Technology peripherals

Technology peripherals

It Industry

It Industry

Amazon's first-quarter revenue was US$143.313 billion, a year-on-year increase of 13%, and net profit was US$10.431 billion, a year-on-year increase of 229%.

Amazon's first-quarter revenue was US$143.313 billion, a year-on-year increase of 13%, and net profit was US$10.431 billion, a year-on-year increase of 229%.

Amazon's first-quarter revenue was US$143.313 billion, a year-on-year increase of 13%, and net profit was US$10.431 billion, a year-on-year increase of 229%.

Morning news on May 1, Beijing time, Amazon today released its financial report for the first quarter of fiscal year 2024: net sales were US$143.313 billion, a year-on-year increase of 13%, excluding the impact of exchange rate changes, a year-on-year increase of 13% Net profit was US$10.431 billion, a significant increase of 229% year-on-year; diluted earnings per share was US$0.98, a significant increase compared with US$0.31 diluted earnings per share in the same period last year.

Amazon’s first-quarter revenue and diluted earnings per share exceeded Wall Street analysts’ expectations, but the company’s outlook for second-quarter revenue fell short of expectations. After the financial report was released, Amazon’s stock price rose nearly 3% after hours.

Main results:

According to reports, Amazon’s financial performance as of March 31 In the third quarter, net profit was US$10.431 billion and diluted earnings per share were US$7.09. This performance was much better than the same period last year. According to the financial report data released by Amazon, diluted earnings per share were much better than the same period last year, while diluted earnings per share were US$0.98, and the revenue growth rate was US$3.172 billion. This shows that Amazon's earnings performance in the first quarter of fiscal 2023 was very strong, with diluted earnings per share rising by $0.31. Amazon’s net sales in the first quarter were US$143.313 billion, an increase of 13% compared with US$127.358 billion in the same period last year. Excluding a $200 million negative impact from currency changes, Amazon's first-quarter net sales increased 13% compared with the same period last year. Amazon’s first-quarter operating profit was $15.307 billion, a significant increase from $4.774 billion in the same period a year earlier. In February this year, when Amazon released its fourth quarter and full-year financial reports for fiscal year 2023, it predicted that net sales in the first quarter of fiscal year 2024 would reach between US$138 billion and US$143.5 billion, year-on-year. Growth of 8% to 13% includes an expected positive impact of approximately 40 basis points from exchange rate changes. Its average value is $140.75 billion. Amazon also expected at the time that operating profit in the first quarter of fiscal 2024 would reach between US$8 billion and US$12 billion. This means that Amazon’s first-quarter revenue and operating profit exceeded the company’s previous expectations. According to data provided by Yahoo Finance, 44 analysts predicted that Amazon’s first-quarter revenue and diluted earnings per share exceeded Wall Street analysts’ expectations. According to data, 44 analysts had previously expected Amazon's net sales to reach US$14.25 billion on average in the first quarter, while the average expected earnings per share was US$0.83. In addition, 39 analysts had expected Amazon's first-quarter earnings per share to reach $0.83, while the actual earnings per share were $1.07, exceeding expectations. Amazon’s total operating expenses in the first quarter were US$128.006 billion, an increase from US$122.584 billion in the same period last year. Among them, the cost of sales was US$72.633 billion, an increase compared with US$67.791 billion in the same period last year; fulfillment expenses were US$22.317 billion, an increase compared with US$20.905 billion in the same period last year; marketing expenses were US$9.662 billion. , a decrease compared with US$10.172 billion in the same period last year; technology and content expenses were US$20.424 billion, basically the same as US$20.450 billion in the same period last year; general and administrative expenses were US$2.742 billion, down from US$20.450 billion in the same period last year. A decrease compared with US$3.043 billion; other operating expenses were US$228 million, basically the same as US$223 million in the same period last year.Performance of each department:

Amazon product sales in the first quarter were US$60.915 billion, an increase compared with US$56.981 billion in the same period last year; service net sales The amount was US$82.398 billion, an increase compared with US$70.377 billion in the same period last year. This shows that Amazon achieved promising sales growth in the first quarter. By geography: - Amazon’s North American division (United States, Canada) net sales in the first quarter were US$86.341 billion, an increase of 12% compared with US$76.881 billion in the same period last year; Operating profit was US$4.983 billion, a significant increase of 455% compared with US$898 million in the same period last year. - Amazon International segment (UK, Germany, France, Japan and China) net sales in the first quarter were $31.935 billion, an increase of 10% compared to $29.123 billion in the same period last year, excluding currency The impact of the change was an 11% year-on-year increase; operating profit was US$903 million, turning a profit compared to an operating loss of US$1.247 billion in the same period last year. - Amazon AWS cloud service net sales in the first quarter were US$25.037 billion, an increase of 17% compared with US$21.354 billion in the same period last year. Excluding the impact of exchange rate changes, the same year-on-year increase was 17%; Operating profit was US$9.421 billion, an increase of 84% compared with US$5.123 billion in the same period last year. - Amazon’s sales from the North American segment accounted for 60% of total sales in the first quarter, which was the same as the proportion of 60% in the same period last year; sales from the international segment The proportion of total sales was 22%, down from 23% in the same period last year; sales from AWS cloud services accounted for 18% of total sales, down from 23% in the same period last year. The proportion increased compared with 17% in the same period.Divided by service and business type, Amazon’s first quarter performance of each department is as follows:

