BlackRock's Bitcoin ETF sees $217 million in outflows

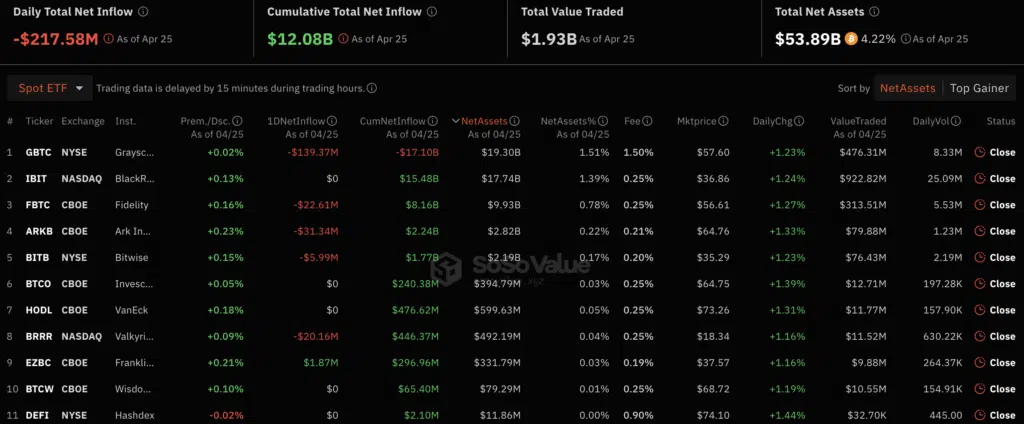

The spot Bitcoin ETF sector fell into the loss zone again, experiencing an outflow of $217 million on April 25.

According to data from SoSo Value, five ETFs, including BlackRock’s iShares Bitcoin Trust ETF (IBIT), have not experienced capital inflows in recent days. It should be mentioned that BlackRock's fund has recorded no capital inflows for the second consecutive day.

Image source: SoSo Value

In addition to the Grayscale Bitcoin Trust ETF (GBTC), four other ETFs recorded outflows, including those from Fidelity Investment and ARK Invest/21Shares.

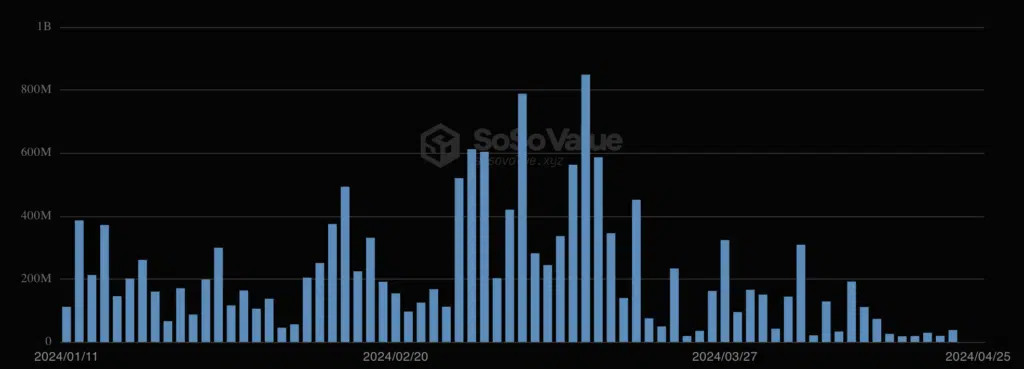

Despite the recent trend of outflows, IBIT (BlackRock’s iShares Bitcoin Trust ETF) remains one of the top 10 ETFs with consistent long-term inflows. However, inflows into the fund have declined since early March 2024.

Image source: SoSo Value

Average flows into spot Bitcoin ETFs have also slowed significantly in recent weeks. Hunter Horsley, CEO of Bitwise, said that many institutional investors in the market are still secretly preparing to inject large amounts of funds into cryptocurrency-based financial instruments.

Hunter Horsley is convinced that the introduction of a new class of digital assets will help make the cryptocurrency market more attractive to investors.

Investor interest in cryptocurrency-based products has waned recently. Analysts at CoinShares noted that large professional investors pulled $206 million out of crypto products over the past week.

The above is the detailed content of BlackRock's Bitcoin ETF sees $217 million in outflows. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

Top 10 Digital Virtual Currency Apps Rankings: Top 10 Digital Currency Exchanges in Currency Circle Trading

Apr 22, 2025 pm 03:00 PM

Top 10 Digital Virtual Currency Apps Rankings: Top 10 Digital Currency Exchanges in Currency Circle Trading

Apr 22, 2025 pm 03:00 PM

The top ten digital virtual currency apps are: 1. OKX, 2. Binance, 3. gate.io, 4. Coinbase, 5. Kraken, 6. Huobi, 7. KuCoin, 8. Bitfinex, 9. Bitstamp, 10. Poloniex. These exchanges are selected based on factors such as transaction volume, user experience and security, and all provide a variety of digital currency trading services and an efficient trading experience.

