web3.0

web3.0

Penetrating Eigenlayer Token Economics: A New Social Consensus Mechanism to Solve Where ETH Can't

Penetrating Eigenlayer Token Economics: A New Social Consensus Mechanism to Solve Where ETH Can't

Penetrating Eigenlayer Token Economics: A New Social Consensus Mechanism to Solve Where ETH Can't

The long-awaited Eigenlayer finally announced more details of its token economy today, and announced that it will allocate 15% of the EIGEN tokens to those who previously participated in the re-staking through linear unlocking. user.

Is there more value in the EIGEN token itself? What exactly is it used for? What impact can it have on re-staking and even the entire Ethereum ecosystem?

The answers are all in this more than 40-page token economy white paper released by Eigenlayer.

Different from a few hasty token release diagrams when general projects introduce the token economy, Eigenlayer spent a lot of pen and ink to explain the EIGEN token in detail, meticulously and even with some technical geeks. The role of , and its relationship with ETH tokens.

Shenchao’s research team has read through this white paper and organized the technical points into easy-to-understand words to help you quickly understand the role and value of EIGEN.

Quick overview of key points

EIGEN token functions and problems to be solved

Universality and Cross-TaskStaking(Universality and Restaking)

Traditional Block Chain tokens are usually only used for specific tasks, such as ETH which is mainly used for block verification on Ethereum. This limits the token’s scope of use and flexibility.

The re-pledge mechanism allows users to use their already staked ETH assets for multiple tasks and services without unlocking or transferring these assets.

Intersubjectively Verifiable

The white paper uses “Intersubjectively "(Between Subjectives) This word, which is very difficult to convert into Chinese, is used to describe some complex network tasks: they are often difficult to verify through simple automated procedures and require subjective consensus from human observers.

EIGEN token acts as a medium of “social consensus” in these tasks. In scenarios that require verification of different opinions, EIGEN can be used as a voting tool, and token holders can influence network decisions through voting.

Forking Tokens and Slashing

Network Disagreement on certain issues or decisions may arise in the network, and a mechanism is needed to resolve these disagreements and maintain the consistency of the network.

In the event of major disagreements, the EIGEN token may undergo a fork, creating two independent token versions, each representing a different decision-making path. Token holders need to choose which version to support, and unselected versions may lose value.

If a network participant fails to perform staking tasks correctly or behaves inappropriately, EIGEN staked tokens may be reduced as a penalty for their bad behavior.

