LRTs provides users with a simple interface to re-stake ETH and LSTs to earn additional income. Now that the Points meta activities of LRT, Eigenlayer and more than 10 AVS have ended, we need to shift our attention to LRT like EzETH and eETH, and think about how to obtain ETH’s native yield of 3.21% Extra income.

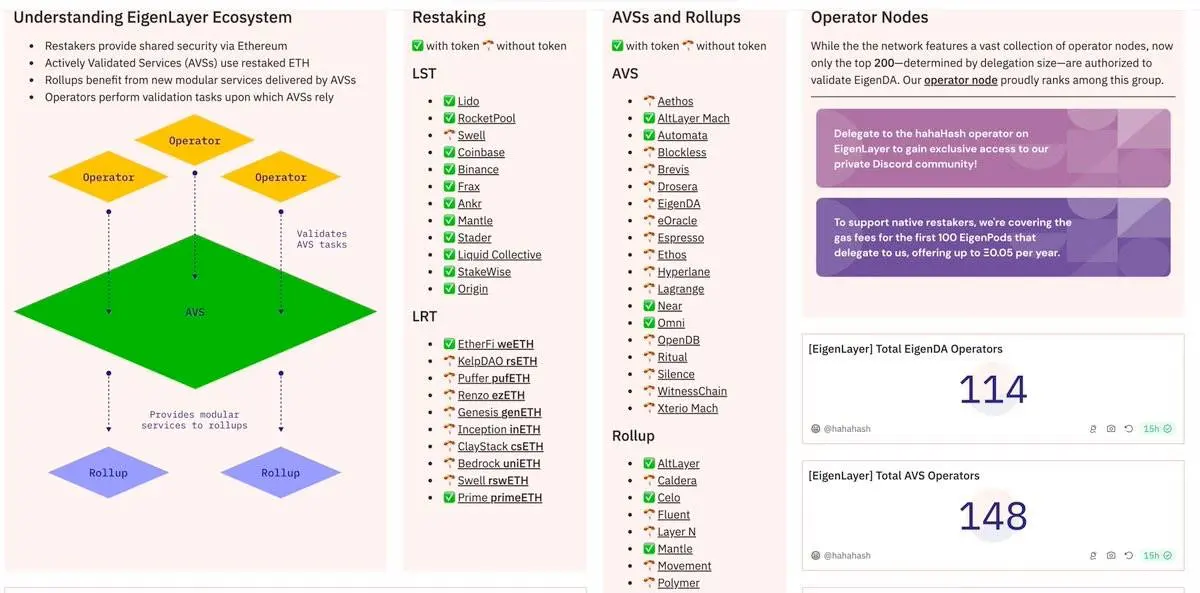

In EL’s design, the AVS operator runs the hardware to perform calculations and verifications, and delegates the re-staking ETH to AVS – AVS is essentially web3 bootstrapped using Eigenlayer’s economic security pool Service Agreement.

Since they borrow financial guarantees from EL, they need to pay some fees, and these fees are the additional benefits they promised.

In the early stages, most AVS struggle to gain project adoption, so earning revenue in the form of Rev shares is almost impossible. For them, the only way is to launch a token out of thin air.

Venture capital firms are blindly investing in AVS these days, so I wouldn’t be surprised if some of AVS’s tokens achieve multi-billion dollar valuations by TGE.

Web3 service protocols like Graph, Pyth, and Axelar all allocate a certain proportion of the supply to node rewards, and have token inflation dedicated to node rewards every year. The supply distribution of node rewards is usually between 5-10%, but again this is subjective if you are looking at the size of the economic security they receive from Eigenlayer. For example, AXL has $750 million in economic security, and if you look at AVS like Witness Chain, Lagrange, etc., they are sitting on over $5 billion in economic security in less than a month.

Ideally, they will allocate more than 10% of the supply to provide fair rewards to AVS operators, who will share a portion of it with re-stakers.

Initially, before these AVS launch the Points program, you can earn AVS Points by staking ETH in Renzo, Puffer, and Etherfi... and will continue to do so until we Find the saturation stage of Points meta.

For LRT’s tokens, they currently have governance utility, so unless they start sharing things like fees or other revenue from stakers, buying these tokens is meaningless.

The entire EL ecosystem is a venture capitalist’s dream.

For retail investors, this is purely a capital dilution to get some extra yield on ETH.

You can also optimize returns in other DeFi strategies, so only play this game if you understand the rules and risks.

Finally, the author of the original post also compiled a comprehensive dashboard about the operating status of EigenLayer, covering various LRT, AVS and user indicators. The real-time situation of the data provides a useful reference for readers who are concerned about the EigenLayer ecology.

EL ecological data dashboard link (click here)

The above is the detailed content of After the EIGEN airdrop, where will the future of LRT go?. For more information, please follow other related articles on the PHP Chinese website!

Usage of UpdatePanel

Usage of UpdatePanel

How do I set up WeChat to require my consent when people add me to a group?

How do I set up WeChat to require my consent when people add me to a group?

How to use spyder

How to use spyder

What is the difference between css framework and component library

What is the difference between css framework and component library

Configure HOSTS file

Configure HOSTS file

What are the methods of remote computer maintenance?

What are the methods of remote computer maintenance?

What are the common testing techniques?

What are the common testing techniques?

Usage of drawstring

Usage of drawstring

How is the performance of thinkphp?

How is the performance of thinkphp?