web3.0

web3.0

Revenue of $1.64 billion, net profit of $1.18 billion, a quick look at Coinbase's 2024 Q1 financial report highlights

Revenue of $1.64 billion, net profit of $1.18 billion, a quick look at Coinbase's 2024 Q1 financial report highlights

Revenue of $1.64 billion, net profit of $1.18 billion, a quick look at Coinbase's 2024 Q1 financial report highlights

Author: Fan Jiabao, Odaily Planet Daily

Recently, Coinbase released its 2024 First quarter financial report.

The report showed that Coinbase’s first-quarter revenue was US$1.64 billion, higher than analysts’ average estimate of US$1.34 billion; net profit was US$1.18 billion, or US$4.40 per share, compared with a loss of US$7,890 in the same period last year. This was a staggering financial turnaround compared to a loss of 34 cents per share. This profit performance comes after the company reported its first profit in two years in February this year.

Notably, profit for the quarter included a $650 million gain from the adoption of new accounting standards for marking-to-market crypto assets held for investment.

Sudden increase in transaction fees: Market recovery plus Bitcoin ETF By

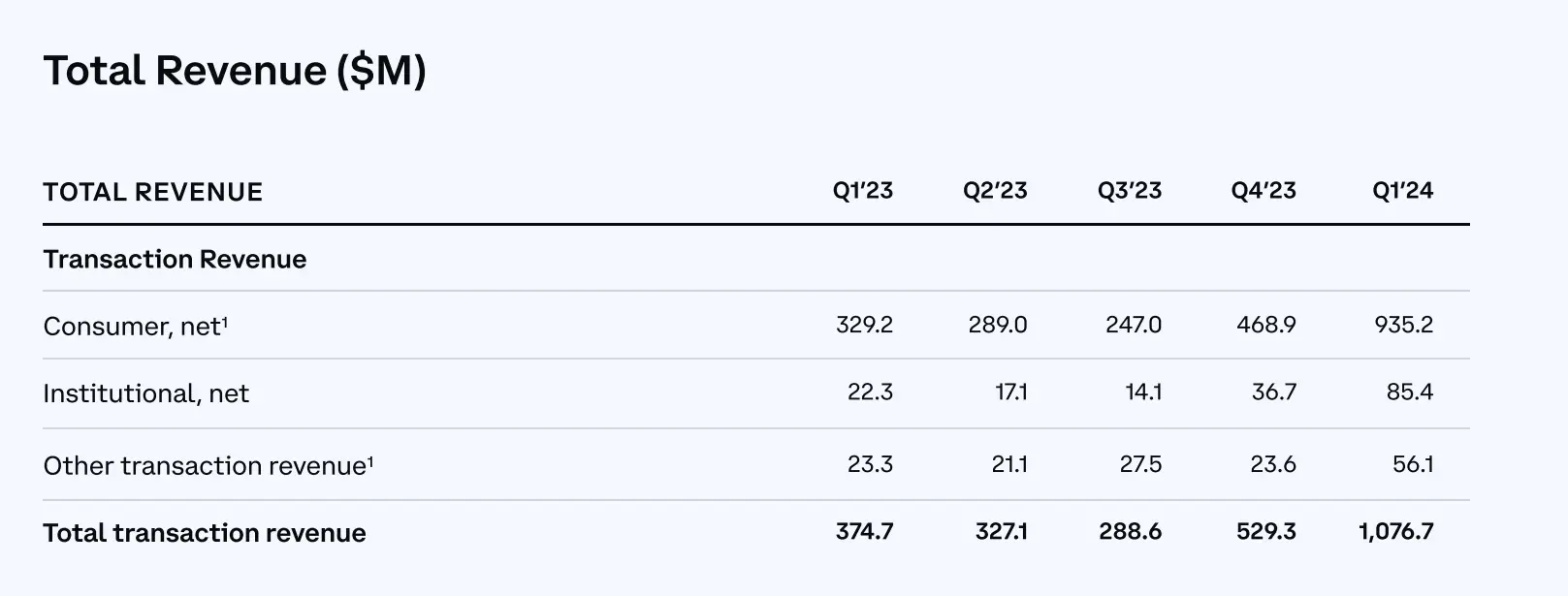

Looking by business type, the total transaction fee income in 2024 Q1 was US$1.077 billion, a month-on-month increase of 103.42%, a year-on-year increase of 187.35%, Revenue accounted for 65.75%, becoming the main source of revenue.

