加密貨幣市場今日再次遭遇重挫,雖然比特幣自身的跌幅現已收窄至不足1%,但山寨幣板塊卻隨著BTC 的短線出現了集體跳水行情,SOL、PEPE、ORDI、ARB 、TIA 等不同賽道的代表級山寨幣均錄得了超10% 甚至是20% 的跌幅。

雖然目前的二級市場可謂是“腥風血雨”,但對於普通投資者而言,除了直接下場交易之外,其實還有著另一條相對緩慢但勝在穩健的操作模式—— 透過各大DeFi 協議,利用穩定幣去實現相對低風險、高收益的生息策略。

在下文中,Odaily 星球日報將結合自身操作經驗,為大家推薦多條網絡上的多個穩定幣生息策略,這些策略在操作層面雖然都相當簡單,但普遍都可實現10% 甚至20% 的穩健收益,且部分策略還可同步互動一些未發幣的底層網路或DeFi 協議,實現「一魚多吃」。

需要強調的是,任何DeFi 協議都無法完全避免合約風險,部分DeFi 協議因其業務模式還會面臨一定的流動性風險、組合性風險等等,因此大家在選擇執行具體某種策略之時,請務必事先了解各項具體風險,且應盡量做到不要「將雞蛋放在同一個籃子裡」。

操作方式:在Ethena官網直接先購入USDe ,再透過質押兌換成sUSDe;

即時收益率:17.5%;

收益構成(即可獲得的獎勵代幣類型):sUSDe 升值(可兌換更多USDe);

其他潛在收益:ENA 二期空投;

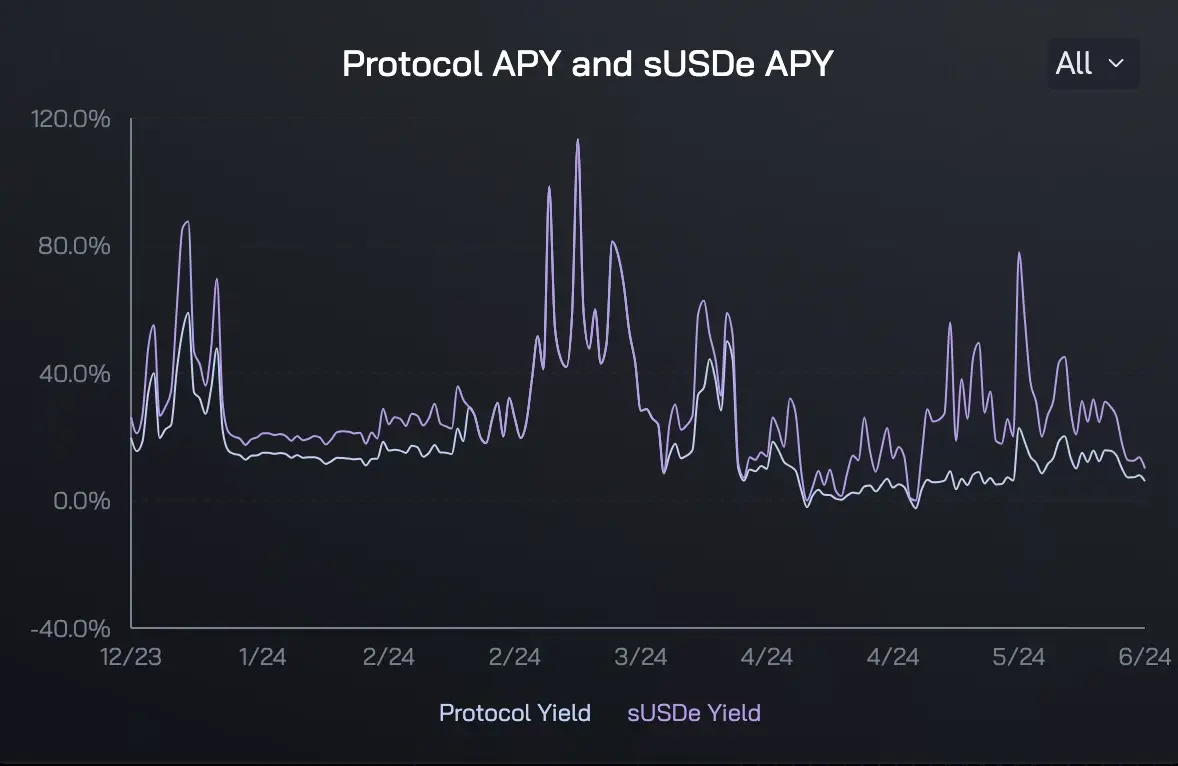

備註:Ethena 的sUSDe是目前加密貨幣市場內成規模(數十億美元等級)的穩定幣礦池的中APY 最高的收益機會,遠高於MakerDAO 的sDAI 等代幣化國債產品。 sUSDe 的即時 APY 會隨著市場的槓桿狀況而有所變化,但就過往波動記錄來看一直都穩定處於較高水平。此外,透過 sUSDe 還可以累積 Ethena 的二期空投憑證 sats(累積效率較低,但勝在收益穩定),藉此取得 ENA 的下一次空投。

