This site (120bTC.coM): Aave Labs, the development team behind the decentralized lending protocol AAVE, released a project called "Aave 2030" on the AAVE Governance Forum last night (1) Proposal, describing the three-year development plan based on AAVE V4.

AAVE Labs proposes AAVE V4

In the proposal, Aave Labs stated that the launch of AAVE V4 is the basis of the entire plan. It previews AAVE V4 by adding a series of improvement plans based on the V3 version. Will include several features:

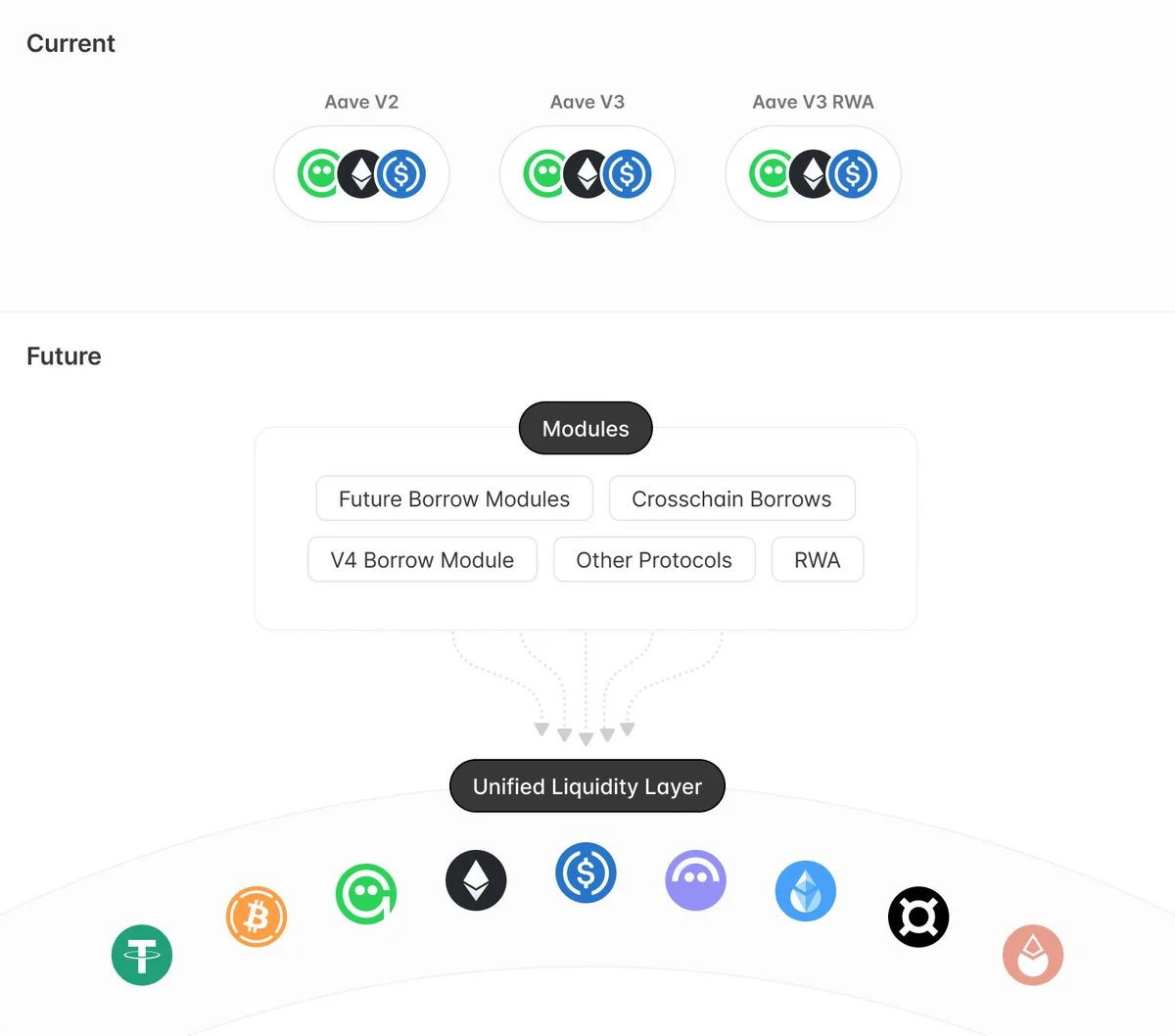

Unified Liquidity Layer

Aave V4 launches a unified liquidity layer designed to manage supply/withdrawal (borrowing) caps, interest rates, assets and Incentives that allow other mods to provide and withdraw liquidity from it. Compared with the V3 version, the new liquidity layer is abstracted (integrated) and there is no need to migrate existing liquidity.