Transaction fee income increased significantly, mainly due to the substantial increase in retail and institutional trading volume.

Details of trading income (in millions of dollars)

Retail trading fees

2024 Q1 Retail transaction fee income was US$935 million, a month-on-month increase of 99.45% and a year-on-year increase of 184.08%. Retail trading volume in Q1 2024 was US$56 billion, a month-on-month increase of 93.10% and a year-on-year increase of 166.67%. Coinbase's financial officer pointed out during the conference call that the significant increase in transaction fees was due to the growth of new users and the recovery of transaction volume of existing users, as well as the increase in per-user transaction volume.

Institutional transaction fees

In 2024 Q1, institutional transaction fee income was US$85 million, a month-on-month increase of 132.70% and a year-on-year increase of 282.96%. Institutional trading volume in Q1 2024 was US$256 billion, a month-on-month increase of 104.8% and a year-on-year increase of 106.45%.

Institutional trading fee revenue benefited from the approval of a Bitcoin spot ETF and the company’s product innovation. The U.S. Securities and Exchange Commission has attracted an influx of institutional investors since it approved a new series of U.S. spot Bitcoin exchange-traded funds. Many exchange-traded funds have chosen Coinbase as their custody partner, with the funds collectively attracting more than $50 billion in capital as of the end of the first quarter.

Institutional platform Coinbase Prime 2024 Q1 trading volume and number of active customers hit record highs. The Prime platform provides custody, trading, financing and staking services to institutional clients, with the approval of a Bitcoin ETF in January 2024 and the rise in Bitcoin prices in the first quarter significantly increasing customer engagement across the Prime product suite.

Thanks to the stimulation of trading activities by ETF issuance, as a custody partner of exchange-traded funds, Coinbase Prime’s trading volume hit a record high in the first quarter, rising 115% year-on-year to 312 billion times. First-quarter revenue It also surged from US$22.3 million in the same period last year to US$85.4 million, and loans surged to US$797 million in the same period.

Other transaction income

2024 Q1 Other transaction income was US$56 million, a month-on-month increase of 137.71% and a year-on-year increase of 140.77%. Other trading revenue benefited from increased revenue from Base, the Layer 2 solution provided by Coinbase.

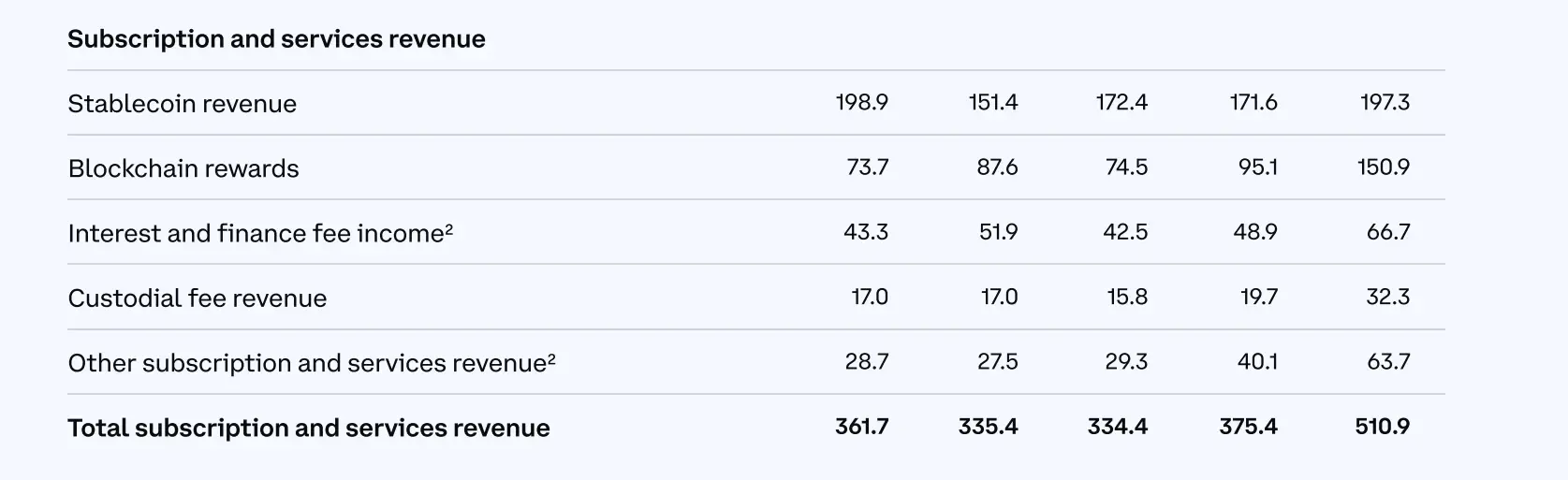

Subscription and service revenue growth is gratifying

Subscription and service revenue reached US$511 million this quarter, a month-on-month increase of 36.09%, a year-on-year increase of 41.25%, and revenue accounting for 31.20%, mainly due to blockchain Driven by growth in rewards revenue, hosting fee revenue and other subscription services revenue.

