EigenLayer, a re-pledge protocol based on the Ethereum network, proposes to utilize ETH pledged for Ethereum network verification to share security and capital efficiency with other protocols while providing additional interest to protocol participants. Driven by concepts such as AVS, re-pledge, and points systems, a huge ecosystem has gradually formed. From the beginning of 2024 to now, EigenLayer's TVL has increased 12 times, attracting an investment of approximately US$160 million from crypto VCs including a16z. , quickly rose to second place in the total TVL ranking of DeFi protocols, second only to Lido. Recently, with the launch of the EigenLayer mainnet, it has aroused heated discussions and widespread attention in the industry.

EigenLayer is a re-pledge protocol based on Ethereum, which allows the pledged ETH on the Ethereum network to increase the security of the network through re-pledge. That is, users who stake ETH can choose to join the EigenLayer smart contract to re-stake their ETH and extend cryptoeconomic security to other applications on the network. At the same time, additional benefits will be provided to network participants. This process not only improves the efficiency of capital utilization, but also enhances the overall security of the network.

EigenLayer supports the safe operation of other blockchain protocols and applications by utilizing ETH that has been pledged on Ethereum. This process is called restaking. Re-pledge allows Ethereum validators to use part or all of their pledged ETH to support other active validation services (AVS), such as bridge protocols, sequencers, oracles, etc. These services typically require their own staking and verification mechanisms to secure the network, but with EigenLayer’s re-staking functionality, they can achieve Ethereum-level security without attracting large amounts of capital themselves.

Through re-pledge, the originally single-purpose pledged capital can support multiple networks at the same time, thereby improving the capital efficiency and security of the entire ecosystem. This mechanism does not require additional native tokens. You only need to use ETH or liquid pledge tokens (LST), such as stETH, rETH, etc., to participate in the pledge verification process of AVS.

The features and advantages of EigenLayer are as follows:

1. Establish a new security sharing model: The innovation of EigenLayer is that it brings a new security sharing model to Ethereum, Allowing different blockchain protocols to share Ethereum’s security infrastructure without having to build a huge network of verification nodes themselves, significantly reducing the startup costs of new blockchain protocols. In addition, re-staking also increases the attack resistance of the entire network, because attacking any protected protocol requires overcoming the security protection added by re-staking.

2. Improve ETH capital efficiency: The re-pledge mechanism introduced by EigenLayer improves the liquidity and use efficiency of capital. Now the same ETH can serve multiple networks at the same time. While enjoying the original staking benefits, users can also get additional rewards for participating in other AVS protocols. Bringing greater flexibility and scalability to the Ethereum network and the entire blockchain ecosystem.

3. Lower the threshold for participation: Through the re-pledge mechanism, small pledgers can also participate in the network security of Ethereum. Stakeholders do not have to have the full staking threshold of 32 ETH, and individual pledgers can also participate in the form of Liquidity Staking Tokens (LST). EigenLayer supports LST, such as stETH, etc. These tokens represent pledged interests in original ETH and can be freely circulated and used in DeFi projects.

4. Increase decentralization: By allowing small amounts to be staked, EigenLayer further decentralizes the contributor base of network security and reduces reliance on large stakers, which helps prevent potential centers risk and the phenomenon of verifier monopoly. In addition, EigenLayer's design also encourages broader community participation and governance, making the blockchain network more democratized and decentralized.

1. Re-pledge: In the EigenLayer ecosystem, security shared with Ethereum is provided through re-pledge, which is the foundation of the entire EigenLayer. Participants re-stake their ETH on Ethereum into the EigenLayer network, and these ETH serve as guaranteed capital to support the security and operation of the network. Stakeholders will receive dual benefits from native Ethereum network verification and AVS.

2. Active Verification Service (AVS): Active Verification Service (AVS) uses these re-pledged ETH to enhance its service functions. AVS is a special service or application that runs on EigenLayer and directly uses these re-staking funds to provide enhanced network services. These services can include computing, storage, data processing and other functions. AVS can be compared to middleware or modules, such as new blockchain, DA layer, virtual machine, prediction network, cross-chain bridge and other projects. AVS can provide data services for DeFi, games, and wallets.

