web3.0

web3.0

BlackRock Bitcoin Spot ETF IBIT has seen net capital inflows for 70 consecutive days! Entering the top ten in history

BlackRock Bitcoin Spot ETF IBIT has seen net capital inflows for 70 consecutive days! Entering the top ten in history

BlackRock Bitcoin Spot ETF IBIT has seen net capital inflows for 70 consecutive days! Entering the top ten in history

Apr 24, 2024 am 09:50 AM

This site (120bTC.coM): After the U.S. Securities and Exchange Commission (SEC) approved 11 Bitcoin spot ETFs in January this year, many traditional institutions with assets of hundreds of billions, Open the door to compliant investment in Bitcoin.

Among them, "iShares Bitcoin Trust (IBIT)" issued by BlackRock, the world's largest asset management company, reached a record of net capital inflows for 70 consecutive days yesterday (22nd).

IBIT has net inflows for 70 consecutive days, ranking among the top ten in history

Yesterday (22nd), Bloomberg ETF analyst Eric Balchunas released a chart on the If the German Fund (IBIT) successfully achieves 70 consecutive days of net inflows, it will become one of the most successful ETFs in history.

"IBIT inflows are now at 69 consecutive days. Another day and it will be in the top 10 and tied with JETS. But it would also be quite interesting if the record breaks today."

According to HODL15 Capital's data shows that BlackRock's Bitcoin spot ETF had a near-inflow of US$20 million yesterday (22). In addition, according to SosoValue data, the ETF had a net inflow of US$19.65 million on the same day.

This also means that BlackRock’s Bitcoin Spot ETF (IBIT) has officially entered the top ten with the longest capital inflow record, and is likely to continue to break this record.

The asset management scale exceeded 18.1 billion U.S. dollars and is about to exceed GBTC

It is understood that BlackRock’s Bitcoin spot ETF’s assets under management increased by more than 600 million U.S. dollars yesterday, making its total asset management scale Reaching US$18.16 billion. The ETF had net assets of $17.55 billion as of Friday's close, according to BlackRock.

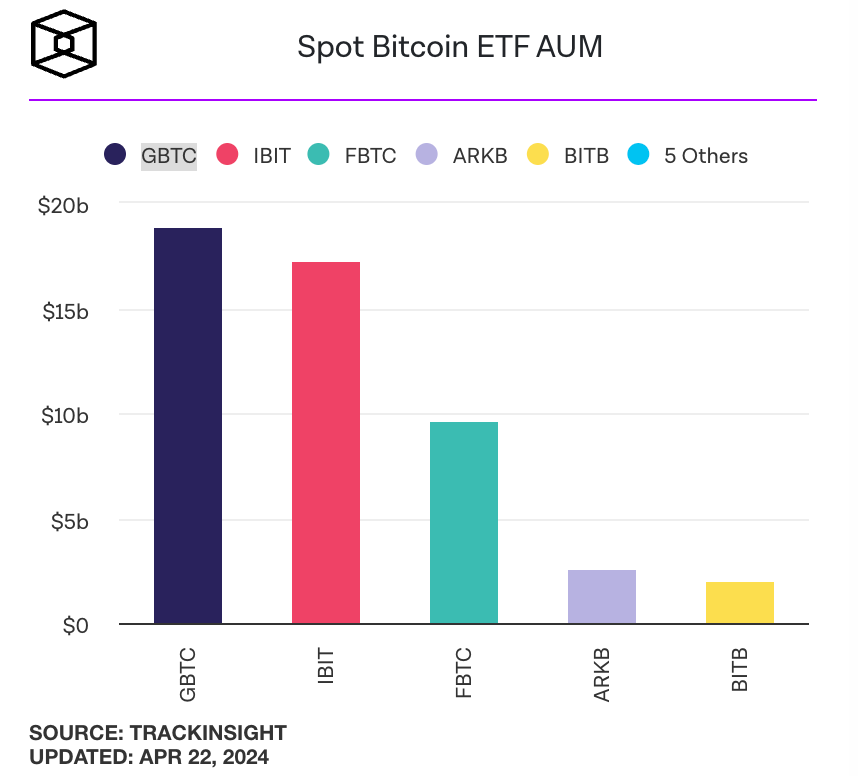

In addition, according to data from The Block, the current Bitcoin spot ETF with the largest assets under management (AUM) is GBTC issued by asset management company GrayScale, and the second place is issued by BlackRock. IBIT, it is worth mentioning that the difference in asset management scale between the two is less than US$2 billion.