-Net sales from online stores were US$54.670 billion, an increase compared with US$51.096 billion in the same period last year 7. Excluding the impact of exchange rate changes, it also increased by 7% year-on-year;

-Net sales from physical stores were US$5.202 billion, an increase of 6% compared with US$4.895 billion in the same period last year. Excluding the impact of exchange rate changes, it also increased by 6% year-on-year;

-Net sales from third-party seller services were US$34.596 billion, an increase of 16% compared with US$29.820 billion in the same period last year. Excluding the impact of currency changes, it also increased 16% year-on-year;

-Net sales from subscription services were US$10.722 billion, an increase of 11% compared with US$9.657 billion in the same period last year, excluding The impact of changes in import exchange rates was also a year-on-year increase of 11%;

-Net sales from advertising services were US$11.824 billion, an increase of 24% compared with US$9.509 billion in the same period last year, excluding exchange rates The impact of the change was also a year-on-year increase of 24%;

-Net sales from AWS cloud services were US$25.037 billion, an increase of 17% compared with US$21.354 billion in the same period last year, excluding exchange rate changes The impact was also a year-on-year increase of 17%;

-Net sales from other businesses were US$1.262 billion, an increase of 23% compared with US$1.027 billion in the same period last year, excluding the impact of exchange rate changes It was also a year-on-year increase of 23%.

Cash flow information:

For the 12 months ended March 31, 2024, Amazon’s operating cash flow was $99.1 billion, compared with the prior year An increase of 82% compared with the same period; in the 12 months ended March 31, 2023, Amazon's operating cash flow was US$54.3 billion.

In the 12 months ended March 31, 2024, Amazon's free cash flow was $50.1 billion, a significant improvement compared with the same period last year; in the 12 months ended March 31, 2023 Amazon's free cash flow was $3.3 billion in the trailing 12 months.

After deducting lease principal repayments, Amazon’s free cash flow in the past 12 months was US$46.1 billion, a significant improvement compared with the same period last year; as of March 31, 2023 In the 12 months as of today, Amazon's free cash flow after excluding the aforementioned items was an outflow of $10.1 billion.

After deducting principal repayments on finance leases and assets acquired under capital leases, Amazon’s free cash flow in the past 12 months was $48.8 billion, a significant improvement compared to the same period last year. ; In the 12 months ended March 31, 2023, Amazon's free cash flow after deducting the aforementioned items was an outflow of $4.5 billion.

Performance expectations:

Amazon expects the company’s net sales to reach between US$144 billion and US$149 billion in the second quarter of fiscal 2024, a year-on-year increase 7% to 11%, including the expected negative impact of approximately 60 basis points from exchange rate changes. In the fiscal first quarter of fiscal 2024, the leap year had a gain effect of approximately 120 basis points on Amazon's year-over-year net sales growth rate.

Amazon also expects the company’s operating profit to be between $10 billion and $14 billion in the second quarter of fiscal 2024, compared with operating profit of $7.7 billion in the same period of fiscal 2023.

The above guidance assumes that Amazon will not enter into any other business acquisitions, restructurings or legal settlements in the second quarter of 2024.

The average range of Amazon’s forecast range for second-quarter net sales was $146.5 billion, missing analysts’ expectations. On average, 42 analysts expected Amazon to post net sales of $150.07 billion in the second quarter, according to data provided by Yahoo Finance.

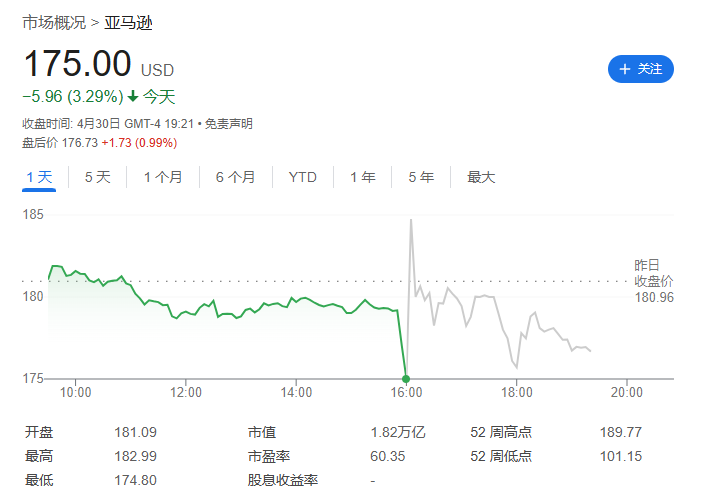

Stock price changes:

