web3.0

web3.0

LayerZero has completed the first phase of airdrop snapshots and details will be announced soon! Token ZRO expected price?

LayerZero has completed the first phase of airdrop snapshots and details will be announced soon! Token ZRO expected price?

LayerZero has completed the first phase of airdrop snapshots and details will be announced soon! Token ZRO expected price?

This site (120BTc.coM): LayerZero, a full-chain interoperability protocol with a valuation of more than US$3 billion, was invested by many star institutions such as a16z and Sequoia Capital last year. The news that the airdrop was finalized in early December aroused heated discussions in the community about whether the snapshot has ended and what the price is expected to be?

At 8 a.m. today, LayerZero officially announced on Twitter that it had completed the first phase snapshot at 7:59:59 a.m. on May 2, Beijing time, and would release more information soon, which means It seems that LayerZero may conduct an airdrop and issuance of the token $ZRO in the near future.

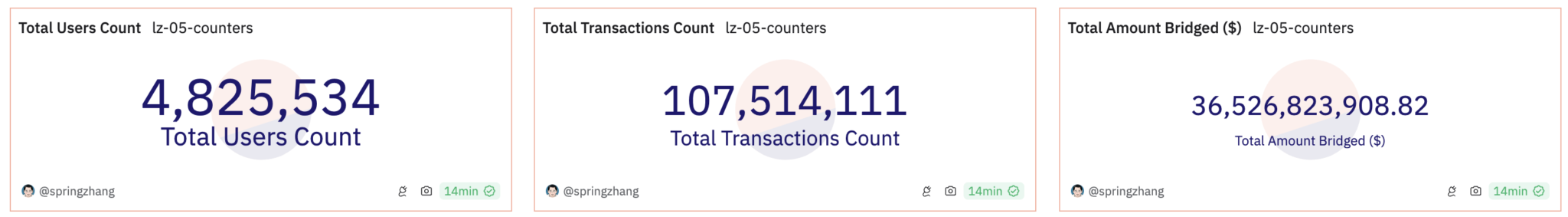

The number of Layerzero users exceeded 4.8 million

According to the Dune data panel produced by @springzhang, currently Arbitrum, Avalanche-C, BNB, Ethereum, Fantom, GNosis, Optimism and Polygon are on the chain Summing up the data, the data participating in Layerzero are as follows:

Number of users participating in cross-chain: 4.82 million

Number of cross-chain transactions participated : 107 million times

Participate in cross-chain funds: 36.5 billion US dollars

Participate in various projects of Layerzero Data

However, this does not necessarily mean that LayerZero will airdrop to 4.82 million users. LayerZero CEO Bryan Pellegrino has repeatedly mentioned some possible airdrop rules and Sybil attack prevention measures, which will limit the range of users who can receive airdrops.

For example, on July 1 last year, Pellegrino discussed the criteria for evaluating real and effective wallets, which included average monthly transaction volume. At that time, Stargete’s average monthly transaction volume was $455, implying that only monthly transaction volumes exceeded this amount. wallets may be eligible for short investing.

In addition, in response to the Witch attack, Pellegrino also said that officials have marked those wallet addresses that use extremely low amounts for cross-chain operations to protect the interests of real users.

LayerZero’s ecosystem covers multiple chains, and may also stipulate that air investment wallets must participate in a specific ecosystem. There has been heated discussion in the community that interacting with Aptos’ official cross-chain bridge may be one of the necessary conditions for obtaining airdrops. In short, the specific price of air investment will be further clarified by the official.

Layerzero token estimated price?

LayerZero’s first round was led by Sequoia Capital and its valuation was US$1 billion. It raised US$135 million and Series B financing of US$120 million. The valuation increased to US$3 billion. New investors include a16z and Christie’s. Auction houses, Sequoia Capital….

Since the official has not yet explained the token economy, it is not easy to estimate the price yet, and we will continue to track it for you.

