web3.0

web3.0

Bitcoin spot saw net outflows for 3 consecutive weeks! Analysts warn of BTC falling channel forming

Bitcoin spot saw net outflows for 3 consecutive weeks! Analysts warn of BTC falling channel forming

Bitcoin spot saw net outflows for 3 consecutive weeks! Analysts warn of BTC falling channel forming

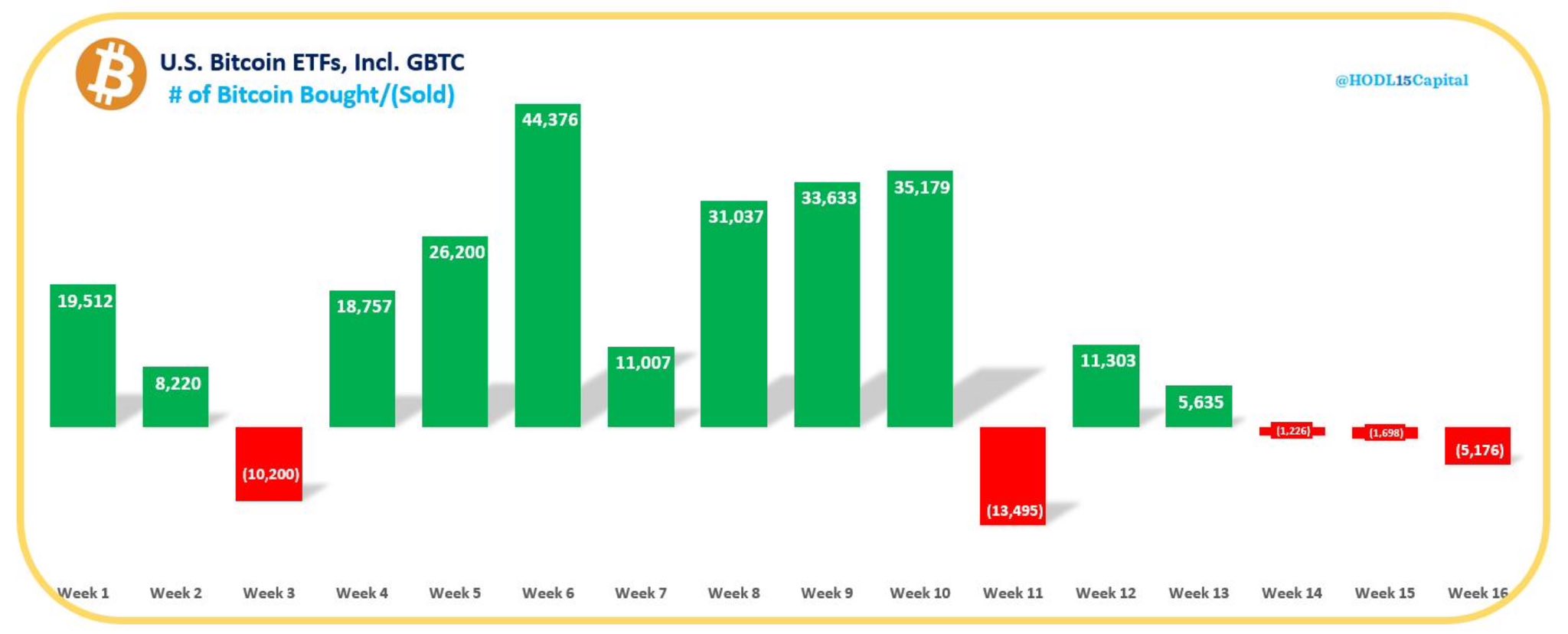

After experiencing continuous large net inflows in the first few weeks, the Bitcoin spot ETF craze seems to have subsided. According to HODL Capital data, the Bitcoin spot ETF continued to have gains in the 16th week. There was a significant outflow of funds, totaling 5,176 Bitcoins. This is the third consecutive week of net outflows.

Net outflow for 3 consecutive weeks

Analyst: 1,310 BTC will be outflowed at the opening of Monday

In addition, according to on-chain analyst Ember According to the data, in the trading on April 26, the eleven U.S. Bitcoin spot ETFs collectively experienced a net outflow of US$83.61 million. This number also indicates that after the U.S. stock market opens next Monday (April 29), there will be a total net outflow of approximately 1,310 Bitcoins from the custody addresses of these ETFs.

Among them, the ETF with the most outflows is Grayscale’s GBTC. Together with the other two ETFs, a total of about 1,395 Bitcoins have been outflowed, and the corresponding capital outflow is US$89.04 million. Overall, the current eleven The total number of Bitcoins held by the BTC spot ETFs is 833,562, with a market value of approximately US$5.321 billion.

US Bitcoin spot ETF status on Monday

10X Research: BTC may fall to the $52,000 range

In terms of market conditions, according to According to 10X Research analysis, Bitcoin currently faces certain downside risks and may fall further towards the expected range of US$52,000 to US$55,000. This risk assessment comes from multiple market structure data, including the reduction in Bitcoin miner income, which to some extent reflects problems with Bitcoin’s fair value.

After Bitcoin hit an all-time high on March 15, it has already experienced two significant price drops. These downward behaviors are generally regarded in the market as signals of exhaustion of upward momentum.

#10X Research analysts believe that Bitcoin has currently settled on the short-term high of a downward trend and is entering a descending channel that may point to $52,000 in the future. 24 hours will be a critical moment in determining whether Bitcoin will fall further.

