12:09 PM

Recommended top ten digital currency APPs in the world (authoritative release in 2025)

Apr 21, 2025 pm 12:09 PM

The world's leading ten digital currency apps include: 1. OKX, 2. Binance, 3. Huobi, 4. Matcha (MXC), 5. Bitget, 6. BitMEX, 7. Pionex, 8. Deribit, 9. Bybit, 10. Kraken. These platforms have their own characteristics in security, transaction services, technical architecture, risk control team, user experience and ecosystem.

What to do if the USDT transfer address is incorrect? Guide for beginners

Apr 21, 2025 pm 12:12 PM

What to do if the USDT transfer address is incorrect? Guide for beginners

Apr 21, 2025 pm 12:12 PM

After the USDT transfer address is incorrect, first confirm that the transfer has occurred, and then take measures according to the error type. 1. Confirm the transfer: view the transaction history, obtain and query the transaction hash value on the blockchain browser. 2. Take measures: If the address does not exist, wait for the funds to be returned or contact customer service; if it is an invalid address, contact customer service and seek professional help; if it is transferred to someone else, try to contact the payee or seek legal help.