This architecture allows new or improved lending features (such as segregated pools, RWA modules and CDP) without changing the entire system or liquidation module. It also avoids the liquidity dispersion problem that existed in older versions. .

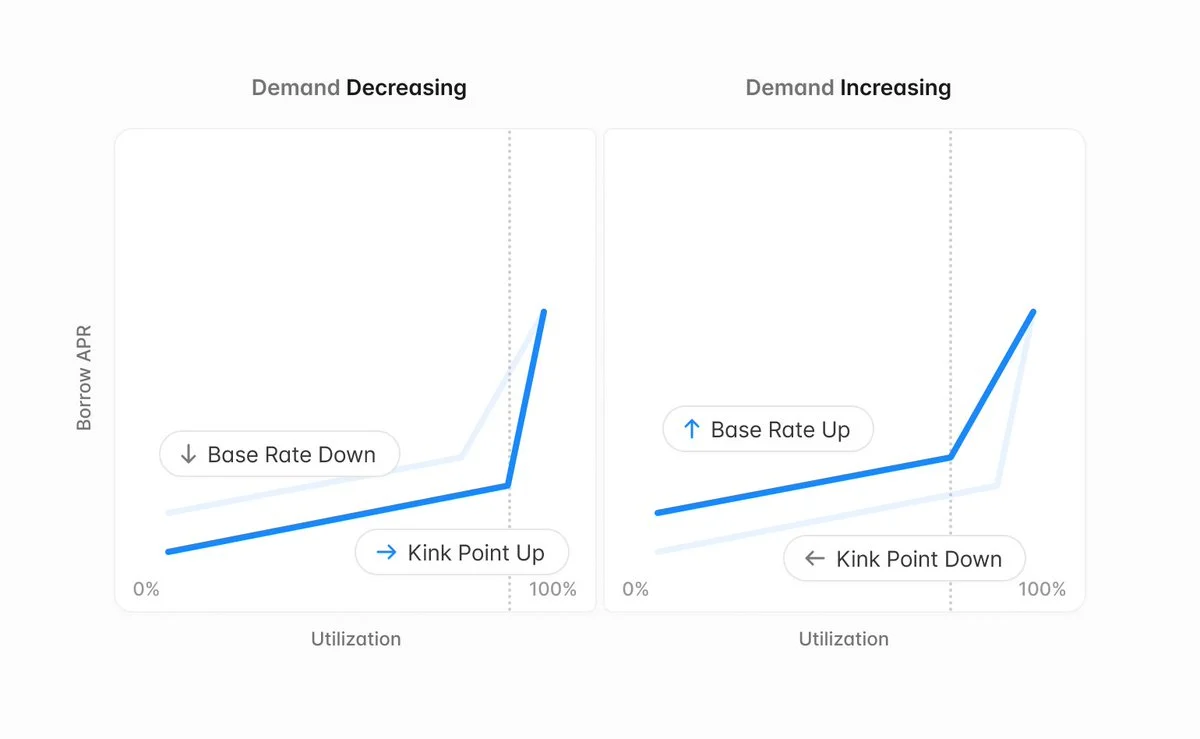

Fuzzy-controlled Interest Rates

Aave V4 proposes automatic interest rates that can adjust slopes and turning points. Since the current setting is controlled by the governance mechanism, it not only increases the governance burden, but also reduces capital efficiency. Fuzzy interest rates are designed to actively control turning points so that they can be dynamically adjusted according to market conditions. The base interest rate will rise or fall based on market demand to optimize interest rates for suppliers and borrowers.