The above is the detailed content of LayerZero has completed the first phase of airdrop snapshots and details will be announced soon! Token ZRO expected price?. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

Hong Kong Legislative Council Member Wu Kit-chuang: We will start discussing the inclusion of Bitcoin in fiscal reserves

Jul 30, 2024 am 01:07 AM

Hong Kong Legislative Council Member Wu Kit-chuang: We will start discussing the inclusion of Bitcoin in fiscal reserves

Jul 30, 2024 am 01:07 AM

This site (120BtC.coM): Hong Kong Legislative Council member Johnny Ng (Ng Chieh-chuang) yesterday (28) expressed support for former US President Trump’s initiative at the Bitcoin Conference to include Bitcoin in the country’s government’s financial reserve assets. , saying that the issue of Bitcoin being listed as an official strategic financial reserve is something that can be considered. Hong Kong Legislative Council member: Will start discussing the inclusion of Bitcoin in fiscal reserves. Johnny Ng tweeted on X that the development of Bitcoin and Web3 has long attracted attention from countries around the world, and Hong Kong has also actively become a place to promote technological and financial innovation: Bitcoin and Web3 are important nodes in the development of globalization. Blockchain technology has also solved many financial and practical application innovations. We should encourage global

Inflation data is moderate, Bitcoin will attract attention! BTC price rebounds, ETH trend flat

Jul 27, 2024 pm 04:50 PM

Inflation data is moderate, Bitcoin will attract attention! BTC price rebounds, ETH trend flat

Jul 27, 2024 pm 04:50 PM

This site (120bTC.coM): Led by the rebound of technology giants from deep declines, the three major U.S. stock indexes rose on Friday, but the S&P500 and Nasdaq still closed in the black on the weekly lines. Bitcoin rebounded to around 68K, and Ethereum barely remained flat under the selling pressure of Grayscale ETHE, falling more than 7% in a week. Inflation data is moderate. According to CNBC, the U.S. Department of Commerce's personal consumption expenditures (PCE) price index in June rose slightly by 0.1% as expected after remaining flat in May, highlighting the improvement in the inflation environment and the possibility that the Federal Reserve will start cutting interest rates in September. . The PCE price index rose 2.5% year-on-year after rising 2.6% in May, also in line with the forecast of economists polled by Reuters. The Federal Reserve closely tracks the PCE price indicator of monetary policy.

Ethereum historical price trend chart 2015-2024 Ethereum k-line chart ten years trend trend

Mar 12, 2025 pm 06:57 PM

Ethereum historical price trend chart 2015-2024 Ethereum k-line chart ten years trend trend

Mar 12, 2025 pm 06:57 PM

This article reviews the price trend of Ethereum since its listing in 2015, from the initial $0.31, it experienced a surge in 2017 to nearly $1,400, as well as a market plunge in 2018 and 2022, and then hit a record high of $4,891.70 in 2021, as well as a rebound and stability in 2023. The article data covers the significant changes in Ethereum prices over each year and predicts price trends for 2024-2025, providing investors with a comprehensive historical reference and future outlook for Ethereum prices. Understand the history of Ethereum price fluctuations and seize investment opportunities!

The activity of Tonado Cash, the leading Ethereum mixer, has surged in the past six months! DeFi bull market precursor?

Jul 20, 2024 am 03:07 AM

The activity of Tonado Cash, the leading Ethereum mixer, has surged in the past six months! DeFi bull market precursor?

