web3.0

web3.0

CEX launches RUNECOIN. Can rune coins, which are at their peak since their debut, usher in a turn of events?

CEX launches RUNECOIN. Can rune coins, which are at their peak since their debut, usher in a turn of events?

CEX launches RUNECOIN. Can rune coins, which are at their peak since their debut, usher in a turn of events?

Head CEX is online on RUNECOIN. Can the rune sector, which has reached its peak since its debut, usher in a turn for the better? With the arrival of Bitcoin halving, the Runes protocol is officially launched. I thought that the Bitcoin ecosystem could use this to set off a third wave, but surprisingly, multiple rune ecosystem projects reached their peak upon their debut. Many investors have suffered heavy losses due to casting runes, and the price of inscriptions on the secondary market has almost halved. So is there still hope for rune coins? Where is the turning point for the runes sector? Let’s take a look below!

On the eve of the launch of the retro rune, it can be said that it is highly anticipated. The floor price of Runestone has risen to a maximum of 0.095 BTC, multiple projects have set up pledge airdrop rune rules, and community members have prepared their wallets in advance. However, the Runes protocol, which claims to surpass BRC-20, does not seem to have escaped the law of death if it is popular, and it does not even bring considerable profits to early inscription newcomers like the ordinals protocol.

The two-level reversal is that investors who were previously optimistic about the Runes protocol have gradually questioned the innovativeness of its technology. At this time, OKX stepped forward, first announcing the listing of RUNECOIN (RSIC•GENESIS•RUNE) on OKX Jumpstart on April 29, and officially listing the project's spot the next day, which undoubtedly brought some excitement to Rune investors. confidence. But will the rune circuit get better?

The day of going online, the time of smashing the market

On April 20, the Bitcoin halving came, and at the same time the Runes protocol was launched. The creator of the protocol, Casey Rodarmor, hard-coded the No. 0 rune "UNCOMMON GOODS" that he deployed in the Runes protocol. The remaining 9 runes are no longer hard-coded into the Runes protocol because the token names are not very creative. This allowed large households and institutions to see wealth opportunities and rush to seize them, causing gas prices to soar.

However, Laman’s high expectations and high costs have not resulted in equivalent returns. Since the launch of the Runes protocol, many rune projects have experienced a brief moment of glory and then quickly declined. Only a few The performance of the head runes is acceptable.

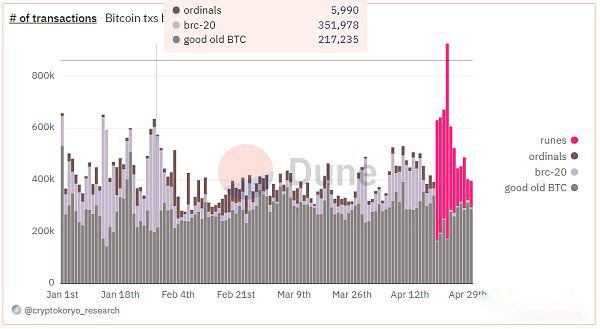

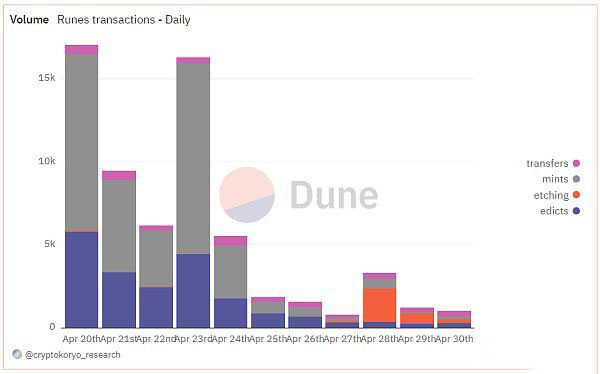

According to a chart provided by Dune user @cryptokoryo_research, since there was rune transaction volume on the Bitcoin network on April 20, it only reached its peak on April 23. Runes’ daily trading volume exceeded 750,000, but has declined since then, reaching 93,000 on April 30.

#Separate each step of the Runes protocol, and you can more intuitively see the significant degree of decline in various rune data. Among them, the decline rate of rune casting is the most obvious, which is mainly due to the surge in on-chain transaction fees and the decline in the market performance of rune projects.

The star project Runestone before the launch of the Runes protocol once ranked second in the NFT market value rankings, second only to CryptoPunks. This has surprised countless investors at the explosive power of Rune, and at the same time they are full of expectations for its prospects. However, it didn't take long for Runestone to remain strong.

According to CoinGecko data, Runestone’s floor price soared to 0.095 BTC on April 11, but fell almost straight from 0.0775 BTC on April 21. Currently Only 0.018 BTC, a drop of 81%.

Looking at other rune projects No. 1 to 9, several runes with high popularity in the community are still unavoidable from the fate of decline.

As of writing, according to OKX data:

- ##1 average price of rune Z•Z•Z•Z•Z•FEHU•Z•Z•Z•Z•Z It was at its peak when it debuted, with a total trading volume of 14.94 BTC. The trading volume reached its peak on April 24 at 6.45 BTC. On April 30, the trading volume was only 0.33 BTC. The current floor price is 37,990 sats (worth approximately US$24.22). .