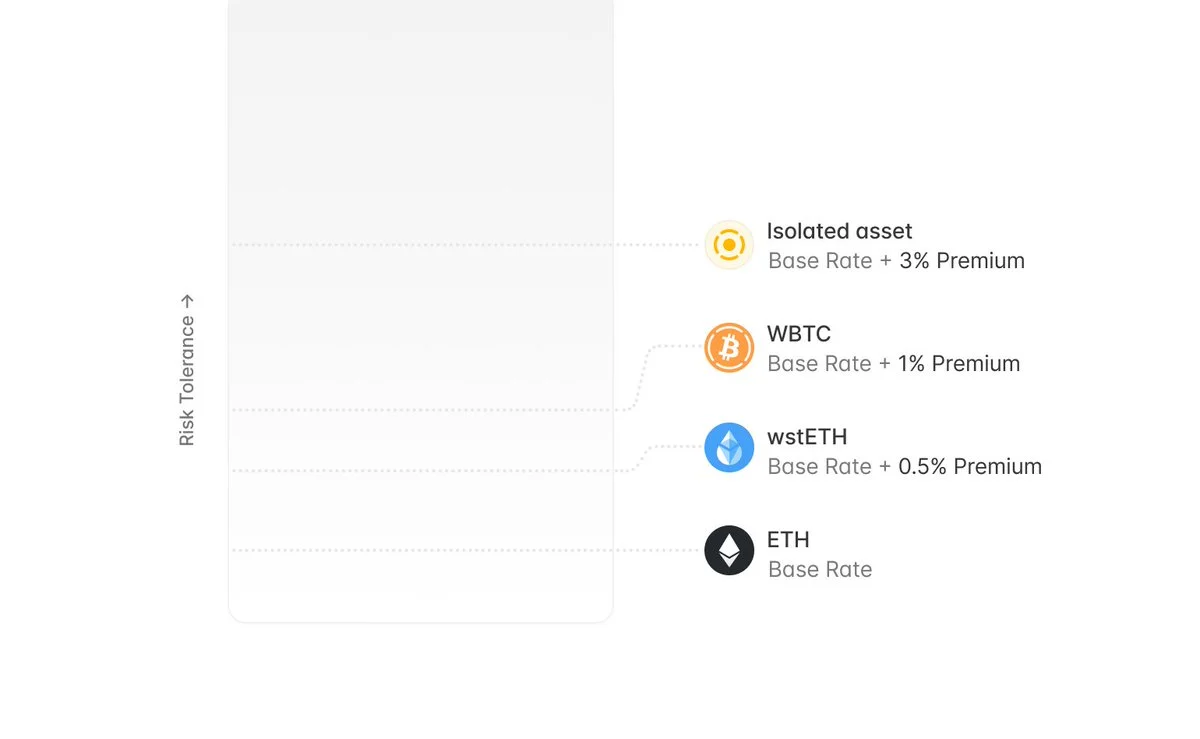

Liquidity premium mechanism

Aave V4’s liquidity premium mechanism adjusts the borrowing costs in the market based on the risk level of the collateral, which ensures that all parties Fairness in pricing. In the face of higher-risk collateral, borrowing costs are relatively higher, and conversely, lower risks help reduce borrowing costs.