3.Rollups: In the EigenLayer ecosystem, Rollups, as an Ethereum Layer 2 solution, benefit from the modular services provided by AVS. For example, through services such as EigenDA (EigenLayer's super data availability service), Rollups is able to achieve super-scale data processing, which greatly increases its ability to handle large-scale data.

4. Operators: Operators play a key role in the EigenLayer ecosystem. They perform various verification tasks, and these verification behaviors rely on the pledged ETH as a security guarantee, which is also the basis for AVS to rely on. . The operator's responsibilities include but are not limited to verifying transactions, executing smart contracts, maintaining network security, etc. Their work ensures that AVS can run reliably and provide support for upper-layer applications and services.

5. Safeguard measures: Considering the additional risks that re-pledge may bring, EigenLayer has introduced a number of risk control mechanisms. For example, regarding security issues that may be caused by AVS, EigenLayer designed a system called "Decentralized Verifier Cluster" (DVC) to spread risks and ensure that even if some AVS problems occur, it will not affect the security of the entire network. In order to ensure the normal operation of the network and the security of pledged capital, EigenLayer implements a penalty mechanism for improper operation of pledgers. Slashing refers to the method EigenLayer will use to ensure the honesty of AVS operators, and validators will face the risk of their pledges being revoked if they act maliciously.

6. Points Mechanism: EigenLayer has introduced an internal points system that will award one EigenLayer point every hour for each re-pledger’s deposited ETH. The purpose of this method is to measure the user's contribution to the network and reflect the activity and duration of their staking through the number of points. Although the EigenLayer team has not yet specified the specific use of points and has not announced any details about the launch of EigenLayer tokens, many users continue to engage in re-staking activities and look forward to possible points-based token airdrops in the future. This shows that users have expectations and confidence in the future development of EigenLayer.

Currently, EigenLayer supports two re-pledge methods: Liquid Restaking and Native Restaking Restaking).

Allows staking of Liquid Staking Tokens (LST), which are pledge certificates issued by LSP (Liquid Pledge Protocol) and represent the interest in the original ETH pledge, and It can be freely circulated and used in various decentralized finance (DeFi) protocols, thus not affecting the pledger's staking status and reward collection on Ethereum. LSP resolves certain limitations of Ethereum network staking, allowing users to participate in Ethereum network verification and receive verification rewards with capital of less than 32 ETH. Also allowing the use of LST in DeFi protocols to generate additional revenue, or by selling LST on the market without waiting for the unstaking period, effectively providing the same benefits as unstaking. For example, Lido Finance is currently the most well-known LSP, and the LST issued by Lido Finance is stETH. EigenLayer accepts users to pledge stETH, making it the infrastructure that ensures the security of AVS.

Currently EigenLayer supports a total of 12 types of LST for liquid re-pledge, including stETH, swETH, mETH, stETH, wbETH, rETH, sfrxETH, cbETH, osETH, oETH, lsETH, ankrETH.

EigenLayer will only accept LST re-pledge deposits during a specific time period, or limit the incentive and governance participation rights that a single LST obtains from EigenLayer to a maximum of 33%. EigenLayer’s LST re-staking limit has been increased five times to date. On April 16, EigenLayer announced the cancellation of all deposit limits for LST and reopened the deposit window. ETH can be re-staking through EigenPod on the EigenLayer application.

Local re-staking is a more direct method. The pledger uses his pledged ETH directly for EigenLayer’s smart contract, that is, Ethereum PoS node verification Participants connect their ETH pledged in the network to EigenLayer to participate in the verification process of AVS. Performing local re-staking requires staking at least 32 ETH, and participants need to directly manage an Ethereum node, which provides a higher entry barrier compared to liquid re-staking.

Because ETH is used directly in EigenLayer’s smart contracts, local re-staking provides higher security. The pledged assets are directly exposed to the penalty standards of Ethereum and AVS, increasing the protection of capital. Compared to liquid re-staking, local re-staking does not involve any intermediate tokens, which reduces the risk caused by token volatility or mismanagement. The downside is that funds are less liquid and it may take longer to unlock and transfer assets.

Currently, the EigenLayer ecosystem has begun to support a variety of AVS and has been integrated with multiple well-known DeFi protocols and other blockchain services. It allows the use of different types of proof of staking (such as LST and native ETH) to support these services, allowing capital to be utilized more efficiently.

