The upgraded Blob of Ethereum Dencun gives L2 more room for development and also accelerates competition on the Layer 2 track. Last week VanEck published an article predicting the valuation of Ethereum Layer-2 in 2030, analyzing a series of L2 solutions from the perspectives of transaction pricing, developer experience, user experience, trust assumptions, and ecosystem scale.

Based on these factors, VanEck proposed a prediction that the total market size of L2 will reach US$1 trillion by 2030. This prediction has opened up the imagination space of the L2 track.

The report emphasizes that although competition in the L2 ecosystem is fierce, there is still no obvious "winner takes all" feature. In fact, looking at the data changes of L2 this year, we can also find that the TVL differences between L2 can easily be changed in a short period of time, so the pattern of the L2 track is still undecided.

VanEck also gave five main indicators for evaluating L2 in the report:

Transaction pricing-the cost of transaction users;

Developer experience-easy to build products and Application;

User experience - simplicity of deposits, withdrawals and transactions;

Trust assumptions - liveness and security assumptions;

Size of the ecosystem - how much fun there is things to do.

If we apply these indicators to L2 with a small market capitalization, can it help us discover potential L2 projects?

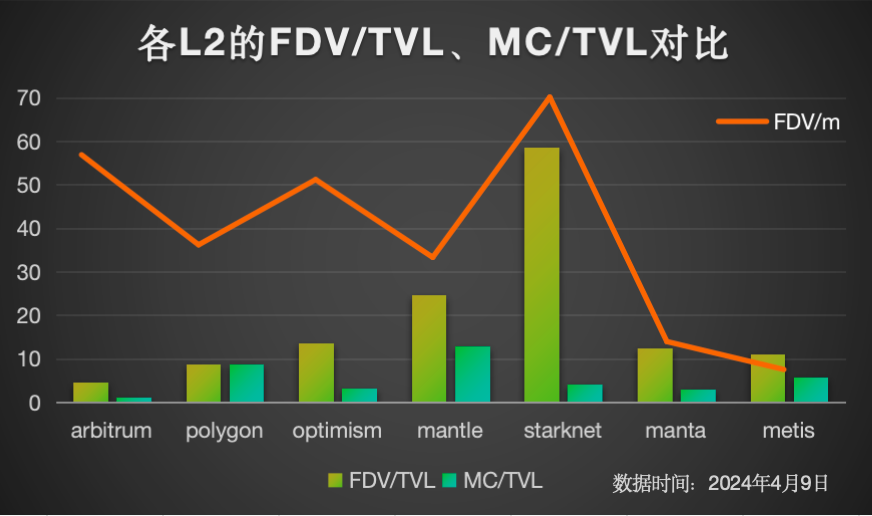

First, we screen a target based on the comparison of FDV and MC with TVL: it can be found that the FDV/TVL values of Arbitrum, polygon, optimization, manta, and metis are relatively comparable. Among them, Metis's market capitalization is currently the lowest and has the largest upside potential.

So does Metis have the potential to become an L2 dark horse? We use the five indicators given by VanEck to make judgments:

1. Transaction pricing - In terms of the cost of transaction users, one of the main designs of Metis is to optimize data processing and smart contract execution mechanisms, by reducing the impact on Ethereum Reliance on the main chain reduces transaction costs and shortens confirmation time; and supports a variety of revenue models and cost structures, including but not limited to generating revenue through transaction fees, data compression and smart contract execution, satisfying the first point.

2. Developer experience - In terms of easily building products and applications, the platform provides a complete set of security tools and frameworks to help developers build secure DApps to meet the second point.

3. User experience - In terms of simplicity of deposits, withdrawals and transactions, Metis has also made great efforts, especially in terms of quick deposits and withdrawals of assets and transaction confirmation, to meet the third requirement.

