What do you understand about liquidity staking? How does it work?

What is liquidity staking? How does it work? What is the difference between liquidity staking and entrusted staking? Liquid staking allows stakers to maintain the liquidity of their staked tokens through the use of alternative tokens, which they can use to earn additional income through DeFi protocols.

Today, the editor of this website will introduce to you in detail what is liquid staking? How liquidity staking works, and the difference between liquidity staking and entrusted staking. Hope you all like it!

1. What is liquidity staking?

Liquid staking allows stakers to maintain the liquidity of their staked tokens by using alternative tokens, which they can use to earn additional income through DeFi protocols.

Before we dive into liquidity staking, let’s first understand staking and the issues associated with it. Staking refers to the process of locking cryptocurrency in a blockchain network to maintain it, which enables stakers to earn profits. However, pledged assets often become illiquid during the staking period as they cannot be traded or transferred.

Liquidity staking enables cryptocurrency holders to participate in staking without giving up control of their holdings. This changes the way users perform staking. Projects such as Lido have introduced liquidity staking, providing tokenization of pledged assets in the form of tokens and derivatives.

It allows users to gain the advantages of staking while retaining the flexibility to trade these tokens in decentralized finance (DeFi) applications or transfer them to other users.

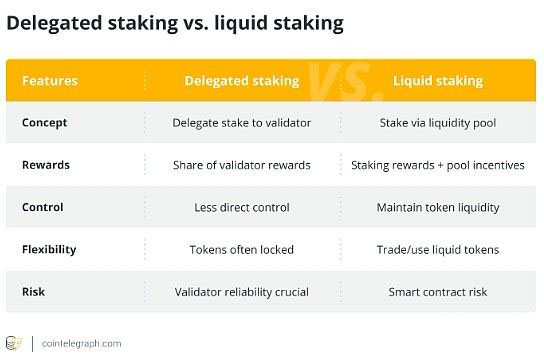

#2. Is there a difference between entrusted staking and liquidity staking?

Network users in Delegated Proof of Stake (DPoS) vote to choose their preferred delegator. However, the purpose of liquid staking is to allow stakers to circumvent minimum staking thresholds and mechanisms to lock up tokens.

Although DPoS borrows the basic concept of Proof of Stake, the way it is executed is different. In DPoS, network users have the power to elect representatives called “witnesses” or “block producers” to validate blocks. The number of representatives participating in the consensus process is limited and can be adjusted by voting. Network users in DPoS can pool their tokens into a staking pool and use their combined voting power to vote for preferred representatives.

Liquidity staking, on the other hand, aims to lower the investment threshold and provide stakers with a way to circumvent the token locking mechanism. Blockchains often have minimum requirements for staking. For example, Ethereum requires anyone who wants to set up a validator node to stake at least 32 Ethereum (ETH). It also requires specific computer hardware, software, time and expertise, which in turn requires significant investment.

3. What is staking as a service?

Staking-as-a-Service is a platform that acts as an intermediary, connecting the blockchain’s consensus mechanism with cryptocurrency holders who wish to contribute to the functionality of the network.

Staking-as-a-Service is a platform or service that enables users to entrust their crypto assets to a third party, who then participates in staking on the user’s behalf, typically charging a fee or sharing in rewards. According to JPMorgan Chase, the pledge services industry will expand to $40 billion by 2025. Cryptocurrency staking services will play an important role in this emerging economy, and liquidity staking will become an integral part of it.

Staking-as-a-service platforms can be classified into custodial and non-custodial based on the degree of decentralization, which plays an important role in safeguarding the best interests of stakeholders and maintaining transparency. To facilitate decentralized governance, key decisions are made by Decentralized Autonomous Organizations (DAOs).

Managed Staking as a Service involves extensive management of the staking process. The staking services provided by cryptocurrency exchanges are custodial. Rewards flow first to staking providers and then to stakers.

In a non-custodial staking-as-a-service model, validators charge a commission to anyone who wants to participate in staking. In PoS networks that support native delegation, stakers’ reward shares are sent directly to them without the involvement of validators.