Subscription and service revenue breakdown (in millions of dollars)

Stablecoin Revenue

2024 Q1 Stablecoin revenue was US$197 million, a month-on-month increase of 14.98% and a year-on-year decrease of 0.8%. Stablecoin revenue benefited from the increase in USDC market value. The value of USDC on the platform is $5.5 billion, roughly double what it was at the end of Q4 2023.

It is worth noting that in the first quarter, USDC’s market capitalization growth rate was the highest among all U.S. dollar stablecoins.

Reward income

2024 Q1 blockchain reward income was US$151 million, a year-on-year increase of 104.75% and a month-on-month increase of 58.68%. Blockchain reward revenue has mainly benefited from the sharp rise in crypto assets, especially the price of Ethereum, which increased by approximately 60% on March 31 compared to December 31 last year.

Custody fee income

2024 Q1 Custody fee income was US$32 million, a month-on-month increase of 63.96% and a year-on-year increase of 90.00%. Custody fees benefited from rising crypto asset prices and increased custody business for Bitcoin spot ETFs. Among the 11 Bitcoin spot ETFs approved by the SEC in January 2024, Coinbase served as the custodian of 8 of the ETFs. At the end of Q1 2024, the company's assets under custody were approximately US$171 billion.

Interest and Financing Income

2024 Q1 Prime financing income was reclassified from other subscription service income to interest and financing income. Interest and financing income was US$67 million, a month-on-month increase of 36.40%, a year-on-year increase 54.04%.

Other subscription service income

2024 Q1 Prime financing income was reclassified from other subscription service income to interest and financing income. Interest and financing income was US$67 million, a month-on-month increase of 36.40%, a year-on-year increase 54.04%.

New growth pole supports continued expansion of performance

In the foreseeable future, the passage of the Stablecoin Act will provide Coinbase stablecoin revenue