On the same day, Amazon’s stock price fell by $5.96 in regular Nasdaq trading, closing at $175.00, a decrease of 3.29%. In subsequent after-hours trading as of 5:36 pm ET on Tuesday (5:36 am on Wednesday, Beijing time), Amazon shares rose $5.10, or 2.91%, to $180.10. Over the past 52 weeks through Tuesday's close, Amazon's highest price was $189.77 and its lowest price was $101.15.

The above is the detailed content of Amazon's first-quarter revenue was US$143.313 billion, a year-on-year increase of 13%, and net profit was US$10.431 billion, a year-on-year increase of 229%.. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

AI Hentai Generator

Generate AI Hentai for free.

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

1376

1376

52

52

Amazon Kindle Oasis is discontinued in the United States, marking the end of the era of high-end e-readers

Feb 25, 2024 pm 12:10 PM

Amazon Kindle Oasis is discontinued in the United States, marking the end of the era of high-end e-readers

Feb 25, 2024 pm 12:10 PM

According to the latest news, Amazon has announced the discontinuation of its high-end e-reader Kindle Oasis and has removed it from the US market. This move indicates that the once highly anticipated Kindle Oasis has officially withdrawn from the market. Although there is still a small amount of stock in some overseas markets such as Canada and the United Kingdom, once sold out, it will no longer be available. This marks the beginning of this acclaimed high-end reader becoming a thing of the past. Kindle Oasis is loved by users for its excellent performance and design. However, as market demand changes and new products are launched, Amazon may have decided to discontinue this product. Although Kindle Oasis has left a certain mark on the market, Amazon may have shifted its focus to other product lines

Amazon Prime Video will start rolling out ads on January 29th, and you'll have to pay extra to watch ad-free

Jan 13, 2024 am 08:27 AM

Amazon Prime Video will start rolling out ads on January 29th, and you'll have to pay extra to watch ad-free

Jan 13, 2024 am 08:27 AM

Amazon has finally announced the implementation date for its much-anticipated Prime Video advertising program. Starting from January 29, 2024, PrimeVideo will begin to embed advertisements in some movies and TV series. Amazon explained in an email sent to users that this is done to continue investing in attractive content and to increase related investments in the long term. Amazon promises that the number of ads on Prime Video will be much lower than traditional TV and other streaming platforms. Members don’t need to take any additional action, and Prime membership prices remain the same. However, users who want to enjoy an ad-free experience can pay an additional $2.99 per month (note from this site: currently about 21 yuan). The email also mentioned that Prime members can enjoy

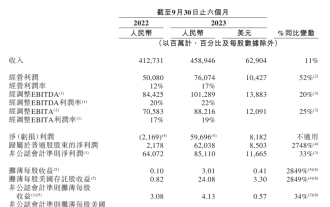

Alibaba's semi-annual financial report for fiscal year 2024 shows that revenue reached 458.946 billion yuan, a year-on-year increase of 11%, and net profit attributable to the parent company increased by 2748% year-on-year.

Jan 04, 2024 pm 06:44 PM

Alibaba's semi-annual financial report for fiscal year 2024 shows that revenue reached 458.946 billion yuan, a year-on-year increase of 11%, and net profit attributable to the parent company increased by 2748% year-on-year.

Jan 04, 2024 pm 06:44 PM

According to news from this site on December 23, Alibaba announced its interim report for fiscal year 2024 (six months ending September 30, 2023), achieving revenue of 458.946 billion yuan, a year-on-year increase of 11%; operating profit of 76.074 billion yuan, a year-on-year increase of 52% %; net profit attributable to parent companies was 62.038 billion yuan, a year-on-year increase of 2748%; diluted earnings per share was 3.01 yuan, a year-on-year increase of 2849%. This site noticed that Taotian Group’s revenue increased by 8% year-on-year. Alibaba International Digital Business Group's overseas business performed strongly, with revenue increasing by 47%. Cainiao Group's revenue increased 29%. Local Living Group's revenue increased 22%. Dawen Entertainment Group's revenue increased 21% for the six-month period ended September 30, 2023, Cainiao

Cloud computing giant launches legal battle: Amazon sues Nokia for patent infringement

Jul 31, 2024 pm 12:47 PM

Cloud computing giant launches legal battle: Amazon sues Nokia for patent infringement