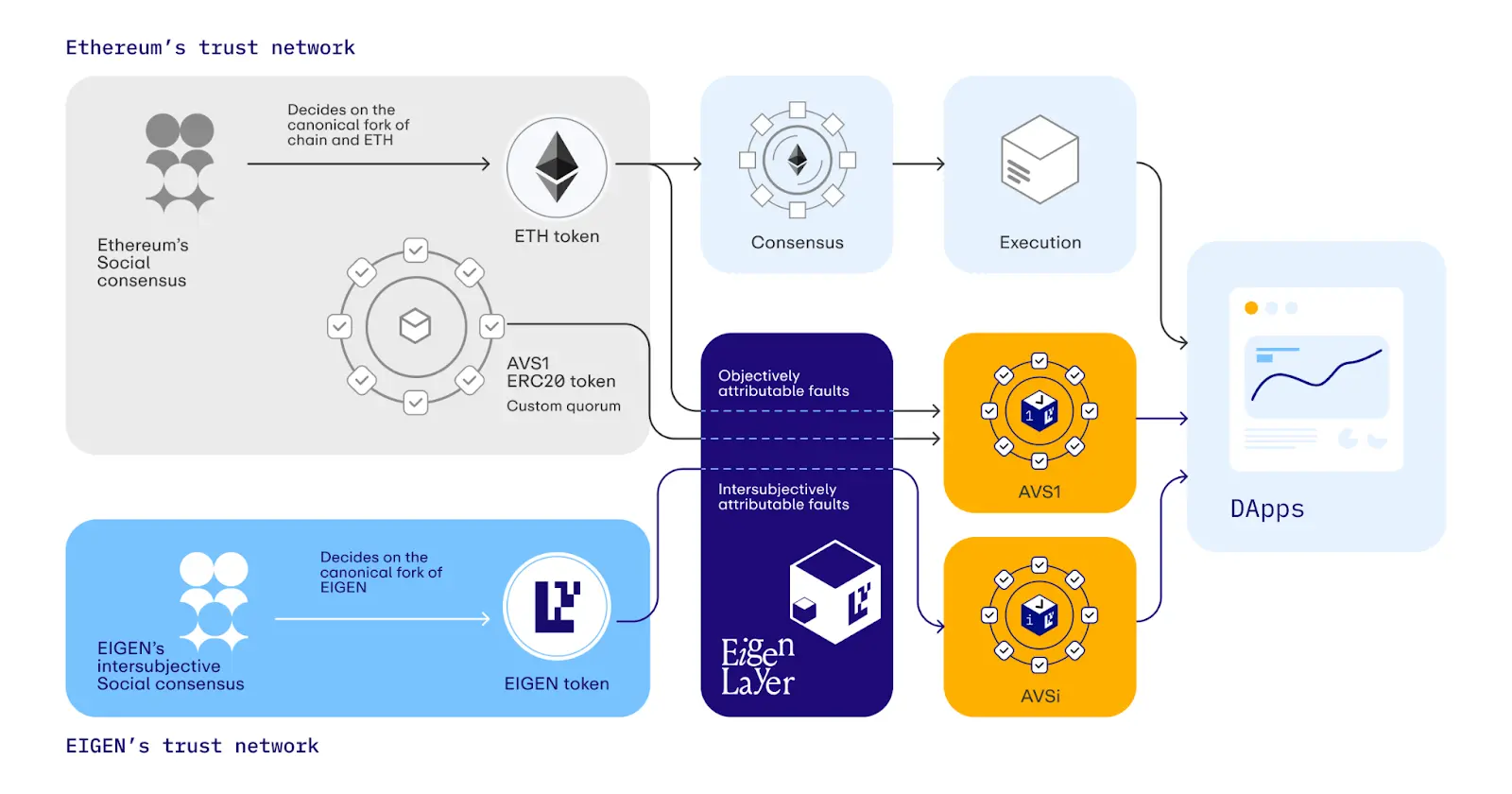

The relationship between EIGEN and ETH

Supplement rather than replace: EIGEN tokens are not intended to replace ETH, but are the basis for the existence of ETH Supplements are provided.

#ETH is primarily used for staking and network security as a general purpose work token. ETH staking supports the reduction of objective failures (for example, verification nodes will be punished if they verify incorrectly)

EIGEN staking supports the reduction of subjective failures (errors that cannot be verified on the chain, such as oracles) The price quoted to you is itself wrong), thereby greatly expanding the range of digital tasks that blockchain can safely provide users.

EIGEN Token: Provides a new social consensus mechanism that specifically handles subjective errors beyond the reach of ETH

If you want to know about EIGEN To understand what the token does, you must first know what the ETH token does.

Before there was the concept of Eigenlayer and re-staking, ETH could be regarded as a "working token with a specific purpose". In human terms:

ETH tokens are used to maintain the security of the network, generate new blocks, and perform tasks related to the maintenance of the Ethereum blockchain. They cannot be used for anything else.

In this case, the characteristics of ETH are:

has a very specific working purpose;

Extremely strong objectivity. For example, if there are double signature errors on the Ethereum chain or errors in Rollup summary, you can pass pre-written instructions on the chain. It is judged by objective rules and a certain amount of ETH will be punished to the verifier.

With Eigenlayer, ETH is actually converted into a "Universal Target" working token. In human terms:

You can take ETH and pledge it to various tasks, such as new consensus mechanisms, Rollup, bridge or MEV management solutions, etc., it is no longer limited to The pledge of Ethereum's own chain is also an important function of Eigenlayer.

