web3.0

web3.0

Overload, a re-pledge protocol similar to EigenLayer, appears in the Base ecosystem! Any ERC-20 token can be pledged

Overload, a re-pledge protocol similar to EigenLayer, appears in the Base ecosystem! Any ERC-20 token can be pledged

Overload, a re-pledge protocol similar to EigenLayer, appears in the Base ecosystem! Any ERC-20 token can be pledged

This site (120BTc.coM): Overload, a re-pledge protocol similar to EigenLayer, appears in the Base ecosystem. Its highlight is that it can pledge any ERC-20 tokens and is not limited to ETH. On the other hand, This agreement will also not reduce the number of node operators, further reducing the asset risk of re-pledgers.

Re-pledge introduction

Re-pledge refers to staking the liquid pledge token (LST) again. In addition to protecting the main network, it can also protect other external networks. For example, users can choose to pledge ETH to the Lido protocol to protect the security of the Ethereum network, and pledge their pledge-proof token stETH to EigenLayer to protect more other networks and obtain higher returns.

EigenLayer is the first re-staking protocol that uses node operators to manage stakers’ tokens and help protect the security of external network projects. The latter is also called actively validated services (AVS).

At present, the TVL of this agreement has reached more than 16 billion US dollars, and there are already nine AVS waiting for cooperation.

Introduction to the re-pledge protocol Overload

In the Base ecosystem, a similar re-pledge project Overload has also appeared. According to the team, this project has three differences:

Any ERC-20 token can be pledged

On-chain consensus

No slashing mechanism (slashing)

Pledger privilege elevation

Each of these changes the re-pledge mechanism, which are explained below.

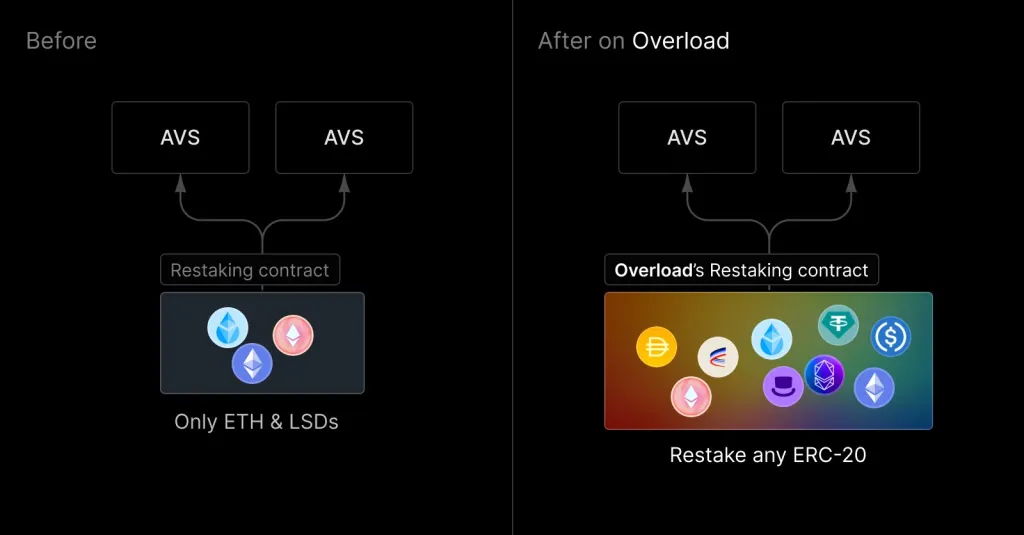

Any ERC-20 token can be pledged

Compared with EigenLayer which only accepts ETH and its corresponding liquidity pledge token, Overload can accept users to pledge any ERC-20 token. It can increase the flexibility and motivation of pledgers.

Overload can accept any ERC-20 token for pledge

This is to make up for the lack of asset volume in the Base ecosystem. On the other hand, whether Overload's design will compromise the network security of its AVS in the future still requires more discussion.

Onchain Consensus

Overload introduces the concept of Onchain Consensus, allowing AVS to perform verification directly on the chain. According to the team’s description, this move can prevent malicious behavior by node operators and greatly simplify the development of AVS.

No reduction mechanism

On the Ethereum network, there are 4 possibilities for validators to be punished:

Propose a different block

Surround voting

Double signature

-

Inactivity leaks

The validator who reduces the token will lose part of the pledged ETH. If the ecology is pledged again, it will become a node operator and cause the staker's assets to suffer losses, which is considered to be a way to obtain more benefits. The risks and costs to be borne.

However, there is no reduction mechanism in Overload. Since AVS uses on-chain consensus, only the "inactive participation" penalty is applied. Instead, the verifier is imprisoned and temporarily kicked out of the verifier set to allow the verifier to Miss out on proof rewards. This penalty will not cause the staker's assets to be lost.

