web3.0

web3.0

Hong Kong spot Ethereum and Bitcoin ETFs have accumulated US$300 million! Transactions differ 268 times from the U.S.

Hong Kong spot Ethereum and Bitcoin ETFs have accumulated US$300 million! Transactions differ 268 times from the U.S.

Hong Kong spot Ethereum and Bitcoin ETFs have accumulated US$300 million! Transactions differ 268 times from the U.S.

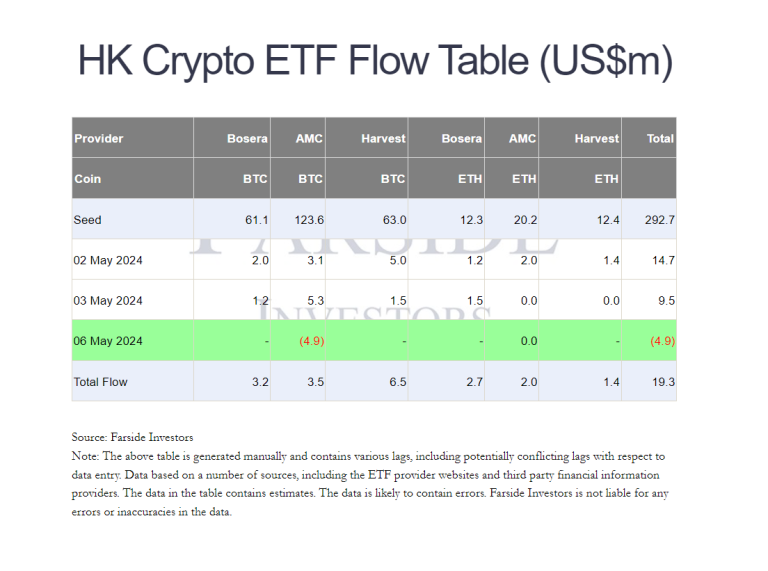

Hong Kong’s newly launched spot Ethereum and Bitcoin ETFs have accumulated $300 million in assets under management in just one week, outperforming futures ETFs by 80%.

The trading volume on May 6 was HK$60.41 million (US$7.72 million), significantly lower than the US$1.88 billion Bitcoin spot ETF trading volume in the United States; Hong Kong had a net outflow of US$4.9 million. There are rumors that these ETFs may soon be open to mainland Chinese investors, sparking discussions about financial integration between the region. Despite this, Hong Kong’s transaction volume still pales in comparison to that of the United States, with a gap of 268 times.

The above is the detailed content of Hong Kong spot Ethereum and Bitcoin ETFs have accumulated US$300 million! Transactions differ 268 times from the U.S.. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

1386

1386

52

52

What is Ouyi for? What is Ouyi

Apr 01, 2025 pm 03:18 PM

What is Ouyi for? What is Ouyi

Apr 01, 2025 pm 03:18 PM

OKX is a global digital asset trading platform. Its main functions include: 1. Buying and selling digital assets (spot trading), 2. Trading between digital assets, 3. Providing market conditions and data, 4. Providing diversified trading products (such as derivatives), 5. Providing asset value-added services, 6. Convenient asset management.

Will Dogecoin etf be approved?

Mar 28, 2025 pm 03:51 PM

Will Dogecoin etf be approved?

Mar 28, 2025 pm 03:51 PM

As of March 2025, the Dogecoin ETF has not yet had a clear approval schedule. 1. There is no formal application yet and the SEC has not received any relevant application. 2. Market demand and controversy are high, and regulators are conservative. 3. The potential timeline is a 1-2-year review period, which may be observed from 2025 to 2026, but there is high uncertainty.

How to calculate the transaction fee of gate.io trading platform?

Mar 31, 2025 pm 09:15 PM

How to calculate the transaction fee of gate.io trading platform?

Mar 31, 2025 pm 09:15 PM

The handling fees of the Gate.io trading platform vary according to factors such as transaction type, transaction pair, and user VIP level. The default fee rate for spot trading is 0.15% (VIP0 level, Maker and Taker), but the VIP level will be adjusted based on the user's 30-day trading volume and GT position. The higher the level, the lower the fee rate will be. It supports GT platform coin deduction, and you can enjoy a minimum discount of 55% off. The default rate for contract transactions is Maker 0.02%, Taker 0.05% (VIP0 level), which is also affected by VIP level, and different contract types and leverages

Currency Trading Network Official Website Collection 2025

Mar 31, 2025 pm 03:57 PM

Currency Trading Network Official Website Collection 2025

Mar 31, 2025 pm 03:57 PM

It ranks among the top in the world, supports all categories of transactions such as spot, contracts, and Web3 wallets. It has high security and low handling fees. A comprehensive trading platform with a long history, known for its compliance and high liquidity, supports multilingual services. The industry leader covers currency trading, leverage, options, etc., with strong liquidity and supports BNB deduction fees.

Matcha Exchange eth transfer tutorial

Mar 31, 2025 pm 12:39 PM

Matcha Exchange eth transfer tutorial

Mar 31, 2025 pm 12:39 PM

The steps for transferring ETH from the Matcha Exchange are as follows: 1. Preparation: Register and authenticate with real name to ensure that there is enough ETH, and download and install TP Wallet. 2. Get the ETH address of the TP Wallet. 3. Log in to the Matcha Exchange. 4. Find the Assets or Package options. 5. Select ETH and click "Extract" or "Extract". 6. Fill in the withdrawal information, paste the ETH address and enter the amount. 7. Complete security verification. 8. Confirm the funds to arrive.

Top 10 of the formal Web3 trading platform APP rankings (authoritatively released in 2025)

Mar 31, 2025 pm 08:09 PM

Top 10 of the formal Web3 trading platform APP rankings (authoritatively released in 2025)

Mar 31, 2025 pm 08:09 PM

Based on market data and common evaluation criteria, this article lists the top ten formal Web3 trading platform APPs in 2025. The list covers well-known platforms such as Binance, OKX, Gate.io, Huobi (now known as HTX), Crypto.com, Coinbase, Kraken, Gemini, BitMEX and Bybit. These platforms have their own advantages in user scale, transaction volume, security, compliance, product innovation, etc. For example, Binance is known for its huge user base and rich product services, while Coinbase focuses on security and compliance. Choosing a suitable platform requires comprehensive consideration based on your own needs and risk tolerance.

gate official website login address gateio web version login portal address

Mar 31, 2025 pm 01:15 PM

gate official website login address gateio web version login portal address

Mar 31, 2025 pm 01:15 PM

Gate.io not only provides basic buying, selling and trading functions, but also launches a variety of innovative trading models and services to meet the needs of different users. The platform also provides a wealth of trading tools and analysis functions to help users make smarter investment decisions. Users can pledge their holdings to the platform, participate in mining activities, and obtain additional benefits.

The top ten authoritative releases of the currency circle contract introduction trading apps

Mar 31, 2025 pm 02:51 PM

The top ten authoritative releases of the currency circle contract introduction trading apps

Mar 31, 2025 pm 02:51 PM

The world's first unified trading account, supports delivery/perpetual/optional contracts, provides a 100,000 TPS memory matching engine, and responds to extreme market conditions in milliseconds. The world's largest spot contract ecosystem, supports 1,200 trading pairs, and the 24-hour trading volume exceeds 100 billion US dollars. Used by more than 20 million users, it can replicate the global win rate of 85%.