Topics

Topics

excel

excel

Practical Excel skills sharing: Use pivot tables and VLOOKUP functions to analyze accounts receivable

Practical Excel skills sharing: Use pivot tables and VLOOKUP functions to analyze accounts receivable

Practical Excel skills sharing: Use pivot tables and VLOOKUP functions to analyze accounts receivable

In the previous article "Sharing practical Excel skills: Quickly create two-color charts", we learned an Excel skill and learned how to quickly create two-color charts. The following article will introduce to you how to use Excel Pivot Table and VLOOKUP function to analyze accounts receivable. Come and collect it and learn it!

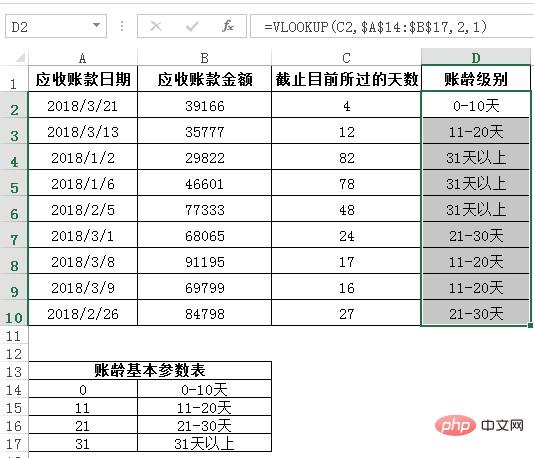

Summary of content: Excel accounts receivable aging analysis will use pivot tables for analysis. Before analysis, use the VLOOKUP function to organize the data.

Aging refers to the length of time a company has outstanding accounts receivable. Aging is the most important information when analyzing accounts receivable. All accounts receivable that are aged more than a reasonable number of days will have a negative impact on company operations. The higher the age, the lower the capital efficiency and the risk of bad debts. The bigger it is, the higher the financial cost.

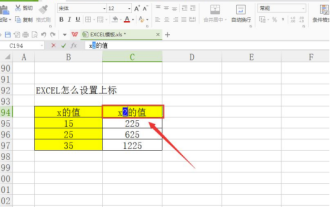

The following is the accounts receivable table. Now the leader requires us to count the amounts of each aging level (accounts receivable aging analysis).

Final effect:

##Solution:

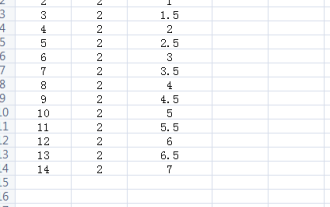

1. First solve the number of days that have passed so far: the formula in cell C2 is: =TODAY()-A2, the current date minus the receivable date.

The above is the detailed content of Practical Excel skills sharing: Use pivot tables and VLOOKUP functions to analyze accounts receivable. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

1652

1652

14

14

1413

1413

52

52

1304

1304

25

25

1251

1251

29

29

1224

1224

24

24

What should I do if the frame line disappears when printing in Excel?

Mar 21, 2024 am 09:50 AM

What should I do if the frame line disappears when printing in Excel?

Mar 21, 2024 am 09:50 AM

If when opening a file that needs to be printed, we will find that the table frame line has disappeared for some reason in the print preview. When encountering such a situation, we must deal with it in time. If this also appears in your print file If you have questions like this, then join the editor to learn the following course: What should I do if the frame line disappears when printing a table in Excel? 1. Open a file that needs to be printed, as shown in the figure below. 2. Select all required content areas, as shown in the figure below. 3. Right-click the mouse and select the "Format Cells" option, as shown in the figure below. 4. Click the “Border” option at the top of the window, as shown in the figure below. 5. Select the thin solid line pattern in the line style on the left, as shown in the figure below. 6. Select "Outer Border"

How to filter more than 3 keywords at the same time in excel

Mar 21, 2024 pm 03:16 PM

How to filter more than 3 keywords at the same time in excel

Mar 21, 2024 pm 03:16 PM

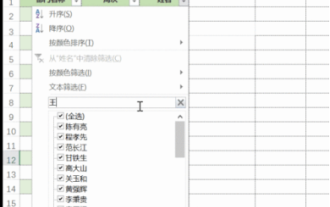

Excel is often used to process data in daily office work, and it is often necessary to use the "filter" function. When we choose to perform "filtering" in Excel, we can only filter up to two conditions for the same column. So, do you know how to filter more than 3 keywords at the same time in Excel? Next, let me demonstrate it to you. The first method is to gradually add the conditions to the filter. If you want to filter out three qualifying details at the same time, you first need to filter out one of them step by step. At the beginning, you can first filter out employees with the surname "Wang" based on the conditions. Then click [OK], and then check [Add current selection to filter] in the filter results. The steps are as follows. Similarly, perform filtering separately again