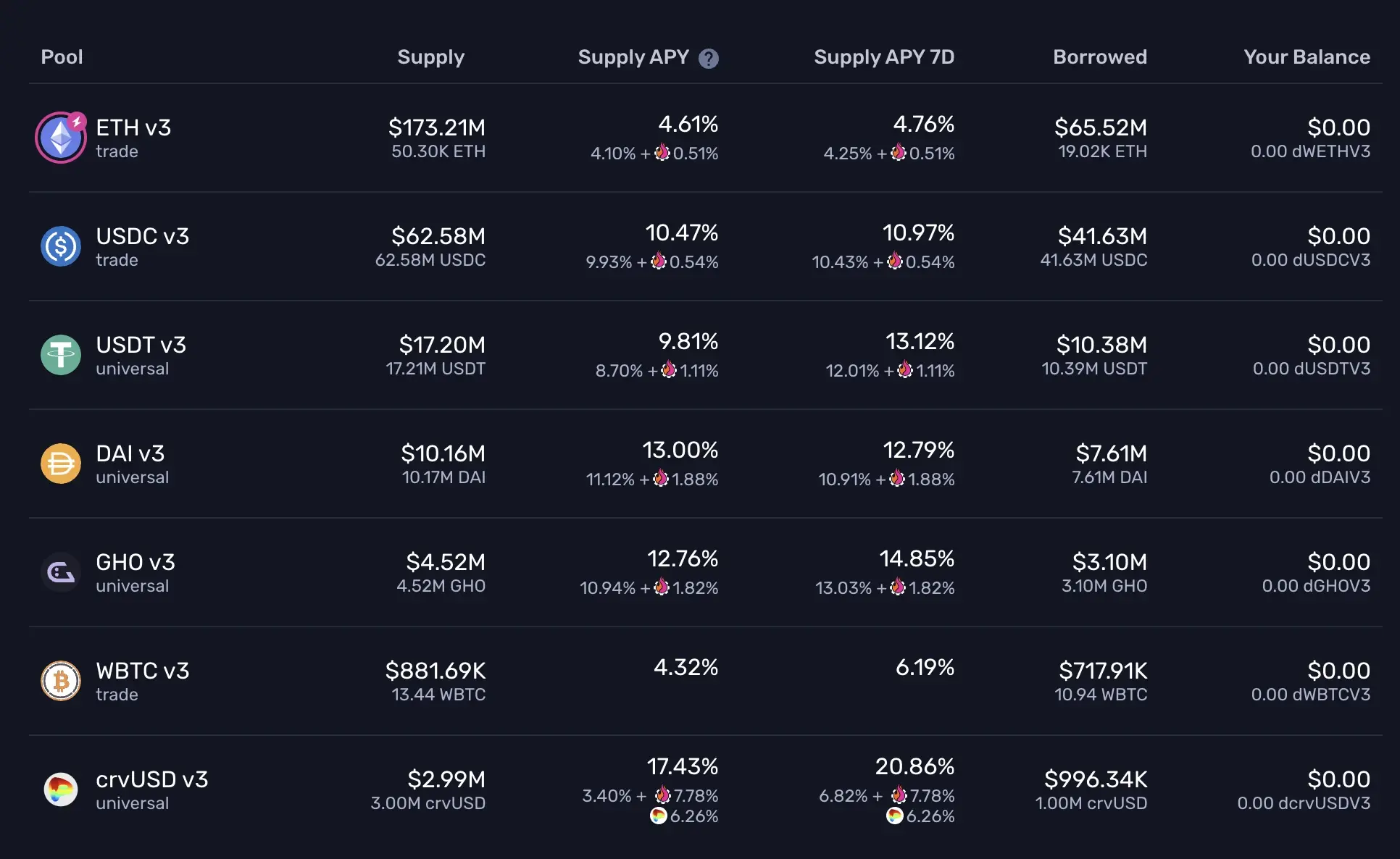

操作方式:在Gearbox官網透過Earn 存入各種類型的穩定幣;

即時收益率:除USDT 外,普遍大於10%;

