web3.0

web3.0

The first-day trading volume of 6 Bitcoin and Ethereum spot ETFs in Hong Kong was HK$87.58 million! Less than 1% when listed in the United States

The first-day trading volume of 6 Bitcoin and Ethereum spot ETFs in Hong Kong was HK$87.58 million! Less than 1% when listed in the United States

The first-day trading volume of 6 Bitcoin and Ethereum spot ETFs in Hong Kong was HK$87.58 million! Less than 1% when listed in the United States

This site (120bTC.coM): 6 Bitcoin and Ethereum spot ETFs (Boshi International, China Asset Management, Harvest International) approved by the Hong Kong Securities Regulatory Commission yesterday (30) It was officially listed on the Hong Kong Stock Exchange on the same day, but it immediately encountered currency price headwinds. Early this morning, BTC once fell to 59,177 US dollars, and is still trying to stabilize at the 60,000 mark.

The trading volume of the six ETFs on the first day was HK$87.58 million.

According to statistics from the Hong Kong Stock Exchange, the total trading volume of the six ETFs on the first day was HK$87.58 million (approximately US$11.2 million). According to the transaction The order of volume is:

China Bitcoin ETF (3042.HK) reached HKD 37.16 million

China Ethereum ETF (3046.HK) Reaching HK$12.66 million

Harvest Bitcoin Spot ETF (3,439.HK) reached HK$17.89 million

Boshi HashKey Bitcoin ETF (3008.HK) HK) The transaction amount was approximately HK$12.44 million

Harvest Ethereum Spot ETF (3179.HK) reached HK$4.95 million

HashKey Ether ETF (3009.HK) reached HK$2.48 million

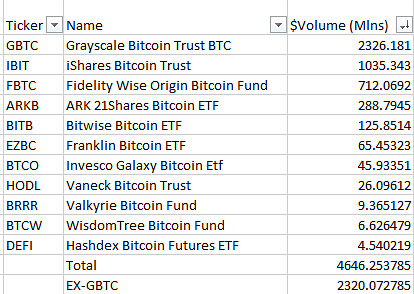

Compared to the total trading volume of the 11 U.S. Bitcoin spot ETFs on the first day of official trading (1/11) exceeding US$4.6 billion , less than 1% of it.

However, at that time, Grayscale’s GBTC trading volume accounted for about half (2.32 billion U.S. dollars, mostly due to profit-taking selling pressure), and BlackRock’s IBIT ranked second with 1 billion U.S. dollars. , Fidelity’s FBTC ranked third with a trading volume of US$710 million.

First-day trading volume of 11 Bitbit spot ETFs in the United States

Now it seems that although Hong Kong’s ETFs can adopt physical delivery, they do not seem to be able to become A very big incentive to buy. On the other hand, investors in mainland China are currently not allowed to invest in Hong Kong’s cryptocurrency spot ETFs. Will there be corresponding regulatory adjustments in the future to bring more incremental funds? Continuous observation is also required.

The current prices of the six ETFs

According to data from the Hong Kong Stock Exchange, the current prices of the six ETFs as of the time of publication are as follows:

Boshi Ethereum ETF ( 3009.HK) is currently quoted at HKD 24.8

Boshi Bitcoin ETF (3008.HK) is currently quoted at HKD 49.58

Harvest Ether ETF ( 3179.HK) is currently quoted at HK$7.7

Harvest Bitcoin ETF (3439.HK) is currently quoted at HK$7.95

China Ethereum ETF( 3046.HK) is currently quoted at HK$7.77

China Bitcoin ETF (3042.HK) is currently quoted at HK$7.95

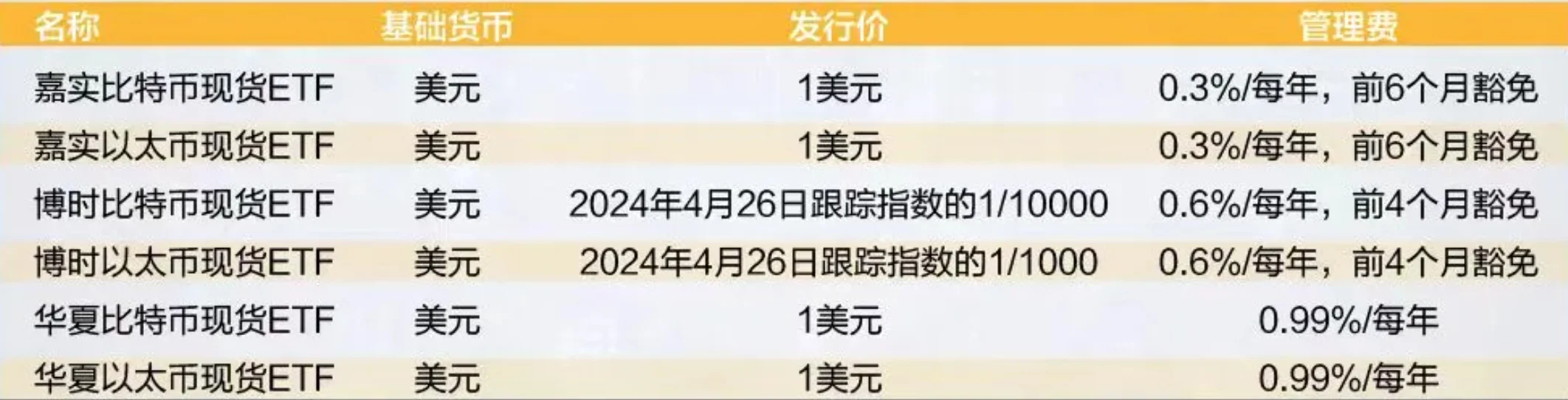

Differences in the issuance mechanism of the six spot ETFs

In terms of management fees:

The annual management fee for Harvest Bitcoin and Ethereum spot ETFs is 0.3 of the net asset value %, exempted for the first 6 months from the listing date

The annual management fee of Boshi Bitcoin and Ethereum spot ETFs is 0.6% of the net asset value, starting from the listing date on April 30 The fees will be temporarily reduced until August 2024

The annual management fee for China Bitcoin and Ethereum spot ETFs is 0.99%

In terms of issuance price :

Harvest International and Huaxia (Hong Kong)’s products are issued at US$1 per share

The initial issuance of Boshi Bitcoin and Ethereum spot ETFs The prices are basically consistent with 1/10000 and 1/1000 of the tracking index on April 26, 2024. That is, the converted net value of fund shares corresponds to the price of approximately 0.0001 Bitcoins and the price of 0.001 Ethereums, which means that holding 10,000 shares is approximately Equivalent to 1 Bitcoin, 1,000 shares are approximately equivalent to 1 Ethereum.

From the perspective of trading units:

Harvest International’s Bitcoin/Ethereum Spot ETF 1 The primary market application is at least 100,000 shares (or multiples thereof), and the minimum trading unit in the secondary market is 100 shares

The primary market application for Boshi Bitcoin Spot ETF is 50,000 shares (or Its multiple), the minimum buying and selling unit in the secondary market is 10 shares, the Ethereum spot ETF is a primary market application is 100,000 shares (or its multiple), the minimum buying and selling unit in the secondary market is also 10 shares.

The above is the detailed content of The first-day trading volume of 6 Bitcoin and Ethereum spot ETFs in Hong Kong was HK$87.58 million! Less than 1% when listed in the United States. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

AI Hentai Generator

Generate AI Hentai for free.

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

1378

1378

52

52

okx Ouyi Exchange web version enter link click to enter

Mar 31, 2025 pm 06:21 PM

okx Ouyi Exchange web version enter link click to enter

Mar 31, 2025 pm 06:21 PM

1. Enter the web version of okx Euyi Exchange ☜☜☜☜☜☜ Click to save 2. Click the link of okx Euyi Exchange app ☜☜☜☜ Click to save 3. After entering the official website, the clear interface provides a login and registration portal. Users can choose to log in to an existing account or register a new account according to their own situation. Whether it is viewing real-time market conditions, conducting transactions, or managing assets, the OKX web version provides a simple and smooth operating experience, suitable for beginners and veterans. Visit OKX official website now for easy experience

gate.io registration tutorial

Mar 31, 2025 pm 11:09 PM

gate.io registration tutorial

Mar 31, 2025 pm 11:09 PM

This article provides a detailed Gate.io registration tutorial, covering every step from accessing the official website to completing registration, including filling in registration information, verifying, reading user agreements, etc. The article also emphasizes security measures after successful registration, such as setting up secondary verification and completing real-name authentication, and gives tips from beginners to help users safely start their digital asset trading journey.