4. How Liquidity Staking Works

Liquidity Staking aims to eliminate the staking threshold and allow holders to profit from liquidity tokens.

The staking pool allows users to combine several small pledges into one large pledge using smart contracts, which provide each staker with corresponding liquid tokens (representing their share of the staking pool).

This mechanism eliminates the threshold for becoming a staker. Liquid staking goes a step further, allowing stakers to double their returns. On the one hand, they earn from the staked tokens, and on the other hand, they earn from the liquidity tokens by conducting financial activities such as trading, lending or any other activities without affecting their original staked positions. profit.

Using Lido as a case study will help us better understand how liquidity staking works. Lido is a liquid staking solution for PoS currencies, supporting multiple PoS blockchains including Ethereum, Solana, Kusama, Polkadot, and Polygon. Lido provides an innovative solution to the barriers posed by traditional PoS staking by effectively lowering the barriers to entry and costs associated with locking assets in a single protocol.

#Lido is a staking pool based on smart contracts. Users who deposit assets into the platform will stake them on the Lido blockchain through the protocol. Lido allows ETH holders to stake a fraction of the minimum threshold (32 ETH) to earn block rewards. After depositing funds into Lido's staking pool smart contract, users receive Lido Staked ETH (stETH), an ERC-20 compatible token that is minted on deposits and destroyed on withdrawals.

The protocol distributes staked ETH to validators (node operators) within the Lido network, which is then deposited into the Ethereum beacon chain for verification. These funds are then protected by a smart contract, which is inaccessible to validators. ETH deposited through the Lido staking protocol is divided into sets of 32 ETH among active node operators on the network.

These operators utilize public verification keys to verify transactions involving user-staking assets. This mechanism allows users’ staked assets to be spread across multiple validators, thereby reducing the risks associated with single points of failure and single validator staking.

Stakers who deposit Solana (SOL) tokens, Polygon (MATIC), Polkadot (DOT), and Kusama KSM via a set of smart contracts in Lido will receive stSOL, stMATIC, stDOT, and stKSM respectively. stToken can be used to earn DeFi yields, provide liquidity, trade on decentralized exchanges (DEX), and many other use cases.

5. Are there any risks in the liquidity staking platform?

As with any product or service in the cryptocurrency space, technical threats and market volatility need to be considered when dealing with liquidity staking.

Technical Threats

PoS blockchain is still relatively new, and there is always the possibility of protocol errors or vulnerabilities that could lead to assets being lost or exploited. Relying on validators for staking also creates counterparty risk.

Market Risk

Liquidity staking unlocks staked assets, allowing stakers to earn rewards from DeFi applications. However, this also brings the risk of losing ground on both fronts during market downturns.

Keeping the liquidity staking platform open source and regularly audited can help prevent threats to a certain extent. Having a bounty program for the platform can also help minimize bugs.

Conducting comprehensive due diligence is critical to addressing the risks associated with market volatility. This includes studying historical market data, assessing the financial health of potential investments, understanding the regulatory environment, and developing a diversified investment strategy.

The above is the detailed content of What do you understand about liquidity staking? How does it work?. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

AI Hentai Generator

Generate AI Hentai for free.

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

gate.io registration tutorial

Mar 31, 2025 pm 11:09 PM

gate.io registration tutorial

Mar 31, 2025 pm 11:09 PM

This article provides a detailed Gate.io registration tutorial, covering every step from accessing the official website to completing registration, including filling in registration information, verifying, reading user agreements, etc. The article also emphasizes security measures after successful registration, such as setting up secondary verification and completing real-name authentication, and gives tips from beginners to help users safely start their digital asset trading journey.

okx Ouyi Exchange web version enter link click to enter

Mar 31, 2025 pm 06:21 PM

okx Ouyi Exchange web version enter link click to enter

Mar 31, 2025 pm 06:21 PM

1. Enter the web version of okx Euyi Exchange ☜☜☜☜☜☜ Click to save 2. Click the link of okx Euyi Exchange app ☜☜☜☜ Click to save 3. After entering the official website, the clear interface provides a login and registration portal. Users can choose to log in to an existing account or register a new account according to their own situation. Whether it is viewing real-time market conditions, conducting transactions, or managing assets, the OKX web version provides a simple and smooth operating experience, suitable for beginners and veterans. Visit OKX official website now for easy experience