Aave V4 borrowing module

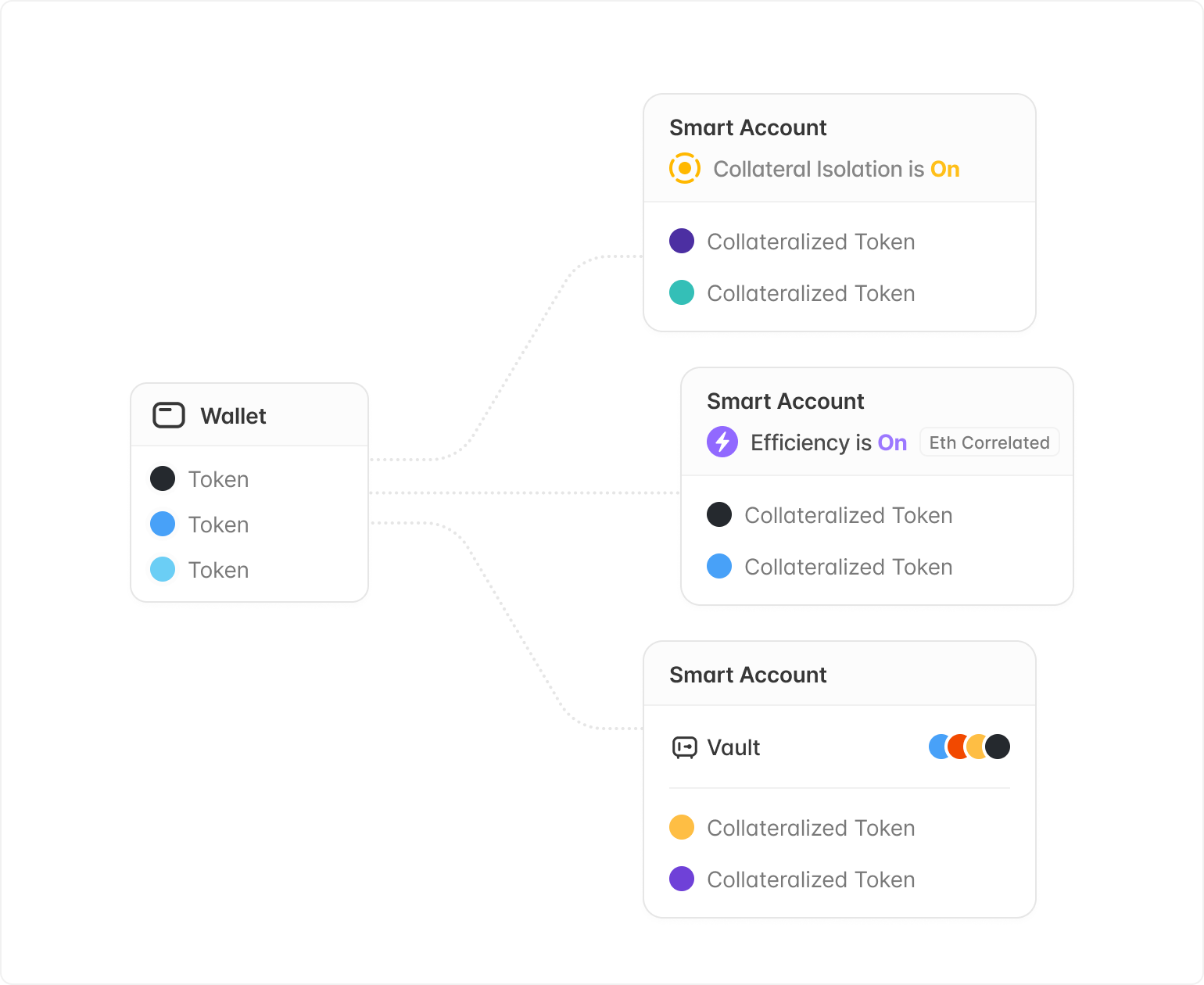

Vault and smart account

In the V4 version, Aave introduces the concept of smart accounts, aiming to solve User experience issues in the V3 version. When users use eMode or independent asset borrowing, users need to use different wallets to manage positions. Smart Accounts allow users to create multiple accounts using just one wallet, significantly simplifying the process of interacting with the protocol.

At the same time, the smart account will also implement another major function-the Aave vault. Under the treasury mechanism, users can borrow without providing additional collateral to the liquidity layer. The collateral will be stored in smart accounts, and these assets will be locked until the borrowing is completed or liquidation occurs.