On April 10, EigenLayer announced the official launch of the blockchain mainnet. This release was also accompanied by the data availability (DA) service EigenDA launched by the EigenLayer team. At the end of February, a16z announced an investment of US$100 million in EigenLayer, making it a crypto unicorn with a valuation of tens of billions. As of April 18, according to DefiLlama data, EigenLayer TVL has exceeded US$12.8 billion.

As of April 18, EigenLayer has distributed approximately 4.2 billion points to all re-stakeholders. Each EigenLayer point trades at $0.165 on the OTC Whales Market.

Currently, there are 13 AVS announced by EigenLayer. EigenDA, the first AVS launched, was developed by Eigen Labs to help other blockchain protocols store transaction data and other information. AVS outside of EigenDA will be able to "register" with the protocol, but they are not yet fully deployed.

1. EigenDA: EigenDA is the first AVS on EigenLayer, which provides efficient, ultra-large-scale throughput data availability services for Rollups. With the shared cryptoeconomic security provided by EigenLayer's re-stakeholders, EigenDA makes Rollups more cost-effective and efficient when processing large-scale data. On April 18, EigenLayer announced that it had lowered the pledge threshold for EigenDA verification nodes from 320 ETH to 96 ETH. EigenLayer stated that this change will allow more new verification nodes to participate in EigenDA’s AVS verification service.

2. Aethos: Aethos is a smart contract policy engine that abstracts pre-transaction calculations while maintaining decentralization. Aethos makes contract execution more efficient and secure by simplifying the pre-processing of smart contracts.

3. AltLayer: AltLayer is a decentralized inter-layer network designed specifically for Rollups. It leverages EigenLayer for fast finality and guarantees data availability via EigenDA, optimizing interoperability and performance between Rollups.

4. Blockless: Blockless is a verifiable computing engine with economic incentives through a re-staking mechanism. It provides a decentralized verification platform for complex calculations, enhancing the transparency and credibility of calculation results.

5. Drosera Network: Drosera Network has created a strong and responsive first-sounder collective through re-staking, focusing on decentralized verification. This provides networks with new ways to respond to emergencies and verify security.

6. Espresso: Espresso is a decentralized serialization service that uses re-staking to achieve Ethereum alignment and strong economic security. It ensures the order and consistency of transaction execution.

7. Ethos: Ethos is a security coordination layer that leverages the security of re-pledged ETH to power Cosmos. It enhances the security and efficiency of cross-chain interactions.

8. Hyperlane: Hyperlane uses EigenLayer to strengthen the message security of inter-chain application developers and provide guarantee for inter-application communication through the economic security of re-pledge.

9. Lagrange: Lagrange creates a secure and scalable light client through re-staking, dedicated to OP Rollups. It improves the accessibility and responsiveness of the network through light clients.

10. Near: Near aims to build a fast finality layer to improve composability and liquidity in the Ethereum Rollup ecosystem. This helps improve the efficiency of cross-rollup operations.

11. Omni: Omni is a low-latency interoperable network that connects all Ethereum Rollups through re-staking, ensuring the security and efficient operation of the entire network.

12. Silence Laboratories: Silence Laboratories is building multi-party computation (MPC)-based authentication libraries and SDKs that are technology stack and device agnostic, improving network security and flexibility.

13. Witness Chain: Witness Chain is a monitoring network that utilizes re-staking for proof, focusing on the security and proof position of Rollup. It enhances the network's monitoring and verification capabilities by providing the ability to prove diligence and location.

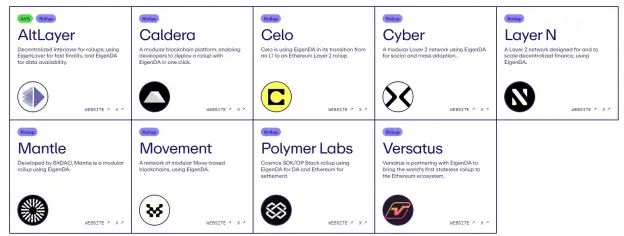

The Rollups project uses EigenLayer's technology to achieve fast finality and efficient data availability, and further expands its blockchain solutions. Currently, it has integrated Layer2 There are 9 plans. Among them, AltLayer is both AVS and Rollup project.