- 91% of the total amount of Rune No. 2 DECENTRALIZED was allocated to Pre-Rune series Prometheans, but Prometheans fell sharply after the snapshot ended. The floor price has dropped all the way from a high of 0.0845 BTC to currently 0.016 BTC.

- #3 rune DOG•GO•TO•THE•MOON was launched on Gate.io on April 25. The token name is DOG. Its price has shot up to US$0.0057, but is currently only 0.00315. Dollar.

- #9 rune LOBO•THE•WOLF•PUP is also online on Gate.io. The highest price comparison is US$0.0028, but the current price is US$0.0009.

Among the many rune items, only the symbol No. 1 is Z·Z·Z·Z·Z·FEHU·Z·Z·Z·Z·Z, and the symbol No. 3 is DOG·GO •TO•THE•MOON and Rune No. 8's RSIC•GENESIS•RUNE have market values of over 100 million US dollars. Rune No. 4 THE•RUNIX•TOKEN and Rune No. 2 DECENTRALIZED have a market value of over US$50 million. The rest are below this. number.

Under the tide: low recognition, over-hyping, lack of innovation

The overall performance of the rune sector so far has been disappointing. This is due to both its own lack of technological innovation and Factors caused by excessive speculation in the external market.

First of all, the runes themselves have MEME attributes, but their recognition is not high. On April 21, because Casey Rodarmor liked the WANKO·MANKO·RUNES project’s no pre-mining mechanism, the latter’s price rose by more than 450% that day. Casey also posted on social media that "Runes (runes) are built for Degen and Memecoin." However, all current rune names are very lengthy and very unfriendly to non-English users.

Ordinal Theory Handbook states that rune names must be between 1 and 28 characters, the length is limited to letters A through Z, and the name must be unique with or without spaces. There will be a minimum of 13 letters for the first 4 months of the launch, and will decrease by 1 digit every four months thereafter. This means that it will only be reduced by 3 people a year.

To this point, Casey said the Runes protocol has a minimum name length built into it to prevent so-called name squatting, which is largely due to the idea of unique names.

But this type of runes is obviously more difficult to gain popularity than catchy MEMEs such as DOG, SHIB, and PEPE.

Secondly, Runes was overdrafted and hyped before it was launched. As early as December last year, Casey announced that the Runes protocol mainnet would be launched together with the Bitcoin halving. The gap of nearly 5 months was enough for various capitals to speculate on related concept projects.

In particular, the inscription wealth effect brought by the Ordinals protocol has made many investors full of FOMO. Based on the principle of rather selling wrong than missing out, we placed our bets on Rune Protocol well before it was launched. The crypto market has a tradition of buying news and selling facts. Therefore, when the incident occurs, the real traders have already begun to close the net and prepare to catch fish.

The most obvious example is the above-mentioned Runestone. With the completion of the Runestone snapshot on April 22, block 840,269 users can obtain 889,806 DOG•GO•TO•THE•MOON for each Runestone NFT held by them. Rune (No. 3 Rune), the floor price of this project fell 59.5% in 24 hours.

Finally, although Casey Rodarmor has repeatedly belittled the BRC-20 protocol and touted the Runes protocol as more secure, concise, and efficient, as far as the technology itself is concerned, there is not much innovation for the Bitcoin network. And there was a similar Atomics protocol long before the Runes protocol.

For example, KOL@白菜 once posted that Casey lacks basic respect for BRC20, which brought Flying Ordinals, and its creator domo. While enjoying the halo and traffic brought by BRC20, he is extremely disgusted with the standard. At the same time, he borrowed the idea of the UTXO-base protocol from Atomics to create Runes, but he never mentioned it.

In addition, compared with inscriptions, the fairness of runes is also open to question. Most of the inscriptions on the market adopt the Fair Launch method, but in rune projects, there are more or less reserved behaviors. And the top-ranked runes are usually snatched up by institutions or big players.

Conclusion

The inscription wealth effect brought by the Ordinals protocol has made the encryption market begin to believe that the Bitcoin ecosystem can be further constructed and mined, but the current market performance of the rune sector can be described as pouring. A basin of cold water. This includes both the impact of the overall crypto market and its own lack of product capabilities.

The current good news on the rune track includes: exchanges including OKX have launched rune tokens, OKX Ventures has cooperated with OnePiece Labs, Merlin Chain and Franklin Templeton to support the Runes incubator, and RuneChain has launched rune tokens. Chain bridges, exchanges, etc.

In short, the ecological infrastructure surrounding the rune sector is in the process of being built. And as far as the current data is concerned, the head rune items are showing a stabilizing and recovering trend. Therefore, investors do not need to be overly pessimistic and may wish to continue to monitor the progress of the Runes protocol.

The above is the detailed content of CEX launches RUNECOIN. Can rune coins, which are at their peak since their debut, usher in a turn of events?. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

AI Hentai Generator

Generate AI Hentai for free.