However, in this case, although the usage scenario has changed, ETH still has the following characteristics:

“Objective” restrictions still exist, as slashing and slashing actions can only be applied to objectively verifiable tasks on the Ethereum chain.

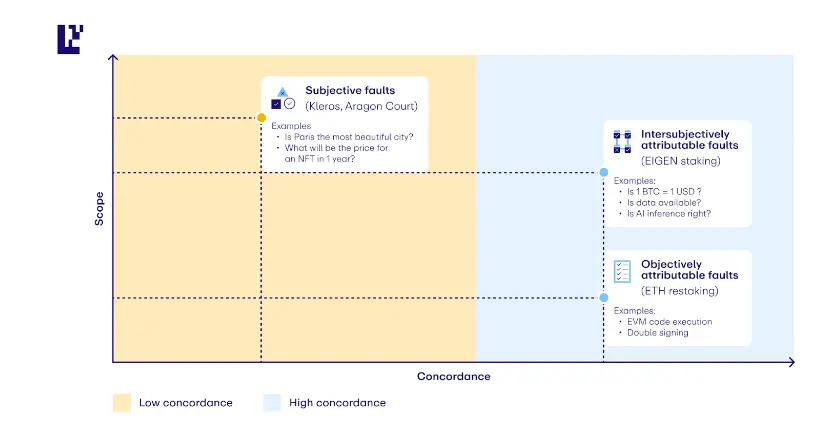

#But you have to know that not all errors in the encryption world can be attributed on the chain, and not all arguments can rely on the consensus on the chain. algorithm to solve.

Sometimes, these non-objective, difficult to prove, and controversial errors and problems significantly affect the security of the blockchain itself.

As an extreme example, the oracle quotes 1BTC = 1 USD. This data is wrong from the source. You can’t identify it using any objective contract code or consensus algorithm on the chain; and if something goes wrong, it won’t help if you confiscate the validator’s ETH. To put it bluntly:

You cannot use an objective solution on the chain to sanction a subjective error off the chain.

What is the price of an asset, whether a data source is available, whether an AI interface program runs correctly... These issues cannot be agreed upon and solved on the chain, and more are needed A "social consensus" in which answers are arrived at through subjective discussion and judgment.

Eigenlayer calls this type of problem Intersubjectively attributable faults: All reasonably active observers of the system There is broad consensus among a set of faults.

Therefore, EIGEN tokens have a place to play ---- Provide a complementary new social consensus mechanism besides ETH to maintain network integrity and security. Specially designed to solve this "subjective" failure.

Specific method: EIGEN pledge, token fork

ETH is still a working token for general purpose, but EIGEN will be used as a general purpose The "subjective" work tokens are complementary.

If the verifier pledges ETH and some objective failure occurs, the pledged ETH can be reduced and forfeited;

You can also pledge EIGEN, when some subjective failures (which cannot be directly judged on the chain and require subjective judgment) occur, the pledged EIGEN can be reduced and forfeited.

Let’s take a specific scenario and see how EIGEN works.

Suppose there is a decentralized reputation system based on Eigenlayer, where users can rate service providers on the platform. Each service provider stakes EIGEN tokens to demonstrate their credibility.

Before starting this system, there are 2 phases that are necessary:

Setup phase: System benefits Coordination rules between relevant parties are encoded to give rules for how to resolve subjective disputes; Enforce pre-agreed rules metaphorically, preferably locally.

-

#In this system, users can enforce the conditions they have agreed to in advance.

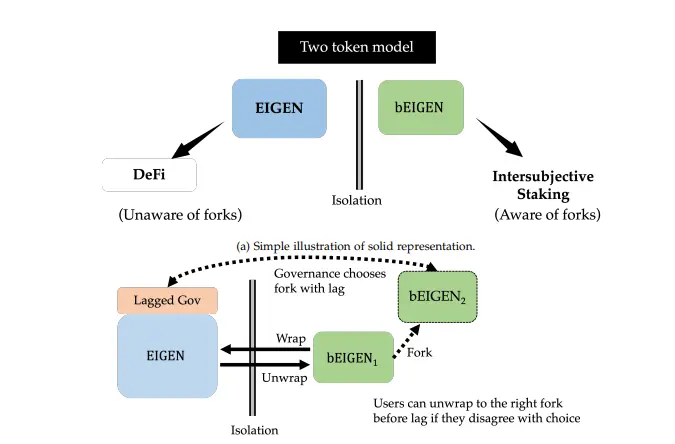

Then, if the service provider is considered to have provided false services or misled users, the community consensus mechanism of the platform may trigger a challenge, forming a forked token event, and then turning into two versions of the EIGEN token. Coins---EIGEN and bEIGEN.