The above is the detailed content of Bitcoin spot saw net outflows for 3 consecutive weeks! Analysts warn of BTC falling channel forming. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

1387

1387

52

52

How to avoid losses after ETH upgrade

Apr 21, 2025 am 10:03 AM

How to avoid losses after ETH upgrade

Apr 21, 2025 am 10:03 AM

After ETH upgrade, novices should adopt the following strategies to avoid losses: 1. Do their homework and understand the basic knowledge and upgrade content of ETH; 2. Control positions, test the waters in small amounts and diversify investment; 3. Make a trading plan, clarify goals and set stop loss points; 4. Profil rationally and avoid emotional decision-making; 5. Choose a formal and reliable trading platform; 6. Consider long-term holding to avoid the impact of short-term fluctuations.

Ranking of legal platform apps for virtual currency trading

Apr 21, 2025 am 09:27 AM

Ranking of legal platform apps for virtual currency trading

Apr 21, 2025 am 09:27 AM

This article lists the ranking of APPs for legal platforms for virtual currency transactions, emphasizing that compliance is an important consideration for choosing a platform. The article recommends platforms such as Coinbase, Gemini, and Kraken, and reminds investors to study regulatory information and pay attention to security records when making choices. At the same time, the article emphasizes that virtual currency transactions are high-risk and investments should be cautious.

Keep up with the pace of Coinjie.com: What is the investment prospect of crypto finance and AaaS business

Apr 21, 2025 am 10:42 AM

Keep up with the pace of Coinjie.com: What is the investment prospect of crypto finance and AaaS business

Apr 21, 2025 am 10:42 AM

The investment prospects of crypto finance and AaaS businesses are analyzed as follows: 1. Opportunities of crypto finance include market size growth, gradual clear regulation and expansion of application scenarios, but face market volatility and technical security challenges. 2. The opportunities of AaaS business lie in the promotion of technological innovation, data value mining and rich application scenarios, but the challenges include technical complexity and market acceptance.

How to distinguish between altcoins and mainstream coins? Which one is more worth investing in? Learn about the coin circle in one article

Apr 21, 2025 am 11:18 AM

How to distinguish between altcoins and mainstream coins? Which one is more worth investing in? Learn about the coin circle in one article

Apr 21, 2025 am 11:18 AM

The difference between altcoins and mainstream coins is mainly reflected in: 1. Market value and liquidity: The mainstream currency has a large market value and strong liquidity; the altcoins have a small market value and poor liquidity. 2. Technology and innovation: The mainstream currency technology is mature and has extensive innovation; innovation or replication based on altcoin technology. 3. Application scenarios and communities: mainstream coins are widely used and active in the community; altcoins are narrow and small in the community. Investment choices require risk tolerance and goals.

Top 11 list of Bitcoin Exchange Rate Conversion Global (Updated in 2025)

Apr 21, 2025 am 11:27 AM

Top 11 list of Bitcoin Exchange Rate Conversion Global (Updated in 2025)

Apr 21, 2025 am 11:27 AM

The exchange rate of Bitcoin to currencies of various countries is as follows: 1. USD: at 7:20 on April 9, the exchange rate is 10,152.53. 2. Domestic: at 2:2 on April 9, 1 Bitcoin = 149,688.2954 yuan. 3. Swedish Krona: At 12:30 on April 9, the exchange rate was 758,541.05.

How to choose the Bitcoin trading platform that suits you

Apr 21, 2025 am 11:42 AM

How to choose the Bitcoin trading platform that suits you

Apr 21, 2025 am 11:42 AM

When choosing a Bitcoin trading platform that suits you, you need to consider the following factors: 1. Security: Choose a platform that uses advanced security technologies such as multi-signature and cold storage, such as Coinbase. 2. Transaction fees: Research the charging standards of the platform, such as Binance's low handling fees. 3. Regulatory compliance: Choose a platform that complies in your region to protect your legitimate rights and interests. 4. Trading functions and services: Choose a platform that provides rich trading functions and good customer service, such as Huobi.com. 5. Ease of use: For beginners, choose a platform with a friendly interface and simple operation, such as Coinbase. 6. Liquidity: Choose a platform with high liquidity, such as Binance, to ensure timely transactions.

Gate.io Sesame Open Exchange Tips for Buying and Selling Coins (Guide to Novice)

Apr 21, 2025 am 11:51 AM

Gate.io Sesame Open Exchange Tips for Buying and Selling Coins (Guide to Novice)

Apr 21, 2025 am 11:51 AM

Tips for buying and selling coins on Gate.io include: 1. Make research plans before buying coins to understand the market and risks; 2. Choose trading pairs with high liquidity such as BTC/USDT; 3. Use limit orders to control the buying cost; 4. Pay attention to market trends and analyze price trends; 5. Set stop-profit and stop-loss when selling coins, and manage risks; 6. Use batch selling strategies to balance returns and risks; 7. Combine market sentiment and judge the selling timing; 8. Pay attention to macroeconomic and policy changes, and adjust strategies in a timely manner.

Top 10 secure cryptocurrency trading platforms rankings in 2025 The latest rankings of cryptocurrency trading platforms

Apr 21, 2025 am 10:21 AM

Top 10 secure cryptocurrency trading platforms rankings in 2025 The latest rankings of cryptocurrency trading platforms

Apr 21, 2025 am 10:21 AM

The top ten secure cryptocurrency trading platforms in 2025 are: 1. Binance, the world's largest, with a leading trading volume; 2. Bybit, the market share has increased, second only to Binance; 3. OKX, comprehensive service, covering spot and derivatives; 4. Coinbase, the largest in the United States, with high ease of use; 5. Kraken, the oldest in the United States, with strong security; 6. Huobi (HTX), the Asian market has a great influence; 7. Gate.io, low fees, multi-language support; 8. KuCoin, user-friendly, suitable for investment in emerging projects; 9. Crypto.com, innovative features and reward plans; 10. BitMEX, focusing on Bitcoin futures, suitable for professional traders.