web3.0

web3.0

A must-see for Pendle YT investment! Deciphering the true return rate of leverage points

A must-see for Pendle YT investment! Deciphering the true return rate of leverage points

A must-see for Pendle YT investment! Deciphering the true return rate of leverage points

This site (120BtC.coM): Current airdrops for new projects mostly depend on the user’s points, and Pendle, an interest rate trading protocol that allows users to leverage points, has become the focus of the market. Since the beginning of the year, $PENDLE has soared by more than 424%. , its TVL has exceeded US$5 billion, an increase of nearly 22 times compared with US$230 million at the beginning of the year.

On the 22nd, Pendle opened a new ezETH fund pool (the liquidity token of the liquidity re-pledge protocol Renzo) on the Ethereum and BNB chains, which provides users with the opportunity to earn 3x points. .

However, considering the risk that the value of holding YT tokens will return to zero until the expiration date, investors may worry that the proceeds from future airdrops may not be enough to offset the cost of purchasing YT. Therefore, this article will provide a detailed return calculation to analyze the potential return of investing in YT-ezETH and holding it until maturity, for investors’ reference and to enhance their confidence. This article will also share an Excel spreadsheet for interested readers to operate.

Step 1. Calculate the points that can be earned from YT every day

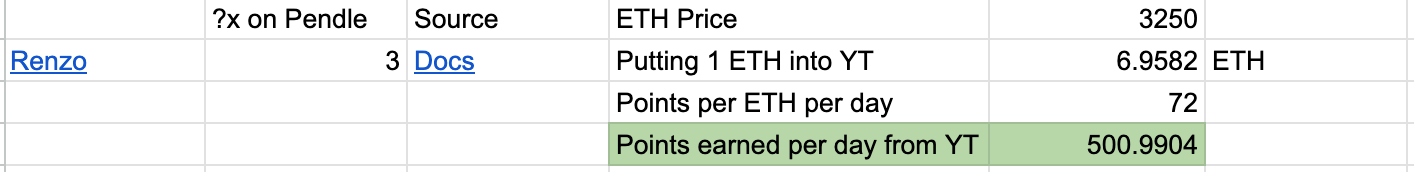

First, in the "?x on Pendle" field in Figure 1: we must first fill in the points currently provided by Pendle The multiplier is currently 3 times so enter 3. Then fill in the current price of ETH in "ETH Price", which is the cost of entering the market now.

Figure 1

In the "Putting 1 ETH into YT" field: You need to enter the Pendle website, select ETH in the Input field and enter 1 , that is, you can see that it can be exchanged for 6.9582 YTezETH. This means that participants can earn 6.9582 YT ezETH points with 1 ETH. This is exactly what Pendle means by allowing users to leverage points.

"Points per ETH per day" field: You need to check the official document for the method of calculating points. You can see that without considering any incentives, you can get 1 point per hour for every ETH you deposit. , you can get 24 points in one day, and Pendle provides a 3x bonus, so fill in 72 (the Excel table formula has been filled in).

"Points earned per day from YT": This represents how many points a participant can earn for each ETH they hold. In summary, 6.9582 times 72 equals 500.99 (the Excel table formula has been filled in) .