1. Caldera: Caldera is a modular blockchain platform that allows developers to deploy Rollup with EigenDA services with one click. This platform greatly reduces the technical threshold for developers by simplifying the deployment process, allowing more innovations and applications to be quickly launched.

2. Celo: Celo was originally an independent first-layer network, and is now using EigenDA to transform into a second-layer rollup of Ethereum. Through this transformation, Celo can be better integrated into the Ethereum ecosystem while improving the performance and scalability of its network.

3. Cyber: Cyber is a modular two-layer network designed for social and mass adoption, using EigenDA to optimize data processing and user experience. Cyber's goal is to promote the application of blockchain technology in the social media field through efficient data services.

4. Layer N: Layer N is a second-layer network designed to accelerate decentralized finance (DeFi). It also uses EigenDA to improve data processing capabilities. With this technical support, Layer N aims to provide higher efficiency and better scalability for DeFi applications.

5. Mantle: Mantle is developed by BitDAO and is a modular Rollup using EigenDA. This project provides users with an efficient and powerful blockchain platform by combining BitDAO's resources and EigenDA's technology.

6. Movement: The Movement network consists of a series of modular blockchains based on the Move language and also uses EigenDA technology. This design enables Movement to ensure efficient processing and security of data while providing flexibility.

7. Polymer Labs: Polymer Labs is a Rollup that combines the Cosmos SDK and OP stack, uses EigenDA for data availability services, and uses Ethereum for settlement. This multi-technology integrated solution provides its users with diverse application scenarios and powerful network support.

8. Versatus: Versatus is a project in partnership with EigenDA, aiming to introduce the world's first stateless Rollup into the Ethereum ecosystem. This innovative Rollup design brings new development potential to the Ethereum ecosystem through efficient data processing and unique network structure.

Liquid Re-Pledge Protocol (LRP) is a key component of the EigenLayer ecosystem, aiming to attract and increase users in a flexible and efficient way participation. LRP allows users to deposit ETH or LST (liquid pledge tokens) and re-pledge on EigenLayer on behalf of users, which provides users with a more flexible way to participate in the EigenLayer ecosystem. Users can choose to re-stake through the LRP platform without directly participating in the complex staking process, including earning EigenLayer points and additional points provided by the platform.

In order to prove the user's deposit and participation, LRP will issue LRT. These tokens represent the user's pledge share in LRP. LRT not only serves as a certificate for the holder's assets, but can also be freely traded in the DeFi market, providing additional liquidity and income opportunities, thereby further increasing income based on EigenLayer points. Representative LRT-related projects include Ether.fi, Kelp DAO, EigenPie, Pendle Finance and Gearbox, etc.

1.Ether.fi: As a member of the EigenLayer ecosystem, Ether.fi initially started as part of the LSP, but soon showed its presence through its innovative eETH and weETH tokens. The breadth of applications in the DeFi field. Through the design of the repurchase mechanism and reward nature, these two tokens not only ensure compatibility with mainstream DeFi protocols, but also enhance user participation and the liquidity of pledged assets through the EigenLayer points farm.

2.Kelp DAO: Kelp DAO provides users with an attractive staking and re-staking scenario through its unique re-staking solution and Kelp Miles points system. Its development reflects the LRP ecosystem’s efforts to improve user experience and reduce transaction costs, especially when high gas fees and network congestion often hinder user experience.

3.EigenPie: As part of the MagPie ecosystem, EigenPie focuses on aggregating governance tokens and influencing DeFi protocol decisions. Its strategy lies in diversifying risks and optimizing the liquidity and usability of tokens through independent re-staking methods. This is particularly critical to promoting the long-term sustainability of the agreement.

4.Pendle Finance: Pendle Finance has partnered with Ether.fi to launch Ether.fi’s eETH as the first LRT available on its platform. Ether.fi has designed a system to allocate EigenLayer Points and Ether.fi Loyalty Points to users who hold eETH’s YT token (YT-eETH). This enables users to purchase YT-eETH that is approaching expiry (which is getting cheaper) and accumulate interest and points up to that date.