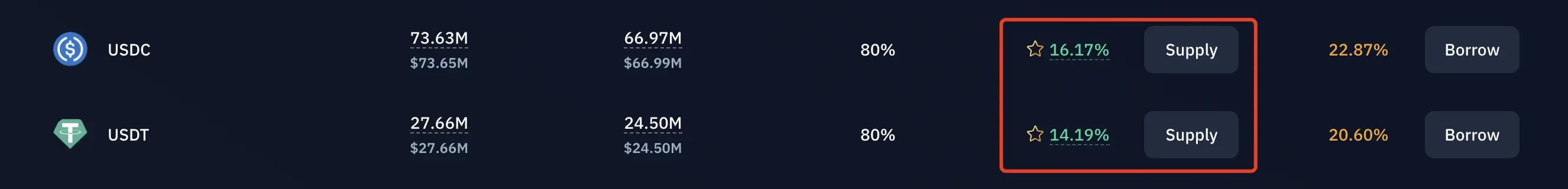

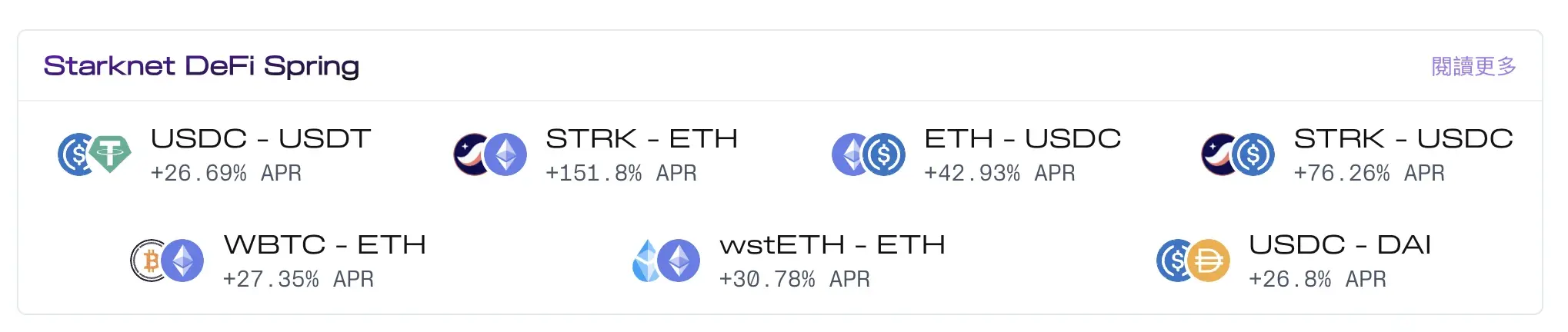

Operation method: Deposit on zkLend and Nostra USDT or USDC earns interest;

Real-time yield: about 20%;

Income composition: STRK mainly, supplemented by stable currency native income ;

Note: The basic loan agreement is similar to marginfi and Kamino on Solana, but the income composition is mainly composed of STRK incentives (this is similar to Ekubo), and we are optimistic about the future of STRK Performance users may participate at their discretion.