Now users and AVS are free to decide which one to respect and value. If it is widely believed that the slashed stake holder acted inappropriately, then users and AVS will only value the forked tokens, not the original tokens;

Then, the malicious stakers’ The original EIGEN tokens will be reduced and confiscated through this fork.

So this is equivalent to a social consensus ruling system to resolve disputes that cannot be handled objectively on the ETH chain.

It’s also worth mentioning that for users and other stakeholders, you don’t have to worry about the impact of this “fork” at all.

Generally speaking, after a token forks, you must make an overall choice for it, which also affects the performance of your tokens in other However, EIGEN creates an isolation barrier between CeFi/DeFi use cases and EIGEN staking use cases. Even if bEIGEN is affected by inter-subject fork disputes, any use of it will EIGEN holders in non-staking applications also don’t have to worry, as it can redeem bEIGEN at any time in the future for the fork.

Through this fork isolation mechanism, Eigenlayer not only improves the efficiency and fairness of handling disputes, but also protects the interests of users who are not involved in the dispute, thereby providing powerful functions while , ensuring the overall stability of the network and the security of user assets.

Summary

It can be seen that EIGEN’s inter-subject pledge and dispute handling mechanism supplements what ETH cannot handle as an on-chain pledge mechanism. subjective disputes and failures, unlocking a large number of previously impossible AVS on Ethereum, with strong crypto-economic security.

This may open the door to innovation in: oracles, data availability layers, databases, artificial intelligence systems, game virtual machines, intent and order matching and MEV engines, prediction markets wait.

However, judging from the roadmap given in its white paper, the current use cases of EIGEN are still in a very preliminary start-up stage. It is more like the concept has been fully formulated but is far from practical. implement.

As users can officially receive EIGEN tokens after May 10, let us wait and see whether the use value envisaged by EIGEN can effectively carry the changes in the token market price.

The above is the detailed content of Penetrating Eigenlayer Token Economics: A New Social Consensus Mechanism to Solve Where ETH Can't. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

AI Hentai Generator

Generate AI Hentai for free.

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

1385

1385

52

52

What is Ouyi for? What is Ouyi

Apr 01, 2025 pm 03:18 PM

What is Ouyi for? What is Ouyi

Apr 01, 2025 pm 03:18 PM

OKX is a global digital asset trading platform. Its main functions include: 1. Buying and selling digital assets (spot trading), 2. Trading between digital assets, 3. Providing market conditions and data, 4. Providing diversified trading products (such as derivatives), 5. Providing asset value-added services, 6. Convenient asset management.

How to roll positions in digital currency? What are the digital currency rolling platforms?

Mar 31, 2025 pm 07:36 PM

How to roll positions in digital currency? What are the digital currency rolling platforms?

Mar 31, 2025 pm 07:36 PM

Digital currency rolling positions is an investment strategy that uses lending to amplify trading leverage to increase returns. This article explains the digital currency rolling process in detail, including key steps such as selecting trading platforms that support rolling (such as Binance, OKEx, gate.io, Huobi, Bybit, etc.), opening a leverage account, setting a leverage multiple, borrowing funds for trading, and real-time monitoring of the market and adjusting positions or adding margin to avoid liquidation. However, rolling position trading is extremely risky, and investors need to operate with caution and formulate complete risk management strategies. To learn more about digital currency rolling tips, please continue reading.

How to calculate the transaction fee of gate.io trading platform?

Mar 31, 2025 pm 09:15 PM

How to calculate the transaction fee of gate.io trading platform?