How to change excel table compatibility mode to normal mode

Mar 20, 2024 pm 08:01 PM

How to change excel table compatibility mode to normal mode

Mar 20, 2024 pm 08:01 PM

In our daily work and study, we copy Excel files from others, open them to add content or re-edit them, and then save them. Sometimes a compatibility check dialog box will appear, which is very troublesome. I don’t know Excel software. , can it be changed to normal mode? So below, the editor will bring you detailed steps to solve this problem, let us learn together. Finally, be sure to remember to save it. 1. Open a worksheet and display an additional compatibility mode in the name of the worksheet, as shown in the figure. 2. In this worksheet, after modifying the content and saving it, the dialog box of the compatibility checker always pops up. It is very troublesome to see this page, as shown in the figure. 3. Click the Office button, click Save As, and then

How to set superscript in excel

Mar 20, 2024 pm 04:30 PM

How to set superscript in excel

Mar 20, 2024 pm 04:30 PM

When processing data, sometimes we encounter data that contains various symbols such as multiples, temperatures, etc. Do you know how to set superscripts in Excel? When we use Excel to process data, if we do not set superscripts, it will make it more troublesome to enter a lot of our data. Today, the editor will bring you the specific setting method of excel superscript. 1. First, let us open the Microsoft Office Excel document on the desktop and select the text that needs to be modified into superscript, as shown in the figure. 2. Then, right-click and select the "Format Cells" option in the menu that appears after clicking, as shown in the figure. 3. Next, in the “Format Cells” dialog box that pops up automatically

How to use the iif function in excel

Mar 20, 2024 pm 06:10 PM

How to use the iif function in excel

Mar 20, 2024 pm 06:10 PM

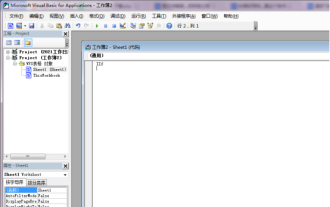

Most users use Excel to process table data. In fact, Excel also has a VBA program. Apart from experts, not many users have used this function. The iif function is often used when writing in VBA. It is actually the same as if The functions of the functions are similar. Let me introduce to you the usage of the iif function. There are iif functions in SQL statements and VBA code in Excel. The iif function is similar to the IF function in the excel worksheet. It performs true and false value judgment and returns different results based on the logically calculated true and false values. IF function usage is (condition, yes, no). IF statement and IIF function in VBA. The former IF statement is a control statement that can execute different statements according to conditions. The latter

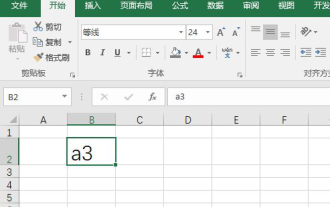

How to type subscript in excel

Mar 20, 2024 am 11:31 AM

How to type subscript in excel

Mar 20, 2024 am 11:31 AM

eWe often use Excel to make some data tables and the like. Sometimes when entering parameter values, we need to superscript or subscript a certain number. For example, mathematical formulas are often used. So how do you type the subscript in Excel? ?Let’s take a look at the detailed steps: 1. Superscript method: 1. First, enter a3 (3 is superscript) in Excel. 2. Select the number "3", right-click and select "Format Cells". 3. Click "Superscript" and then "OK". 4. Look, the effect is like this. 2. Subscript method: 1. Similar to the superscript setting method, enter "ln310" (3 is the subscript) in the cell, select the number "3", right-click and select "Format Cells". 2. Check "Subscript" and click "OK"

Where to set excel reading mode

Mar 21, 2024 am 08:40 AM

Where to set excel reading mode

Mar 21, 2024 am 08:40 AM

In the study of software, we are accustomed to using excel, not only because it is convenient, but also because it can meet a variety of formats needed in actual work, and excel is very flexible to use, and there is a mode that is convenient for reading. Today I brought For everyone: where to set the excel reading mode. 1. Turn on the computer, then open the Excel application and find the target data. 2. There are two ways to set the reading mode in Excel. The first one: In Excel, there are a large number of convenient processing methods distributed in the Excel layout. In the lower right corner of Excel, there is a shortcut to set the reading mode. Find the pattern of the cross mark and click it to enter the reading mode. There is a small three-dimensional mark on the right side of the cross mark.

How to insert excel icons into PPT slides

Mar 26, 2024 pm 05:40 PM

How to insert excel icons into PPT slides

Mar 26, 2024 pm 05:40 PM

1. Open the PPT and turn the page to the page where you need to insert the excel icon. Click the Insert tab. 2. Click [Object]. 3. The following dialog box will pop up. 4. Click [Create from file] and click [Browse]. 5. Select the excel table to be inserted. 6. Click OK and the following page will pop up. 7. Check [Show as icon]. 8. Click OK.