How to use Golang functions to handle web request routing

In Golang, using functions to handle web request routing is an extensible and modular way to build APIs. It involves the following steps: Install the HTTP router library. Create a router. Define path patterns and handler functions for routes. Write handler functions to handle requests and return responses. Run the router using an HTTP server. This process allows for a modular approach when handling incoming requests, thereby improving reusability, maintainability, and testability.

How to use Golang functions to handle Web request routing

In Golang, using functions to handle Web request routing is a way to build A common way to extend and modularize APIs. This article will show you how to use an HTTP router library (such as github.com/gorilla/mux) to define routes and use handler functions to handle incoming requests.

Step 1: Install the HTTP router library

import "github.com/gorilla/mux"

Step 2: Create a router

router := mux.NewRouter()

Step 3: Define the route

Define the path pattern for the route and specify the processing function used to handle the request. For example:

router.HandleFunc("/users", getUsers).Methods("GET") // GET /users 处理函数

router.HandleFunc("/users/{id}", getUser).Methods("GET") // GET /users/{id} 处理函数Step 4: Write the processing function

The processing function is a function used to process incoming requests and return responses. The following is an example of a processing function:

func getUsers(w http.ResponseWriter, r *http.Request) {

// 获取所有用户数据

users := []User{

{ID: 1, Name: "John"},

{ID: 2, Name: "Jane"},

}

// 以 JSON 格式编码响应

json, err := json.Marshal(users)

if err != nil {

http.Error(w, err.Error(), http.StatusInternalServerError)

return

}

// 设置响应标头和状态代码

w.Header().Set("Content-Type", "application/json")

w.WriteHeader(http.StatusOK)

// 写入响应主体

w.Write(json)

}Step 5: Run the router

Use the HTTP server to start the router, for example:

srv := &http.Server{

Handler: router,

Addr: ":8080",

}

if err := srv.ListenAndServe(); err != nil && err != http.ErrServerClosed {

log.Fatal(err)

}Actual combat Case

Create a simple API to manage users:

package main

import (

"github.com/gorilla/mux"

"net/http"

)

type User struct {

ID int

Name string

}

var users = []User{

{1, "John"},

{2, "Jane"},

}

func main() {

router := mux.NewRouter()

router.HandleFunc("/users", Get).Methods("GET")

router.HandleFunc("/users/{id}", GetByID).Methods("GET")

srv := &http.Server{

Handler: router,

Addr: ":8080",

}

srv.ListenAndServe()

}

func Get(w http.ResponseWriter, r *http.Request) { json.Encode(w, users) }

func GetByID(w http.ResponseWriter, r *http.Request) {

id := mux.Vars(r)["id"] // 从 URL 中提取参数

for _, user := range users {

if user.ID == id {

json.Encode(w, user)

return

}

}

http.Error(w, "Not found", http.StatusNotFound)

}By running this program, you can create a simple API between localhost:8080/users and localhost Obtain and retrieve user information under the path :8080/users/{id}.

The above is the detailed content of How to use Golang functions to handle web request routing. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

AI Hentai Generator

Generate AI Hentai for free.

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

What are the Grayscale Encryption Trust Funds? Common Grayscale Encryption Trust Funds Inventory

Mar 05, 2025 pm 12:33 PM

What are the Grayscale Encryption Trust Funds? Common Grayscale Encryption Trust Funds Inventory

Mar 05, 2025 pm 12:33 PM

Grayscale Investment: The channel for institutional investors to enter the cryptocurrency market. Grayscale Investment Company provides digital currency investment services to institutions and investors. It allows investors to indirectly participate in cryptocurrency investment through the form of trust funds. The company has launched several crypto trusts, which has attracted widespread market attention, but the impact of these funds on token prices varies significantly. This article will introduce in detail some of Grayscale's major crypto trust funds. Grayscale Major Crypto Trust Funds Available at a glance Grayscale Investment (founded by DigitalCurrencyGroup in 2013) manages a variety of crypto asset trust funds, providing institutional investors and high-net-worth individuals with compliant investment channels. Its main funds include: Zcash (ZEC), SOL,

Delphi Digital: How to change the new AI economy by parsing the new ElizaOS v2 architecture?

Mar 04, 2025 pm 07:00 PM

Delphi Digital: How to change the new AI economy by parsing the new ElizaOS v2 architecture?

Mar 04, 2025 pm 07:00 PM

ElizaOSv2: Empowering AI and leading the new economy of Web3. AI is evolving from auxiliary tools to independent entities. ElizaOSv2 plays a key role in it, which gives AI the ability to manage funds and operate Web3 businesses. This article will dive into the key innovations of ElizaOSv2 and how it shapes an AI-driven future economy. AI Automation: Going to independently operate ElizaOS was originally an AI framework focusing on Web3 automation. v1 version allows AI to interact with smart contracts and blockchain data, while v2 version achieves significant performance improvements. Instead of just executing simple instructions, AI can independently manage workflows, operate business and develop financial strategies. Architecture upgrade: Enhanced A

As top market makers enter the crypto market, what impact will Castle Securities have on the industry?

Mar 04, 2025 pm 08:03 PM

As top market makers enter the crypto market, what impact will Castle Securities have on the industry?

