Bitcoin has continued to fluctuate in recent days, and the trend of the market outlook has attracted much attention, and analysts have very different views.

Veteran trader Peter Brandt published a prediction on April 29 stating that Bitcoin has peaked in the current bull cycle and predicted that Bitcoin may drop to more than $30,000 or even lower. This happens to be contrary to many price models and predictions in the market, which believe that Bitcoin is still far from the peak of this cycle and may reach a peak of $210,000 before the end of the bull market. Therefore, Peter Brandt’s prediction triggered a lot of market speculation. debate.

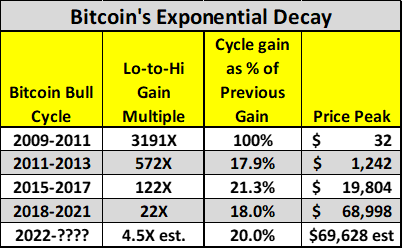

According to Peter Brandt’s article, it can be seen that the theoretical condition he proposed is that Bitcoin’s bull market cycle shows an “exponential decay” pattern. This is also the conclusion he drew from the observation of four Bitcoin bull market cycles.

That is, when the peak price of each consecutive period is only about 20% of the peak increase of the previous period, it meets the conditions of "exponential decay". Data also shows that this has happened over the past three Bitcoin market cycles.

>>The scale in 2011-2013 is about 20% of that in 2009-2011

>>The scale in 2015-2017 is about 20% of that in 2011-2013

>>The scale from 2018 to 2021 is about 20% of that from 2015 to 2017

And according to this decay rate, Brandt estimates that this bull market will only rise if it starts from the low point. About 4.5 times, which means it rises to about $70,000. The price of Bitcoin did reach $73,000 in March. However, Brandt is not very sure about his theory. He believes that there is only a 25% chance that Bitcoin has peaked.

Assuming that Bitcoin has really peaked, Peter Brandt believes that the price may fall back to around $30,000 to a low in 2021; however, from the perspective of technical analysis This kind of sharp decline is the most advantageous development for the long-term market.

Regarding Brandt’s prediction, Giovanni Santostasi, CEO and research director of Quantonomy, proposed another theory based on long-term power law behavior and Completely opposite theory to Brandt's.

Santostasi believes that Brandt’s theory only uses three historical data points, and it is necessary to deduct the one before the halving, because Brandt’s analysis includes the 4 years after the birth of Bitcoin, that is, the first The bubble before the second halving. Santostasi believes that this bubble behaves irregularly and should be excluded from the analysis and only focus on the cycles related to the halving.

The remaining two data are not enough for reliable statistical analysis. Santostasi measured the percentage of Bitcoin’s historical highs deviating from the long-term power law trend and came up with another exponential decay model. (The price of Bitcoin obeys a power law distribution, which means that its growth is non-linear, scale-invariant, and predictable to a certain extent)

According to this model, it can be predicted that the fourth round of the bull market It may peak around December 2025, with a maximum price of about $210,000 and then falling back to about $83,000. Santostasi’s analysis takes into account the power law trend of Bitcoin prices, the four-year halving cycle, the exponential decay of historical highs, and other data.

In addition, many experts have given predictions about the peak of this Bitcoin bull market:

In short, many analysts in the market have different opinions on when this bull market will peak and how high it can rise. However, most people still believe that Bitcoin is still some distance from its peak. 70,000 The U.S. dollar is probably not the end of the bull market.

The above is the detailed content of Will Bitcoin fall back to $30,000 or rise to $210,000? Analysts and forecasting models engage in 'price war”. For more information, please follow other related articles on the PHP Chinese website!