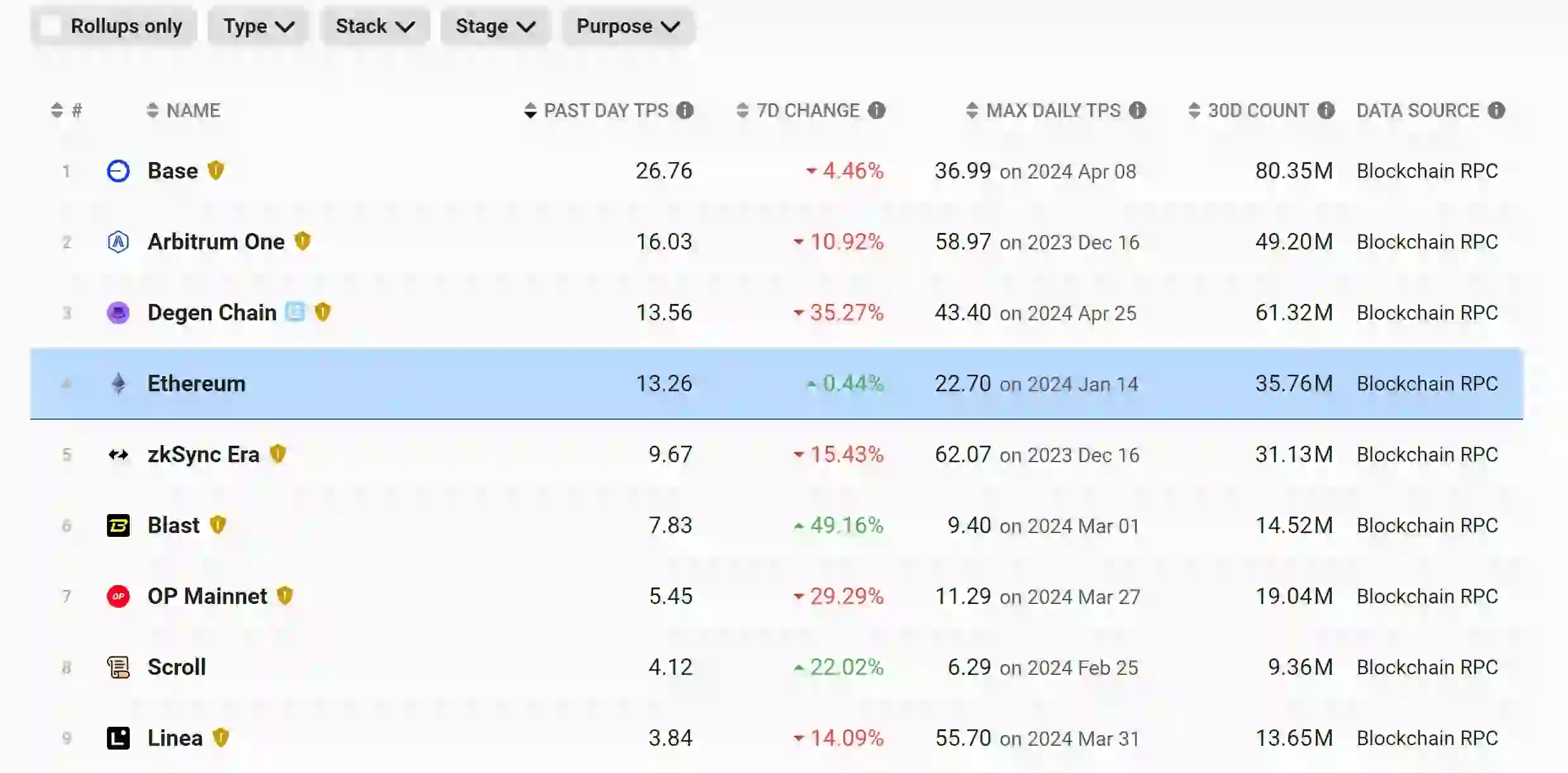

Furthermore, Base chain As Coinbase's bet on L2 beat, it has performed well in the past quarter. Due to the active trading of a large number of new and old Meme tokens, the transactions on Base have far exceeded other L2 second-tier chains in the past few months.

Comparison of Layer 2 Network Transaction Overview

In addition, according to the estimates of Wall Street analysts, in the future Coinbase's new business derivatives revenue will reach hundreds of millions of dollars in two years. Coinbase's main platform's expansion into derivatives adds to its upside in the long term.

Finally, the continuous growth of Coinbase’s international site and the fact that Coinbase has obtained compliance licenses for crypto assets in more countries will also promote the continuous expansion of its business scale.

The above is the detailed content of Revenue of $1.64 billion, net profit of $1.18 billion, a quick look at Coinbase's 2024 Q1 financial report highlights. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

1390

1390

52

52

Recommended essential software for currency contract parties

Apr 21, 2025 pm 11:21 PM

Recommended essential software for currency contract parties

Apr 21, 2025 pm 11:21 PM

The top ten cryptocurrency contract exchange platforms in 2025 are: 1. Binance Futures, 2. OKX Futures, 3. Gate.io, 4. Huobi Futures, 5. BitMEX, 6. Bybit, 7. Deribit, 8. Bitfinex, 9. CoinFLEX, 10. Phemex, these platforms are widely recognized for their high liquidity, diversified trading functions and strict security measures.

Ranking of leveraged exchanges in the currency circle The latest recommendations of the top ten leveraged exchanges in the currency circle

Apr 21, 2025 pm 11:24 PM

Ranking of leveraged exchanges in the currency circle The latest recommendations of the top ten leveraged exchanges in the currency circle

Apr 21, 2025 pm 11:24 PM

The platforms that have outstanding performance in leveraged trading, security and user experience in 2025 are: 1. OKX, suitable for high-frequency traders, providing up to 100 times leverage; 2. Binance, suitable for multi-currency traders around the world, providing 125 times high leverage; 3. Gate.io, suitable for professional derivatives players, providing 100 times leverage; 4. Bitget, suitable for novices and social traders, providing up to 100 times leverage; 5. Kraken, suitable for steady investors, providing 5 times leverage; 6. Bybit, suitable for altcoin explorers, providing 20 times leverage; 7. KuCoin, suitable for low-cost traders, providing 10 times leverage; 8. Bitfinex, suitable for senior play

How to trade quantum chains

Apr 21, 2025 pm 11:42 PM

How to trade quantum chains

Apr 21, 2025 pm 11:42 PM

The quantum chain (Qtum) transaction process includes three stages: preliminary preparation, purchase and sale. 1. Preparation: Select a compliant exchange, register an account, perform identity verification, and set up a wallet. 2. Purchase quantum chains: recharge funds, find trading pairs, place orders (market orders or limit orders), and confirm transactions. 3. Sell quantum chains: Enter the trading page, select the trading pair and order type (market order or limit order), confirm the transaction and withdraw cash.

