Hardware Tutorial

Hardware Tutorial

Hardware News

Hardware News

In Q1 of 2024, China's learning tablet online market surged by 80%: the average price increased by 573 yuan, an increase of 21%

In Q1 of 2024, China's learning tablet online market surged by 80%: the average price increased by 573 yuan, an increase of 21%

In Q1 of 2024, China's learning tablet online market surged by 80%: the average price increased by 573 yuan, an increase of 21%

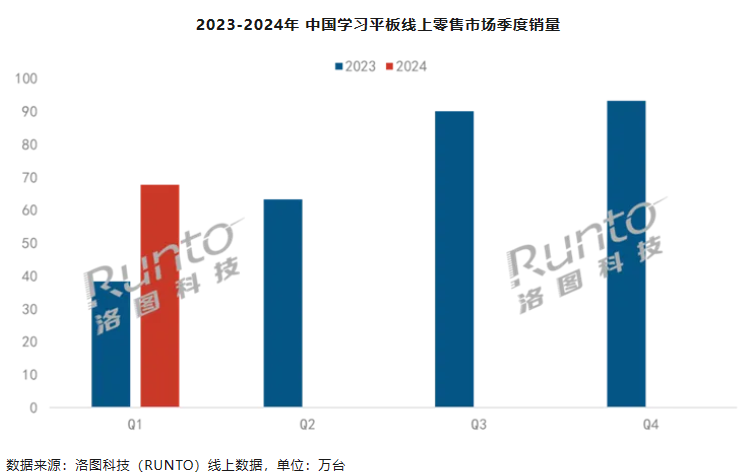

News from this site on April 24, according to the latest data released by Luotu Technology (RUNTO), In the first quarter of 2024, China’s learning tablet market will have all online channels (including Pinduoduo, Douyin, Kuaishou Platform) sales volume was 689,000 units, a year-on-year increase of 79.9%.

Market data for the first quarter of 2024 shows that Chinese parents and students’ tutoring demand for educational hardware is still growing rapidly. The report summarizes the characteristics of the following four aspects:

Brand Camp

The education and training enterprise camp has surpassed the technology enterprise camp, mainly relying on its strong content resource advantages and artificial intelligence research technology Help.

In terms of channels

In the first quarter of this year, the growth of emerging e-commerce (Pinduoduo, Douyin, Kuaishou) more than doubled. Learning tablets will gradually begin to be sold in 2023. After a year of accumulation and development, learning tablets have gradually stabilized in the emerging e-commerce market, and the spread and grass-planting effect of content e-commerce has brought more demand.

In terms of price

The average price of products has increased, which shows that parents have a stable and high willingness to pay for the education and training of their students. In addition, the equalization of price segments also reflects that the supply and demand ends of the market are maturing.

In terms of products

The key brand new products in the first quarter have further developed in the application of AI large models, and the product functions have expanded from personalized learning to teaching students learning methods; in terms of hardware , significant upgrades can be seen in many aspects such as resolution, memory, battery capacity, peripheral tools, and WIFI connection frequency bands.

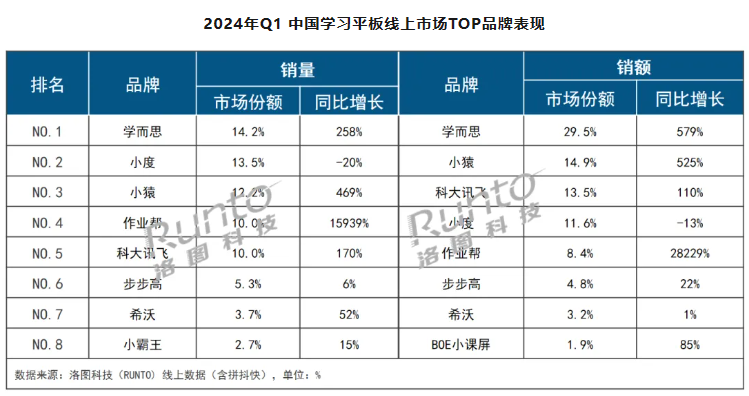

The report shows that in the first quarter of 2024, the combined share (CR4) of TOP4 brands was 49.8%, a decrease of 11.3 percentage points from the same period last year.