Mar 31, 2025 pm 09:15 PM

The handling fees of the Gate.io trading platform vary according to factors such as transaction type, transaction pair, and user VIP level. The default fee rate for spot trading is 0.15% (VIP0 level, Maker and Taker), but the VIP level will be adjusted based on the user's 30-day trading volume and GT position. The higher the level, the lower the fee rate will be. It supports GT platform coin deduction, and you can enjoy a minimum discount of 55% off. The default rate for contract transactions is Maker 0.02%, Taker 0.05% (VIP0 level), which is also affected by VIP level, and different contract types and leverages

Binance binance computer version entrance Binance binance computer version PC official website login entrance

Mar 31, 2025 pm 04:36 PM

Binance binance computer version entrance Binance binance computer version PC official website login entrance

Mar 31, 2025 pm 04:36 PM

This article provides a complete guide to login and registration on Binance PC version. First, we explained in detail the steps for logging in Binance PC version: search for "Binance Official Website" in the browser, click the login button, enter the email and password (enable 2FA to enter the verification code) to log in. Secondly, the article explains the registration process: click the "Register" button, fill in the email address, set a strong password, and verify the email address to complete the registration. Finally, the article also emphasizes account security, reminding users to pay attention to the official domain name, network environment, and regularly updating passwords to ensure account security and better use of various functions provided by Binance PC version, such as viewing market conditions, conducting transactions and managing assets.

Tutorial on how to register, use and cancel Ouyi okex account

Mar 31, 2025 pm 04:21 PM

Tutorial on how to register, use and cancel Ouyi okex account

Mar 31, 2025 pm 04:21 PM

This article introduces in detail the registration, use and cancellation procedures of Ouyi OKEx account. To register, you need to download the APP, enter your mobile phone number or email address to register, and complete real-name authentication. The usage covers the operation steps such as login, recharge and withdrawal, transaction and security settings. To cancel an account, you need to contact Ouyi OKEx customer service, provide necessary information and wait for processing, and finally obtain the account cancellation confirmation. Through this article, users can easily master the complete life cycle management of Ouyi OKEx account and conduct digital asset transactions safely and conveniently.

What are the recommended websites for virtual currency app software?

Mar 31, 2025 pm 09:06 PM

What are the recommended websites for virtual currency app software?

Mar 31, 2025 pm 09:06 PM

This article recommends ten well-known virtual currency-related APP recommendation websites, including Binance Academy, OKX Learn, CoinGecko, CryptoSlate, CoinDesk, Investopedia, CoinMarketCap, Huobi University, Coinbase Learn and CryptoCompare. These websites not only provide information such as virtual currency market data, price trend analysis, etc., but also provide rich learning resources, including basic blockchain knowledge, trading strategies, and tutorials and reviews of various trading platform APPs, helping users better understand and make use of them

Currency Trading Network Official Website Collection 2025

Mar 31, 2025 pm 03:57 PM

Currency Trading Network Official Website Collection 2025

Mar 31, 2025 pm 03:57 PM

It ranks among the top in the world, supports all categories of transactions such as spot, contracts, and Web3 wallets. It has high security and low handling fees. A comprehensive trading platform with a long history, known for its compliance and high liquidity, supports multilingual services. The industry leader covers currency trading, leverage, options, etc., with strong liquidity and supports BNB deduction fees.

On which platform is web3 transaction?

Mar 31, 2025 pm 07:54 PM

On which platform is web3 transaction?

Mar 31, 2025 pm 07:54 PM

This article lists the top ten well-known Web3 trading platforms, including Binance, OKX, Gate.io, Kraken, Bybit, Coinbase, KuCoin, Bitget, Gemini and Bitstamp. The article compares the characteristics of each platform in detail, such as the number of currencies, trading types (spot, futures, options, NFT, etc.), handling fees, security, compliance, user groups, etc., aiming to help investors choose the most suitable trading platform. Whether it is high-frequency traders, contract trading enthusiasts, or investors who focus on compliance and security, they can find reference information from it.