The Overload team believes that this can increase users’ willingness to pledge assets.

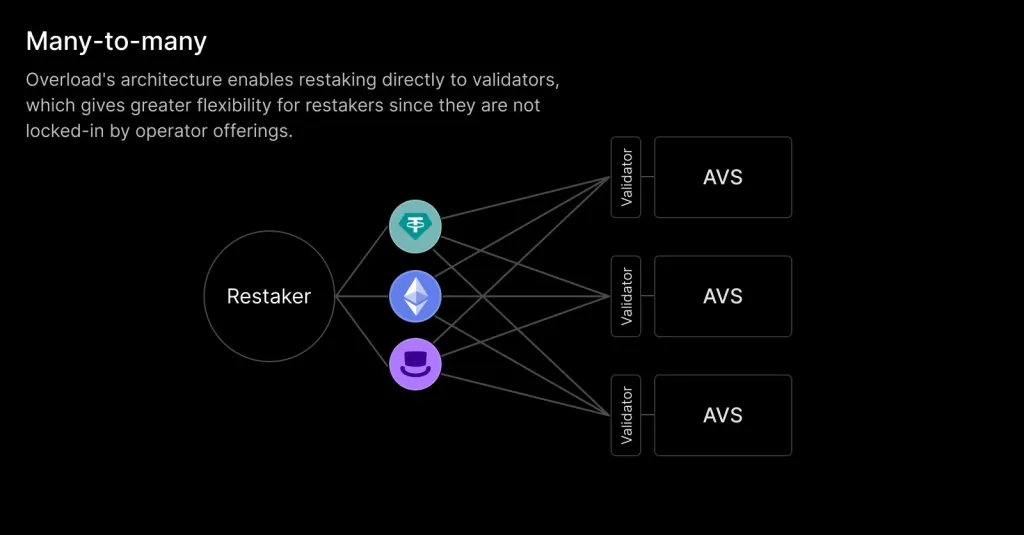

Pledger privilege enhancement

Compared with the design in EigenLayer, the pledger entrusts the tokens to the node operator, and the latter can choose which AVS to operate, so the token is actually pledged The user's authority and operation difficulty are not high.

Overload downplays the role of node operators, allowing pledgers to choose which AVSs they want to operate their tokens on, and then pledge them to the corresponding verifiers. They can also choose more than one object to increase their assets. autonomy.

Overload allows stakers to decide which AVS to operate

New points competition

The Overload team said it will launch re-staking in the near future The related points competition, imitating the EigenLayer marketing model, is expected to attract some users to try it first.

The Overload team’s first step is quite satisfactory and the strategy is reasonable. Opening diversified ERC-20 assets as collateral can make up for the lack of existing funds in the Base ecosystem; on the other hand, the non-penalty mechanism can reduce users' doubts about Layer 2 and it is a new project; finally, because Layer 2 users are relatively It can perform more advanced operations, so opening more permissions to pledgers may meet the needs of these people.

However, whether the market will pay for this remains to be verified.

Restaking facilities are emerging in major ecosystems

In addition to this Base network, in fact, there have been many restaking projects in Solana this year, such as Cambrian, Solayer Labs, and Picasso. Create a Solana-style EigenLayer to enhance the existing ecosystem.

Достаточная ли безопасность?

Однако суть повторной ставки заключается в том, чтобы разделить безопасность с внешними децентрализованными сетями, которые должны быть построены на прочном фундаменте исходной основной сети.

По сравнению с рыночной стоимостью ETH (370 миллиардов долларов) или SOL (71 миллиард долларов), у Base в настоящее время TVL составляет всего 5,4 миллиарда долларов. Имеет ли она возможность управлять сильной экосистемой рестейкинга? Кажется, впереди еще долгий путь.

Нужно ли строить экосистему перезалога?

Еще один ключевой вопрос, который необходимо прояснить всем командам по повторному стейкингу: «Действительно ли сеть предлагаемого протокола нуждается в экосистеме повторного стейкинга?» Например, некоторые пользователи в сообществе Solana считают, что это будущее развитие? Solana будет основана на единой. Действительно ли необходима выгода от децентрализации безопасности на другие внешние сети, если body Chain является основной?

Конечно, команде Overload также необходимо подумать (или обосновать), нужно ли снова закладывать экосистему Base? Будет ли он пересекаться с существующей экологической инфраструктурой Ethereum?

The above is the detailed content of Overload, a re-pledge protocol similar to EigenLayer, appears in the Base ecosystem! Any ERC-20 token can be pledged. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

AI Hentai Generator

Generate AI Hentai for free.