Figure 2

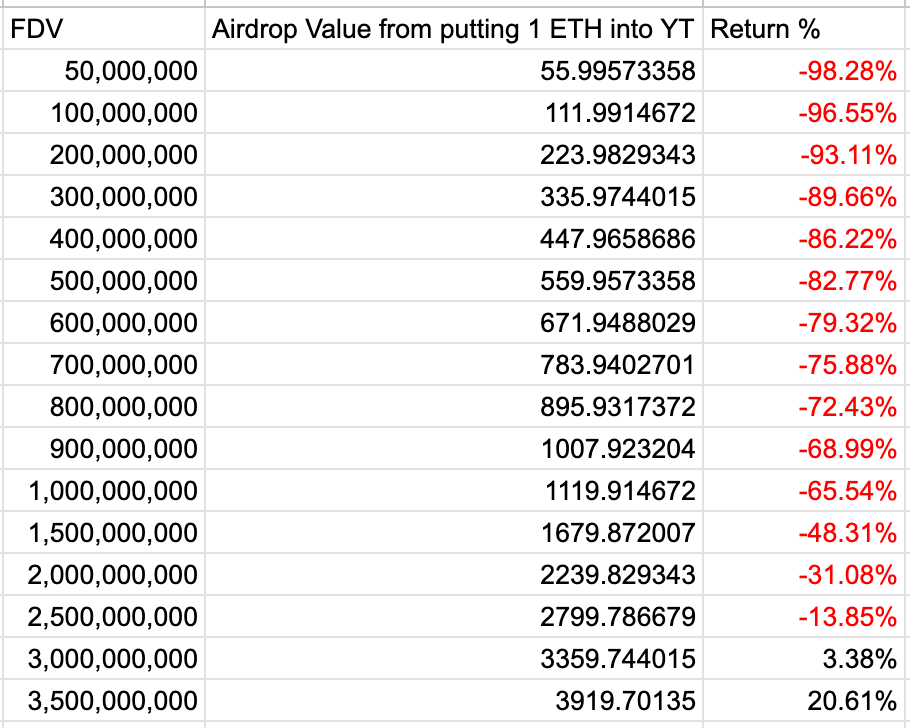

Step 3. Reveal the rate of return on investment

"FDV$": FDV is hypothetical data, which can be found in the currency An got more firm data after listing $REZ on the 30th. Currently, he makes a conservative estimate based on the $3.885 billion FDV of $ETHFI, the only liquidity re-pledge agreement that issues currency, assuming it is $2.5 billion.

「Airdrop allocated%」: According to Renzo’s token economy, airdrops will account for 10% of the total supply, and the first airdrop will issue 5%, so it is estimated that the remaining 5% of airdrops will be distributed this year The distribution is completed.

「Total airdrop$」: The total airdrop value at this time is FDV’s US$2.5 billion multiplied by 5% of the airdrop allocation, which is equal to US$125 million (the Excel table formula has been filled in).

「My Return in$」: The reward is the total airdrop value multiplied by 0.002% points ratio, which is equal to US$2,799 (the Excel table formula has been filled in).

"Return%", "APY%": The return rate is US$2,799. Compared with the current cost of entering the market to purchase ETH, it is equal to -13.85%, and the annualized return rate is -20.64%. It seems... investment YT still needs to think carefully.

Figure 3

Step 4. Adjust FDV to calculate the corresponding return rate

Finally, check the return on investment at each level of FDV , it can be observed that after US$3 billion, the rate of return can turn positive. This part of the Excel table formula has been filled in.

An Excel spreadsheet is also provided here, and interested readers can operate freely after copying it.

Figure 4

Figure 4

The above is the detailed content of A must-see for Pendle YT investment! Deciphering the true return rate of leverage points. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

AI Hentai Generator

Generate AI Hentai for free.

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

1378

1378

52

52

What is Ouyi for? What is Ouyi

Apr 01, 2025 pm 03:18 PM

What is Ouyi for? What is Ouyi

Apr 01, 2025 pm 03:18 PM

OKX is a global digital asset trading platform. Its main functions include: 1. Buying and selling digital assets (spot trading), 2. Trading between digital assets, 3. Providing market conditions and data, 4. Providing diversified trading products (such as derivatives), 5. Providing asset value-added services, 6. Convenient asset management.

gate.io latest registration tutorial for beginners

Mar 31, 2025 pm 11:12 PM

gate.io latest registration tutorial for beginners

Mar 31, 2025 pm 11:12 PM

This article provides newbies with detailed Gate.io registration tutorials, guiding them to gradually complete the registration process, including accessing the official website, filling in information, identity verification, etc., and emphasizes the security settings after registration. In addition, the article also mentioned other exchanges such as Binance, Ouyi and Sesame Open Door. It is recommended that novices choose the right platform according to their own needs, and remind readers that digital asset investment is risky and should invest rationally.