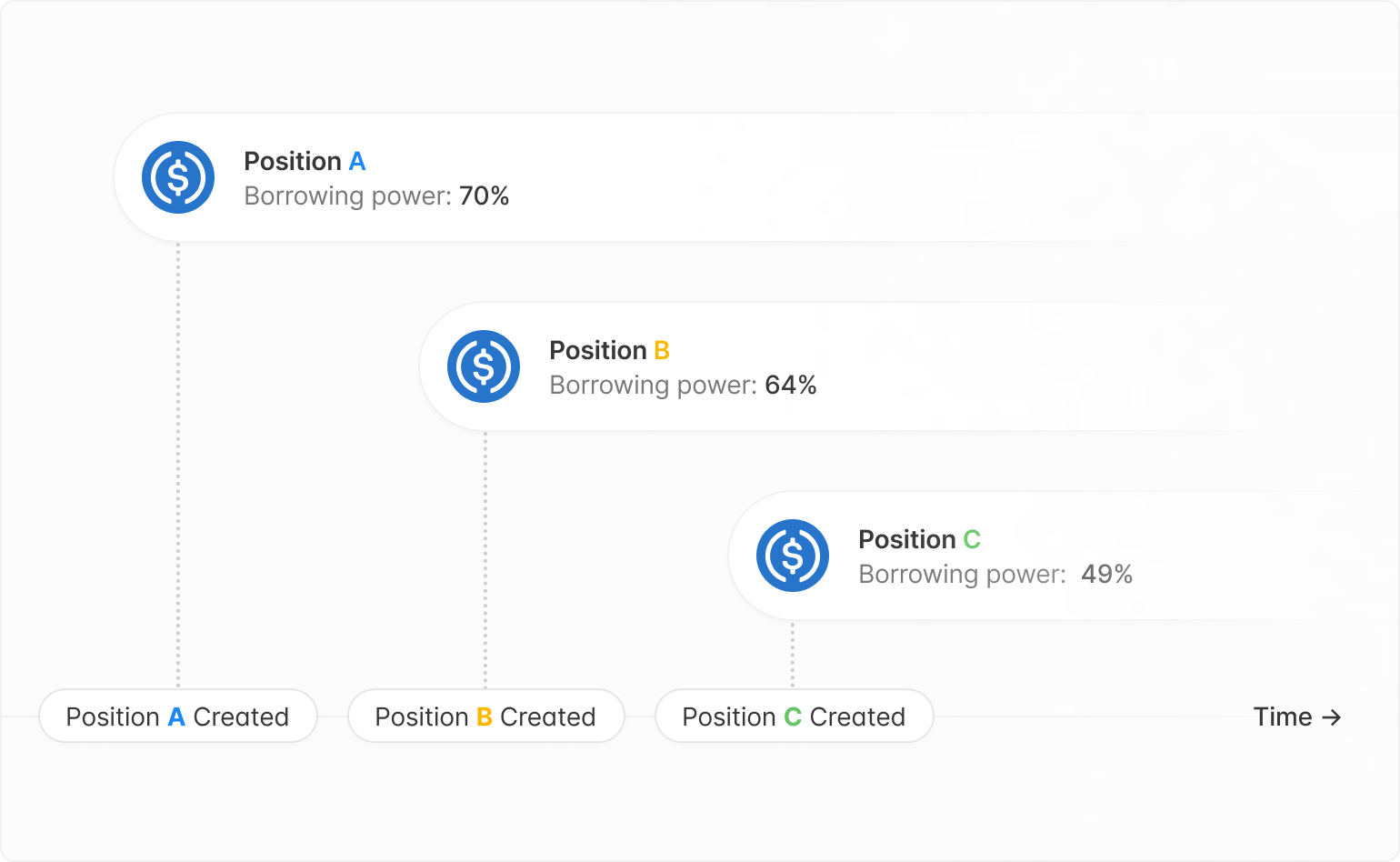

Dynamic Risk Configuration

One of the major risks faced in the V3 version is that when the market environment changes, its risk parameters (especially the liquidation threshold) cannot Change. As for the dynamic allocation mechanism proposed by Aave V4, under this mechanism, whenever a loan occurs, the user's loan will be connected to the current asset allocation. If the market conditions change and the configuration needs to be updated, a new asset allocation instance will be created, and currently User configurations are not affected.