What is Ouyi for? What is Ouyi

Apr 01, 2025 pm 03:18 PM

What is Ouyi for? What is Ouyi

Apr 01, 2025 pm 03:18 PM

OKX is a global digital asset trading platform. Its main functions include: 1. Buying and selling digital assets (spot trading), 2. Trading between digital assets, 3. Providing market conditions and data, 4. Providing diversified trading products (such as derivatives), 5. Providing asset value-added services, 6. Convenient asset management.

ok official portal web version ok exchange official web version login portal

Mar 31, 2025 pm 06:24 PM

ok official portal web version ok exchange official web version login portal

Mar 31, 2025 pm 06:24 PM

This article details how to use the official web version of OK exchange to log in. Users only need to search for "OK Exchange Official Web Version" in their browser, click the login button in the upper right corner after entering the official website, and enter the user name and password to log in. Registered users can easily manage assets, conduct transactions, deposit and withdraw funds, etc. The official website interface is simple and easy to use, and provides complete customer service support to ensure that users have a smooth digital asset trading experience. What are you waiting for? Visit the official website of OK Exchange now to start your digital asset journey!

How to calculate the transaction fee of gate.io trading platform?

Mar 31, 2025 pm 09:15 PM

How to calculate the transaction fee of gate.io trading platform?

Mar 31, 2025 pm 09:15 PM

The handling fees of the Gate.io trading platform vary according to factors such as transaction type, transaction pair, and user VIP level. The default fee rate for spot trading is 0.15% (VIP0 level, Maker and Taker), but the VIP level will be adjusted based on the user's 30-day trading volume and GT position. The higher the level, the lower the fee rate will be. It supports GT platform coin deduction, and you can enjoy a minimum discount of 55% off. The default rate for contract transactions is Maker 0.02%, Taker 0.05% (VIP0 level), which is also affected by VIP level, and different contract types and leverages

Binance binance computer version entrance Binance binance computer version PC official website login entrance

Mar 31, 2025 pm 04:36 PM

Binance binance computer version entrance Binance binance computer version PC official website login entrance

Mar 31, 2025 pm 04:36 PM

This article provides a complete guide to login and registration on Binance PC version. First, we explained in detail the steps for logging in Binance PC version: search for "Binance Official Website" in the browser, click the login button, enter the email and password (enable 2FA to enter the verification code) to log in. Secondly, the article explains the registration process: click the "Register" button, fill in the email address, set a strong password, and verify the email address to complete the registration. Finally, the article also emphasizes account security, reminding users to pay attention to the official domain name, network environment, and regularly updating passwords to ensure account security and better use of various functions provided by Binance PC version, such as viewing market conditions, conducting transactions and managing assets.

What are the recommended websites for virtual currency app software?

Mar 31, 2025 pm 09:06 PM

What are the recommended websites for virtual currency app software?

Mar 31, 2025 pm 09:06 PM

This article recommends ten well-known virtual currency-related APP recommendation websites, including Binance Academy, OKX Learn, CoinGecko, CryptoSlate, CoinDesk, Investopedia, CoinMarketCap, Huobi University, Coinbase Learn and CryptoCompare. These websites not only provide information such as virtual currency market data, price trend analysis, etc., but also provide rich learning resources, including basic blockchain knowledge, trading strategies, and tutorials and reviews of various trading platform APPs, helping users better understand and make use of them

Official website entrance of major digital currency trading platforms 2025

Mar 31, 2025 pm 05:33 PM

Official website entrance of major digital currency trading platforms 2025

Mar 31, 2025 pm 05:33 PM

This article recommends ten mainstream cryptocurrency exchanges, including Binance, OKX, Sesame Door (gate.io), Coinbase, Kraken, Bitstamp, Gemini, Bittrex, KuCoin and Bitfinex. These exchanges have their own advantages, such as Binance is known for its largest trading volume and rich currency selection in the world; OKX provides innovative tools such as grid trading and a variety of derivatives; Coinbase focuses on US compliance; Kraken attracts users for its high security and pledge returns; other exchanges have their own characteristics in different aspects such as fiat currency trading, altcoin trading, high-frequency trading tools, etc. Choose an exchange that suits you, and you need to use your own investment experience