Technology peripherals

Technology peripherals

It Industry

It Industry

The impact of the AI wave is obvious. TrendForce has revised up its forecast for DRAM memory and NAND flash memory contract price increases this quarter.

The impact of the AI wave is obvious. TrendForce has revised up its forecast for DRAM memory and NAND flash memory contract price increases this quarter.

The impact of the AI wave is obvious. TrendForce has revised up its forecast for DRAM memory and NAND flash memory contract price increases this quarter.

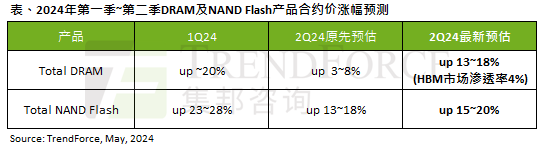

According to TrendForce’s survey report, the AI wave has a significant impact on the DRAM memory and NAND flash memory markets. In this site’s news on May 7, TrendForce said in its latest research report today that the agency has increased the contract price increases for two types of storage products this quarter.

Specifically, TrendForce originally estimated that the DRAM memory contract price in the second quarter of 2024 will increase by 3~8%, and now estimates it at 13~18%;

As for NAND flash memory, the original forecast It is estimated to increase by 13~18%, and the new estimate is 15~20%. Only eMMC/UFS has a lower increase of 10%.

TrendForce said that the agency originally expected to increase prices in two or three consecutive quarters. Later, the demand side of DRAM memory and NAND flash memory was not willing to accept significant price increases.

But in late April, storage companies completed the first round of contract price negotiations after the earthquake in Taiwan, and the increase was larger than expected. The reason is that in addition to the buyer's intention to support the price of the inventory in hand, the greater impact is that the AI craze has brought psychological changes to both supply and demand sides of the storage industry.

In terms of the DRAM market, storage manufacturers are worried that the increase in HBM memory production capacity will further crowd out the supply of traditional memory:

According to an earlier report by this website, Micron stated that the wafer volume consumption of HBM3E memory 3 times that of traditional DDR5 memory; the research report stated that by the end of 2024, about 60% of Samsung Electronics’ overall DRAM production capacity in the 1αnm process will be occupied by HBM3E memory.

After the assessment, the demand side considered preparing DRAM memory in advance in the second quarter to deal with the supply tension caused by the increase in HBM memory production starting from the third quarter.

In terms of NAND flash memory products, energy saving has become a priority for AI inference servers, and North American cloud service providers are expanding their adoption of QLC enterprise-class solid-state drives. The inventory of flash memory products has accelerated. Against this background, some suppliers have become reluctant to sell.However, the research report also mentioned that due to the uncertainty about the recovery of demand for consumer products, storage manufacturers’ capital expenditures on non-HBM memory production capacity still tend to be conservative, especially when they are still at the break-even point. DRAM flash memory.

The above is the detailed content of The impact of the AI wave is obvious. TrendForce has revised up its forecast for DRAM memory and NAND flash memory contract price increases this quarter.. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

Large memory optimization, what should I do if the computer upgrades to 16g/32g memory speed and there is no change?

Jun 18, 2024 pm 06:51 PM

Large memory optimization, what should I do if the computer upgrades to 16g/32g memory speed and there is no change?

Jun 18, 2024 pm 06:51 PM

For mechanical hard drives or SATA solid-state drives, you will feel the increase in software running speed. If it is an NVME hard drive, you may not feel it. 1. Import the registry into the desktop and create a new text document, copy and paste the following content, save it as 1.reg, then right-click to merge and restart the computer. WindowsRegistryEditorVersion5.00[HKEY_LOCAL_MACHINE\SYSTEM\CurrentControlSet\Control\SessionManager\MemoryManagement]"DisablePagingExecutive"=d

Sources say SK Hynix's five-layer stacked 3D DRAM memory yield has reached 56.1%

Jun 24, 2024 pm 01:52 PM

Sources say SK Hynix's five-layer stacked 3D DRAM memory yield has reached 56.1%

Jun 24, 2024 pm 01:52 PM

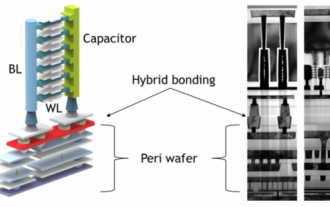

According to news from this website on June 24, Korean media BusinessKorea reported that industry insiders revealed that SK Hynix published the latest research paper on 3D DRAM technology at the VLSI 2024 Summit held in Hawaii, USA from June 16 to 20. In this paper, SK Hynix reports that its five-layer stacked 3D DRAM memory yield has reached 56.1%, and the 3D DRAM in the experiment exhibits similar characteristics to current 2D DRAM. According to reports, unlike traditional DRAM, which arranges memory cells horizontally, 3D DRAM stacks cells vertically to achieve higher density in the same space. However, SK hynix

Industry's highest transfer rate of 3.6GB/s, Micron announces mass production of ninth-generation 276-layer TLC NAND flash memory

Jul 31, 2024 am 08:05 AM

Industry's highest transfer rate of 3.6GB/s, Micron announces mass production of ninth-generation 276-layer TLC NAND flash memory

Jul 31, 2024 am 08:05 AM

According to news from this site on July 30, Micron announced today (local time) that its ninth generation (site note: 276 layers) 3DTLC NAND flash memory will be mass-produced and shipped. Micron said that its G9NAND has the industry's highest I/O transfer rate of 3.6GB/s (i.e. 3600MT/s flash memory interface rate), which is 50% higher than the existing competing products of 2400MT/s, and can better meet the needs of data-intensive workloads. High throughput requirements. At the same time, Micron's G9NAND is 99% and 88% higher than other solutions on the market in terms of write bandwidth and read bandwidth respectively. This NAND particle-level advantage will bring performance and energy efficiency to solid-state drives and embedded storage solutions. improvement. In addition, like previous generations of Micron NAND flash memory, Micron 276

