This site (120bTC.coM): The Hong Kong Securities Regulatory Commission also approved the preliminary application for local Bitcoin and Ethereum spot ETFs on April 15. The first batch of issuers are Hong Kong Harvest International, China Asset Management and Boshi International/HashKey Capital.

The Securities and Futures Commission lists Harvest, ChinaAMC and Boshi ETFs

According to the official website of the Hong Kong Securities Regulatory Commission, the Bitcoin and Ethereum spot ETFs of the three funds of Harvest, ChinaAMC and Boshi have been listed. , the approval date is April 23, 2024, and was officially approved to start trading on April 30. Specifically include:

China Bitcoin ETF(BUU163)#, stock codes are 03042, 09042, 83042

China Ethereum ETF(BUU164 )#, the stock codes are 03046, 09046, 83046

博时HashKey Bitcoin ETF (BUU104)#, the stock codes are 03008, 09008

博时HashKey Ethereum ETF (BUU105)#, stock codes are 03009, 09009

Harvest Bitcoin Spot ETF (BUT244), stock codes are 03439, 09439

Harvest Ethereum Spot ETF (BUU885), stock code is 03179, 09179

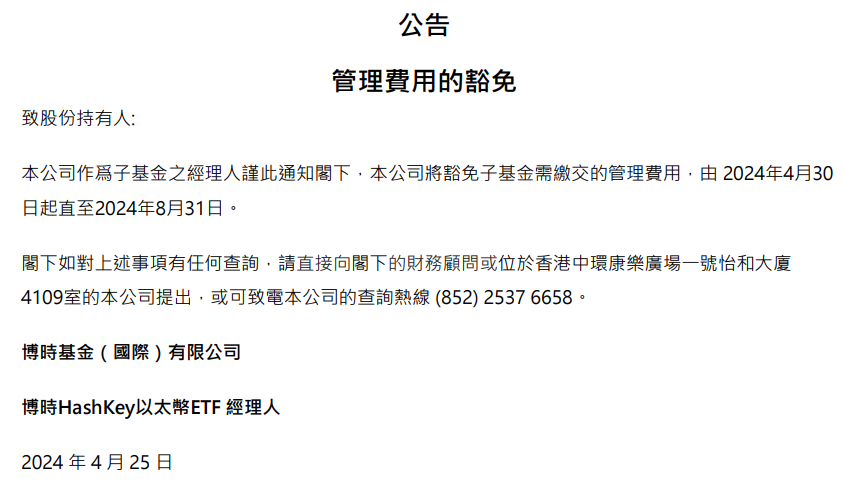

Bosera Fund exempts Bitcoin and Ethereum ETF management fees

It is worth noting that the parent company of Boshi Fund, Boshi Global Exchange Traded Fund Open-End Fund Company, also issued a document on April 25 stating that it will exempt Boshi HashKey Bitcoin from April 30 to August 31 this year. Management fees required for ETF and Boshi HashKey Ethereum ETF.

Bloomberg Analyst: The ETF fees of three funds are lower than expected

Later yesterday (24th), Bloomberg senior ETF analyst Eric Balchunas issued a statement stating that the fees of the above three fund companies are 30 basis points, 60 basis points and 99 basis points respectively, which are lower than their previous expectations: Hong Kong’s Bitcoin spot ETF and Ethereum spot ETF will be officially approved to start on April 30 For transactions, fees are 30 basis points, 60 basis points and 99 basis points respectively, which is a good sign.

In addition, James Seyffart, also a Bloomberg ETF analyst, also pointed out that Hong Kong fund companies are likely to break out of a fee war: Hong Kong may break out of a fee war because of these ETFs, because Harvest (Harvest) is launching It was previously announced that fees will be waived across the board, with the lowest fee reaching 0.3% after the exemption.

The above is the detailed content of Hong Kong's 6 Bitcoin and Ethereum spot ETFs are listed for trading on 4/30! Harvest, Huaxia and Boshi start cost war. For more information, please follow other related articles on the PHP Chinese website!