Automated asset offline

In the current version, asset offline requires multiple governance decisions, including gradually reducing the loan-to-value ratio and liquidation threshold of the asset. ultimately eliminating its borrowing capacity.

In the V4 version, when governance starts the automatic offline operation, a new configuration will be introduced to immediately reduce the liquidation threshold of assets to zero for new users. Every activity on the asset will trigger a series of lowering of the liquidation threshold, starting from the highest liquidation threshold, until the liquidation threshold of all users drops to zero, at which time the asset is officially offline.

Automated Fund Management

The current V3 version collects the reserve factors of each asset, which requires governance to be regularly reallocated to stablecoins or ETH, while the V4 version proposes a reverse auction mechanism. Once it is reached At a certain threshold, every token collected through the reserve factor can be automatically sold to any pre-allocated asset.

Actions

Aave V4 allows users to customize automated actions to respond to management decisions.

Liquidation Engine V4

Although the current version of the liquidation engine has proven its reliability, Aave V4 proposes some improvements:

Variable Liquidation Factor: sufficient to return the position to safety, reducing the impact on the borrower compared to V3

Variable liquidation reward: Introducing a reverse Dutch auction, as the position health factor decreases, Liquidation rewards increase linearly.

Liquidation strategy: Different assets can use different liquidation engines to improve efficiency.

Multiple parallel liquidations: Aave V4 liquidation engine will allow batch liquidations for the same debt/collateral, maximizing liquidator efficiency

Excess Debt Protection

One of the disadvantages of the shared liquidity model is that if an asset accumulates too much debt, there is a risk of contagion. Excess debt can present itself in a number of ways, primarily custody and liquidity risk. Therefore, Aave V4 proposes to set a threshold for excess debt. Once this threshold is exceeded, the asset will automatically lose its lending function, preventing it from being used to spread bad debts to other assets.

Other prospects for Aave 2030, GHO, RWA and application chains are all under planning

In addition to Aave V4, Aave Labs is also planning other applications to complete the 3-year project of Aave 2030. plans for the year, including:

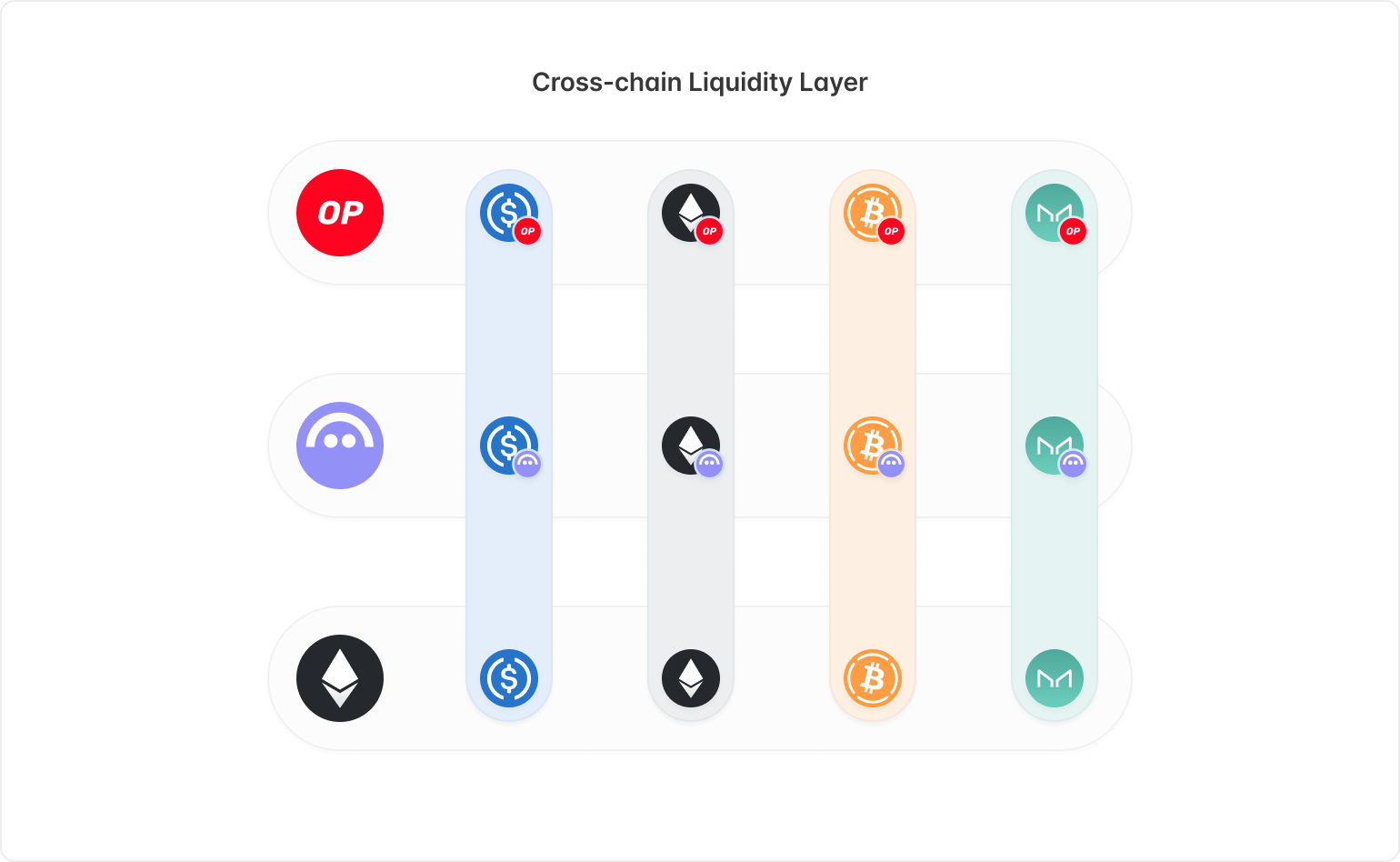

Cross-Chain Liquidity Layer

When Aave V3 was launched, one of the main functions was "Portal". The purpose is to make Aave a chainless and borderless liquidity protocol. With the adoption of CCIP, the hyperchain concept, and the unified liquidity layer of Aave V4, Aave will be able to expand into a cross-chain liquidity protocol, which will enable borrowers to obtain instant liquidity on all supported chains.

Native stablecoin GHO and real world assets (RWA)

On the other hand, Aave Labs stated in the proposal that the emergence of RWA is perfectly consistent with adoption GHO, the native stablecoin of the Aave ecosystem, after the release of Aave V4, Aave Labs hopes to focus on RWA products built around GHO, which will help further expand the scale of GHO as an infrastructure. On such topics, Aave Labs will work closely with Chainlink.

Aave Network

In addition, Aave Labs proposes to introduce the Aave network so that it can perform multiple functions as an application chain, and Aave Labs will implement on-chain governance Considerations are included in the proposal:

Using GHO for charging: By using Validium on the Aave network, cost-effective micropayments can be achieved and the user experience can be improved. .

Aave V4 is integrated at the network level: Aave V4 will become the main network liquidity center, providing developers with simple integrated access.

AAVE as the main staking asset for decentralized validators/orderers

Interface to the Aave network and Ethereum through Aave Governance V3 Enable governance controls

Wide use of account abstractions

Inherit Ethereum’s network security

Three-year plan roadmap

In order to effectively manage and implement the Aave 2030 plan, Aave Labs proposes specific goals and timelines:

First year

Scope of the agreement:

Introducing Aave visual identity (changing pattern design)

Aave V4 sample (Q4 2024)

Aave V Code Completion (2025 Season 2)

Additional Work:

Integrate at least one innovative GHO facilitator

Support a non-EVM chain

Second Year

Aave Network

Cross-chain liquidity layer

Research and introduction of RWA products

Integrate with at least one non-EVM chain

Launch at least one Aave Labs product to promote the growth of Aave/GHO

The above is the detailed content of AAVE Labs presents AAVE V4! One article summarizes its highlights. For more information, please follow other related articles on the PHP Chinese website!