Mar 04, 2025 pm 08:03 PM

The entry of top market maker Castle Securities into Bitcoin market maker is a symbol of the maturity of the Bitcoin market and a key step for traditional financial forces to compete for future asset pricing power. At the same time, for retail investors, it may mean the gradual weakening of their voice. On February 25, according to Bloomberg, Citadel Securities is seeking to become a liquidity provider for cryptocurrencies. The company aims to join the list of market makers on various exchanges, including exchanges operated by CoinbaseGlobal, BinanceHoldings and Crypto.com, people familiar with the matter said. Once approved by the exchange, the company initially planned to set up a market maker team outside the United States. This move is not only a sign

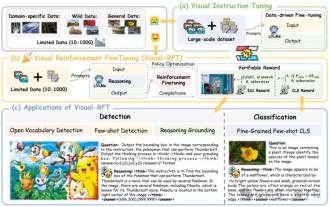

Significantly surpassing SFT, the secret behind o1/DeepSeek-R1 can also be used in multimodal large models

Mar 12, 2025 pm 01:03 PM

Significantly surpassing SFT, the secret behind o1/DeepSeek-R1 can also be used in multimodal large models

Mar 12, 2025 pm 01:03 PM

Researchers from Shanghai Jiaotong University, Shanghai AILab and the Chinese University of Hong Kong have launched the Visual-RFT (Visual Enhancement Fine Tuning) open source project, which requires only a small amount of data to significantly improve the performance of visual language big model (LVLM). Visual-RFT cleverly combines DeepSeek-R1's rule-based reinforcement learning approach with OpenAI's reinforcement fine-tuning (RFT) paradigm, successfully extending this approach from the text field to the visual field. By designing corresponding rule rewards for tasks such as visual subcategorization and object detection, Visual-RFT overcomes the limitations of the DeepSeek-R1 method being limited to text, mathematical reasoning and other fields, providing a new way for LVLM training. Vis

Bitwise: Businesses Buy Bitcoin A Neglected Big Trend

Mar 05, 2025 pm 02:42 PM

Bitwise: Businesses Buy Bitcoin A Neglected Big Trend

Mar 05, 2025 pm 02:42 PM

Weekly Observation: Businesses Hoarding Bitcoin – A Brewing Change I often point out some overlooked market trends in weekly memos. MicroStrategy's move is a stark example. Many people may say, "MicroStrategy and MichaelSaylor are already well-known, what are you going to pay attention to?" This is true, but many investors regard it as a special case and ignore the deeper market forces behind it. This view is one-sided. In-depth research on the adoption of Bitcoin as a reserve asset in recent months shows that this is not an isolated case, but a major trend that is emerging. I predict that in the next 12-18 months, hundreds of companies will follow suit and buy large quantities of Bitcoin

Euzi Coin (EOS) price forecast: analysts' forecast for EOS prices in 2025-2050

Mar 03, 2025 pm 10:30 PM

Euzi Coin (EOS) price forecast: analysts' forecast for EOS prices in 2025-2050

Mar 03, 2025 pm 10:30 PM

EOS price forecast and investment analysis: Outlook for 2025-2050 EOS, as a blockchain platform aimed at promoting the development of decentralized applications (dApps) and smart contracts, has attracted much attention since its launch in 2018. It adopts a delegated proof of stake (DPoS) mechanism, which significantly improves transaction speed and network bandwidth. This article explores the future trend of EOS prices in depth and analyzes the factors that affect their prices to help investors make smarter decisions. Key Points: As of February 24, 2025, the EOS price was $0.6134. The highest price of EOS is $22.8904 (April 29, 2018), the lowest price

Altcoin Investment Guide: Teach you how to pay money on the DEX Exchange, now is a good time to build positions at low prices

Mar 05, 2025 am 09:45 AM

Altcoin Investment Guide: Teach you how to pay money on the DEX Exchange, now is a good time to build positions at low prices

Mar 05, 2025 am 09:45 AM

In the cold winter of 2018, I inspected the photovoltaic power station in the Gobi in Qinghai. In the cold wind of minus 20 degrees Celsius, the engineer pointed to the shutdown photovoltaic panels and said, "These are the legacy of the previous round of expansion. Only when the market is cleared will new technologies rise." Now looking at the Binance altcoin list, those long-term sideways K-line charts are very similar to the photovoltaic panel arrays that were back then. The crypto market is undergoing the same cycle as traditional industries. Just like the knockout match of the photovoltaic industry from 2012 to 2016, the CEX altcoin market has entered a cruel liquidation stage: the daily trading volume of many star projects in 2021 fell below 10 million US dollars, and the median market value shrank by more than 70% from its peak. This is just like the trajectory of photovoltaic, Internet and coal giants falling from high-priced stocks to low-priced stocks. But behind the cyclical cruelty,

What is Binance Launchpool? How to participate in Binance Launchpool?

Mar 05, 2025 pm 03:06 PM

What is Binance Launchpool? How to participate in Binance Launchpool?

Mar 05, 2025 pm 03:06 PM

Binance Launchpool in-depth analysis: High-yield mining guide and detailed explanation of BIO projects. This article will conduct in-depth discussion of Binance Launchpool, analyze its yield, explain in detail the participation method, and focus on introducing the latest project BIO Coin (BIOl). As the world's largest cryptocurrency exchange, Binance has selected high-quality projects with Launchpool, providing investors with easy mining and opportunities to obtain new tokens. What is Binance Launchpool? Binance Launchpool is a platform that earns new tokens for free by pledging a specified currency. Users can easily earn money by pledging a cryptocurrency. This is similar to new stock subscriptions in the stock market, but there are fewer participants, lower competition, and small investments can also get high returns.