Reliable and easy-to-use virtual currency exchange app recommendations The latest ranking of the top ten exchanges in the currency circle

Apr 22, 2025 pm 01:21 PM

Reliable and easy-to-use virtual currency exchange app recommendations The latest ranking of the top ten exchanges in the currency circle

Apr 22, 2025 pm 01:21 PM

The reliable and easy-to-use virtual currency exchange apps are: 1. Binance, 2. OKX, 3. Gate.io, 4. Coinbase, 5. Kraken, 6. Huobi Global, 7. Bitfinex, 8. KuCoin, 9. Bittrex, 10. Poloniex. These platforms were selected as the best for their transaction volume, user experience and security, and all offer registration, verification, deposit, withdrawal and transaction operations.

What are the digital currency trading platforms in 2025? The latest rankings of the top ten digital currency apps

Apr 22, 2025 pm 03:09 PM

What are the digital currency trading platforms in 2025? The latest rankings of the top ten digital currency apps

Apr 22, 2025 pm 03:09 PM

Recommended apps for the top ten virtual currency viewing platforms: 1. OKX, 2. Binance, 3. Gate.io, 4. Huobi, 5. Coinbase, 6. Kraken, 7. Bitfinex, 8. KuCoin, 9. Bybit, 10. Bitstamp, these platforms provide real-time market trends, technical analysis tools and user-friendly interfaces to help investors make effective market analysis and trading decisions.

Top 10 digital currency exchange app recommendations, top ten virtual currency exchanges in the currency circle

Apr 22, 2025 pm 03:03 PM

Top 10 digital currency exchange app recommendations, top ten virtual currency exchanges in the currency circle

Apr 22, 2025 pm 03:03 PM

Recommended apps on top ten digital currency exchanges: 1. OKX, 2. Binance, 3. gate.io, 4. Huobi, 5. Coinbase, 6. KuCoin, 7. Kraken, 8. Bitfinex, 9. Bybit, 10. Bitstamp, these apps provide real-time market trends, technical analysis and price reminders to help users monitor market dynamics in real time and make informed investment decisions.

gate.io sesame door latest official app address

Apr 22, 2025 pm 01:03 PM

gate.io sesame door latest official app address

Apr 22, 2025 pm 01:03 PM

The official Gate.io APP can be downloaded in the following ways: 1. Visit the official website gate.io to download; 2. Search "Gate.io" on the App Store or Google Play to download. Be sure to download it through the official channel to ensure safety.

What are the top ten digital currency trading software? The top ten exchange platforms in the currency circle

Apr 22, 2025 pm 03:06 PM

What are the top ten digital currency trading software? The top ten exchange platforms in the currency circle

Apr 22, 2025 pm 03:06 PM

The top ten trading softwares in the currency exchange platform are: 1. OKX, 2. Binance, 3. gate.io, 4. Huobi Global, 5. KuCoin, 6. Coinbase, 7. Kraken, 8. Bitfinex, 9. Bitstamp, 10. Poloniex. These platforms provide a variety of trading modes and security measures to ensure the safety of user assets.

Top 10 safe and easy-to-use virtual currency trading platforms, ranking of the top ten reliable digital currency exchanges

Apr 22, 2025 pm 12:45 PM

Top 10 safe and easy-to-use virtual currency trading platforms, ranking of the top ten reliable digital currency exchanges

Apr 22, 2025 pm 12:45 PM

The top ten safe and easy-to-use virtual currency trading platforms are: Binance, OKX, gate.io, Coinbase, Kraken, Huobi, Bybit, KuCoin, Bitfinex, and Bittrex. These platforms are highly praised for their high liquidity, low transaction fees, diversified trading products, global layout, strong technical support, innovative trading systems, high security, rich currency and user-friendly interface.

Top 10 Global Virtual Currency Exchange Rankings Top 10 Latest Virtual Currency APPs in 2025

Apr 22, 2025 pm 02:39 PM

Top 10 Global Virtual Currency Exchange Rankings Top 10 Latest Virtual Currency APPs in 2025

Apr 22, 2025 pm 02:39 PM

Top 10 global virtual currency exchanges rankings: 1. OKX, 2. Binance, 3. Gate.io, 4. Huobi, 5. Coinbase, 6. Kraken, 7. Bitfinex, 8. KuCoin, 9. Bybit, 10. Bitstamp, these platforms provide real-time market trends, technical analysis tools and user-friendly interfaces to help investors conduct effective market analysis and trading decisions.