The latest registration tutorial for gate.io web version

Mar 31, 2025 pm 11:15 PM

The latest registration tutorial for gate.io web version

Mar 31, 2025 pm 11:15 PM

This article provides a detailed Gate.io web version latest registration tutorial to help users easily get started with digital asset trading. The tutorial covers every step from accessing the official website to completing registration, and emphasizes security settings after registration. The article also briefly introduces other trading platforms such as Binance, Ouyi and Sesame Open Door. It is recommended that users choose the right platform according to their own needs and pay attention to investment risks.

How to roll positions in digital currency? What are the digital currency rolling platforms?

Mar 31, 2025 pm 07:36 PM

How to roll positions in digital currency? What are the digital currency rolling platforms?

Mar 31, 2025 pm 07:36 PM

Digital currency rolling positions is an investment strategy that uses lending to amplify trading leverage to increase returns. This article explains the digital currency rolling process in detail, including key steps such as selecting trading platforms that support rolling (such as Binance, OKEx, gate.io, Huobi, Bybit, etc.), opening a leverage account, setting a leverage multiple, borrowing funds for trading, and real-time monitoring of the market and adjusting positions or adding margin to avoid liquidation. However, rolling position trading is extremely risky, and investors need to operate with caution and formulate complete risk management strategies. To learn more about digital currency rolling tips, please continue reading.

What are the recommended websites for virtual currency app software?

Mar 31, 2025 pm 09:06 PM

What are the recommended websites for virtual currency app software?

Mar 31, 2025 pm 09:06 PM

This article recommends ten well-known virtual currency-related APP recommendation websites, including Binance Academy, OKX Learn, CoinGecko, CryptoSlate, CoinDesk, Investopedia, CoinMarketCap, Huobi University, Coinbase Learn and CryptoCompare. These websites not only provide information such as virtual currency market data, price trend analysis, etc., but also provide rich learning resources, including basic blockchain knowledge, trading strategies, and tutorials and reviews of various trading platform APPs, helping users better understand and make use of them

Top 10 popular web3 digital currency trading software download app

Mar 31, 2025 pm 08:00 PM

Top 10 popular web3 digital currency trading software download app

Mar 31, 2025 pm 08:00 PM

This article provides download methods for the top ten popular Web3 digital currency trading software APPs, including OKX, Binance, Gate.io, Coinbase, Huobi (now HTX), KuCoin, Kraken, Bitget, MEXC and Bybit. Users can search for download links by visiting the official websites of each platform, or search for platform names in mainstream application stores to download and install. The article introduces the download methods of each APP in detail, so that users can quickly and conveniently find the appropriate download method. Download the Web3 trading software you need now and start your digital currency investment journey!

Official website entrance of major digital currency trading platforms 2025

Mar 31, 2025 pm 05:33 PM

Official website entrance of major digital currency trading platforms 2025

Mar 31, 2025 pm 05:33 PM

This article recommends ten mainstream cryptocurrency exchanges, including Binance, OKX, Sesame Door (gate.io), Coinbase, Kraken, Bitstamp, Gemini, Bittrex, KuCoin and Bitfinex. These exchanges have their own advantages, such as Binance is known for its largest trading volume and rich currency selection in the world; OKX provides innovative tools such as grid trading and a variety of derivatives; Coinbase focuses on US compliance; Kraken attracts users for its high security and pledge returns; other exchanges have their own characteristics in different aspects such as fiat currency trading, altcoin trading, high-frequency trading tools, etc. Choose an exchange that suits you, and you need to use your own investment experience

On which platform is web3 transaction?

Mar 31, 2025 pm 07:54 PM

On which platform is web3 transaction?

Mar 31, 2025 pm 07:54 PM

This article lists the top ten well-known Web3 trading platforms, including Binance, OKX, Gate.io, Kraken, Bybit, Coinbase, KuCoin, Bitget, Gemini and Bitstamp. The article compares the characteristics of each platform in detail, such as the number of currencies, trading types (spot, futures, options, NFT, etc.), handling fees, security, compliance, user groups, etc., aiming to help investors choose the most suitable trading platform. Whether it is high-frequency traders, contract trading enthusiasts, or investors who focus on compliance and security, they can find reference information from it.