This site attaches the ranking of China’s learning tablet online market in the first quarter of 2024 as follows:

Xueersi in terms of sales and sales Both ranked first, with sales accounting for 14.2% of the market share, a year-on-year increase of 258%, and sales accounting for 29.5%, a year-on-year increase of 579%;

Xiaodu ranked second with a sales volume share of 13.5%, a year-on-year decrease 20%, sales accounted for 11.6%, a year-on-year decrease of 13%.

Xiaoyuan ranks third in sales volume and second in sales volume, with sales accounting for 12.2% of the market share, a year-on-year increase of 469%, and sales accounting for 14.9%, a year-on-year increase of 525%;

Zhuoyebang ranked fourth in sales volume, benefiting from last year’s low base and experiencing large year-on-year growth. Luotu Technology said that Zuoyebang has a key layout in the Kuaishou e-commerce channel and ranks high in this segmented channel.

iFlytek ranked fifth, with a sales share of 10% and a year-on-year increase of 179%, but sales accounted for 13.5%, ranking third, with a sales volume that nearly tripled year-on-year. At the end of February, it released a new product priced at 2,699 yuan P30 is expanding into the mid-range price market.

BBK ranked sixth in both sales volume and sales volume, with a sales share of 5.3%, a year-on-year increase of 6%; sales accounted for 4.8%, a year-on-year increase of 22%. Its Douyin e-commerce channel has a year-on-year growth About 190%, driving overall online sales year-on-year growth.

Seventh-ranked Seewo’s sales surged by 52%, with sales increasing by 1%. In the first quarter of last year, the brand's product line was mainly positioned in the mid-to-high-end market priced above 3,000 yuan. However, the mid-to-low-end product T1, launched in December last year and priced at 1,399 yuan, has been selling well on the Douyin platform, which is the main reason for the large difference in sales volume and sales growth.

Xiaobawang has entered the TOP list of sales with its low-priced and small-size products, and BOE’s small classroom screen has entered the TOP list of sales.

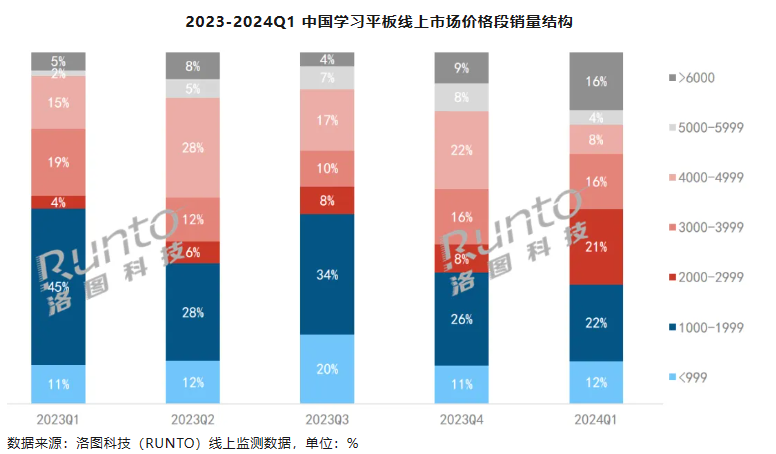

Report data shows that in the first quarter of 2024, the average online market price of learning tablets was 3,357 yuan, an increase of 573 yuan over the same period last year, an increase of 20.6%.

In terms of price segments, the sales volume of 1,000-1,999 yuan accounted for the highest proportion, accounting for 21.8%, but it showed an obvious downward trend, down 22.7 percentage points from the same period last year.

Among them, Xiaodu and iFlytek upgraded their mid-to-low-end product layout to the mid-range price range of 2,000-2,999 yuan, resulting in a year-on-year increase of 17.7 percentage points in the share of the 2,000-2,999 yuan price segment. The two brands together accounted for nearly 60% market share.