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

1378

1378

52

52

What is Ouyi for? What is Ouyi

Apr 01, 2025 pm 03:18 PM

What is Ouyi for? What is Ouyi

Apr 01, 2025 pm 03:18 PM

OKX is a global digital asset trading platform. Its main functions include: 1. Buying and selling digital assets (spot trading), 2. Trading between digital assets, 3. Providing market conditions and data, 4. Providing diversified trading products (such as derivatives), 5. Providing asset value-added services, 6. Convenient asset management.

Will Dogecoin etf be approved?

Mar 28, 2025 pm 03:51 PM

Will Dogecoin etf be approved?

Mar 28, 2025 pm 03:51 PM

As of March 2025, the Dogecoin ETF has not yet had a clear approval schedule. 1. There is no formal application yet and the SEC has not received any relevant application. 2. Market demand and controversy are high, and regulators are conservative. 3. The potential timeline is a 1-2-year review period, which may be observed from 2025 to 2026, but there is high uncertainty.

Detailed explanation of the issuance price and issuance time of LOOM coins

Mar 20, 2025 pm 06:21 PM

Detailed explanation of the issuance price and issuance time of LOOM coins

Mar 20, 2025 pm 06:21 PM

LOOM Coin, a once-highly-known blockchain game and social application development platform token, its ICO was held on April 25, 2018, with an issue price of approximately US$0.076 per coin. This article will conduct in-depth discussion on the issuance time, price and important precautions of LOOM coins, including market volatility risks and project development prospects. Investors should be cautious and do not follow the trend blindly. It is recommended to refer to the official website of Loom Network, blockchain browser and cryptocurrency information platform to obtain the latest information and conduct sufficient risk assessment. The information in this article is for reference only and does not constitute investment advice. Learn about LOOM coins, start here!

What are the Ethereum trading platforms?

Mar 26, 2025 pm 04:48 PM

What are the Ethereum trading platforms?

Mar 26, 2025 pm 04:48 PM

Want to play Ethereum? Choose the right trading platform first! There are centralized exchanges (CEXs) such as Binance, Ouyi, Coinbase, Kraken, and Gate.io. The advantages are fast speed and good liquidity, while the disadvantages are centralized risks. There are also decentralized exchanges (DEXs) such as Uniswap, SushiSwap, Balancer, and Curve. The advantages are security and transparency, while the disadvantages are slow speed and poor experience.

The latest summary of Ethereum formal trading platform 2025

Mar 26, 2025 pm 04:45 PM

The latest summary of Ethereum formal trading platform 2025

Mar 26, 2025 pm 04:45 PM

In 2025, choosing a "formal" Ethereum trading platform means security, compliance and transparency. Licensed operations, financial security, transparent operations, AML/KYC, data protection and fair trading are key. Compliant exchanges such as Coinbase, Kraken, and Gemini are worth paying attention to. Binance and Ouyi have the opportunity to become formal platforms by strengthening compliance. DeFi is an option, but there are risks. Be sure to pay attention to security, compliance, expenses, spread risks, back up private keys, and conduct your own research.

The difference between Ether and Bitcoin What is the difference between Ether and Bitcoin

Mar 19, 2025 pm 04:54 PM

The difference between Ether and Bitcoin What is the difference between Ether and Bitcoin

Mar 19, 2025 pm 04:54 PM

The difference between Ethereum and Bitcoin is significant. Technically, Bitcoin uses PoW, and Ether has shifted from PoW to PoS. Trading speed is slow for Bitcoin and Ethereum is fast. In application scenarios, Bitcoin focuses on payment storage, while Ether supports smart contracts and DApps. In terms of issuance, the total amount of Bitcoin is 21 million, and there is no fixed total amount of Ether coins. Each security challenge is available. In terms of market value, Bitcoin ranks first, and the price fluctuations of both are large, but due to different characteristics, the price trend of Ethereum is unique.

How to check the contract address on gate.io exchange

Mar 25, 2025 pm 03:54 PM

How to check the contract address on gate.io exchange

Mar 25, 2025 pm 03:54 PM

There are two ways to view contract addresses on the Gate.io exchange: 1. Through the currency details page: log in to the account, search for the target currency, and enter the details page to find the contract address. 2. Through the recharge page: log in to the account, enter the recharge page, and select the currency to view the contract address in the recharge information.

gate exchange web version entrance gate exchange latest official website entrance

Mar 25, 2025 pm 04:15 PM

gate exchange web version entrance gate exchange latest official website entrance

Mar 25, 2025 pm 04:15 PM

The web version of the Gate.io exchange can be obtained in three ways: 1. Obtain official links through authoritative platforms such as CoinMarketCap or CoinGecko; 2. Follow Gate.io's official social media to obtain the latest entry; 3. Use the cryptocurrency navigation website to find official links. To ensure security of access, you need to carefully check the domain name, view the SSL certificate, not trust unknown links, verify official announcements, beware of abnormal prompts, and enable two-factor authentication, set complex passwords, keep keys and mnemonics, and regularly check account activities.