What is a quantum chain? What are the quantum chain transactions?

Apr 21, 2025 pm 11:51 PM

What is a quantum chain? What are the quantum chain transactions?

Apr 21, 2025 pm 11:51 PM

Quantum Chain (Qtum) is an open source decentralized smart contract platform and value transmission protocol. 1. Technical features: BIP-compatible POS smart contract platform, combining the advantages of Bitcoin and Ethereum, introduces off-chain factors and enhances the flexibility of consensus mechanisms. 2. Design principle: realize on-chain and off-chain data interaction through main control contracts, be compatible with different blockchain technologies, flexible consensus mechanisms, and consider industry compliance. 3. Team and Development: An international team led by Shuai Chu, 80% of the quantum coins are used in the community, and 20% rewards the team and investors. Quantum chains are traded on Binance, Gate.io, OKX, Bithumb and Matcha exchanges.

Recommend several apps to buy mainstream coins in 2025 latest release

Apr 21, 2025 pm 11:54 PM

Recommend several apps to buy mainstream coins in 2025 latest release

Apr 21, 2025 pm 11:54 PM

APP software that can purchase mainstream coins includes: 1. Binance, the world's leading, large transaction volume and fast speed; 2. OKX, innovative products, low fees, high security; 3. Gate.io, a variety of assets and trading options, focusing on security; 4. Huobi (HTX), low fees, good user experience; 5. Coinbase, suitable for novices, high security; 6. Kraken, safe and compliant, providing a variety of services; 7. KuCoin, low fees, suitable for professional traders; 8. Gemini, emphasizes compliance, and provides custodial services; 9. Crypto.com, providing a variety of offers and services; 10. Bitstamp, an old exchange, strong liquidity,

How to cancel Ethereum transactions_How to trade for Ethereum novices

Apr 21, 2025 pm 11:03 PM

How to cancel Ethereum transactions_How to trade for Ethereum novices

Apr 21, 2025 pm 11:03 PM

Ethereum transactions can be cancelled in a pending state. 1) Use the cancel function of wallets such as MetaMask: Find the transaction in the "Activities" section, select "Cancel", and confirm the cancellation through a new transaction with high gas fees. 2) Cancel with custom nonce: Advanced users can find the nonce value of the stuck transaction through the blockchain browser, and then send a new transaction with the same nonce but high gas fees to replace the original transaction.

Currency Circle Contract Trading Platform Ranking 2025

Apr 21, 2025 pm 11:15 PM

Currency Circle Contract Trading Platform Ranking 2025

Apr 21, 2025 pm 11:15 PM

Here are the top ten cryptocurrency futures exchanges in the world: 1. Binance Futures: Provides a wealth of contract products, low fees and high liquidity. 2. OKX: Supports multiple currency transactions, using SSL encryption and cold wallet storage. 3. Huobi Futures: Known for its stable platform and good service, it provides educational resources. 4. Gate.io: Innovative contract products and high liquidity, but FTX was bankrupt. 5. Deribit: Focus on options and perpetual contracts, providing professional trading tools. 6. CoinFLEX: Provides tokenized futures contracts and governance tokens FLEX. 7. Phemex: up to 100 times leverage, low transaction fees, and provides innovative contracts. 8. B

Which Bitcoin futures exchange is global?

Apr 21, 2025 pm 11:18 PM

Which Bitcoin futures exchange is global?

Apr 21, 2025 pm 11:18 PM

The top five Bitcoin futures exchanges rankings are: 1. CME Group: The most trustworthy in the world, attracting institutional investors, and have strong compliance; 2. Coinbase: Specially for retail investors, providing 13 futures contracts, with high ease of use; 3. Binance: High leverage, good liquidity, and large user volume; 4. OKX: Large cumulative trading volume, professional interface, and complete risk management; 5. Kraken: High security, suitable for European market and institutional customers.