At the same time, the market share of high-priced products above 6,000 yuan was 16.4%, an increase of 11.4 percentage points from the same period last year. Among them, Xueersi accounts for more than 70% of the market share through the high-end new products launched at the end of last year.

#The screen size of learning tablets is generally 10-14 inches. Report data shows that 10-12 inches were the mainstream size in the first quarter, accounting for 56.9%, remaining stable year-on-year; 12-14 inches accounted for 26.8%, a year-on-year increase of 6.7 percentage points; large-size products above 14 inches accounted for 8.8% %, a year-on-year decrease of 5.6 percentage points.

In addition, the popularity of high-resolution screens of learning tablets has increased. In the first quarter of 2024, the market share of 2K resolution reached nearly 70%, a decrease from the same period last year; while the combined market share of 2.5K and higher resolutions was 16.9%, an increase of about 13 percentage points from the same period last year. .

The standard stylus pen further enhances the functionality and ease of operation of the product. In the first quarter of 2024, the sales volume of learning tablets with standard stylus pens accounted for 43.3%, a sharp increase of 30.1 percentage points from the same period last year.

The above is the detailed content of In Q1 of 2024, China's learning tablet online market surged by 80%: the average price increased by 573 yuan, an increase of 21%. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

AI Hentai Generator

Generate AI Hentai for free.

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

1379

1379

52

52

A complete collection of expression packs of foreign women

Jul 15, 2024 pm 05:48 PM

A complete collection of expression packs of foreign women

Jul 15, 2024 pm 05:48 PM

What are the emoticons of foreign women? Recently, a foreign woman's emoticon package has become very popular on the Internet. I believe many friends will encounter it when watching videos. Below, the editor will share with you some corresponding emoticon packages. If you are interested, come and take a look. A complete collection of expression packs of foreign women

Bytedance Cutting launches SVIP super membership: 499 yuan for continuous annual subscription, providing a variety of AI functions

Jun 28, 2024 am 03:51 AM

Bytedance Cutting launches SVIP super membership: 499 yuan for continuous annual subscription, providing a variety of AI functions

Jun 28, 2024 am 03:51 AM

This site reported on June 27 that Jianying is a video editing software developed by FaceMeng Technology, a subsidiary of ByteDance. It relies on the Douyin platform and basically produces short video content for users of the platform. It is compatible with iOS, Android, and Windows. , MacOS and other operating systems. Jianying officially announced the upgrade of its membership system and launched a new SVIP, which includes a variety of AI black technologies, such as intelligent translation, intelligent highlighting, intelligent packaging, digital human synthesis, etc. In terms of price, the monthly fee for clipping SVIP is 79 yuan, the annual fee is 599 yuan (note on this site: equivalent to 49.9 yuan per month), the continuous monthly subscription is 59 yuan per month, and the continuous annual subscription is 499 yuan per year (equivalent to 41.6 yuan per month) . In addition, the cut official also stated that in order to improve the user experience, those who have subscribed to the original VIP

I have been honest and asked to let go of the meme introduction.

Jul 17, 2024 am 05:44 AM

I have been honest and asked to let go of the meme introduction.

Jul 17, 2024 am 05:44 AM

What does it mean to be honest and let go? As an Internet buzzword, "I've been honest and begging to be let go" originated from a series of humorous discussions about rising commodity prices. This expression is now mostly used in self-deprecation or ridicule situations, meaning that individuals face specific situations (such as pressure, When you are teasing or joking), you feel that you are unable to resist or argue. Let’s follow the editor to see the introduction of this meme. Source of introduction to the meme of "Already Begging to Let It Go": "Already Begging to Let It Go" originated from "If you add a punctual treasure, you will be honest", and later evolved into "If Liqun goes up by two yuan, you will be honest" and "Iced black tea will go up by one yuan. Be honest." Netizens shouted "I have been honest and asked for a price reduction", which eventually developed into "I have been honest and asked to be let go" and an emoticon package was born. Usage: Used when breaking defense, or when you have no choice, or even for yourself