Jul 31, 2024 pm 12:47 PM

According to news from this site on July 31, technology giant Amazon sued Finnish telecommunications company Nokia in the federal court of Delaware on Tuesday, accusing it of infringing on more than a dozen Amazon patents related to cloud computing technology. 1. Amazon stated in the lawsuit that Nokia abused Amazon Cloud Computing Service (AWS) related technologies, including cloud computing infrastructure, security and performance technologies, to enhance its own cloud service products. Amazon launched AWS in 2006 and its groundbreaking cloud computing technology had been developed since the early 2000s, the complaint said. "Amazon is a pioneer in cloud computing, and now Nokia is using Amazon's patented cloud computing innovations without permission," the complaint reads. Amazon asks court for injunction to block

Amazon AWS and Microsoft will compete in GenAI field

Nov 29, 2023 pm 08:15 PM

Amazon AWS and Microsoft will compete in GenAI field

Nov 29, 2023 pm 08:15 PM

In an interview with VentureBeat on Monday, Swami Sivasubramanian, Amazon's vice president of data and artificial intelligence at AWS, said he oversees all of AWS's database, analytics, machine learning and artificial intelligence services, and outlined what he said on Wednesday. A keynote address in the morning and a keynote address Tuesday morning from AWS CEO Adam Selipsky, who said the main theme around GenAI is that enterprises want to have the flexibility and choice to use different models from different vendors, rather than Being locked into a single supplier or platform, however, he added that these models may not be sufficient on their own to provide a competitive advantage as they may become commoditized over time and, therefore, the key advantage for the business will be their own proprietary data to

Galaxy Digital reports $296 million in net profit in 2023, after losing $1 billion the year before

Apr 01, 2024 pm 06:55 PM

Galaxy Digital reports $296 million in net profit in 2023, after losing $1 billion the year before

Apr 01, 2024 pm 06:55 PM

As of the end of February this year, Galaxy Digital’s assets under management (AUM) surged to $10.1 billion. The recently released financial statements of Galaxy Digital, a digital asset financial services company owned by Mike Novogratz, show that it achieved a net profit of US$29.6 million for the entire year. This is a significant turnaround after losing $1 billion in 2022. The company said that the fourth quarter of 2023 is particularly turning point for the company. In its official statement, Galaxy Digital said there was a positive change in fortunes in the last quarter of 2023, pushing its net profit to $302 million. This coincides with the much-needed rebound the crypto market has experienced, emerging from a prolonged crypto slump.

Chinese e-book manufacturers are filling the void after Amazon Kindle exits the market, with sales increasing by 12.2% to 762,000 units in 2023

Jan 26, 2024 pm 05:24 PM

Chinese e-book manufacturers are filling the void after Amazon Kindle exits the market, with sales increasing by 12.2% to 762,000 units in 2023

Jan 26, 2024 pm 05:24 PM

According to news from this website on January 26, Luotu Technology today released a new "Global E-Paper Tablet Market Analysis Quarterly Report", which mentioned that global e-paper tablet shipments in 2023 will be 12.54 million units, a year-on-year increase of 17.2%. Among them, the sales volume of global e-book brands in the Chinese market reached 1.23 million units, a year-on-year increase of 20.6%, accounting for 9.8% of the global total, an increase of 0.5 percentage points from 2022. A total of 40 new products were released in the Chinese market throughout the year, continuing the popularity of 2022. In terms of brand performance, iFlytek, PalmReader, Aragonite, and Xiaoyuan lead the sales. This site learned from a report published by Luotu Technology that due to the withdrawal of Kindle e-books from the Chinese market on June 30, 2023, there will be a gap in the industry, resulting in domestic electronic

Former Baidu Vice President Chu Ruisong takes over as head of Amazon Cloud Technology Greater China

Oct 09, 2023 pm 04:57 PM

Former Baidu Vice President Chu Ruisong takes over as head of Amazon Cloud Technology Greater China

Oct 09, 2023 pm 04:57 PM

According to news from this website on October 9, Matt Garman, senior vice president of global sales, marketing and services of Amazon Cloud Technology, announced internally a change in the leadership of Greater China. Chu Ruisong will succeed Zhang Wenyi as Amazon’s global vice president and executive of Amazon Cloud Technology Greater China. Director, Zhang Wenyi will have a new appointment. Chu Ruisong’s public information shows that before joining Amazon Cloud Technology, Chu Ruisong served as the vice president of Baidu Group for nearly four years. He was one of Baidu’s senior management teams and was responsible for leading Baidu’s Apollo smart car business. He resigned in July this year. Prior to that, he spent most of his career at SAP, holding various leadership positions in engineering, strategy, business development, etc., and was ultimately responsible for global R&D of S/4HANA cloud products, with leadership all over Germany.