4. Trust assumption - liveness and security assumptions, this is explained in the VanEck article: Security refers to the properties of the blockchain to ensure that only the account owner can access him/her assets, while liveness refers to safeguards to ensure that assets can be exploited. It also specifically mentioned L2 users' concerns about sequencer failures. Currently, most L2 has a single sequencer, which is fragile. The most prominent advantage of Metis is the design of its decentralized sorter. Although it is slightly lacking in the data availability mentioned by VanEck, its outstanding performance in security can also satisfy this requirement.

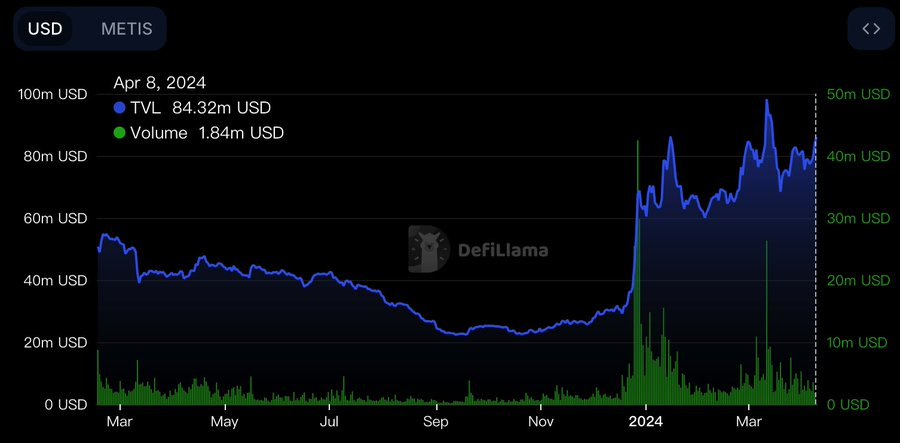

5. The last point is the activity and imagination of its on-chain ecology. At present, Metis' overall TVL and Volume have strong growth, and Metis has also been actively building an ecosystem.

Combined with the characteristics of its decentralized sorter, the first step in the Metis ecosystem should be to start with staking. A set of LSD or even LSDfi or LRD gameplay may be played on Metis.

Many key ecological projects on it have recently been launched one after another, such as the very popular LSD project @ENKIProtocol, which has attracted much attention as the first LSD protocol on Metis, and its token $ENKI has now online. (It is recommended to focus on secondary opportunities) Vector Reserve, an innovative project that proposes LPD (liquidity position derivatives), has also launched Metis. Using the LPD model of Vector Reserve, users can mint their METIS and METIS LST tokens. By becoming vMETIS, you can not only get $VEC rewards, but also further increase METIS's income. vMETIS/METIS can also be put into HerculesDEX to earn another reward.

Metis’ ecosystem proposals are also very active, and the launch of Metis ecological projects has been accelerated through community voting. Currently, hundreds of projects have been launched on Metis through community verification.

It can be seen that through the leverage of liquidity pledge, it is easy to inflate the TVL bubble. Then, through the cross-chain interoperability protocol, the liquidity of other blockchain networks is opened up to further increase the asset scale of the network. Therefore, ecological development is also promising in the future.

In addition, the VanEck article also mentioned: "While there is reason to believe that some L2 tokens will become valuable, the path to value appreciation is more difficult to predict than other crypto industries. Especially L2 tokens are not even its ecosystem base currency”. The empowerment of L2 tokens has always been one of the issues that the community is most concerned about, and $METIS has more advantages than most L2 tokens in terms of value capture.

Currently, Metis’ decentralized sorter is also progressing smoothly and is about to enter the second phase, which mainly implements: multiple transactions within a block, transaction pools, and sorter rewards.

In short, if we look at the evaluation criteria given in the VanEck report, Metis is indeed a potential project. The most urgent work at present, like all public chains, is ecological construction. However, judging from the recent ecological development Look, Metis seems to have a clear direction and is moving forward steadily.

The above is the detailed content of VanEck: After the market crash, why did we choose to buy Metis at the bottom?. For more information, please follow other related articles on the PHP Chinese website!