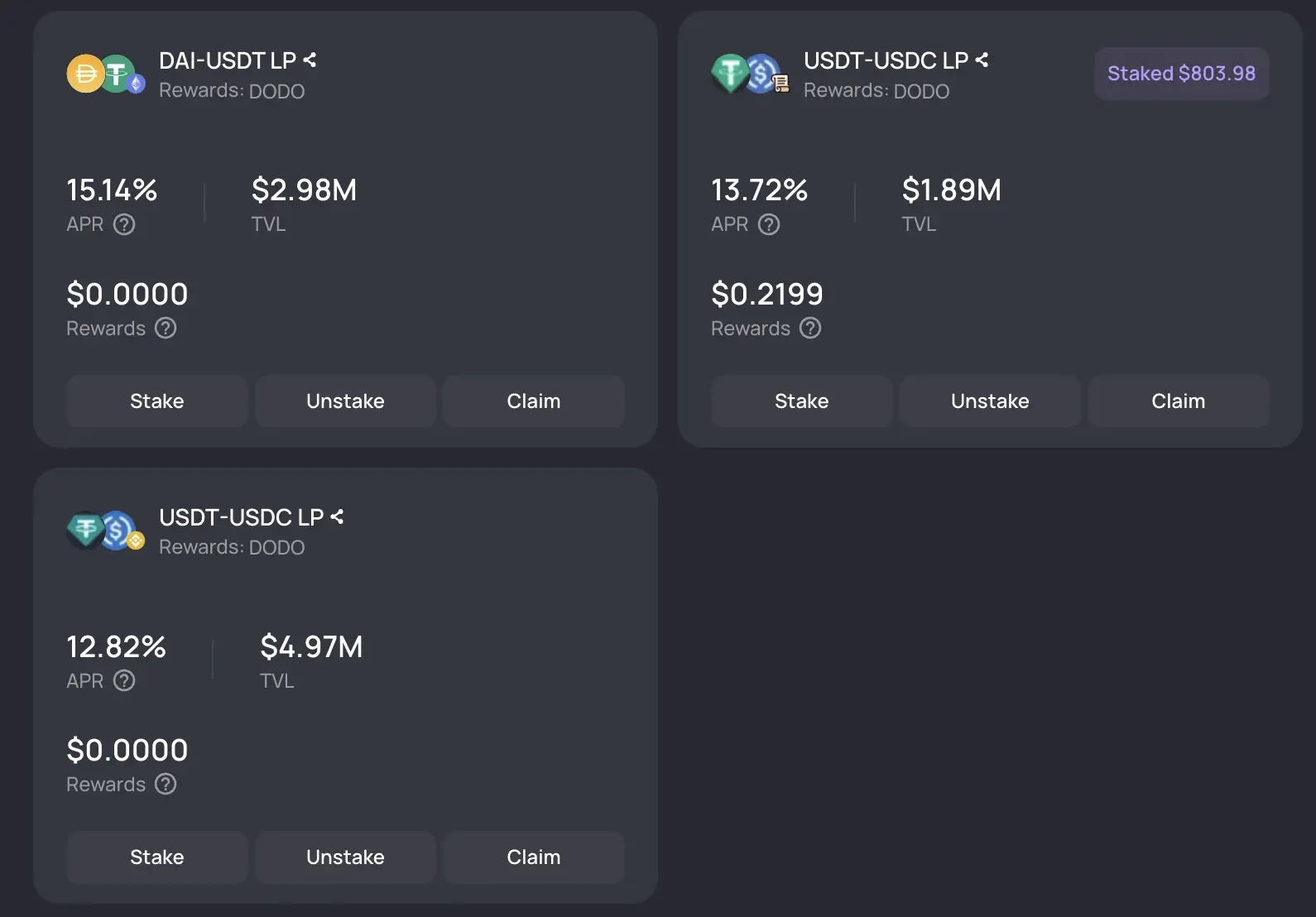

Operation method: in The DODO official website uses DAI, USDT, USDC, etc. to form trading pairs and participate in market making;

Real-time rate of return: 12% - 15%;

Income composition: mainly DODO, supplemented by stablecoin native income;

Other potential income: Scroll airdrop incentives;

Remarks: Any As major Layer 2s are issuing coins one after another, Scroll, which has not yet issued coins, has also received more attention and liquidity. Based on the major DeFi protocols on Scroll, DODO, as an established DEX, is relatively trustworthy in terms of security, and benefiting from DODO’s own liquidity incentive plan, its stablecoin trading pairs also have high APY performance, so it is recommended to users Use it as a great base for interactive Scroll.

Operation method: Deposit various stablecoins on Echelon to earn interest;

Real-time yield: 11% - 17%;

Income composition: stablecoins Native income plus APT incentive income;

Other potential income: Echelon airdrop income;

Note: Echelon is currently ranked second in TVL on Aptos The lending agreement is second only to Aries Markets, but perhaps due to being selected into the Aptos incentive program, the current comprehensive APY of the platform is significantly higher than the latter. In addition, Echelon has currently launched a points program, which also means that there are certain potential airdrop expectations for participating in the agreement.

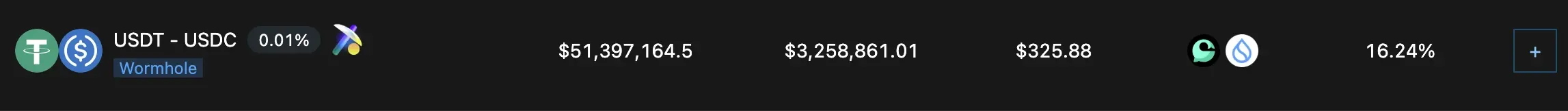

Operation method: in Cetus uses USDT, USDC, etc. to form trading pairs and participate in market making;

Real-time rate of return: 16.28%;

Income composition: SUI Mainly based on incentives, supplemented by native income from CETUS and stablecoins;

Note: The largest DEX protocol on Sui, the income mainly comes from the ecological incentives given by Sui.

The above are some of our currently recommended stablecoin interest-earning strategies.

Due to risk control and replication difficulty considerations, the above strategies only cover some relatively simple DeFi operations, and only involve some more basic pledge, deposit, LP and other operations, but the available The potential income is still generally higher than the interest earned from passive financial management on the exchange. For users who currently don’t know how to operate the secondary market and don’t want to let their stablecoins sit idle, they can consider the above strategies as appropriate.

Finally, it needs to be emphasized again that the DeFi world is a dark forest that is always accompanied by risks. Please be sure to understand the risks in advance before operating, DYOR.

以上是不想再承受下跌的痛苦?收下這份各大主流鏈的穩定幣增值攻略的詳細內容。更多資訊請關注PHP中文網其他相關文章!