Sources say Samsung Electronics and SK Hynix will commercialize stacked mobile memory after 2026

Sep 03, 2024 pm 02:15 PM

Sources say Samsung Electronics and SK Hynix will commercialize stacked mobile memory after 2026

Sep 03, 2024 pm 02:15 PM

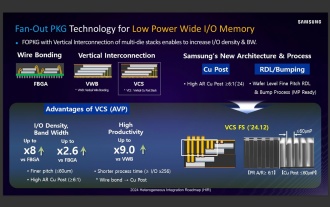

According to news from this website on September 3, Korean media etnews reported yesterday (local time) that Samsung Electronics and SK Hynix’s “HBM-like” stacked structure mobile memory products will be commercialized after 2026. Sources said that the two Korean memory giants regard stacked mobile memory as an important source of future revenue and plan to expand "HBM-like memory" to smartphones, tablets and laptops to provide power for end-side AI. According to previous reports on this site, Samsung Electronics’ product is called LPWide I/O memory, and SK Hynix calls this technology VFO. The two companies have used roughly the same technical route, which is to combine fan-out packaging and vertical channels. Samsung Electronics’ LPWide I/O memory has a bit width of 512

How to fine-tune deepseek locally

Feb 19, 2025 pm 05:21 PM

How to fine-tune deepseek locally

Feb 19, 2025 pm 05:21 PM

Local fine-tuning of DeepSeek class models faces the challenge of insufficient computing resources and expertise. To address these challenges, the following strategies can be adopted: Model quantization: convert model parameters into low-precision integers, reducing memory footprint. Use smaller models: Select a pretrained model with smaller parameters for easier local fine-tuning. Data selection and preprocessing: Select high-quality data and perform appropriate preprocessing to avoid poor data quality affecting model effectiveness. Batch training: For large data sets, load data in batches for training to avoid memory overflow. Acceleration with GPU: Use independent graphics cards to accelerate the training process and shorten the training time.

Samsung's 9th generation V-NAND metal wiring mass production process is revealed to use molybdenum technology for the first time

Jul 03, 2024 pm 05:39 PM

Samsung's 9th generation V-NAND metal wiring mass production process is revealed to use molybdenum technology for the first time

Jul 03, 2024 pm 05:39 PM

According to news from this site on July 3, according to Korean media TheElec, Samsung tried to use molybdenum (Mo) for the first time in the "metal wiring" (metalwiring) of its 9th generation V-NAND. Note from this site: The eight major processes in the semiconductor manufacturing process are: wafer manufacturing oxidation photolithography etching deposition metal wiring testing packaging metal wiring process mainly uses different methods to connect billions of electronic components to form different semiconductors (CPU , GPU, etc.), it can be said to "inject life into semiconductors." Sources say Samsung has introduced five Mo deposition machines from Lam Research, and plans to introduce 20 more pieces of equipment next year. In addition to Samsung Electronics, companies such as SK Hynix, Micron and Kioxia are also

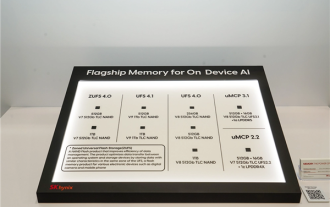

Hynix is the first to demonstrate UFS 4.1 flash memory: based on V9 TLC NAND particles

Aug 09, 2024 pm 03:33 PM

Hynix is the first to demonstrate UFS 4.1 flash memory: based on V9 TLC NAND particles

Aug 09, 2024 pm 03:33 PM

According to news on August 9, at the FMS2024 Summit, SK Hynix demonstrated its latest storage products, including UFS4.1 universal flash memory that has not yet officially released specifications. According to the official website of the JEDEC Solid State Technology Association, the latest UFS specification currently announced is UFS4.0 in August 2022. Its theoretical interface speed is as high as 46.4Gbps. It is expected that UFS4.1 will further improve the transmission rate. 1. Hynix demonstrated 512GB and 1TBUFS4.1 general-purpose flash memory products, based on 321-layer V91TbTLCNAND flash memory. SK Hynix also exhibited 3.2GbpsV92TbQLC and 3.6GbpsV9H1TbTLC particles. Hynix shows off V7-based

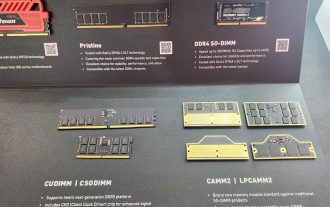

Kingbang launches new DDR5 8600 memory, offering CAMM2, LPCAMM2 and regular models to choose from

Jun 08, 2024 pm 01:35 PM

Kingbang launches new DDR5 8600 memory, offering CAMM2, LPCAMM2 and regular models to choose from

Jun 08, 2024 pm 01:35 PM

According to news from this site on June 7, GEIL launched its latest DDR5 solution at the 2024 Taipei International Computer Show, and provided SO-DIMM, CUDIMM, CSODIMM, CAMM2 and LPCAMM2 versions to choose from. ▲Picture source: Wccftech As shown in the picture, the CAMM2/LPCAMM2 memory exhibited by Jinbang adopts a very compact design, can provide a maximum capacity of 128GB, and a speed of up to 8533MT/s. Some of these products can even be stable on the AMDAM5 platform Overclocked to 9000MT/s without any auxiliary cooling. According to reports, Jinbang’s 2024 Polaris RGBDDR5 series memory can provide up to 8400