The latest registration tutorial for gate.io web version

Mar 31, 2025 pm 11:15 PM

The latest registration tutorial for gate.io web version

Mar 31, 2025 pm 11:15 PM

This article provides a detailed Gate.io web version latest registration tutorial to help users easily get started with digital asset trading. The tutorial covers every step from accessing the official website to completing registration, and emphasizes security settings after registration. The article also briefly introduces other trading platforms such as Binance, Ouyi and Sesame Open Door. It is recommended that users choose the right platform according to their own needs and pay attention to investment risks.

ok official portal web version ok exchange official web version login portal

Mar 31, 2025 pm 06:24 PM

ok official portal web version ok exchange official web version login portal

Mar 31, 2025 pm 06:24 PM

This article details how to use the official web version of OK exchange to log in. Users only need to search for "OK Exchange Official Web Version" in their browser, click the login button in the upper right corner after entering the official website, and enter the user name and password to log in. Registered users can easily manage assets, conduct transactions, deposit and withdraw funds, etc. The official website interface is simple and easy to use, and provides complete customer service support to ensure that users have a smooth digital asset trading experience. What are you waiting for? Visit the official website of OK Exchange now to start your digital asset journey!

Gate.io (Sesame Exchange) APP official download Gate.io official APP free download

Mar 31, 2025 pm 07:12 PM

Gate.io (Sesame Exchange) APP official download Gate.io official APP free download

Mar 31, 2025 pm 07:12 PM

This article details how to install the official Gate.io (Sesame Exchange) app on your phone. First, you need to download the installation package (.apk or .ipa file) from the official channel; Android users need to enable the "Unknown Source" installation permission; then click the installation package to install, and the application can be started after the installation is completed. Finally, register or log in to your account and start experiencing the trading, market viewing and other functions provided by Gate.io. Quickly master the installation steps of Gate.io App and easily start the digital asset trading journey!

Virtual currency trading platform app Ouyi download Virtual currency Ouyi trading APP Android download tutorial

Mar 31, 2025 pm 08:57 PM

Virtual currency trading platform app Ouyi download Virtual currency Ouyi trading APP Android download tutorial

Mar 31, 2025 pm 08:57 PM

This article introduces the basic information of Ouyi OKX trading platform and the installation steps of Android mobile client. Founded in 2017, Ouyi OKX is formerly OKEx, headquartered in Seychelles, providing coin trading, leveraged trading, options, delivery and perpetual contracts to tens of millions of users in more than 200 countries and regions around the world. The article elaborates on four steps from downloading the installation package to completing the installation, so that users can quickly get started with the OKX Android client. If you want to know the installation method of Ouyi OKX trading platform and Android client, please continue to read this article.

What are the recommended websites for virtual currency app software?

Mar 31, 2025 pm 09:06 PM

What are the recommended websites for virtual currency app software?

Mar 31, 2025 pm 09:06 PM

This article recommends ten well-known virtual currency-related APP recommendation websites, including Binance Academy, OKX Learn, CoinGecko, CryptoSlate, CoinDesk, Investopedia, CoinMarketCap, Huobi University, Coinbase Learn and CryptoCompare. These websites not only provide information such as virtual currency market data, price trend analysis, etc., but also provide rich learning resources, including basic blockchain knowledge, trading strategies, and tutorials and reviews of various trading platform APPs, helping users better understand and make use of them

gate.io latest registration tutorial for beginners

Mar 31, 2025 pm 11:12 PM

gate.io latest registration tutorial for beginners

Mar 31, 2025 pm 11:12 PM

This article provides newbies with detailed Gate.io registration tutorials, guiding them to gradually complete the registration process, including accessing the official website, filling in information, identity verification, etc., and emphasizes the security settings after registration. In addition, the article also mentioned other exchanges such as Binance, Ouyi and Sesame Open Door. It is recommended that novices choose the right platform according to their own needs, and remind readers that digital asset investment is risky and should invest rationally.