5.Gearbox: Gearbox is a leveraged yield protocol where borrowers leverage their positions by depositing pledged assets and assets borrowed from the protocol in a credit account. Gearbox launches leveraged points strategy through partnership with LRP protocol. Gearbox allows EigenLayer points and LRP local points to be accumulated in credit accounts and sent to the borrower's wallet, providing users with up to 9x leverage points.

EigenLayer, as a re-pledge layer built on Ethereum, provides innovative solutions for blockchain technology, but it also comes with many risks. and challenges.

1. Technology implementation risk: The implementation of EigenLayer is highly dependent on complex technical solutions, including the stability and security of smart contracts. Smart contract vulnerabilities or protocol-level security issues can result in severe financial losses. In addition, since EigenLayer is directly integrated with Ethereum's node ecosystem, any imperfections in technical execution may affect its overall security and efficiency.

2. Market acceptance: Although EigenLayer provides an innovative re-staking solution, market acceptance is still an important uncertain factor. The volatility of the crypto market may affect the value of pledged assets, and the market's acceptance of this emerging technology will also directly affect the liquidity and widespread application of EigenLayer.

3. Centralization risk: The re-pledge model may lead to the concentration of capital to a small number of high-performance validators, which may further intensify the trend of centralization and form a market monopoly, thereby jeopardizing the decentralization principle of the Ethereum ecosystem. threaten.

4. Possibility of consensus split: If EigenLayer's operation mode directly intervenes in the node ecology of Ethereum, it may have an impact on the social consensus of Ethereum. If not handled properly, it may lead to community fragmentation or even chain forks.

5. Risks of AVS: EigenLayer provides additional functions and services through its AVS (Active Verification Service), but the security and efficiency of these services rely on the reliability and technical implementation of the operator. Any operational failure may result in losses to the staked ETH. For AVS that require very high network security, restaking may not provide sufficient protection, potentially impacting trust and adoption of these services.

EigenLayer has gradually evolved from the concept of sharing Ethereum network security and generating additional income into a huge ecosystem to satisfy infrastructure builders and investors The demand has inspired huge interest and high expectations in the infrastructure industry and crypto market.

1. Expansion of AVS: Following the launch of EigenDA, EigenLayer will introduce more AVS and provide more customized services, such as enhanced data processing capabilities, more efficient transaction verification, etc., thereby expanding its Service scope and influence.

2. Security enhancement: By implementing advanced security measures and audit mechanisms such as the penalty mechanism, we ensure that the operation of AVS is not affected by malicious attacks or vulnerabilities.

3. Cross-chain integration: Develop cross-chain solutions to allow EigenLayer to not only serve Ethereum, but also interoperate with other major blockchains, improving its market applicability and user base. Cooperate with more blockchain and encryption projects to achieve technical interoperability and improve overall network efficiency.

4. Ecosystem expansion: Establish partnerships with more ecological projects such as DeFi, DAO and NFT platforms, and bring value to these platforms by providing efficient re-pledge solutions.

5. Emerging technology integration: Explore the possibility of combining emerging technologies such as artificial intelligence and the Internet of Things with EigenLayer technology to create new application models.

6. Competition and cooperation: Lido, as the largest liquidity staking protocol in the Ethereum ecosystem, not only pledges the most ETH, but also has many node operators. Perhaps these direct conflicts of interest between EigenLayer and Lido will also make Lido Rethinking business models and sustainability, and EigenLayer will also take some time to gradually fill in the missing modules.

As more and more blockchain and encryption projects seek to reduce startup costs by sharing security models, EigenLayer’s re-pledge model may become an important direction for future blockchain network security architecture. In addition, it may also promote the emergence of new economic models and investment opportunities, especially in the fields of DeFi and cross-chain operations. It not only brings innovation and value to the Ethereum network, but also provides power and direction to the entire blockchain ecosystem.

Hotcoin pays close attention to the development of EigenLayer ecology and re-staking track, and has launched high-quality assets such as ALT, ETHFI, OMNI, NEAR, CYBER, and PENDLE. Come to Hotcoin for crypto investment. Get the most popular high-quality assets first and be one step ahead!

The above is the detailed content of Full analysis of EigenLayer ecology: re-staking and the prelude to the rise of AVS. For more information, please follow other related articles on the PHP Chinese website!