I worship you, I worship you, a complete list of emoticons

Jul 15, 2024 am 11:25 AM

I worship you, I worship you, a complete list of emoticons

Jul 15, 2024 am 11:25 AM

What are some of the emoticons of "I worship you, I worship you"? The expression pack "I worship you, I worship you" originated from the "Big Brother and Little Brother Series" created by the online blogger He Diudiu Buchuudi. In this series, the elder brother helps the younger brother in time when he faces difficulties, and then the younger brother will use this line to express The extreme admiration and gratitude have formed a funny and respectful Internet meme. Let’s follow the editor to enjoy the emoticons. I worship you, I worship you, a complete list of emoticons

Introduction to the meaning of red warm terrier

Jul 12, 2024 pm 03:39 PM

Introduction to the meaning of red warm terrier

Jul 12, 2024 pm 03:39 PM

What is red temperature? The red-warm meme originated from the e-sports circle, specifically referring to the phenomenon of former "League of Legends" professional player Uzi's face turning red when he is nervous or excited during the game. It has become an interesting expression on the Internet to describe people's faces turning red due to excitement and anxiety. The following is Let’s follow the editor to see the detailed introduction of this meme. Introduction to the meaning of the Hongwen meme "Red Wen" as an Internet meme originated from the live broadcast culture in the field of e-sports, especially the community related to "League of Legends" (League of Legends). This meme was originally used to describe a characteristic phenomenon of former professional player Uzi (Jian proudly) in the game. When Uzi is playing, his face will become extremely rosy due to nervousness, concentration or emotion. This state is jokingly likened to the in-game hero "Rambo" by the audience.

Why is there no air conditioner in the dormitory?

Jul 11, 2024 pm 07:36 PM

Why is there no air conditioner in the dormitory?

Jul 11, 2024 pm 07:36 PM

Why is there no air conditioner in the dormitory? The Internet meme "Where is the air conditioning in the dormitory?" originated from the humorous complaints made by students about the lack of air conditioning in dormitories. Through exaggeration and self-deprecation, it expresses the desire for a cool and comfortable environment in the hot summer and the realistic conditions. The contrast, let’s follow the editor to take a look at the introduction of this meme. Where is the air conditioning in the dormitory? The origin of the meme: "Where is the air conditioning in the dormitory?" This meme comes from a ridicule of campus life, especially for those school dormitories with relatively basic accommodation conditions and no air conditioning. It reflects students' desire for improved accommodation conditions, especially the need for air conditioning during the hot summer months. This meme is circulated on the Internet and is often used in communication between students to humorously express frustration and frustration with the lack of air conditioning in hot weather.

Because he is good at introductions

Jul 16, 2024 pm 08:59 PM

Because he is good at introductions

Jul 16, 2024 pm 08:59 PM

What does it mean because he is good at stalking? I believe that many friends have seen such a comment in many short video comment areas. So what does it mean because he is good? Today, the editor has brought you an introduction to the meme "because he is good". For those who don’t know yet, come and take a look. The origin of the meme “because he is good”: The meme “because he is good” originated from the Internet, especially a popular meme on short video platforms such as Douyin, and is related to a joke by the well-known cross talk actor Guo Degang. In this paragraph, Guo Degang listed several reasons not to do something in a humorous way. Each reason ended with "because he is good", forming a humorous logical closed loop. In fact, there is no direct causal relationship. , but a nonsensical and funny expression. Hot memes: For example, “I can’t do it

Align the granularity stalk introduction

Jul 16, 2024 pm 12:36 PM

Align the granularity stalk introduction

Jul 16, 2024 pm 12:36 PM

What does it mean to align the granularity? "Align the granularity" first appeared in the movie "The Annual Meeting Can't Stop!" and was proposed by actor Dapeng in an interview. Let's take a look at what happened in detail. I hope it can be helpful to everyone. Introduction to the meme "Align the granularity" [Align the granularity] is not a standard English or professional term, but a kind of workplace slang in a specific situation. The meaning of workplace slang is that the two parties synchronize information and form a common understanding. What the movie refers to is making all the details known to both parties.