Bitcoin spot ETF asset management scale

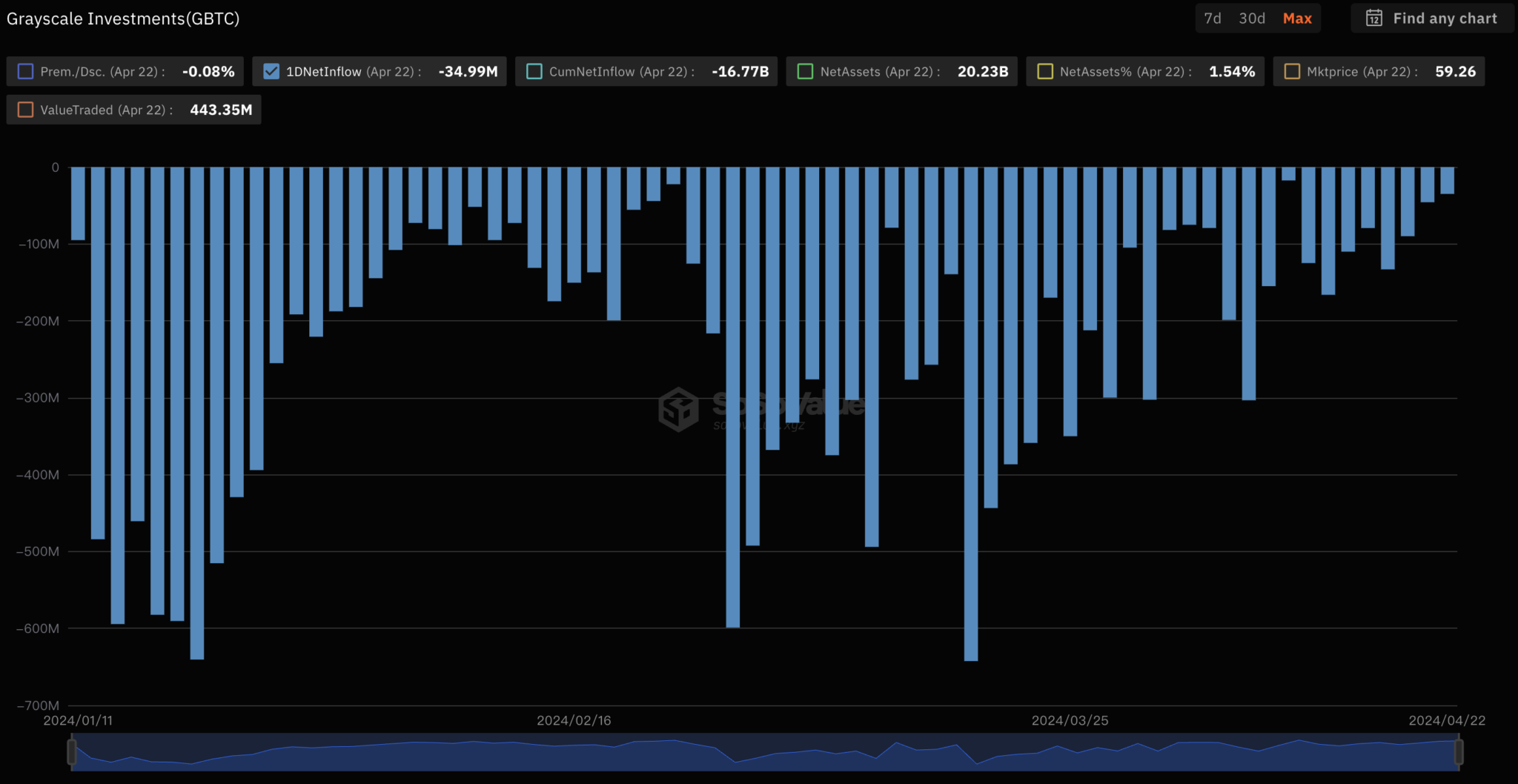

On the other hand, according to data from Sosovalue, the current GBTC funds have been since the official approval of the Bitcoin spot ETF. The daily net inflow of funds is negative, and it is estimated that the asset size of IBIT will exceed GBTC in the near future.

GBTC daily net asset inflow

The above is the detailed content of BlackRock Bitcoin Spot ETF IBIT has seen net capital inflows for 70 consecutive days! Entering the top ten in history. For more information, please follow other related articles on the PHP Chinese website!

Hot Article

Hot tools Tags

Hot Article

Hot Article Tags

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

Top 10 recommended for crypto digital asset trading APP (2025 global ranking)

Mar 18, 2025 pm 12:15 PM

Top 10 recommended for crypto digital asset trading APP (2025 global ranking)

Mar 18, 2025 pm 12:15 PM

Top 10 recommended for crypto digital asset trading APP (2025 global ranking)

Ranking of the best bitcoin exchanges

Mar 18, 2025 pm 04:12 PM

Ranking of the best bitcoin exchanges

Mar 18, 2025 pm 04:12 PM

Ranking of the best bitcoin exchanges

How to use band profit after ETH upgrade

Mar 18, 2025 pm 04:21 PM

How to use band profit after ETH upgrade

Mar 18, 2025 pm 04:21 PM

How to use band profit after ETH upgrade

How to build positions for beginners after ETH upgrade

Mar 18, 2025 pm 04:18 PM

How to build positions for beginners after ETH upgrade

Mar 18, 2025 pm 04:18 PM

How to build positions for beginners after ETH upgrade

What is the current price of Bitcoin?

Mar 19, 2025 pm 05:30 PM

What is the current price of Bitcoin?

Mar 19, 2025 pm 05:30 PM

What is the current price of Bitcoin?

Ranking of the best virtual currency exchanges

Mar 18, 2025 pm 04:15 PM

Ranking of the best virtual currency exchanges

Mar 18, 2025 pm 04:15 PM

Ranking of the best virtual currency exchanges

Recommended safe and reliable Bitcoin exchanges in 2025: A guide to getting started with newbies

Mar 18, 2025 am 11:57 AM

Recommended safe and reliable Bitcoin exchanges in 2025: A guide to getting started with newbies

Mar 18, 2025 am 11:57 AM

Recommended safe and reliable Bitcoin exchanges in 2025: A guide to getting started with newbies