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

1386

1386

52

52

What is Ouyi for? What is Ouyi

Apr 01, 2025 pm 03:18 PM

What is Ouyi for? What is Ouyi

Apr 01, 2025 pm 03:18 PM

OKX is a global digital asset trading platform. Its main functions include: 1. Buying and selling digital assets (spot trading), 2. Trading between digital assets, 3. Providing market conditions and data, 4. Providing diversified trading products (such as derivatives), 5. Providing asset value-added services, 6. Convenient asset management.

okx Ouyi Exchange web version enter link click to enter

Mar 31, 2025 pm 06:21 PM

okx Ouyi Exchange web version enter link click to enter

Mar 31, 2025 pm 06:21 PM

1. Enter the web version of okx Euyi Exchange ☜☜☜☜☜☜ Click to save 2. Click the link of okx Euyi Exchange app ☜☜☜☜ Click to save 3. After entering the official website, the clear interface provides a login and registration portal. Users can choose to log in to an existing account or register a new account according to their own situation. Whether it is viewing real-time market conditions, conducting transactions, or managing assets, the OKX web version provides a simple and smooth operating experience, suitable for beginners and veterans. Visit OKX official website now for easy experience

gate.io latest registration tutorial for beginners

Mar 31, 2025 pm 11:12 PM

gate.io latest registration tutorial for beginners

Mar 31, 2025 pm 11:12 PM

This article provides newbies with detailed Gate.io registration tutorials, guiding them to gradually complete the registration process, including accessing the official website, filling in information, identity verification, etc., and emphasizes the security settings after registration. In addition, the article also mentioned other exchanges such as Binance, Ouyi and Sesame Open Door. It is recommended that novices choose the right platform according to their own needs, and remind readers that digital asset investment is risky and should invest rationally.

The latest registration tutorial for gate.io web version

Mar 31, 2025 pm 11:15 PM

The latest registration tutorial for gate.io web version

Mar 31, 2025 pm 11:15 PM

This article provides a detailed Gate.io web version latest registration tutorial to help users easily get started with digital asset trading. The tutorial covers every step from accessing the official website to completing registration, and emphasizes security settings after registration. The article also briefly introduces other trading platforms such as Binance, Ouyi and Sesame Open Door. It is recommended that users choose the right platform according to their own needs and pay attention to investment risks.

ok official portal web version ok exchange official web version login portal

Mar 31, 2025 pm 06:24 PM

ok official portal web version ok exchange official web version login portal

Mar 31, 2025 pm 06:24 PM

This article details how to use the official web version of OK exchange to log in. Users only need to search for "OK Exchange Official Web Version" in their browser, click the login button in the upper right corner after entering the official website, and enter the user name and password to log in. Registered users can easily manage assets, conduct transactions, deposit and withdraw funds, etc. The official website interface is simple and easy to use, and provides complete customer service support to ensure that users have a smooth digital asset trading experience. What are you waiting for? Visit the official website of OK Exchange now to start your digital asset journey!

How to calculate the transaction fee of gate.io trading platform?

Mar 31, 2025 pm 09:15 PM

How to calculate the transaction fee of gate.io trading platform?

Mar 31, 2025 pm 09:15 PM

The handling fees of the Gate.io trading platform vary according to factors such as transaction type, transaction pair, and user VIP level. The default fee rate for spot trading is 0.15% (VIP0 level, Maker and Taker), but the VIP level will be adjusted based on the user's 30-day trading volume and GT position. The higher the level, the lower the fee rate will be. It supports GT platform coin deduction, and you can enjoy a minimum discount of 55% off. The default rate for contract transactions is Maker 0.02%, Taker 0.05% (VIP0 level), which is also affected by VIP level, and different contract types and leverages

XBIT Decentralized Exchange APP download recommendation

Mar 31, 2025 pm 08:21 PM

XBIT Decentralized Exchange APP download recommendation

Mar 31, 2025 pm 08:21 PM

This article introduces in detail the download and installation steps of the XBIT Exchange mobile APP, including four steps: accessing the official website (https://www.xbit.com/), downloading the installation package of the corresponding operating system (iOS or Android), installing software (including the installation methods of iOS and Android systems), and finally opening the app and registering/logging in. Please be careful to visit the official website to avoid malware and phishing websites, and select the installation package according to your own system version. If you have any questions, please contact XBIT Exchange online customer service.

Official website entrance of major digital currency trading platforms 2025

Mar 31, 2025 pm 05:33 PM

Official website entrance of major digital currency trading platforms 2025

Mar 31, 2025 pm 05:33 PM

This article recommends ten mainstream cryptocurrency exchanges, including Binance, OKX, Sesame Door (gate.io), Coinbase, Kraken, Bitstamp, Gemini, Bittrex, KuCoin and Bitfinex. These exchanges have their own advantages, such as Binance is known for its largest trading volume and rich currency selection in the world; OKX provides innovative tools such as grid trading and a variety of derivatives; Coinbase focuses on US compliance; Kraken attracts users for its high security and pledge returns; other exchanges have their own characteristics in different aspects such as fiat currency trading, altcoin trading, high-frequency trading tools, etc. Choose an exchange that suits you, and you need to use your own investment experience