Jul 20, 2024 am 03:07 AM

This site (120btC.coM): TornadoCash, the leading Ethereum coin mixer protocol, has been used by many hacker groups to conduct illegal money laundering due to its privacy and anonymous transaction characteristics, and has therefore been targeted by the US authorities. In August 2022, the Office of Foreign Assets Control (OFAC) of the U.S. Department of the Treasury announced sanctions against TornadoCash and ordered the freezing of related assets, setting off a fierce controversy over open source and supervision. It has received US$1.9 billion in deposits in the first half of the year, more than in all of 2023. After encountering sanctions, TornadoCash's deposit volume remained sluggish throughout 2023. However, according to data from FlipsideCrypto, in the first six months of this year, TornadoCash has

Bitwise Ethereum ETF will distribute 10% of profits to ETH developers! Buterin: I hope all charity projects will receive support

Jul 24, 2024 pm 08:03 PM

Bitwise Ethereum ETF will distribute 10% of profits to ETH developers! Buterin: I hope all charity projects will receive support

Jul 24, 2024 pm 08:03 PM

This site (120bTC.coM): Ethereum spot ETF issuer Bitwise revealed this morning that it will donate 10% of the profits from the newly launched ETHW fund to Ethereum open source developers, saying that their credit cannot be taken for granted. This move It can be said to be a friendly expression of TradFi and innovative financial technology. Bitwise Ethereum ETF will distribute 10% of profits to Ethereum developers. Bitwise announced the launch of a new Ethereum ETF (code: ETHW) in a tweet on the 23rd, and introduced its features in detail: The fund will invest directly in ETH and charge 0.20% management. Fees (no management fees for the first six months or until the transaction volume reaches 500 million US dollars) 10% of the fund profits will be donated to Ethereum open source developers and disclosed through the fund

Ethereum spot ETF saw a net outflow of $133 million the next day! Grayscale is the culprit

Jul 26, 2024 am 05:10 AM

Ethereum spot ETF saw a net outflow of $133 million the next day! Grayscale is the culprit

Jul 26, 2024 am 05:10 AM

This site (120btC.coM): As the Ethereum spot ETF opened for the second day, the market saw a capital outflow of US$133 million, mainly due to the Grayscale Ethereum Trust Fund (ETHE). ) caused a massive loss of funds. At the same time, BTC once fell below 64k at noon Beijing time, and ETH fell by more than 5% in 24 hours. Ethereum spot ETF saw a net outflow of US$133 million on the second day. Farside Investors data pointed out that eight of the nine Ethereum spot ETFs currently on the market achieved net capital inflows on the next day. However, even so, the overall market still had a net outflow of $133.3 million, reversing Tuesday’s original net inflow of $106.6 million.

Will Ethereum be lonely after upgrading

Mar 18, 2025 pm 04:00 PM

Will Ethereum be lonely after upgrading

Mar 18, 2025 pm 04:00 PM

Ethereum has recently completed a series of important upgrades aimed at improving scalability, security and sustainability, which has sparked discussions on its future direction. Upgrading brings opportunities such as scalability improvement, energy efficiency improvement, security enhancement and ecosystem prosperity, but it also faces challenges such as centralized risks, escalation complexity, intensified competition and market fluctuations. Mainstream exchanges are actively responding to escalation and providing support and risk warnings. The future of Ethereum depends on whether it can effectively solve these challenges, continue to innovate and attract developers and users. Although facing competitive pressure, its strong technical foundation and active community make it still hopeful to maintain its leading position. Investors need to analyze rationally and invest cautiously.

What is Binance opBNB? What are the impacts on users?

Mar 05, 2025 pm 12:36 PM

What is Binance opBNB? What are the impacts on users?

Mar 05, 2025 pm 12:36 PM

Binance launches opBNB: Binance recently announced the launch of a new expansion solution for BNB Smart Chain (BSC) - opBNB Test Network. This article will explain the characteristics of opBNB and its potential impact on users. opBNB Detailed explanation opBNB is a Layer2 extension solution built on OptimismOPStack, compatible with Ethereum Virtual Machine (EVM). It aims to improve the scalability of BSC, alleviate network congestion, and reduce transaction costs. In order to better understand opBNB, we need to understand the following key concepts: Layer2 (Blockchain Layer 2): transfer some main chain functions to the second layer, thereby improving the main